andypro16

@t_andypro16

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

andypro16

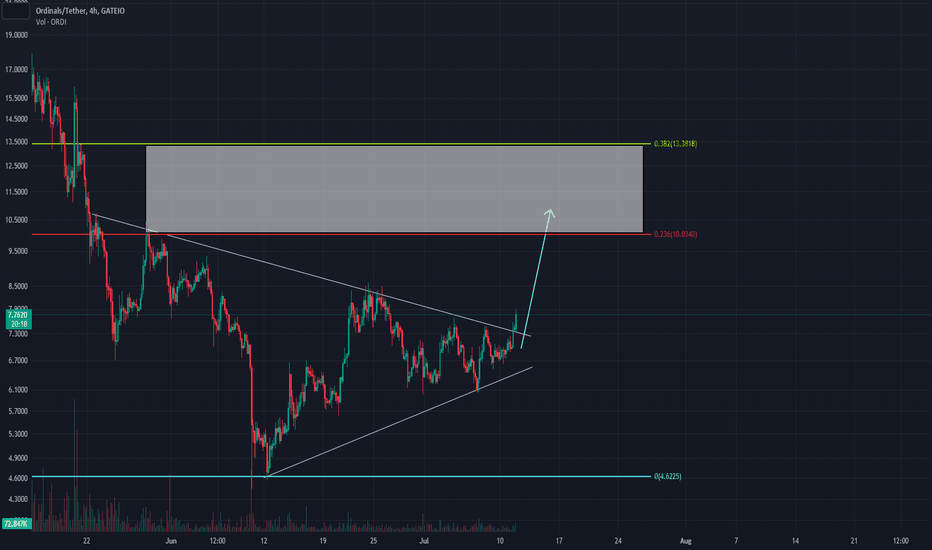

The volume remains low, probably a huge green candles representing a large short covering order on the orderbook. Stop loss below 7.2.

andypro16

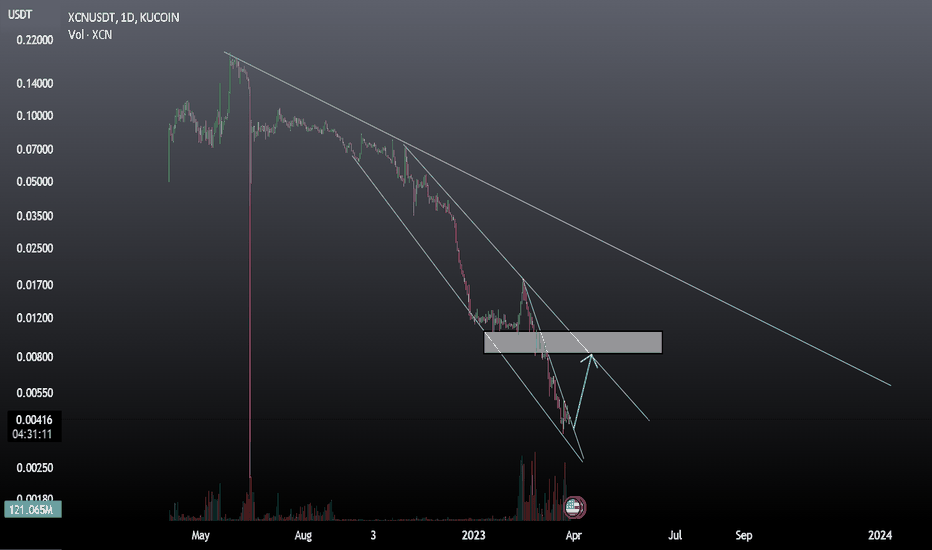

Not sure whether XCN is a scam project. But if this scenario comes true, the reward could be great enough. I do not really think there is so much selling pressure on this coin. This dumping velocity is unusual.

andypro16

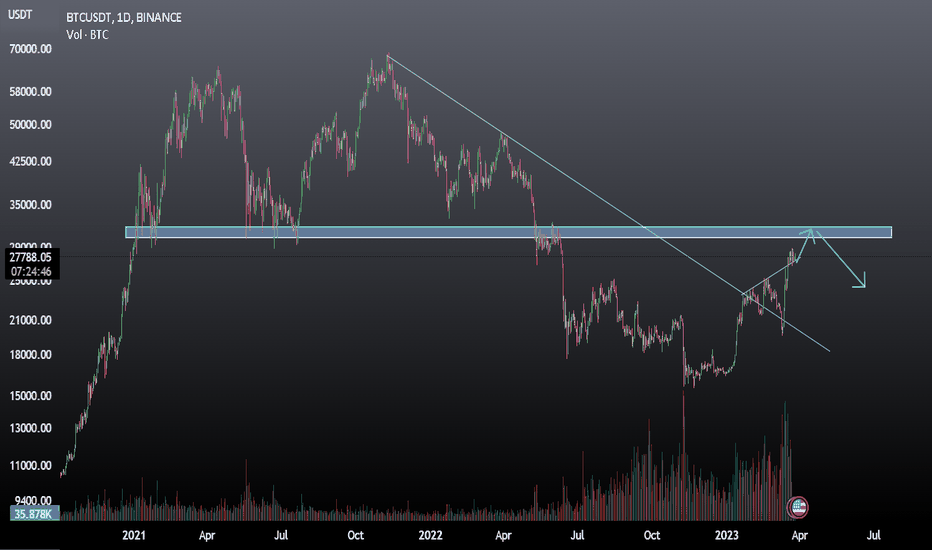

Although we are probably overbought at this zone, the strong momentum will further drive BTC to $31000 and fill the large selling orders before its retracement.

andypro16

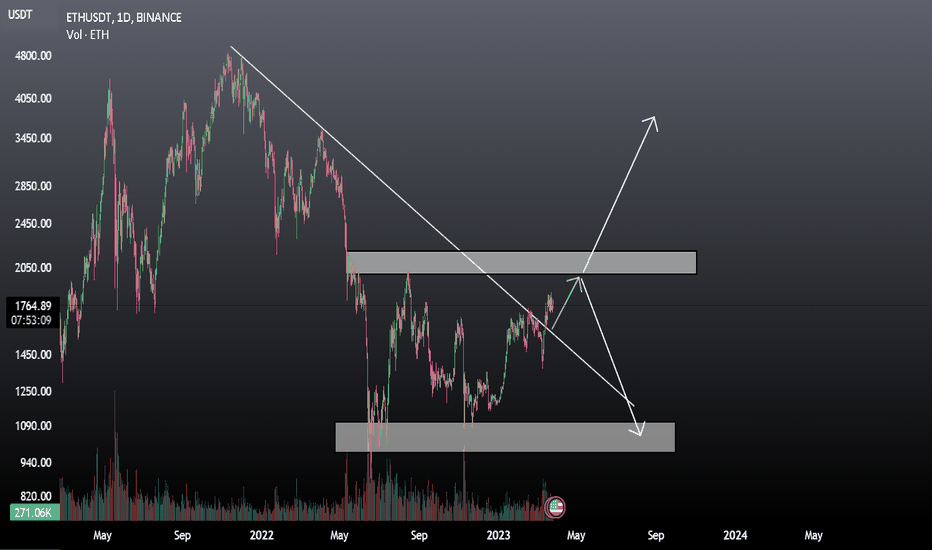

ETH has broken the down trendline, and some people may think it could be a false breakout. From the technical point of view, if this is a false breakout, it is likely that ETH will at least test the upside liquidity zone and show a significant rejection pattern before it goes down. If it is a valid breakout, of course it will go up. So in both scenarios, it is likely ETH will hit at least $2000.$2000 - $2200 is heavy resistance with strong selling pressure. If ETH does not hit those large sell orders at that liquidity zone, there is no significant selling pressure at this moment.

andypro16

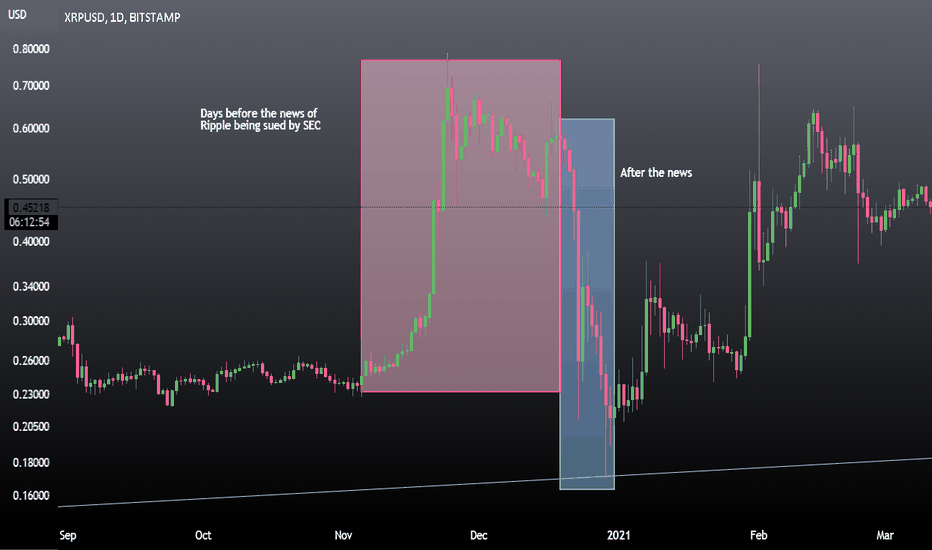

A revision for those who forget the dumpest market manipulation two years ago

andypro16

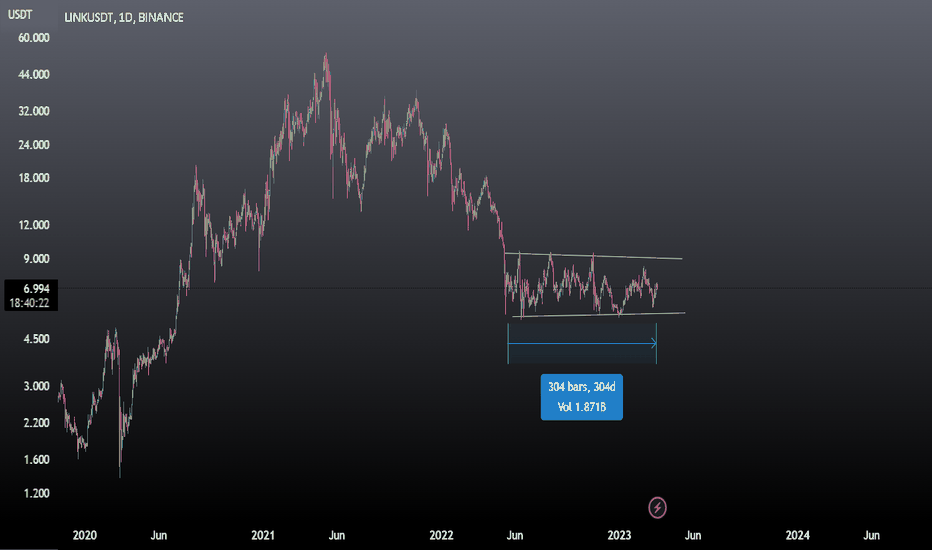

After the consolidation of 300days, I see a possibility of Link breakout from current trading range. Link/btc hits long term support, which indicates a potential bounce .

andypro16

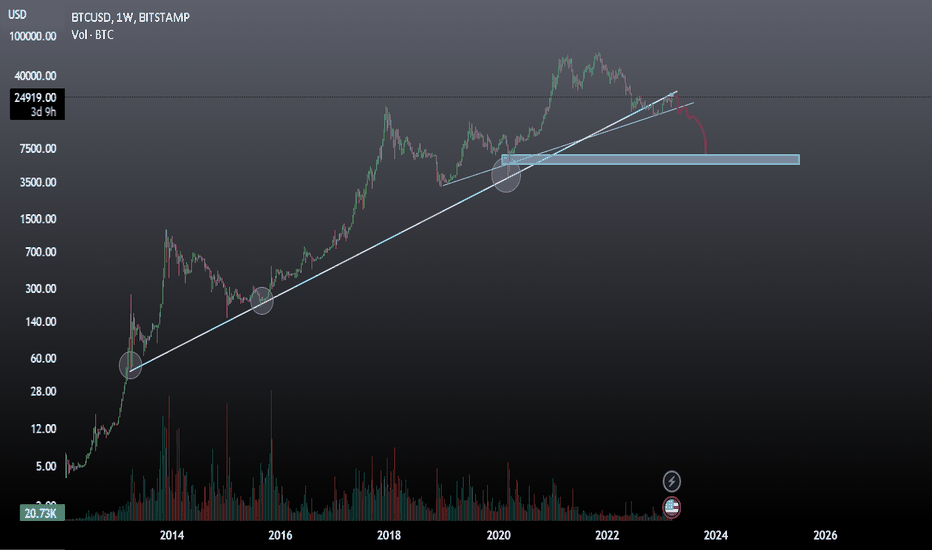

The bitcoin price chart looks like a standard breakout-retest pattern indicating the bear run in the next few years. Take a look at the daily timeframe. The highest point of the wick is exactly at the previous long term support line (which has turned into a resistance), which prove the validity of the long term support line that I have draw. The next support level is at ~$5500 to $6000

andypro16

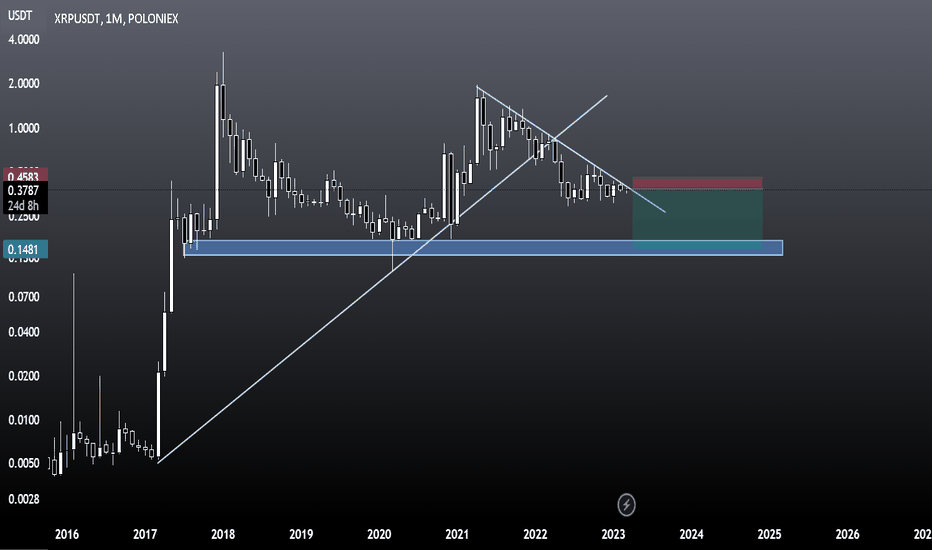

XRP is trading near the resistance line. I am short-bias because of the weak momentum of XRPBTC pair. We have a decent RR ratio to short XRPUSDT.

andypro16

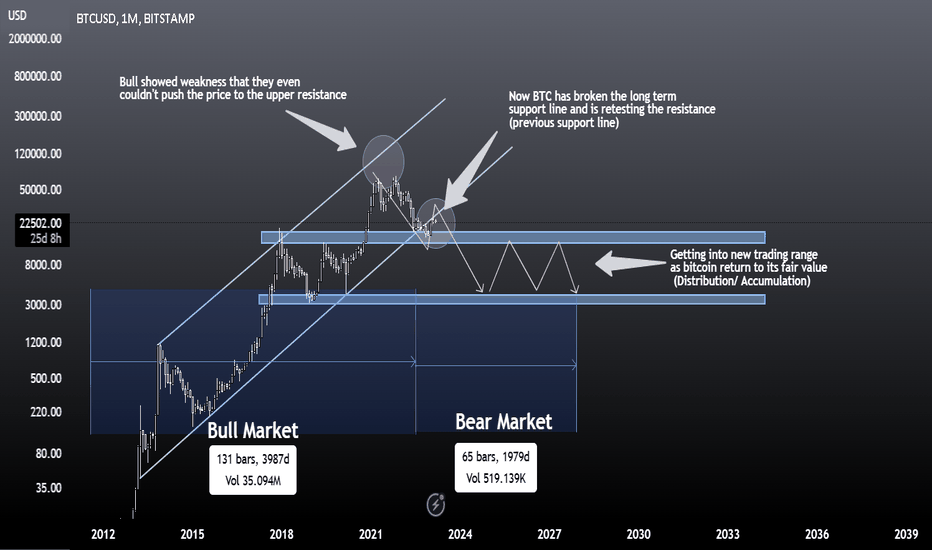

Hello traders, I am glad to share my long term view of Bitcoin in this post. Although I used to post technical analysis for swing trades, it is interesting to leave my long-term view here so I could review my thoughts few years later just like what I did when I first started trading in 2018.( tradingview.com/chart/BTCUSD/ft4QYOTH-Long-Term-Elliot-Wave-Market-sentiment/) Now I have a deeper understanding of crypto market and I wish to share my idea with you. Bitcoin has been in a bull run for more than ten years. I do not believe the bull run would continue for few reasons: 1) Technically, the long-term support did not hold anymore, and the Bitcoin price is currently traded below the support line. It indicates a trend reversal signal that Bitcoin is entering a bear market and it will last for years. But indeed, there are chances that the support line might be wrongly drawn. 2) The macro-economic outlook does not look good. The Fed is continuously rising the interest rates to fight the inflation problem. As a result, it is likely that US will be in a recession in the upcoming years, which leads to global recession. People might want to hold more cash to sustain their lives during the huge recession cycle by selling their Bitcoin/ Cryptos to turn their unrealized profits into realized profits. They will also turn their crypto portfolio into the more liquid asset class like US treasuries which provides 4%+ risk free annual return. This will lead to a liquidity crisis of crypto market that pushes Bitcoin's price down. 3) The crypto hypes are approaching an end which is driven by the inflated altcoin market caps. During the bull market, people FOMO bid the altcoins and neglect the fact that the currency price is mainly driven by demand and supply. In the upcoming years, there will be only more and more VC positions being unlocked and will be dumped for profit-taking. The altcoin project teams also need to dump their coins to sustain the operations and project development including paying their own salaries and the continuing operation expenses. If you take a look to the Coinmarketcap, there are gaps between the current market cap and the fully diluted market cap for the majority of altcoins. Over time, the supply will massively increase. How about the demand? It is a vicious cycle since no investors want to be the exit liquidity of VCs and the project teams. Just like the investors in stock market always be alert to the potential share dilution problem of a profitable company, not to mention the unsuccessful companies (or crypto projects). Eventually, the entire crypto market would be dead, including Bitcoin. The market need time to digest the massive selling pressure. We have experienced 4000 days of bull run, and it is reasonable to assume at least 2000 days of bear market in which the market sentiment will be worse than what we experienced last year (2022). Leave your thoughts below and discuss! Don't forget to follow me if you want to get my latest swing trade ideas!

andypro16

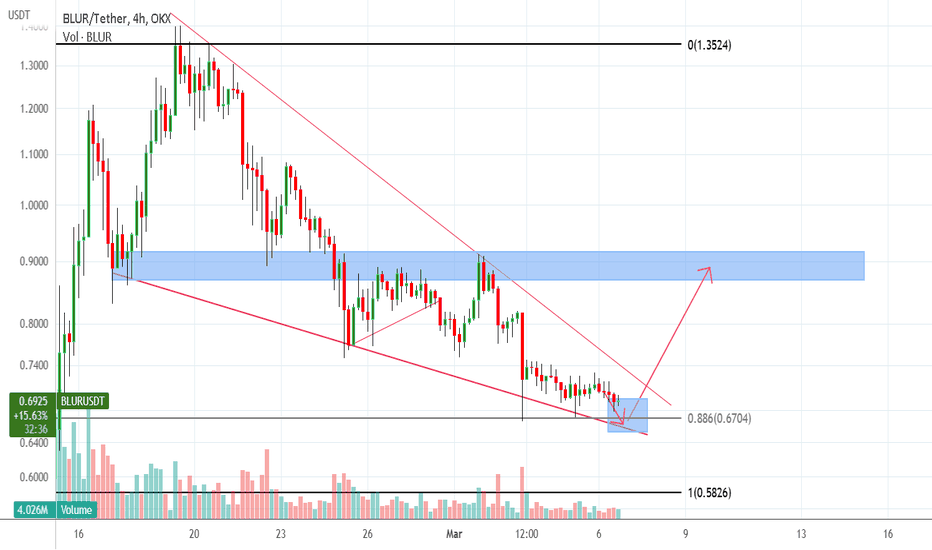

Targeting 0.88 I see selling pressure is controlled and did not further accelerate. If the price drop to 0.66-0.68, then it might be an opportunity to accumulate blur coin. Manage your risk and wait for reversal signals to buy.Falling Wedge does not guarantee a breakout But if we buy at the right price, the RR ratio would be great enough to make it profitable even if the pattern fails sometimes. Be patient and wait!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.