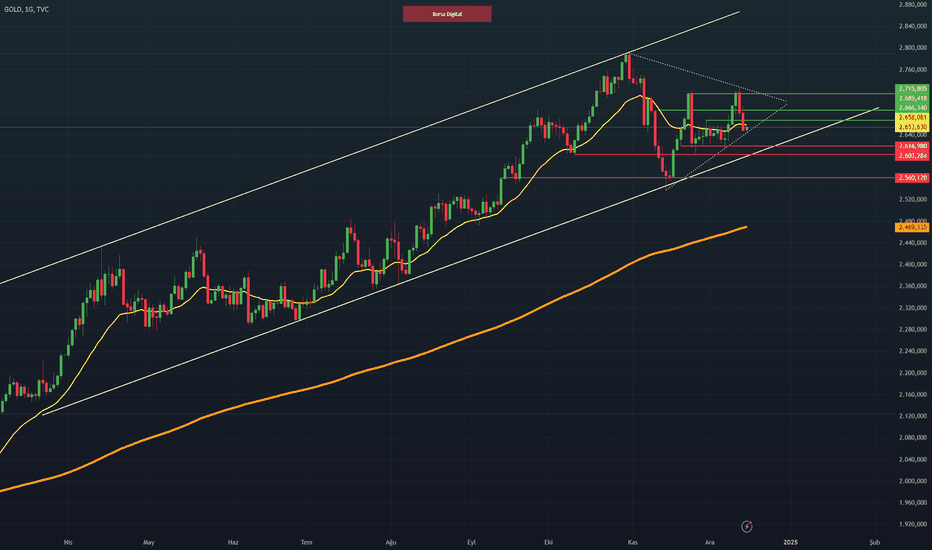

Technical analysis by borsadigital about Symbol PAXG on 12/16/2024

Altın Haftalık Değerlendirme

📝 While the recent decrease in geopolitical risks in global markets has positively affected investor perception, on the other hand, the reemergence of inflation risk in the US continues to have an impact on markets. 📝 The expectation that the Fed will follow a cautious policy in the fight against inflation is also one of the factors that put pressure on gold prices. 📝 These changes that have occurred in the past two months do not please gold investors. 📝 The decrease in safe haven demand due to the decrease in geopolitical risks limits the appeal of gold. 📝 In addition, the expectation that the Fed will take a more reserved stance on interest rate cuts causes gold, an interest-free asset, to become less attractive to investors. 📝 On the other hand, strong economic data and the movement in the dollar index also put additional pressure on gold. 📉📈 In terms of technical appearance, while the levels of 2618 and 2603 can be monitored as support points in gold prices, the levels of 2685 and 2715 stand out as resistance in upward movements. 📉📈 The movements of gold at these levels may be decisive depending on the risk perception in the markets. 📉📈 The decrease in geopolitical risks and the cautious stance of the Fed create a difficult environment for gold to gain value, but on the other hand, inflation risks may continue to support the purchase side of gold. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.