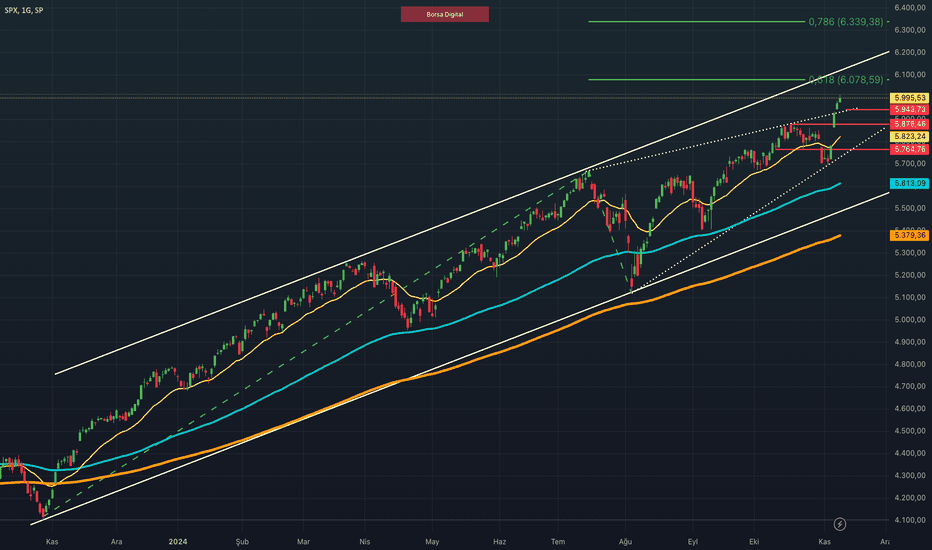

Technical analysis by borsadigital about Symbol SPYX on 11/11/2024

borsadigital

SP500 Endeks Değerlendirme

📝 I guess everything we can call a positive argument for the US markets happened in the same week. 📝 First, the presidential election was held in America on November 5th and Donald Trump became the 47th President of the United States. Of course, Trump was elected president for the second time, even the fact that it was consecutive, this is the second term and unlike his first term, this time the Senate is actually in the hands of the Republicans, in other words, Trump in a way. 📝 As you may remember, Trump was president in the first term, but the Senate was under the control of the Democrats, which naturally made it difficult for Trump to make some decisions official. The political side of the matter aside, Trump winning the presidency was actually priced quite positively in both the US and European markets. 📝 Of course, it is not only Donald Trump himself, but also the attitudes of the Republican administrations towards easing and, if possible, ending global geopolitical tensions that are effective here. This situation naturally increased risk appetite, while we saw serious sales in products such as gold, which are priced with a safe haven perception, and significant increases in products such as stock indices. 📝 On the other hand, we followed the Fed's interest rate decision two days after the election. The US Federal Reserve (Fed) cut interest rates by 25 basis points in line with expectations. 📝 Considering the slowdown in the labor market and the decline in inflation, the Fed lowered the policy rate to 4.5%-4.75%. Chairman Jerome Powell stated that the Fed is not committed to a specific policy path and will continue to make decisions on a meeting-by-meeting basis, in line with current data. 📝 He also emphasized that they did not completely rule out the possibility of a rate cut in December and will act according to current conditions. 📝 US stock markets rose with the optimistic atmosphere created after the Fed's statements and Trump's victory. 📝 Although concerns about customs duties and the budget deficit persist, the market was positively affected by the expectation that regulations will be loosened and taxes will decrease. TECHNICAL ANALYSIS📉📈 The index closed the week at 5995. The current outlook seems to continue in the medium term. 📉📈 However, technically, pullbacks may be seen in line with a profit realization. In this direction, 5878 and 5764 dollars levels can be monitored as support. 📉📈 In upward movements, I think the 6078 dollars level will be monitored as resistance. ℹ️ The investment information, comments and recommendations contained herein are not within the scope of investment consultancy.