Technical analysis by borsadigital about Symbol PAXG on 9/9/2024

borsadigital

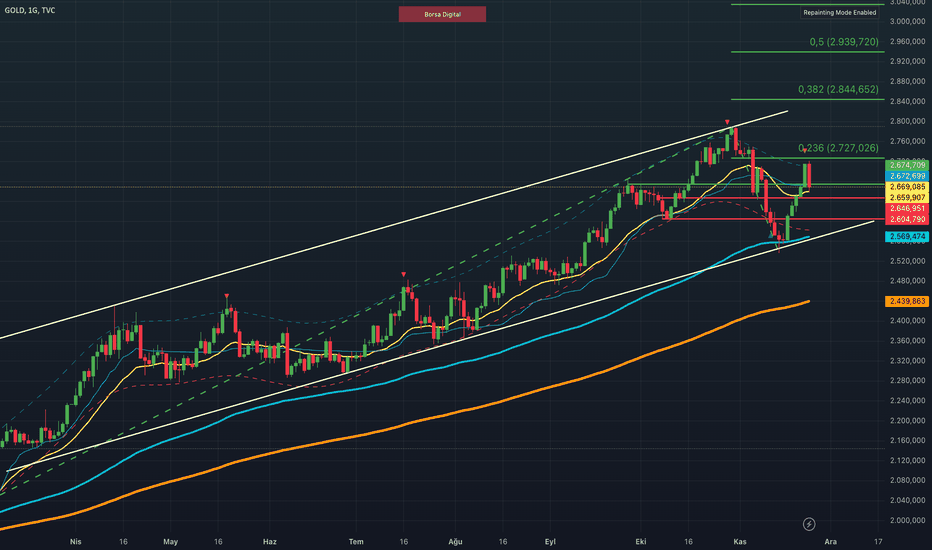

XAUUSD Genel Değerlendirme

📝 Gold, which started with an increase last week, entered the new week with a calmer outlook. Reaction purchases from the 100-day moving average allowed prices to test the 50-day average. 📝 This week, especially maintaining a high above 2665 USD is considered a critical threshold for the continuation of short-term upward momentum. 📝 Important data and statements from the US this week may create volatility in gold prices. 🚩 3rd Quarter Growth Figures: Will shed light on the direction of economic activity. 🚩 FED Minutes: May provide new clues about the interest rate path. 🚩 Headline and Core PCE: Important indicators to follow on the inflation front. 🚩 Personal Income and Spending Data: Will reveal trends on the consumption side. 📝 The Trump factor and geopolitical risks continue to shape the big-picture direction of gold prices. 🚩 Trump: Uncertainty continues regarding economic and trade policies in the new period. In particular, fiscal expansion policies and its relationship with the central bank are on the radar of the markets.🚩 Geopolitical Risks: Ukraine-Russia Line: Missile attacks increase security concerns and keep the perception of nuclear risk on the agenda.🚩 Middle East: Israel's current stance and Iran's preparation to sit at the diplomatic table with Europe may affect the course of tension in the region.📉📈 Technically, $2646, $2604 and $2569 levels can be followed as support, while $2674, $2727 and $2760 levels can be followed as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.