borsadigital

@t_borsadigital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

borsadigital

XAUUSD Genel Değerlendirme

📝 The recent movement in gold prices has been remarkable. 📝 The strong demand for dollars and the increase in bond interest rates continue to put pressure on gold prices. 📝 The fact that the US PPI data announced yesterday came in below estimates made a limited positive contribution to gold prices. 📝 The focus of the markets today will be the US December CPI data. 📉📈 Technically, pricing continues as a harmonic potential formation. After the PPI data received yesterday, it also fell to the levels of $ 2660, its second wave, and a recovery came from this region. 📉📈 In the current price movement, the CD leg has the potential to reach the levels of $ 2702 and $ 2718 on a Fibonacci basis. 📉📈 In the possible selling pressure starting from these regions, the expectation should be a decline to the levels of $ 2675. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

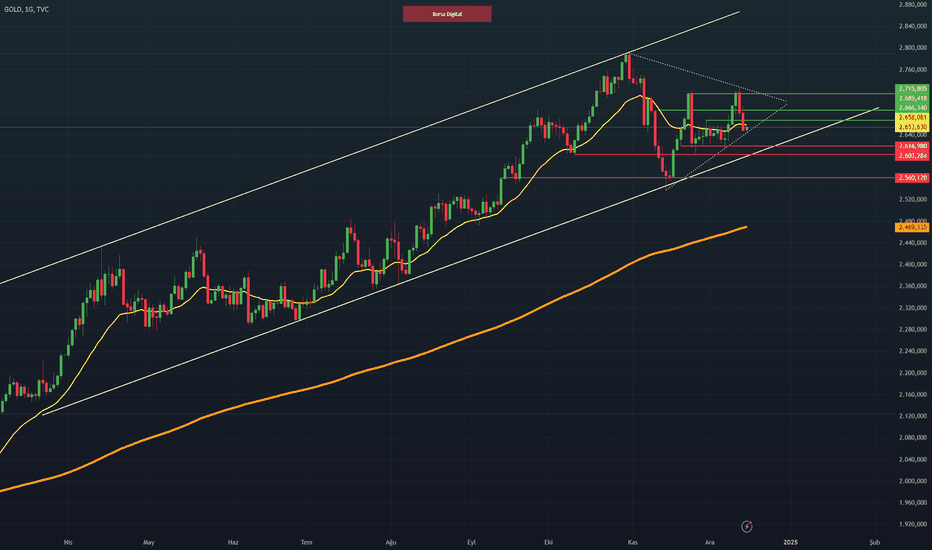

Altın Haftalık Değerlendirme

📝 While the recent decrease in geopolitical risks in global markets has positively affected investor perception, on the other hand, the reemergence of inflation risk in the US continues to have an impact on markets. 📝 The expectation that the Fed will follow a cautious policy in the fight against inflation is also one of the factors that put pressure on gold prices. 📝 These changes that have occurred in the past two months do not please gold investors. 📝 The decrease in safe haven demand due to the decrease in geopolitical risks limits the appeal of gold. 📝 In addition, the expectation that the Fed will take a more reserved stance on interest rate cuts causes gold, an interest-free asset, to become less attractive to investors. 📝 On the other hand, strong economic data and the movement in the dollar index also put additional pressure on gold. 📉📈 In terms of technical appearance, while the levels of 2618 and 2603 can be monitored as support points in gold prices, the levels of 2685 and 2715 stand out as resistance in upward movements. 📉📈 The movements of gold at these levels may be decisive depending on the risk perception in the markets. 📉📈 The decrease in geopolitical risks and the cautious stance of the Fed create a difficult environment for gold to gain value, but on the other hand, inflation risks may continue to support the purchase side of gold. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

Altın Haftalık Değerlendirme

📝 While the recent decrease in geopolitical risks in global markets has positively affected investor perception, on the other hand, the reemergence of inflation risk in the US continues to have an impact on markets. 📝 The expectation that the Fed will follow a cautious policy in the fight against inflation is also one of the factors that put pressure on gold prices. 📝 These changes that have occurred in the past two months do not please gold investors. 📝 The decrease in safe haven demand due to the decrease in geopolitical risks limits the appeal of gold. 📝 In addition, the expectation that the Fed will take a more reserved stance on interest rate cuts causes gold, an interest-free asset, to become less attractive to investors. 📝 On the other hand, strong economic data and the movement in the dollar index also put additional pressure on gold. 📉📈 In terms of technical appearance, while the levels of 2618 and 2603 can be monitored as support points in gold prices, the levels of 2685 and 2715 stand out as resistance in upward movements. 📉📈 The movements of gold at these levels may be decisive depending on the risk perception in the markets. 📉📈 The decrease in geopolitical risks and the cautious stance of the Fed create a difficult environment for gold to gain value, but on the other hand, inflation risks may continue to support the purchase side of gold. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

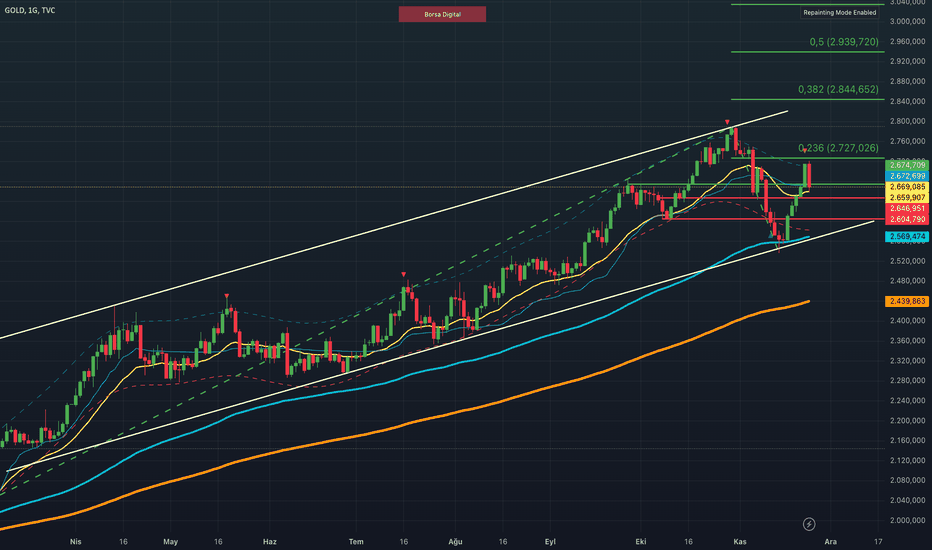

XAUUSD Genel Değerlendirme

📝 Gold, which started with an increase last week, entered the new week with a calmer outlook. Reaction purchases from the 100-day moving average allowed prices to test the 50-day average. 📝 This week, especially maintaining a persistence above 2665 USD is considered a critical threshold for the continuation of short-term upward momentum. 📝 Important data and statements from the US this week may create volatility in gold prices. 🚩 3rd Quarter Growth Figures: Will shed light on the direction of economic activity. 🚩 FED Minutes: May provide new clues about the interest rate path. 🚩 Headline and Core PCE: Important indicators to follow on the inflation front. 🚩 Personal Income and Spending Data: Will reveal trends on the consumption side. 📝 The Trump factor and geopolitical risks continue to shape the big-picture direction of gold prices. 🚩 Trump: Uncertainty continues regarding economic and trade policies in the new period. In particular, fiscal expansion policies and its relationship with the central bank are on the radar of the markets.🚩 Geopolitical Risks: Ukraine-Russia Line: Missile attacks increase security concerns and keep the perception of nuclear risk on the agenda.🚩 Middle East: Israel's current stance and Iran's preparation to sit at the diplomatic table with Europe may affect the course of tension in the region.📉📈 Technically, $2646, $2604 and $2569 levels can be followed as support, while $2674, $2727 and $2760 levels can be followed as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

Ons Altın Değerlendirme

📝 While gold prices were trading at record levels, the expectation that geopolitical tension in the Middle East would decrease with D. Trump winning the presidency created serious selling pressure. 📝 In fact, there was already a strong expectation of profit realization technically. This could be said to have become a bit of an excuse as a basic argument. TECHNICAL ANALYSIS📉📈 I personally think that the increase in gold prices on an ounce basis is now complete and that the gradual decline will continue. 📉📈 I predict that this decline will be priced gradually within the 2685-2586 dollar band. 📉📈 The 2586 level is seen as the most important support point that will determine the course of ounce gold. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

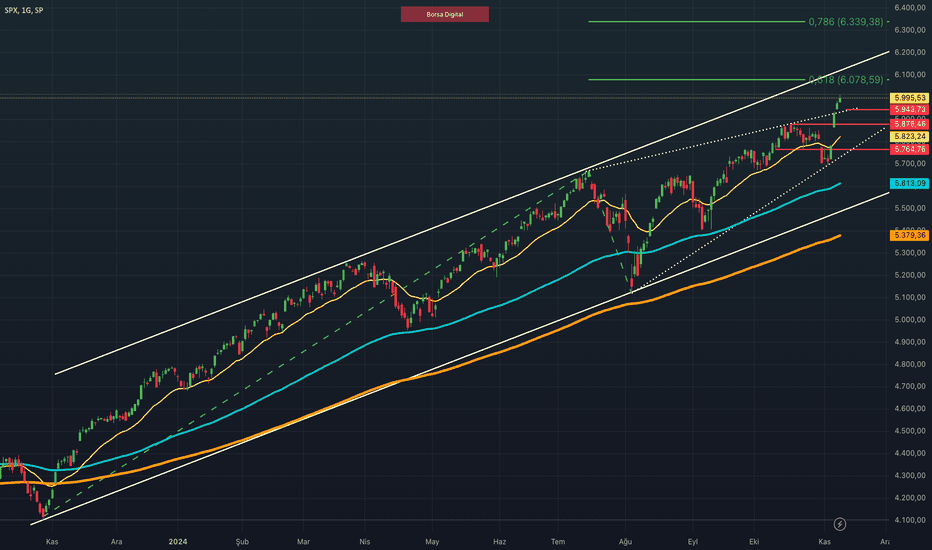

SP500 Endeks Değerlendirme

📝 I guess everything we can call a positive argument for the US markets happened in the same week. 📝 First, the presidential election was held in America on November 5th and Donald Trump became the 47th President of the United States. Of course, Trump was elected president for the second time, even the fact that it was consecutive, this is the second term and unlike his first term, this time the Senate is actually in the hands of the Republicans, in other words, Trump in a way. 📝 As you may remember, Trump was president in the first term, but the Senate was under the control of the Democrats, which naturally made it difficult for Trump to make some decisions official. The political side of the matter aside, Trump winning the presidency was actually priced quite positively in both the US and European markets. 📝 Of course, it is not only Donald Trump himself, but also the attitudes of the Republican administrations towards easing and, if possible, ending global geopolitical tensions that are effective here. This situation naturally increased risk appetite, while we saw serious sales in products such as gold, which are priced with a safe haven perception, and significant increases in products such as stock indices. 📝 On the other hand, we followed the Fed's interest rate decision two days after the election. The US Federal Reserve (Fed) cut interest rates by 25 basis points in line with expectations. 📝 Considering the slowdown in the labor market and the decline in inflation, the Fed lowered the policy rate to 4.5%-4.75%. Chairman Jerome Powell stated that the Fed is not committed to a specific policy path and will continue to make decisions on a meeting-by-meeting basis, in line with current data. 📝 He also emphasized that they did not completely rule out the possibility of a rate cut in December and will act according to current conditions. 📝 US stock markets rose with the optimistic atmosphere created after the Fed's statements and Trump's victory. 📝 Although concerns about customs duties and the budget deficit persist, the market was positively affected by the expectation that regulations will be loosened and taxes will decrease. TECHNICAL ANALYSIS📉📈 The index closed the week at 5995. The current outlook seems to continue in the medium term. 📉📈 However, technically, pullbacks may be seen in line with a profit realization. In this direction, 5878 and 5764 dollars levels can be monitored as support. 📉📈 In upward movements, I think the 6078 dollars level will be monitored as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

Altın Günlük Değerlendirme

📝 With the elimination of the possibility of a 50 basis point interest rate cut by the Fed, gold has started to gain upward momentum again. 📝 There was a significant decline in the precious metal at the beginning of the week due to the calming geopolitical developments in the Middle East. 📉📈 However, the weakening of the dollar during the day allowed gold prices to head towards the levels of $ 2758. 📉📈 In this context, while the levels of $ 2743 and $ 2728 are followed as support in intraday pricing, the levels of $ 2758 and $ 2768 can be evaluated as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

Altın Günlük Değerlendirme

📝 With the elimination of the possibility of a 50 basis point interest rate cut by the Fed, gold has started to gain upward momentum again. 📝 There was a significant decline in the precious metal at the beginning of the week due to the calming geopolitical developments in the Middle East. 📉📈 However, the weakening of the dollar during the day allowed gold prices to head towards the levels of $ 2758. 📉📈 In this context, while the levels of $ 2743 and $ 2728 are followed as support in intraday pricing, the levels of $ 2758 and $ 2768 can be evaluated as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

XAUUSD Genel Değerlendirme

📝 Gold, which started with an increase last week, entered the new week with a calmer outlook. Reaction purchases from the 100-day moving average allowed prices to test the 50-day average. 📝 This week, especially maintaining a high above 2665 USD is considered a critical threshold for the continuation of short-term upward momentum. 📝 Important data and statements from the US this week may create volatility in gold prices. 🚩 3rd Quarter Growth Figures: Will shed light on the direction of economic activity. 🚩 FED Minutes: May provide new clues about the interest rate path. 🚩 Headline and Core PCE: Important indicators to follow on the inflation front. 🚩 Personal Income and Spending Data: Will reveal trends on the consumption side. 📝 The Trump factor and geopolitical risks continue to shape the big-picture direction of gold prices. 🚩 Trump: Uncertainty continues regarding economic and trade policies in the new period. In particular, fiscal expansion policies and its relationship with the central bank are on the radar of the markets.🚩 Geopolitical Risks: Ukraine-Russia Line: Missile attacks increase security concerns and keep the perception of nuclear risk on the agenda.🚩 Middle East: Israel's current stance and Iran's preparation to sit at the diplomatic table with Europe may affect the course of tension in the region.📉📈 Technically, $2646, $2604 and $2569 levels can be followed as support, while $2674, $2727 and $2760 levels can be followed as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.

borsadigital

XAUUSD Genel Değerlendirme (Ons Altın)

📈 Slowing the rise tendency in US bond rates and the speed of the FED's balance sheet reduction will directly affect the ounce gold side. 📈 When we evaluate the geopolitical risks that may occur in the general appearance, I think it would not be wrong to say that downward mobility can continue. 📈 In the technical sense, I think that the downward price movement can be monitored at least in the first place up to $ 2300. 📈 If there is a breakage below $ 2300, the $ 2272 region may also come to the agenda for the precious mine. 📺 You can find more and detailed narratives on my Borsadigital Youtube channel.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.