Ryn8111

@t_Ryn8111

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Ryn8111

BTC: H4 Plan 25/06/25

Trade Plan – H4 BTC Market Context: - Total market cap has retraced into a 4H order block - BTC is holding stronger relative to total - Market has been range-bound for 43 days – HTF is sideways Key Levels: - 3.18T on total = clean long trigger, aligns with BTC monthly close + daily FVG + 0.5 fib retrace - 110k = equal highs, 0.886 fib level, clear derisk point for intraday and key supply zone Trade Strategy: - Wait for 3.18T retest on total market cap before entering - Look to long BTC on any dip into monthly close + daily FVG + 0.5 retrace region - Flip short at 110k – until breakout is confirmed, treat this as a range-bound environment

Ryn8111

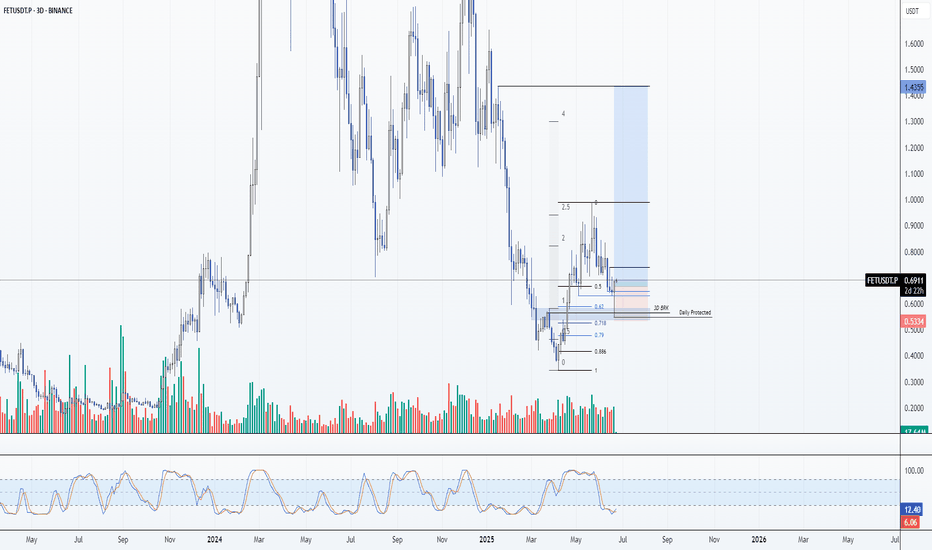

FET: Spot Long 24/06/25

Trade Direction: FET: Spot Long Position Strategy: -Risk approx 1% spot - Layered bids down to 0.636 with first filled here at market 0.692 - Avg entry if all are filled will be 0.668 Reason for Entry: - Strong multi-timeframe support confluence: - 3D breaker block - 3D fair value gap - Weekly fair value gap - OTE retracement - 3D candle close is extremely bullish at support Trade Notes: - This is a swing spot play - Will reassess if full fills hit and structure changesCouple of other fills executed. for clarity, I did secure a hedge short on FET when it came into big resistance at 0.71. This is to mitigate any losses should the idea be invalid, that short is risk free fyi.Note, risk is 0.5% due to the hedge short secured.80% filled. so long as we continue to hold this daily FVG this is going to put in a huge pumpStops BE. returning to entry would not be ideal. Positioned myself in a btc short and aave short overnight.

Ryn8111

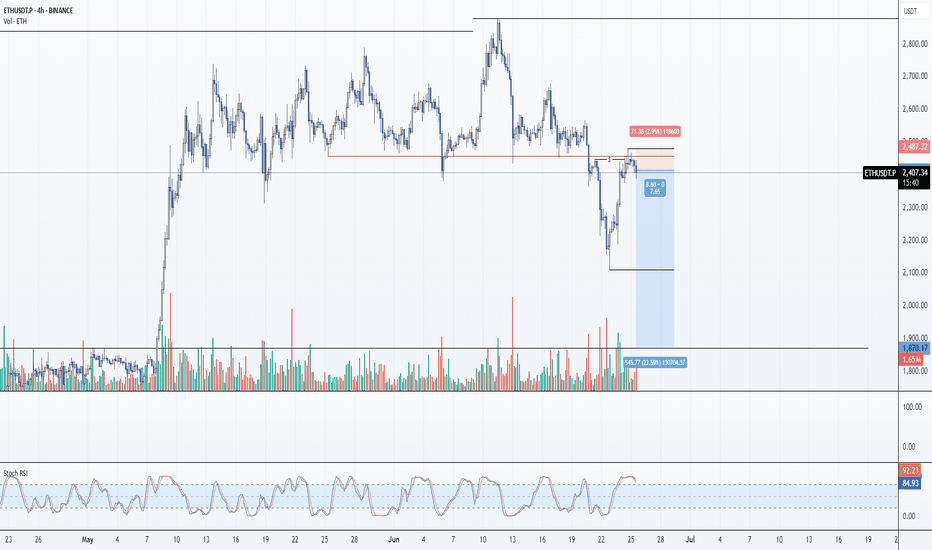

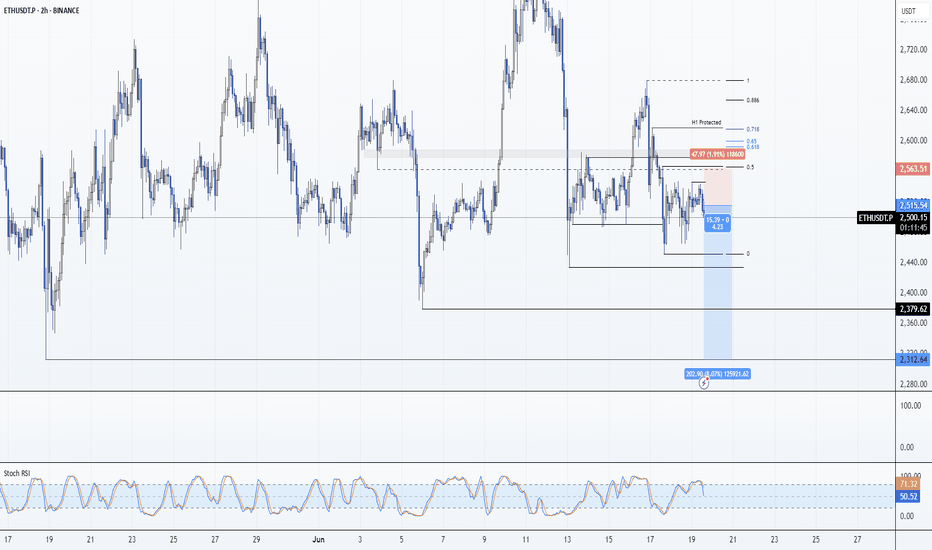

ETH: Short 23/06/25

Trade Direction: ETH Short Risk Management: - 0.5% risk allocation Reason for Entry: - Tagged and rejected from Daily FVG - Market sentiment remains bearish across macro and crypto - News flow is strongly risk-off. Qatar has closed flights, UK and US citizens issued shelter in place warnings aswell - Heightened geopolitical risk from possible Iranian escalation, with largest US base in the region - 0.718 rejectionStopped, -0.5%. Not looking to trade today. Market is 2 news driven and this PA is dog. Back thursday friday if conditions allow

Ryn8111

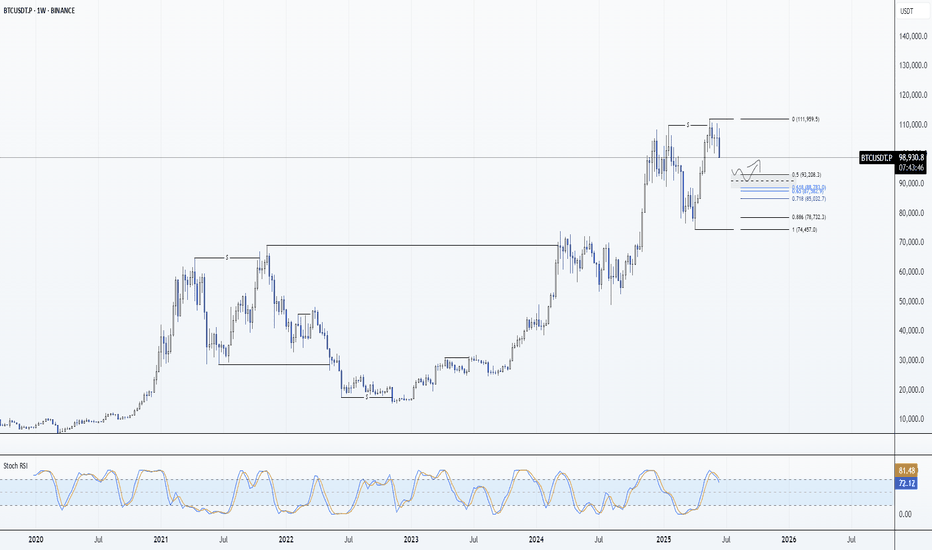

BTC: Bias Map 22/06/25

Previous Week: BTCUSDT BTCUSDT.P Bias: Spot buyer within 93.5k–88k BTC zone. This is the key support region Structure: - Weekly fair value gap sits between 93.5k–88k - Still trending lower, no reversal yet confirmed - Weekly has swept previous ATH and rejected without displacement Plan: - Watch for Bitcoin to move into 93.5k–88k - No trading Monday - sitting flat - Iran’s retaliation risk still unpriced — major global risk looming - Structure or weekly reaction will determine next steps Macro: - Global risk extremely elevated with increased escalation risk from a potential Iranian response - Risk assets like crypto are broadly unattractive in this environment - Capital preservation is still critical A key issue I dislike about this structure is the similarities it shares with the 2021 bull run, where we swept previous ATH, failed to displace and then rejected and moved -77% I do not think we will see a -77% move however but a scenario where this shares similar structure and we visit the 70-60s is without doubt a clear probability and one that must be acknowledged This week will be absolutely critical to be patient and watch how the middle east situation evolves. We are heading into a potentially very dangerous and uncertain era so caution is critical

Ryn8111

ETH: Short 20/06/25

Re-Upload as first was accidental Private Private: Trade Direction: ETH Short Risk Management: - 0.5% account risk Reason for Entry: - H4 Bear FVG BTC - H4 Bear FVG Total - Failure to displace above weekly open on TOTAL - 0.5 Fib retrace - Bearish divergence on BTC - Sentiment remains poor across majors Additional Notes: - High Timeframe point of interest respected - No reclaim of critical resistance zones across majors - Risk is half because I can see a scenario where it moves one leg higherSecuring first partials here. rest can run. completely risk free.Monthly Open reclaim would force closure. Max move: 3.5RMore partials secured here. 50% closed, 50% running. Aggressive with tps as its friday and top tier fuckery can still happen. Rest is running to atleast final tp if not beyond.Booooom. Majority closed here. 10% running as a moon bag. Done for the week. Back sunday night with charts for next week. Enjoy ur weekend!

Ryn8111

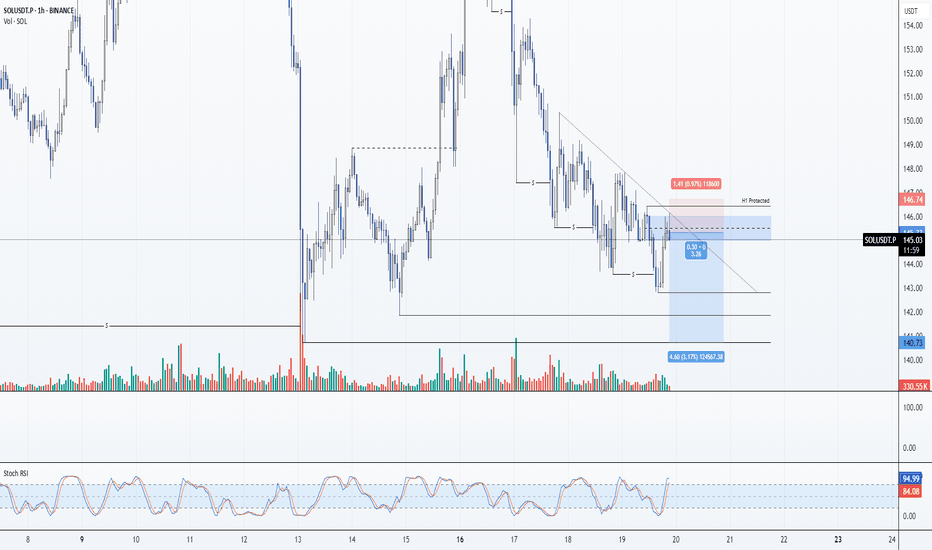

SOL: Short 19/06/25

Trade Direction: - SOL Short Risk Management: - 1% Risk Reason for Entry: - H1 Supply - Multi timeframe overbought - 0.886 Retrace - M15 Leg - HTF Bearish - Consistent Lower highs, Lower Lows being respected - HTF DOL lower ~ $140 Additional Notes: - While technically sound, runs the risk of being stopped quickly based on any news event, market is heavily news driven right now and that means this could be invalidated quickly. - Re-entry - Until price gives me a reason to I have to assume the highest probability direction is down. - For a change in bias, my system requires; a) HTF DOL being swept (Like $140) b) H1 MSB for bulls. - Accepted that this is a fairly risky trade and one IMO will get stopped. But everything aligns with my system so entry must be taken. My only active trade with risk with an additional FET long running Risk free.-1% SL hit. Going to review this tmrrw to establish what key indicators I missed for this bounce.Post-Trade Reflection: The failure came from misjudging the strength of the highs they weren’t major SFPs just weak liquidity markers. Trade idea itself wasn’t invalid the execution timing was. Today’s actual rejection (when BTC hit 106k and SOL hit HTF resistance) was the correct short zone clear confluence with H1 supply and HTF structure. My entry was basically the “pre-move” it got me chopped because I jumped on the first reaction rather than waiting for the final flush. Going Forward: Weak highs / swing failure. Need clearer structure confirmation or full HTF POI engagement. Wait for BTC/TOTAL to hit its key levels — SOL will follow. Build more patience around entries that form off temporary liquidity bounces avoid front running the proper zone just because conditions “look” overbought. Summary: This was not a bad trade in concept it was a premature execution against weak structure. The rejection happened and my read was correct I just shorted too early, off the wrong zone. The lesson is clear let the market confirm it's ready to die don’t jump the gun because it looks tired. Changes: Next week focus will be on H1 + Trades. I want to try doing less. Because simply, "Less is more"

Ryn8111

ETH: Short 19/06/25

Trade Direction: ETH Short Risk Management: - 0.5% Reason for Entry: - Failure to reclaim weekly open - Loss of weekly open, monthly open, and Monday low - H2 timeframe oversold but within a reclaimed bearish order block - Clear bearish grind price action aligning with higher timeframe bearish trend - Higher confidence in shorts at current level than higher up Additional Notes: - Total market cap looks heavy, global situation especially middle east is continuing to see a risk off mindset for risk assets like crypto. - Until price gives me a reason not to have to assume this is continuing bearish. - Potential to short higher if this failsMoving. Will be one of my last trades this week. Very good week overall few ups and downs but not looking to get cocky. I'll have one more attempt at shorting higher up if this fails otherwise going to chill with the positions I have. Enjoy your day :)Will exit here just above be. Not liking this PA. Will look to short 106k btc as that looks likely to happen

Ryn8111

BTC: Short 19/06/25

Trade Direction: BTC Short Risk Management: - Risk approx 0.25% Reason for Entry: - M30 + M15 Bear Div - Rejected off Monday low - Failure to break weekly open - H1 overbought - Market is choppy, HTF Bearish Additional Notes: - Compounding shorts to maximize edge if trade confirms, currently have a risk free SOL short running. Moving my risk to this.Additionally have a risk free FET long running as a hedge against this. I am however leaning bearish here. To many macro events and bearish POI to ignore. If this fails ~106k is next area of interest.Sideways chop, not moving in either direction yet. still running.Will cut if btc prints a bull div m30Moving half the pos to risk free. rest is at current sl.Moving sl on the other 50% to 105,085Full closed. half at BE, half for a small loss.

Ryn8111

SOL: Short 19/06/25

Trade Direction: SOL Short - Hedge Risk Management: - Risk approx 0.5% Reason for Entry: - H1 supply zone at resistance - H1 and M30 timeframes overbought - M15 bearish divergence present - Retracement into 0.718 Fibonacci level - Weak lows beneath price drawing liquidity lower - No breaker structure on higher timeframe; bearish grind continuing - Trade set as a continuation with expectation of a lower high and further roll over Additional Notes: - Clear technical alignment for a short continuation trade - Hedge against my FET LongActive: 146.69 entry chart slightly wrongDislike this reaction. Manual close here for -0.1%Okay actually re-entered lol. Ended up getting same pos size for 0.25% risk so with the 0.1% risk so far total risk is 0.35. Reason for re-entry was BTC and Eth printing divergences now as well + eth weekly open retest. Effectively, its turned into a 5:1 with same pos size and smaller risk. For bearish strucutre to remain intact it must dump here.SL moved to the highs now. risk ~0.12%Risk free, BE. Not getting Chopped in this PA. Secured some partials. If it returns to my entry 147.37 then market wants higher.Moving very well.Stops trailed to 146.5Reason: Potential area for a bounce here, btc might print bull divsSecuring partials hereFull closed now. Flat across the board.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.