Rocksorgate

@t_Rocksorgate

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Rocksorgate

XRP EXITS DESCENDING BROADENING WEDGES

💥 Hey, gonna keep this idea pretty short today since this is mainly a follow up off of yesterday's idea as shown below for reference: 💥 In yesterday's Idea we spoke on how XRP was in a descending broadening wedge and our price target of $1.99, we're waiting on that for confirmation of a bullish reversal though we can see off today's chart that bulls were able to reclaim some ground using the wedge as some technical support to bounce. We can see our 20, 50 EMA's have already converged so it'll be a matter now if whether or not we can avoid falling back within the wedge and reenter our descending channel. 💥 If we manage to break back into our descending channel then I would keep mind of that $1.99 level as it'll play a crucial resistance point until we're above it and even so the next thing will be if we can sustain and regain our 200 EMA to form a bullish crossover else we'll keep facing some volatile activity till the retail market and technical traders get some more bullish confirmation. 💥 Alongside this a big part is sentiment, things are still uneasy as ever. We've still got strong inflows into Bitcoin and positive fundamentals but with macroeconomic concerns and persistent selling pressure, liquidations and Bitcoin trading in this volatile range facing $70k again if it can't break resistance levels, $90k in particular. I would keep these things in mind, we know January has a chance of being a positive month if past-price action proves correct else we may continue to see choppy waters for a few weeks till we get some positive news or some catalyst and better sentiment. 💥 Thanks for tuning in, really appreciate everyone and the words as always, thanks and hope the holidays treat you all well. All the best and happy holidays till next. Best regards, ~ Rock '

Rocksorgate

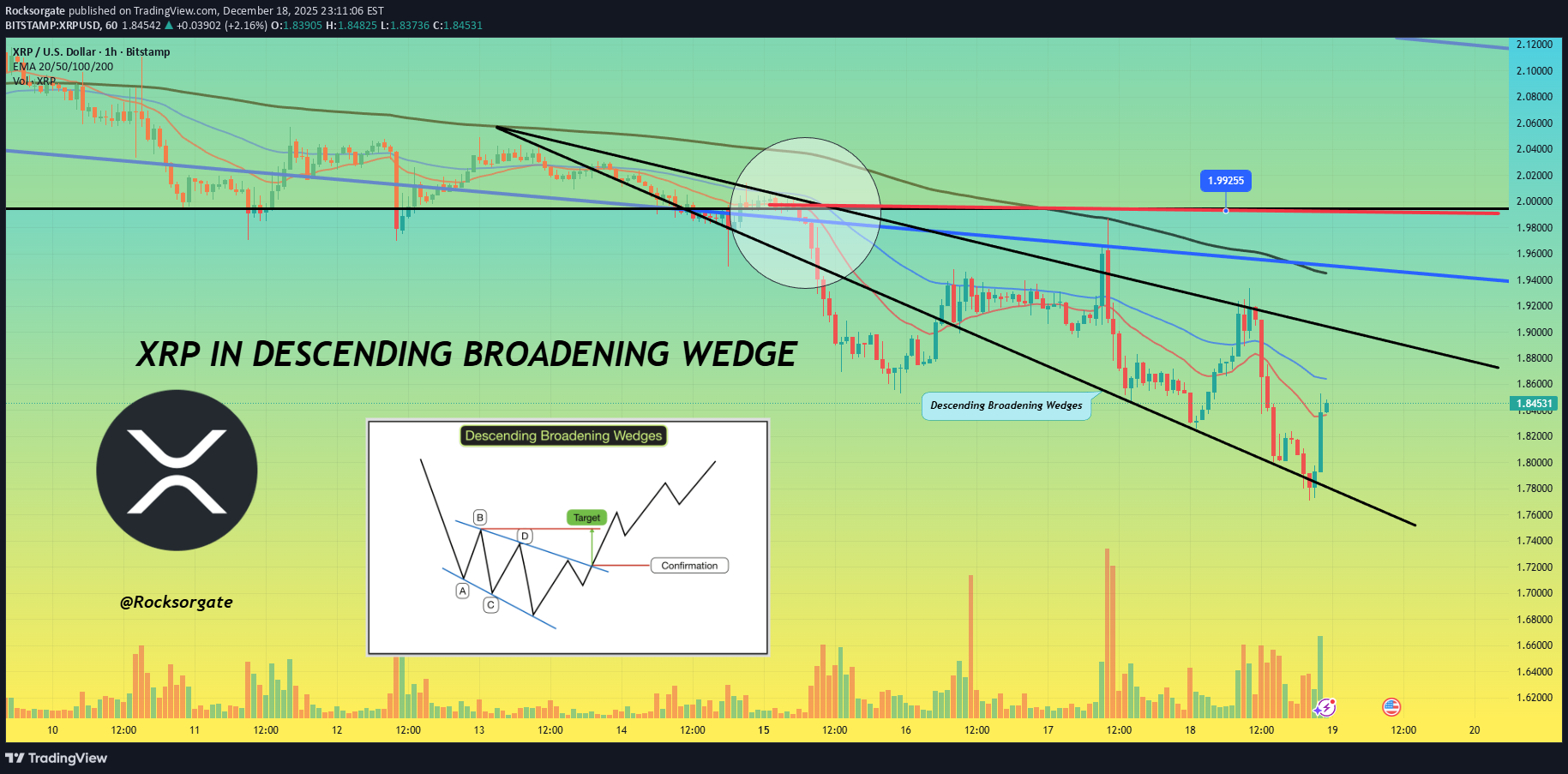

XRP IN DESCENDING BROADENING WEDGE

⚡️ Before I start just wanna give a thanks as always, appreciate the support and hope this finds everyone well, especially as we approach the holidays. ⚡️ Technical Weakness: XRP decisively broke below major support levels, including the $1.916 and the critical $2.00 psychological threshold. This triggered stop-losses and exacerbated selling pressure. The price is trading below its 50-day, 100-day, and 200-day moving averages, reinforcing the bearish outlook ⚡️ Institutional Interest: Despite the price drop, there is strong institutional interest, highlighted by over $1 billion in net inflows into U.S. spot XRP ETFs since their launch in November 2025. ⚡️ Macroeconomic Headwinds: The broader crypto market experienced a downturn as traders de-risked their portfolios ahead of U.S. inflation data and potential commentary from President Trump, fearing crypto-negative rhetoric. A delayed, but lower than expected, inflation report did not catalyze a sustained rally. Bitcoin's drop towards the $85,000 level also dragged down altcoins like XRP ⚡️ Support: Immediate support is near $1.80 to $1.83. A failure to hold this range could see a deeper decline toward the next major support levels at $1.63 - $1.65 (the 61.8% Fibonacci retracement level). ⚡️ Resistance: Key resistance levels are overhead at $1.93 and the crucial psychological barrier of $2.00. Reclaiming the $2.00 mark with significant volume is necessary to signal a potential trend reversal ⚡️ From our chart we can see we've failed to regain our 200, 50 and 20 day EMA's and this descending broadening wedge has formed giving us an opportunity for a bullish reversal but that'll be up to the market and whether or not bull's can break us out of this wedge and hit our target of $1.99 for bullish confirmation as we'll have regained the 200 EMA by then if we can achieve that. ⚡️ Bitcoin and the broader crypto markets are still showing signs of uncertainty with price fluctuating between $86,000 and $90,000 as the market looks to find where we may be headed next, especially as we approach January which off past price-action has shown to be a strong month for crypto markets along with a period of significant volatility so January should be interesting to see. Gonna leave things here but feel free to keep tuned for more and thanks for joining me today. ⚡️ Thanks as always and till next, keep your head up and keep at things. Best regards, ~ Rock'

Rocksorgate

نکات کلیدی هفته XRP: ورود پول بزرگ، قیمت و نقشه راه ریپل!

🔥 Hey, hope everyone's been well, here with a quick follow up on things and some highlights and insights for the week to consider and give a quick read. As always, thanks for tuning in. 🔥 ETF Inflows: U.S. spot XRP ETFs have seen significant inflows. Total assets under management across funds like Canary's XRPC and REX-Osprey's XRPR are approaching $1 billion. This shows strong institutional demand following regulatory clarity. 🔥 Price and Market Activity: XRP is consolidating within the $2.00-$2.30 range, with a current price around $2.11. Whales have been accumulating tokens while retail investors sell, a pattern seen in previous recovery phases. 🔥 Regulatory Clarity: Regulatory support in Europe, particularly under the MiCA framework, has boosted confidence in XRP. This has accelerated adoption among financial firms. The August 2025 U.S. SEC settlement provides a clear legal foundation for institutional participation. 🔥 Ripple's Strategy: Ripple continues to expand its global infrastructure. The focus is on real-world asset tokenization, CBDC collaborations, and expanding its On-Demand Liquidity (ODL) corridors using its RLUSD stablecoin. 🔥With this and XRP consolidating at a monthly support above that $2.00 we can see whales accumulating while retail has been panicking a bit the last few months of which price action has been pretty influenced, driven by sharp price drops followed by aggressive liquidations and our technical which still has us within this descending channel as marked by the blue. 🔥 Main thing I'm keeping watch for is when we break out of the current horizontal channel 'in yellow' and if we can break that $2.20 which would help us regain our 200 EMA and could ultimately lead to a breakout if we exit the main descending channel. Basically we want to get out of the blue channel dragging us down. Think of it as a river, once we get out of the river we can climb up. 🔥 As I said, quick and short highlights there with some important things to consider as we face the next couple of days. Market sentiment may be mixed but whales know more than we do and if their stockpiling I doubt it's for no reason, we already understand the market as a whole is recovering, consolidating, or testing support. At the end of the day the next few months look optimistic as ever. 🔥 Thanks for joining as always, happy to share some quick highlights for the week and let's keep posted, excited to see what the next few months hold for us, especially as XRP continues to grow it's presence and support by the day continuing to build towards the vision we believe in. Everything works out. 🔥 Best regards as usual, stay rocking, ~ Rock'

Rocksorgate

ماه سرنوشتساز XRP: آیا عرضه صندوقهای قابل معامله (ETF) قیمت را منفجر میکند؟

🔥 Hey hey, if your reading this I hope this finds you well. Been a while and figured it'd be good to catch up with things and make a quick analysis on what we're dealing with and looking at on our technical and beyond analysis'. 🔥 The last month or so has seen much of the digital space take on a rather big slump being led by Bitcoin's 14% decline from that $115,000 mark down to the $94-95,000 range. That being said XRP has managed to hold and keep it's gains much better than most others in the space, especially as it holds above that $2.1 mark, even after the flash sale that hit October 10th the asset has held strong. 🔥 It's great to see that price action has been pretty steady, even as we've been dragged down thanks to a descending channel so that's been positive to see the market's resilience through everything. I've set a price alert at $1.95 should we break below that but with tomorrow's XRP ETF launch we may just see things bounce from where we are with bullish optimism, hype. 🔥 Main thing I'll be watching for is the descending channel, mainly looking for bullish confirmation if we reenter the channel and another confirmation would be if we could break out of the channel for a breakout which could help sustain that momentum and help us retest $2.5 and even $3 depending on just how much investors and institutions are willing to buy into the ETF on the opening. 🔥 Definitely won't be easy though, it has also been reported that a whale has transferred roughly $95 Million worth of XRP to Binance within the last few days. Might not mean much but historically speaking more often then not we're use to seeing whales move large quantities off cold storage to the exchanges prior to large events whether it's an ETF or some hype for a project or asset in anticipation of selling some or buying more using leverage depending on which way things lean. So least to say, it'll be a fight this week for bulls and bears. 🔥 Main driver we've got right now for XRP is it's ETF debut's this month with it's first being Canary's Capital funds XRP ETF which saw a record $58 million in volume for the first day setting 2025's ETF debut record. That's been a good boost and with Franklin Templeton's XRP ETF launch today expectations are high for the new investment vehicle so hoping we get some positive price action today. 🔥 Last but not least, much as we love doing our beyond analysis, for our technical we're watching this falling wedge to see if XRP can breakout of that channel and possibly give us the breakout we've been waiting on. If there's ever a day we'd want it, it's today and at the very least this week so keeping track with that and my alert for $2.19 should we reverse and fall further. Either way keep posted and keep your spirits up. 🔥 End of the day, everything works out, just have to trust in the process. Thanks for joining me today and wishing all the best. 🔥 Best regards as always till next time, ~ Rock'

Rocksorgate

WHEN NOTHING FEELS RIGHT XRP

⚡ Hey hey, hope things have been well. Here with a quick and short idea for you guys, been juggling a lot lately but wanted to take the opportunity to get a quick idea out while I had the chance so thanks for stopping by. ⚡ We sit here at a time where nothing seems to feel right in a few ways, at a time when we'd expect things to be pushing with all the hype we had going for us from the crypto legislation and the break above that $3 resistance showing the strength behind the market and XRP. ⚡ That being said we've still got our rules and channels which will continue to apply regardless of sentiments and news. Can see how the last month or so we've been pulled down thanks to these two major descending channels with our second one forming after we broke out and broke away from $2.7 before we again slowly descending back to the $2.7 range where we currently stand. ⚡ Technically speaking we're at a support point, we've bounced back up from here before so it'll be a good reference point for active traders on whether or not we'll be headed for another possible breakout or if we'll continue to trend further down within the descending channel until we regain that 200 EMA. ⚡ Next few days should be pretty eventful, especially once memorial day weekend wraps up I'm sure traders will want to get active and make a move but that brings us to my next highlight. ⚡ Historically speaking September is the weakest performing month for the market, it's the month we see stocks and indexes usually stumble a bit before they recover as the new year then approaches so that should be kept in mind. I'd love to see a breakout but if not this would also be a great time to accumulate given that within the next year or two we'll more than likely be trading above that $5 and $6 range. ⚡ Have to go for now but wanted to get a quick idea out and give some reference points with these descending channels. They will either help us get a breakout or push us further if we can't break out of them so keep that in mind along with Septembers historical performance. Much as we love the present looking on the past helps identify and note many key and potential plays. ⚡ As always, thank you so much for the support and all the best till next. Best regards, ~ Rock'

Rocksorgate

XRP TEST $3.10 AND CRYPTO WEEK CONTINUES!

📊 Hey hey, hope all is well, gonna keep this idea pretty short and concise for the day, have a lot to do but thanks for joining as always. 📊 With Crypto week ongoing and the House of Representatives considering the Guiding and Establishing National Innovation for U.S Stable coins or GENIUS for short. Alongside that there's the Digital Asset Market Clarity Act or Clarity for short which is being considered as well. The last bill being considered is one which would be directed towards blocking the Federal Reserve from issuing a central bank digital currency directly to individuals. 📊 For summary CBDC is fiat money, just in digital form and that fiat money is issued and regulated by a central bank of a country. 📊 GENIUS has already made the rounds and passed through senate but is facing a snag, in limbo as House lawmakers as some lawmakers like Marjorie Taylor Greene and Chip Roy who themselves we're looking to get anti-CBDC language in with 12 republicans voting no on Tuesday's vote. Least to say things are still in flux, so we'll have to see if lawmakers can come to an agreement and sort things out simply put. 📊 If passed GENIUS would require stable coins to be fully backed by U.S dollars or similar liquid assets. Along with this you'd have annual audits for issuers with a market cap of more than $50 billion and guidelines would be established for foreign issuance. 📊 the Clarity Act takes a full on approach to crypto and would create a clear regulatory framework for crypto, this would function through the U.S Securities and Exchange Comission and Commodity Futures Trading Commission will regulate the crypto space. Digital asset firms would also have to provide retail financial disclosures and separate corporate from customer funds. More than likely in a nod to the collapse that FTX brought about for money when the company took advantage and started using customer funds. 📊 Overall these bills and acts alongside the CBDC bill would be a significant change for the digital asset space and give much more clarity for Institutions further allowing more money to enter the space basically. Reference: https://www.coindesk.com/policy/2025/07/16/crypto-week-is-stuck-again-as-house-procedural-vote-drags-on https://www.theblock.co/post/362542/crypto-week-set-to-be-pivotal-moment-for-digital-asset-legislation-heres-what-you-need-to-know 📊 XRP itself will be impact by these changes just like the rest of the space with some digital assets making significant jumps or declines based on what bills and changes are ultimately decided so it's a crazy week to say in the least. For Technical I've added a chart below for reference: 📊 Can see how we're facing that horizontal level of resistance at $3.10 now, gonna set an alert for that but more than anything, right now what's gonna make or break things will be the news, we've already seen how much that's done us the last few weeks, grateful and blessed for it as always. 📊 Main thing now is to keep an eye on the news and watch that $3.10 level for resistance or a further breakout. We've also converged with our 200 EMA on the 3 minute chart so no doubt we'll see bulls and bears fight to break or keep that point. Should be an interesting next few days. 📊 Have to go study but as always, grateful for the continued support and those that take the time to read through these and continue with me on this journey, it's taken a few years but things are coming together finally, grateful we've perservered. Best regards, ~ Rock '

Rocksorgate

XRP SHOOTS UP TO $3!

🌠 Wow, we'll, we've done it. We've hit $3 once again. Before I start this idea just want to give my thanks for tuning in, appreciate it. 🌠 This month has been pretty incredible for Ripple to say in the least from the BNY-Mellon Custodian Deal to Trump's Media company filing for a crypto Blue Chip ETF of which included the likes of XRP. With all the news and positive sentiment around XRP and Bitcoin which itself has hit a new All-Time-High hitting $123,000! Below I'll add a Bitcoin chart for reference: 🌠 To say in the least it's been a golden month for Crypto and Digital Assets. And one important thing to note is that as of today the Fedwire Funds Service is set to go live with the ISO 20022 standard starting July 14, 2025. The implementation will replace Fedwire's dated (FAIM) format with the ISO 20022 message format with the change happening over a single day. 🌠 For those that don't know ISO 20022 is a global messaging standard for financial transactions meant to reduce cost and fraud alongside automate transactions and reduce transactional costs. What this means for XRP is that it could become a much bigger player in cross-border payments now through RippleNet as XRP is one of the selected assets for the ISO 20022 standard. 🌠 ISO 20022 and global institutions will start utilizing XRP and it's ability to process transactions seemingly instantly and efficiently while significantly cutting down on cross border and transaction costs making it a considerably solution for banks and financial institutions. After all, if your objective is to make money, and you can make more money while cutting down on costs and making transactions, record keeping much simpler, then why not? Especially in an age where everyday things are continuously advancing and improving nobody want's to be left behind. Especially the big financial players. 🌠 Curious to see if prices can hold and keep pushing but just going off technical, we already know $3 is a tough point. At $3 just over 95% of XRP holders are in profit which makes a good reason for many to sell and take profit but with all the news and ISO now really kicking in we may not see as much selling, especially as holders are more confident and less likely to be swayed in letting go of their XRP. So it'll definitely be interesting to see how things play out. 🌠 Main thing will be Bitcoin, even if XRP holders hold I can't guarantee the same for Bitcoin, especially should it start to reverse, we know how financial institutions play taking advantage of the news. Just be cautious and set some price level alerts whether your trading XRP or Bitcoin. 🌠 In the long run things look very good regardless of what happens in the next week or two so keep that in mind. I'll be watching XRP to see if we can continue and break $3 but in my experience, with these impulse waves we usually see a big move up followed by some retracement as traders look to test support and liquidity so the waters may turn choppy but again like I said, we're here focused on the long term, whatever happens happens. We'll still be here for that but nonetheless the main objective is the longterm. $3 may seem like a lot but it's nothing compared to what XRP has in store. 🌠 This week is also 'Crypto Week' for lawmakers in DC as U.S lawmakers get ready to potentially pass changes in the regulatory setting when could push even more institutional demand further adding to the hype and optimism the crypto space has been running with as of lately. 🌠 Have to run but thanks as always for tuning in, really appreciate it and hope everyone is doing well! thanks as always and all the best till next. Feel free to keep posted and follow for more as always. Best regards, ~ Rock '

Rocksorgate

XRP SKYROCKETS AND BREAKSOUT PRICE RANGE!

⭐️In a pretty crazy twist and turn of events we're seeing XRP absolutely skyrocket and breakout with this morning's announcement on behalf of President Donald Trump with his Truth Social media platform announcing it had filed for a Crypto Blue Chip ETF with the SEC. ⭐️ The Blue Chip ETF proposal includes 70% holdings in Bitcoin, 15% in Ethereum, 8% in Solana alongside 5% in XRP and 2% in CRO which is from Crypto.com. This notably has led to the breakout with XRP that we're currently seeing with the crypto already up 12% since the day started and news broke out. It's still early morning too so we'll see how the market reacts as the day continues and traders wake up to the news. ⭐️The past few weeks have seen XRP stuck within this horizontal channel and constant tug a war between $1.90-$2.30 with this breakout and the last week signaling bullish optimism towards the crypto alongside news of the BNY-Mellon deal with BNY Mellon set to become the Custodian for Ripple's RLUSD Stable coin. And for those that don't know BNY-Mellon is America's oldest bank having been founded in 1784 and with an estimated $45.7 trillion in assets under custody and/or administration. To say in the least this is a big step for Ripple showing more institutional growth. ⭐️To note also is this as I'll show below on Bitcoin's chart: ⭐️ It's crazy to say but we've just seen Bitcoin form a new All-Time High at $118,100 alongside the Crypto Blue Chip announcement, more than likely with investors and institutions flocking to buy in before the ETF get's approved and likely in anticipation of a bullish shift. ⭐️ We've already seen the crypto space weather the storm through the last few weeks and months with everything that's happened from global escalations to all the new bills and changes in the government. Through thick and thin the crypto space has proved resilient and investors are taking note. ⭐️ Have to run for work but wanted to get a quick idea out there, especially since this news just broke out. Some pretty crazy stuff and I'll be watching these levels here to see if things continue or if the news has simply given us a breakout, regardless it's a win-win with all this news only pushing the directive and story towards crypto and digital assets for many. I'll attach a link below to an article on the Blue-Chip ETF for reference as well. ⭐️ Thanks so much as always and all the best till then, feel free to keep posted for more updates and ideas as we continue on this journey we've been riding the last few years already. It's been a lot but it's got much more to go. Let's keep at it and keep our heads up. ⭐️ Reference on Crypto Blue Chip ETF: https://apnews.com/article/trump-media-crypto-etf-bitcoin-ripple-fb17cef26a8ff211a7a410cbdb8013fe Best regards, ~ Rock'

Rocksorgate

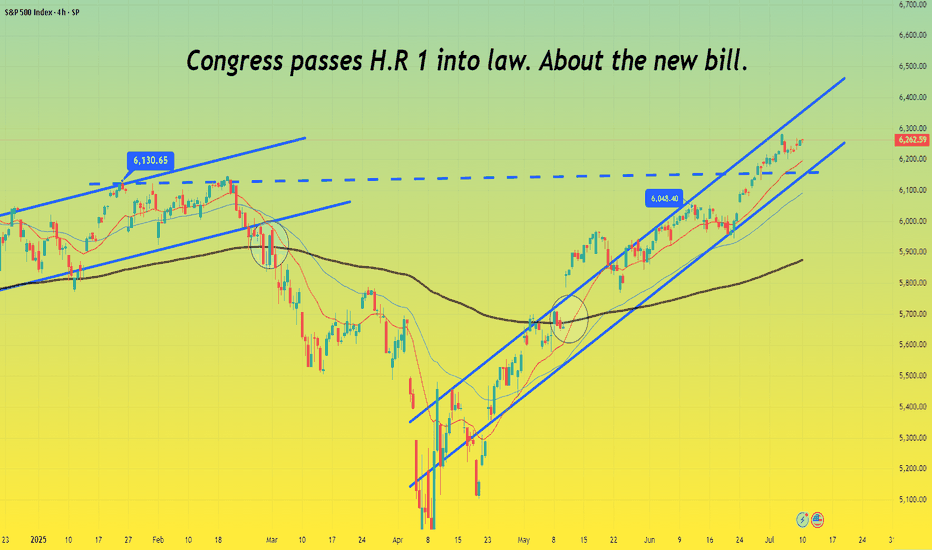

Congress passes H.R 1 into law. About the new bill.

🔵 In what's been an eventful last few weeks congress passed H.R 1 which is essentially Trump's 900 page mega bill Act. Both Democrats and Republicans ultimately united against each other over the bill with Vice President Vance casing the tiebreaking vote giving Senate Republican's the large legislative victory. 🔵 To note is that independent-minded Republican Lisa Murkowski, senator of Alaska had some concerns with the bill before GOP negotiators we're able to acquire her vote for the 50-50 votes. Murkowski's primary issue was with the legislation's changes to Medicaid and federal food assistance funding which she was concerned would hurt her home state understandably. Republican's originally tried to sway her vote by adding language to shield Alaska from the full effect of the legislation's Medicaid and SNAP cuts. 🔵 Parliament opposed that as it violated the Byrd Rule which is there to determine the legislation that can go into a budget reconciliation package as well as passing with only GOP votes. Least to say the amendment was reworked many times in order for the waivers for the SNAP funding cuts to apply more broadly than just Alaska and Hawaii. Parliament rejected the prior amendment and language which targeted just the two states understandably. 🔵 With the rework the new SNAP provisions are planned to reduce food assistance funding more slowly in about 10 states with the number ultimately being decided by a formula and based on the error rate in delivering food assistance benefits in a year. After an arduous process the amendment was passed and Republican's secured the vote with Murkowski saying it was an agonizing process. 🔵 When speaking with reporters afterwards Murkowski noted that the process was stressful with them operating under an artificial timeline in reference to the pressure Trump put on the Senate to pass the bill. 🔵 Her concern was as follows: “Rather than taking the deliberative approach to good legislating, we rushed to get a product out. This is important. I want to make sure that we’re able to keep in place the tax cuts from the 2017 [Tax Cuts and] Jobs Act,” said Murkowski when asked about her support for the bill and why it was hard for her to come around to giving her vote. 🔵 “I struggled mightily with the impact on the most vulnerable in this country when you look to the Medicaid and the SNAP provisions,” said Murkowski. This point highlights just how the effort to push the bill through was met with haste and pressure notably. 🔵 The bill itself is projected to add $2.8 trillion to the federal deficit by 2034. Main reason for that would be thanks to a reduction in revenues as well as interest cost which could have the deficit rise by a potential $5 trillion if some temporary provisions become permanent. Interest payments on the national debt are also expected to increase significantly by 2034. 🔵It should be noted that these numbers and estimates are based on a "current law" baseline and are largely thanks to tax cuts in the bill with Economist having differing opinions on the economic impact of the bill. Time will tell us how estimates go but least to say this is a large turnaround from what many we're expecting with even DOGE's Elon Musk opposing the Bill and forming a new party in strong opposition. 🔵 The tax and spending bill will see spending increase and phase in a cut to Medicaid of an estimated $1 trillion over the next decade with the CBO projecting roughly 11.8 million more American's t hat would become uninsured within the next 10 years compared to the current law. This could lead to many losing healthcare services due to medical cost with states as well likely needing to adjust their own programs and having to take on a larger share of the cost whether that means reducing services or even closing some facilities. 🔵 The bill has many key changes but in summary it solidifies many tax breaks from Trump's first term with an estimated $4.5 trillion in tax cuts alongside tax deductions on tips, overtime and auto loans with deductions for adults that make under $75,000 and a boost to the child tax credit from $2,000 to $2,200 though millions of families at lower income levels would still not receive the full credit as one of the credit's, requirements is a minimum earned income of $2,500. In 2022 alone an estimated 18 million children under age 17 (26 of all children) were ineligible for the full child Tax credit because the family income was not high enough as reported by Columbia University's Center on Poverty and Social Policy. 🔵 To say in the least the new bill has many implications for the country and the next few months and years will definitely represent those changes and how the country shifts and adjusts to this with many having differing opinions understandably. I'll definitely keep you guys posted through it all but definitely a lot to see so much happen so quick and only time will tell and show us just how things play out simply put. The market itself is still continuing within this ascending channel, especially since we got that convergence with the 200 EMA and broke that $6,130 resistance. $6,300 is what I'm expecting resistance to hit the strongest so definitely gonna keep an eye there as traders process the news and changes. 🔵 Have to go but grateful as always for the support, definitely a long idea here but wanted to focus on some important points though the bill itself has so many changes it's hard to go over every one but you get the point. This is a big changes and we'll definitely see things shift a lot over the next few months and years and as always we'll keep posted with things. Thanks as always and all the best. Best regards, ~ Rock'

Rocksorgate

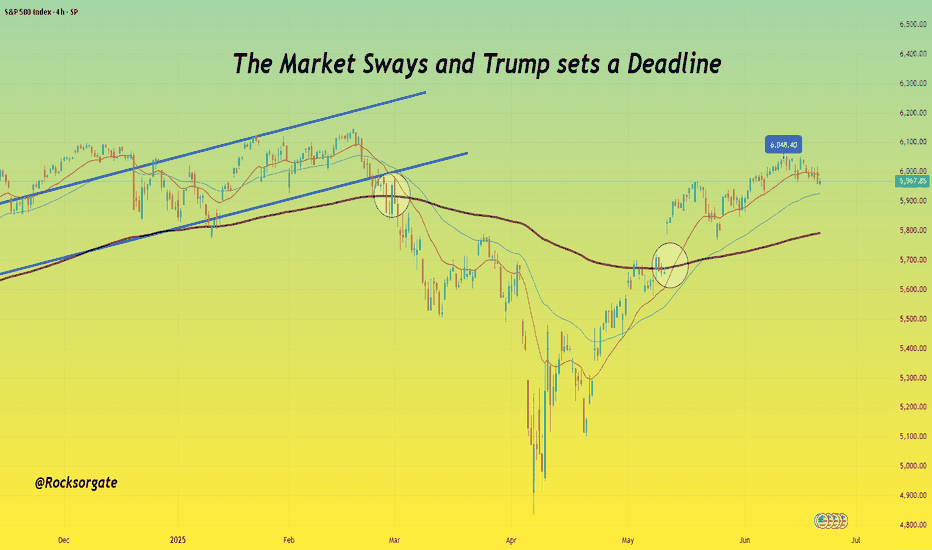

The Market Sways and Trump sets a deadline

‼️ Hey hey, hope all is well, don't have too much time so just gonna keep this short and get at what we need right now, thanks for tuning in. ‼️ If you've been following the news then you understand that tensions are pretty high, the conflict in the Middle East is progressively getting worse and worse by the day with The United States now looking to play peacemaker between Iran and Israel. ‼️ Trump himself has given a two week deadline for him to decide on whether or not the United States will join the fight and bomb Iran which notably has the market shaken. Below I've added a link with a reference to an article which highlights the recent news and trumps deadline. https://www.npr.org/2025/06/20/nx-s1-5440143/trump-two-weeks-deadline-pattern ‼️ Historically, we've seen trump do this before, he's no stranger to setting deadlines, especially when it comes to global conflicts. As the article also references, trump has done this before, take April 24th for example when a reporter asked Trump on his position with continuing military assistance for Ukraine: "You can ask that question in two weeks, and we'll see" responded Trump. It's become a tactic that Trump has used often throughout his term's prompting the question of whether or not we will really see him take action by the end of the two weeks or not. So we should take that understanding and take everything with a grain of salt. ‼️ The market itself is already use to the idea of war or joining a fight like we had to deal with when fighting started between Ukraine and Russia which shook the market before things ultimately got back to routine and the market was able to price in the war. I do have to note though that the global conflicts in Ukraine are much more different than those in the Middle East so that should be taken into consideration as well. ‼️ That being said on Saturday Trump made the announcement that the U.S had launched an attack on three of Iran's main nuclear sites signifying the U.S may be ready to join the fray. That or they have taken advantage of the high tensions to launch an attack of their own to beat at Iran's nuclear progress in order to delay, prevent them from acquiring a nuclear capability understandably. ‼️ I have to go but for technical analysis we'll be watching that 200 EMA for our bullish and bearish convergences, as well as news which will give us an idea of what way the market will head. Definitely one of those times to sit and watch how things play out, we've already come relatively close to retesting our all time high breaking above 6,000 so the market's definitely got some energy. We've dealt with this before but should the U.S really get itself involved with the war and bomb Iran then I would expect the global markets to react heavily. We've seen the U.S offer aid to countries such as Ukraine but when speaking about joining war that's a different matter entirely. ‼️ Definitely be mindful of the news the next few weeks as things progress and don't be to rash with your decision and choices, stick to what's worked and let's focus on what's worked. Paying mind to our indicators and strategies alongside much patience. ‼️ Thank you for tuning in with me as always, appreciate the constant support and wishing all the best. Feel free to keep tuned for more and thanks again. Best regards, ~ Rock '

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.