UnknownUnicorn2319099

@t_UnknownUnicorn2319099

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

UnknownUnicorn2319099

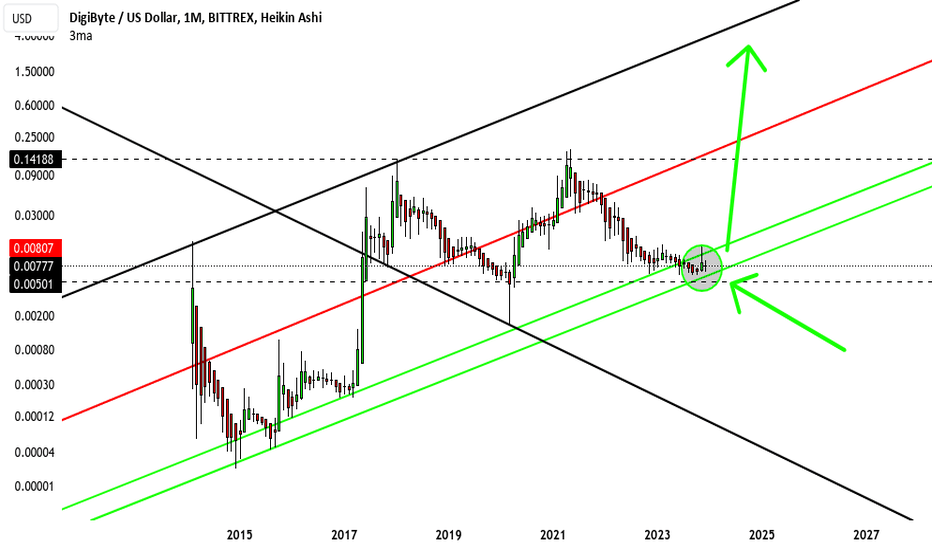

Digibyte: The True Gem of Decentralized Crypto

Unveiling Digibyte: The Decentralized Powerhouse of CryptoIn the dynamic world of cryptocurrencies, where innovation and decentralization are prized, Digibyte stands out as a beacon of true decentralization and utility. Established in 2013 by Jared Tate, Digibyte has weathered the storms of the crypto market, emerging as a robust and resilient digital currency.Decentralization at its CoreAt the heart of Digibyte lies its commitment to decentralization. Unlike many cryptocurrencies that claim decentralization but often fall short due to centralizing forces, Digibyte boasts a truly decentralized network. With five mining algorithms employed to secure its blockchain, Digibyte ensures a more equitable distribution of mining power, thwarting the dominance of any single entity. This multi-algorithm approach enhances security and resilience, making the network less susceptible to 51% attacks.A Rich History and Low FeesHaving been in existence for nearly a decade, Digibyte has proven its longevity and stability in the volatile crypto landscape. One of its standout features is its UTXO (Unspent Transaction Output) model, which enables fast and low-cost transactions. With fees remaining minimal, Digibyte facilitates efficient peer-to-peer transactions, making it an attractive option for both everyday users and businesses alike.The True Value of Proof of Work (PoW) and Real Use CasesIn an ecosystem often dominated by speculative fervor, Digibyte shines as a cryptocurrency grounded in real-world use cases. Its Proof of Work (PoW) consensus mechanism not only ensures network security but also incentivizes active participation from miners, further bolstering decentralization. Moreover, Digibyte's emphasis on real-world utility, with applications ranging from secure payments to decentralized applications (dApps), underscores its potential for long-term viability.Charting New Horizons: The Bullish ProspectsDespite facing resistance at the 0.018 level, Digibyte's price trajectory suggests the formation of a potential bull pennant. As the coin consolidates sideways, investors keenly observe the uptrend channel, anticipating a breakout above historical resistance. Should the pennant indeed break upwards, signaling a major bullish run, Digibyte could see significant price appreciation. However, prudent investors may consider potential pullbacks within the old range for strategic re-entry points.Constant Development and Community EngagementOne of the hallmarks of Digibyte's success lies in its vibrant community and dedicated development team. Active on platforms like Twitter, Digibyte developers consistently engage with the community, providing updates on ongoing developments and fostering a collaborative environment. This commitment to transparency and innovation bodes well for Digibyte's continued growth and adoption.Conclusion: Digibyte - A Hidden Gem in the Crypto UniverseAs the crypto landscape evolves, discerning investors seek assets that embody the principles of decentralization, utility, and long-term value. Digibyte, with its robust decentralized network, low fees, and real-world use cases, epitomizes the essence of a true cryptocurrency gem. While navigating market fluctuations, Digibyte stands poised to carve its niche as a reliable and resilient digital asset, offering investors a compelling addition to their portfolios.

UnknownUnicorn2319099

Shiba Inu Crypto: Riding the Wave of Volatility

The world of cryptocurrency has always been a rollercoaster ride, and Shiba Inu (SHIB) is no exception. Over the past few weeks, SHIB holders have experienced a whirlwind of emotions as the price soared by a staggering 370% from its recent lows. Now, as the price consolidates tightly on the higher short-term support side, investors find themselves on the edge of their seats, eagerly awaiting the next move.At the heart of this excitement is the formation of what appears to be a bullish bull pennant. This technical pattern is characterized by a consolidation phase following a significant price increase, forming a triangular shape resembling a pennant on a flagpole. In the case of Shiba Inu, this consolidation is occurring at higher levels, indicating strong support and a potential continuation of the upward trend.However, while the chart may suggest a bullish bias, there's a crucial piece of the puzzle missing: volume. Volume is the lifeblood of any market, providing valuable insight into the strength and sustainability of price movements. In the case of SHIB, the current consolidation phase is accompanied by relatively low trading volume, leaving investors in a state of uncertainty.Without sufficient volume to confirm the direction of the breakout, traders are left in a precarious position. Will SHIB break out to new highs, propelled by renewed buying interest and investor enthusiasm? Or will it succumb to selling pressure, triggering a downward spiral and erasing recent gains?For now, the answer remains elusive, and investors must exercise caution. While the temptation to jump in and capitalize on potential gains is strong, it's essential to approach the market with a level head and a clear strategy. Risk management is paramount, especially in the face of uncertainty.As someone currently holding a position in SHIB, the stakes are high. Watching closely for any signs of a breakout, whether to the upside or downside, is crucial. Setting stop-loss orders and defining profit targets can help mitigate risk and protect capital in the event of unexpected price movements.Beyond the short-term speculation, it's essential to consider the broader fundamentals of Shiba Inu and its ecosystem. Launched as a playful experiment in decentralized community building, SHIB has captured the imagination of crypto enthusiasts worldwide. With its vibrant community, meme-inspired branding, and ambitious roadmap, SHIB has carved out a niche in the ever-expanding world of cryptocurrencies.Yet, amidst the hype and excitement, it's essential to maintain a balanced perspective. Cryptocurrency markets are notoriously volatile and unpredictable, with fortunes made and lost in the blink of an eye. While the allure of quick gains may be tempting, it's crucial to approach investments in SHIB, or any other cryptocurrency, with caution and diligence.In conclusion, the current consolidation phase of Shiba Inu presents both opportunities and risks for investors. With the potential for a bullish breakout on the horizon, accompanied by the uncertainty of low trading volume, careful observation and risk management are paramount. As the crypto community eagerly awaits the next move, one thing remains certain: the journey of Shiba Inu is far from over.

UnknownUnicorn2319099

Dogecoin Surges in Volume, Breaking Resistance: What's Next?

Dogecoin (DOGE), the beloved meme-inspired cryptocurrency, has recently made headlines with a significant surge in trading volume. This surge has propelled it above the current uptrend resistance level from its recent lows, marking a potentially bullish turn of events for the quirky coin.Breaking Out of the ChannelThe recent uptick in trading activity has seen Dogecoin break out of its established channel, a move that has caught the attention of traders and analysts alike. Breaking free from this channel suggests a departure from previous price trends and opens the door to new possibilities for Dogecoin's price action.The Bull Pennant FormationAs Dogecoin charts its course following the surge in volume, all eyes are now on the formation of a potential bull pennant. A bull pennant, characterized by a period of consolidation within a triangle pattern, could signify a period of temporary stability before another potential price breakout.Potential ScenariosWhile the current setup for Dogecoin appears promising, it's essential to consider potential outcomes. If Dogecoin successfully forms a tight bull pennant within the drawn triangle on the chart, it could signal further bullish momentum. However, failure to create this pennant, coupled with support failure, may lead to a retest of the 10 - 11 cents range, where uptrend major support lies.Looking for Buying OpportunitiesFor traders and investors, a retest of the 10 - 11 cents range could present a significant buying opportunity. This level not only represents a critical support level within the current uptrend but also aligns with historical price action, making it an attractive entry point for those bullish on Dogecoin's prospects.Cautious OptimismWhile the recent surge in volume and breakout from the uptrend resistance level are encouraging signs for Dogecoin, it's essential to maintain a level of caution. Dogecoin is still trading under major resistance levels, and it's premature to assume the beginning of a full-fledged bull run.ConclusionDogecoin's recent surge in volume and breakout from the uptrend resistance level have captured the attention of the crypto community. With the potential formation of a bull pennant and critical support levels to watch, the stage is set for an intriguing chapter in Dogecoin's journey. Traders and investors should remain vigilant, keeping a close eye on price developments and potential buying opportunities as the story of Dogecoin continues to unfold.

UnknownUnicorn2319099

Digibyte Set to Retest Major Resistance: Bull Run Ahead?

In the ever-evolving world of cryptocurrencies, Digibyte (DGB) is currently making waves as it approaches a critical juncture. The coin is now testing the major resistance zone of $0.013 - $0.014, showcasing signs of potential breakthrough. This development is crucial for Digibyte enthusiasts and investors alike as it sets the stage for a possible bull run.Testing the WatersDigibyte, known for its focus on security, decentralization, and blazing-fast transaction speeds, has been steadily gaining traction in the crypto sphere. However, its recent ascent towards the resistance level of $0.013 - $0.014 has caught the attention of many traders and analysts.This zone has historically proven to be a formidable barrier for Digibyte's price action. Yet, the current uptrend has shown signs of strength, with the coin attempting to carve out a new level of major support. This scenario sets the stage for a potential breakout retest, signaling an expansion of the range and reinforcing major support levels.Consolidation and Volume SurgeAs Digibyte consolidates around this critical resistance level, market sentiment is on the edge. The anticipation of a breakthrough is palpable, with traders closely monitoring price movements. If Digibyte manages to decisively breach this resistance zone and sustain its momentum, it could trigger a surge in volume.Increased volume often accompanies significant price movements in the crypto market. In the case of Digibyte, a breakout above the $0.013 - $0.014 range could attract a substantial influx of buyers, propelling the coin into a full-fledged bull run.Implications for InvestorsFor investors eyeing Digibyte, the current scenario presents both opportunities and challenges. A successful breakout above the resistance zone could validate the bullish thesis, potentially unlocking further upside potential. However, failure to breach this level convincingly could result in a period of consolidation or even a temporary pullback.Nevertheless, the underlying fundamentals of Digibyte remain robust, backed by its unique features and strong community support. Whether the coin manages to overcome the current hurdle or faces a setback, its long-term prospects remain promising.Final ThoughtsAs Digibyte tests the major resistance level of $0.013 - $0.014 and seeks to establish a new level of major support, the crypto market is poised for a significant move. The outcome of this critical juncture will not only shape Digibyte's near-term price action but could also set the stage for a broader market trend.With the potential for a breakout retest and a surge in volume, Digibyte stands at a pivotal moment in its journey. For traders and investors, staying vigilant and closely monitoring price developments will be key to navigating this dynamic market environment.

UnknownUnicorn2319099

Ripple (XRP) Enters Crucial Phase: Six-Year Bull Pennant

Deciphering Ripple (XRP): Navigating a 6-Year Bull Pennant Towards Potential UpsurgeIn the realm of cryptocurrency, where price movements often resemble the ebbs and flows of the tide, Ripple (XRP) has emerged as a notable contender, navigating a six-year bull pennant formation that could herald significant price action in the near future. As the cryptocurrency community eagerly anticipates the resolution of this pattern, Ripple finds itself at a critical juncture, poised to overcome obstacles and potentially embark on a major bullish trajectory.Unveiling Ripple: A Brief OverviewRipple, launched in 2012, is more than just a digital currency; it's a blockchain-based payment protocol designed to facilitate fast, low-cost cross-border transactions. Unlike Bitcoin and Ethereum, which rely on proof-of-work consensus mechanisms, Ripple operates on a unique consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA). This approach enables rapid transaction settlement, making Ripple an attractive option for financial institutions seeking to streamline their payment processes.The Six-Year Bull Pennant: A Tale of Compression and AnticipationFor the past six years, Ripple's price has been compressing within a bull pennant formation—a pattern characterized by decreasing volatility and converging price action. This prolonged period of consolidation has fueled speculation and anticipation among traders and investors, with many eagerly awaiting a breakout that could signal the beginning of a major uptrend.With the end of the pennant coinciding with the new year, there's a possibility that Ripple could experience a prolonged squeeze leading up to a significant move. The recent clearance of stage 1 resistance marks a promising development, suggesting that Ripple may be on the cusp of entering stage 2, where short-term breakouts and upward momentum become more prevalent.Navigating Stage 2: Short-Term Breakouts and Price MomentumAs Ripple sets its sights on stage 2 of the bull pennant formation, traders are closely monitoring short-term resistance levels for signs of upward movement. The recent uptick in price suggests that Ripple may be gathering momentum, with the potential for further upside if key resistance levels are breached.However, the journey towards stage 3—a critical milestone signaling a major bull run—remains fraught with obstacles and challenges. Chief among these is regulatory uncertainty, as Ripple continues to grapple with legal issues and regulatory scrutiny, particularly in the United States. The outcome of ongoing legal battles, including the Securities and Exchange Commission (SEC) lawsuit alleging that XRP is an unregistered security, could have significant implications for Ripple's future trajectory and market sentiment.Conclusion: Navigating Uncertainty Towards Potential UpsurgeAs Ripple navigates the complexities of the cryptocurrency landscape, traders and investors remain cautiously optimistic about its prospects. The convergence of technical indicators and market dynamics suggests that Ripple may be on the verge of a major breakout, with the potential for significant price appreciation in the coming months.However, challenges remain, and the path forward is fraught with uncertainty. Regulatory hurdles, legal battles, and broader market conditions will all play a role in shaping Ripple's future trajectory.In conclusion, Ripple's journey from compression within a six-year bull pennant to potential breakout is a testament to the resilience and innovation of the cryptocurrency space. As traders and investors eagerly await the resolution of this pattern, the eyes of the cryptocurrency community remain fixed on Ripple, with the hope that it will overcome obstacles and realize its full potential in the ever-evolving landscape of digital finance.

UnknownUnicorn2319099

Exploring Digibyte: A Robust Cryptocurrency with a Rich History

In the ever-expanding realm of cryptocurrencies, Digibyte stands out as a resilient and innovative player. Launched in 2014, Digibyte has established itself as one of the longest-running UTXO (Unspent Transaction Output) blockchains, renowned for its security, speed, and decentralized nature. Let's delve into what makes Digibyte unique and its potential for the future.What is Digibyte?Digibyte (DGB) is a decentralized blockchain and cryptocurrency that prioritizes security, scalability, and speed. It operates on a UTXO model similar to Bitcoin, where each transaction output can only be spent once, ensuring the integrity of the network. With a focus on both consumer and merchant adoption, Digibyte aims to facilitate fast and secure transactions for a wide range of use cases, from everyday purchases to enterprise solutions.Security and Speed:One of Digibyte's key selling points is its robust security features. Utilizing five mining algorithms (SHA256, Scrypt, Skein, Qubit, and Odocrypt), Digibyte boasts a highly secure network that is resistant to centralized control and 51% attacks. Additionally, its block time of just 15 seconds ensures swift transaction confirmations, making it suitable for real-world applications where speed is crucial.Supply and Mining:In terms of supply, Digibyte has a maximum cap of 21 billion DGB, with a gradual and predictable issuance rate. This ensures that the currency remains deflationary over time, with diminishing inflation as more coins are mined. Unlike Bitcoin, which relies solely on Proof of Work (PoW) mining, Digibyte employs a multi-algorithm approach, enhancing security and decentralization while minimizing the risk of monopolization by large mining pools.Comparison with Bitcoin:While Digibyte shares some similarities with Bitcoin, such as its UTXO model and Proof of Work consensus mechanism, it distinguishes itself through its emphasis on speed and scalability. With faster block times and a more adaptive mining algorithm, Digibyte offers a compelling alternative for users seeking a more efficient and versatile blockchain solution.Current Market Dynamics:At present, Digibyte finds itself at a critical juncture, testing a potential lifetime support level amidst favorable market conditions. With the price hovering around 1 cent per DGB, many investors view this as an opportune moment to dollar-cost average and accumulate for the long run. As cryptocurrency markets enter a new phase of growth and Bitcoin continues to soar, Digibyte's potential for upward momentum remains significant.Development Team:Behind Digibyte's success lies a dedicated team of professionals committed to advancing the project's goals. From developers and engineers to community managers and marketing specialists, the Digibyte ecosystem thrives on collaboration and innovation. Their collective efforts ensure that Digibyte remains at the forefront of blockchain technology, continually evolving to meet the needs of its users.In conclusion, Digibyte represents a compelling proposition in the world of cryptocurrencies, offering a secure, fast, and decentralized blockchain solution. As it navigates through current market dynamics and tests critical support levels, the future looks promising for Digibyte, driven by its strong fundamentals and dedicated community.

UnknownUnicorn2319099

Shiba Inu Price Soars Towards Critical Resistance!

Shiba Inu Price Analysis: Approaching Key Resistance Level Amidst Bullish MomentumThe world of cryptocurrency is always filled with excitement and anticipation, and one coin that's been grabbing attention lately is Shiba Inu. With its adorable dog-inspired branding and a passionate community of supporters, Shiba Inu has been making waves in the digital currency space. Today, we'll delve into its recent price action and what the future might hold for this canine-themed coin.The Price Surge:In recent weeks, Shiba Inu has been on an impressive upward trajectory, with its price heading vertically towards a critical resistance level. As of now, it's approaching the multi-year lows resistance level of 0.00001194. This level holds significant importance as a breakout here could potentially mark the beginning of a bullish cycle for the coin.Technical Analysis:Those closely following Shiba Inu's price movements may have noticed the formation of a compelling pattern. Previously, there was mention of the falling wedge breakout play, particularly around the 0.00000900 mark. This pattern signaled a potential reversal in the coin's fortunes, providing favorable entry points for traders looking to capitalize on the upward momentum.Strategic Positioning:For seasoned traders, identifying optimal entry points is crucial, and the recent price action has provided just that. With higher lows being consistently formed, many have secured positions within the falling wedge pattern, anticipating a sustained bullish trend. These strategic positions offer the potential for long-term gains, albeit with the acknowledgment that market dynamics can always surprise.What's Next?As Shiba Inu approaches the critical resistance level, traders are keeping a close eye on its ability to break through with convincing volume. For those considering entry at this juncture, caution is advised. Waiting for confirmation of a breakout and ensuring volume supports the move can mitigate risks associated with entering at potentially overbought levels.Risk Management:In the volatile world of cryptocurrency trading, risk management is paramount. While the bullish momentum may be enticing, it's essential to have a clear exit strategy in place. Should the price fail to sustain above the resistance level, traders should be prepared to cut losses and reassess their positions.Conclusion:Shiba Inu's recent price surge has captured the attention of traders and enthusiasts alike. With the coin approaching a key resistance level, the possibility of a breakout looms large. However, prudent risk management and strategic entry points remain essential in navigating the unpredictable waters of the cryptocurrency market. As always, staying informed and adaptable is key to success in this ever-evolving landscape.

UnknownUnicorn2319099

Bitcoin's Daily Price Analysis: Expanding Ranges and Ascending

Analyzing Bitcoin's Price Movement: A Detailed Look at the Daily Timeframe ChartIn the dynamic world of cryptocurrency trading, understanding price patterns and chart movements is crucial for making informed decisions. Bitcoin, the pioneer of the crypto market, has exhibited notable price movements since December 5th, 2023, particularly within the daily timeframe chart.Over this period, Bitcoin's price action has formed an expanding range characterized by higher highs and lower lows. This pattern indicates growing volatility and uncertainty in the market sentiment. Within this expanding range, a notable development has been the testing of the high side of an ascending wedge.An ascending wedge is a technical pattern formed by converging trendlines, with the lower trendline rising at a steeper angle than the upper one. It typically suggests a potential reversal to the downside. In the context of Bitcoin's current price movement, the testing of the high side of this ascending wedge indicates a crucial juncture.The recent price action has shown high volatility, with significant swings in both directions. However, there are indications that the price is beginning to encounter resistance, as evidenced by wicks forming at resistance levels. A rejection at this juncture could signal a potential downward movement towards the $48,000 to $49,000 range, where the support side of the ascending wedge lies.Breaking through this support level could lead to further downside momentum, potentially testing the bottom of the expanding range. It's worth noting that the green lines on the chart represent areas of major support levels, adding significance to these price levels in determining market sentiment.Given the current technical setup, it's prudent for traders to closely monitor the ascending wedge pattern. As of now, the focus should be on observing price behavior within this pattern. With the potential for further downside movement, caution is warranted for those considering buying positions, as the market faces a higher probability of correction.In summary, Bitcoin's price movement within the daily timeframe chart since December 5th, 2023, has been characterized by an expanding range with higher highs and lower lows. The testing of the high side of an ascending wedge pattern amidst high volatility suggests a critical juncture for the cryptocurrency. Traders should pay close attention to key support and resistance levels, particularly within the ascending wedge pattern, to gauge potential market direction.

UnknownUnicorn2319099

"Litecoin: Major Opportunity as Bullish Momentum Builds"

Litecoin: Navigating a Major Buy or Sell Opportunity as Bullish Momentum BuildsLitecoin, often dubbed the "silver to Bitcoin's gold," is currently at a critical juncture in its price action, presenting traders and investors with a significant buy or sell opportunity. Over the past six years, the market for Litecoin has been characterized by corrections, but each multi-year low has consistently formed a higher low, establishing a robust support level.This pattern of higher lows underscores the resilience of Litecoin's market structure and suggests accumulating buying pressure at key levels. Now, as Litecoin approaches a pivotal moment, all eyes are on whether it will break out to the upside, surpassing the multi-year resistance level marked in red on the chart.A breakout above this critical resistance level could signal the start of a bullish trend reversal and potentially ignite a sustained bull run. With Litecoin poised to challenge all-time highs, investors are closely monitoring the current pennant formation, marked by the black triangle on the chart, for clues about the coin's next move.The pennant formation is a technical pattern characterized by converging trend lines, signaling a period of consolidation before a potential continuation of the prior trend. In the case of Litecoin, this consolidation phase could be setting the stage for a decisive breakout, either to the upside or downside.For traders assessing this buy or sell opportunity, it's essential to consider the broader market context and key technical indicators. The pattern of higher lows provides a strong foundation of support, while the multi-year resistance level represents a significant hurdle for Litecoin's bullish aspirations.As Litecoin navigates this critical juncture, investors must exercise caution and closely monitor price action for signs of a breakout. Whether Litecoin breaks out to the upside and embarks on a bull run or faces rejection at the multi-year resistance level remains to be seen. Nonetheless, the current pennant formation presents a compelling opportunity for traders to capitalize on Litecoin's next major move in the cryptocurrency market.

UnknownUnicorn2319099

"Ripple Faces Crucial Resistance, Potential Breakout Looms"

Ripple (XRP) Navigates Pennant Formation: Critical Juncture Signals Potential BreakoutRipple's XRP, a cryptocurrency known for its unique utility in cross-border payments, is currently at a pivotal moment in its price action. On the shorter time frame, XRP is exhibiting a compression pattern resembling a pennant formation, suggesting an imminent breakout. However, the rejection off the downward resistance within this pattern is signaling caution among traders.A pennant formation is a technical chart pattern characterized by converging trend lines, forming a triangular shape resembling a pennant. Typically, this pattern occurs after a strong price movement and indicates a period of consolidation before a potential continuation of the prior trend.At present, XRP is witnessing a compression within this pennant formation, with price action oscillating between the converging trend lines. The rejection off the downward resistance line is a crucial development to note, as it indicates selling pressure at higher levels.For traders and investors, this is a key point in time to closely monitor the XRP chart. The rejection off the downward resistance suggests that XRP may be poised for a breakout to the downside. If this scenario unfolds, the coin could potentially test the 31 cents support level once again.A breakdown below the bottom trend line of the pennant could result in a significant decline, possibly leading to a 30 percent loss from current levels. Such a move would warrant careful risk management and could trigger further selling pressure among investors.However, it's important to consider the alternative scenario. If XRP manages to hold the lower boundary of the pennant and subsequently breaks above the red expanding range resistance, it could signal a bullish breakout. In this case, traders may look to play the breakout, anticipating a continuation of the prior uptrend.As always, trading cryptocurrencies involves inherent risks, and it's essential for traders to conduct thorough analysis and implement appropriate risk management strategies. While the pennant formation presents a potential opportunity for traders, it also carries the risk of a downside breakout. Therefore, exercising caution and closely monitoring price action is paramount in navigating these uncertain market conditions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.