MrWhale

@t_MrWhale

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

MrWhale

Chainlink (LINK) Daily Setup – Retesting Key Support

**Chainlink (LINK) Daily Setup – Retesting Key Support** Chainlink is currently retesting its 3-month support zone on the daily timeframe as price approaches a local apex, potentially resolving late December or early January. **Bullish Outlook** - Hoping for a successful hold and bounce from this 3-month level. - A strong defense here could lead to upside resolution as the apex tightens. **Bearish Risks** - Watching closely for daily candle closes below the 3-month support. - The more consecutive daily closes below, the higher the probability of breakdown. - Invalidation of the support could open significant downside, targeting as low as **$10**. - Additional monthly support sits around **$11**, which could come into play on a deeper pullback if the current 3-month region is lost. **Key Levels to Monitor** - Immediate support: 3-month daily zone - Downside targets: $10 (major low), $11 (monthly support) Staying vigilant for confirmation of hold vs. breakdown in the coming sessions.

MrWhale

XRP Monthly Update – Risk of Losing Key Support

**XRP Monthly Update – Risk of Losing Key Support** XRP is currently threatening to lose its long-held monthly support level. With ~14 days remaining until the December monthly close, a swift recovery is critical. **Bullish Requirement** - Need consecutive daily candle closes back above the monthly support as soon as possible. - If price fails to reclaim and hold this level within the next 7–8 days, the monthly support will likely be fully lost, opening the door to a significant downside move. **Bearish Scenario (Increasingly Likely)** - First potential temporary support: Daily level around **$1.49** region. Expect this to act only as short-term relief (likely holding on 1H or lower timeframes) before giving way. - Next major target: **$1.10–$1.20** zone – this aligns with the descending weekly trendline and should produce a local bounce. - If the weekly trendline respects (acts as resistance on the bounce), XRP will continue forming lower lows, ultimately driving price toward the **macro apex** (highlighted in yellow) around mid-2026. **Key Levels to Watch** - Immediate: Monthly support (must reclaim quickly) - Downside: $1.49 (daily), then $1.10–$1.20 (weekly trendline) - Macro target: Yellow apex box (mid-next year) Bias shifts strongly bearish on confirmed monthly close below current support. Monitoring closely for either reclamation or breakdown confirmation.

MrWhale

Bitcoin local play on the daily time frame

**Daily Timeframe Local Setup** Price is currently approaching the local apex while respecting the daily uptrend line. - As long as the uptrend holds, expect a volatile breakout/move sometime late this week or early next week. - If price breaks below the uptrend line, a retest of the 3-month support (marked in green) becomes the high-probability outcome. Watching closely for confirmation on either scenario.

MrWhale

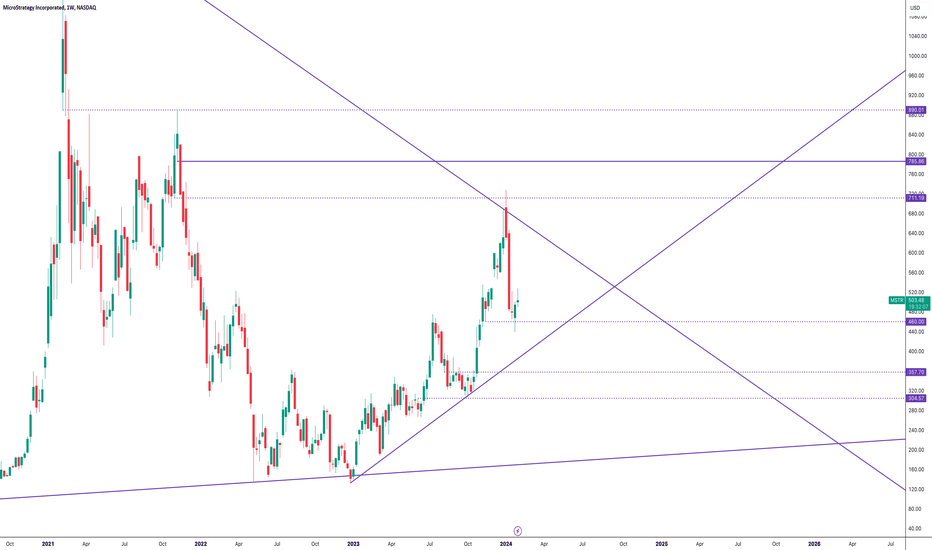

microstrategies

The weekly apex is not until ~June (Q2) of this year. The entire structure is being held by a weekly uptrend marked back in October 2023. Although current price is being held by a weekly support at $460, the uptrend is what important here. Breaking below the uptrend will result in a drop the following tested supports at $304-$360 A break OUT of the apex will result in a move up to the tested resistance at $711, then $785 if $711 breaks. considering $711 has already been tested there is a chance that it will likely reject hard at $785.

MrWhale

MrWhale

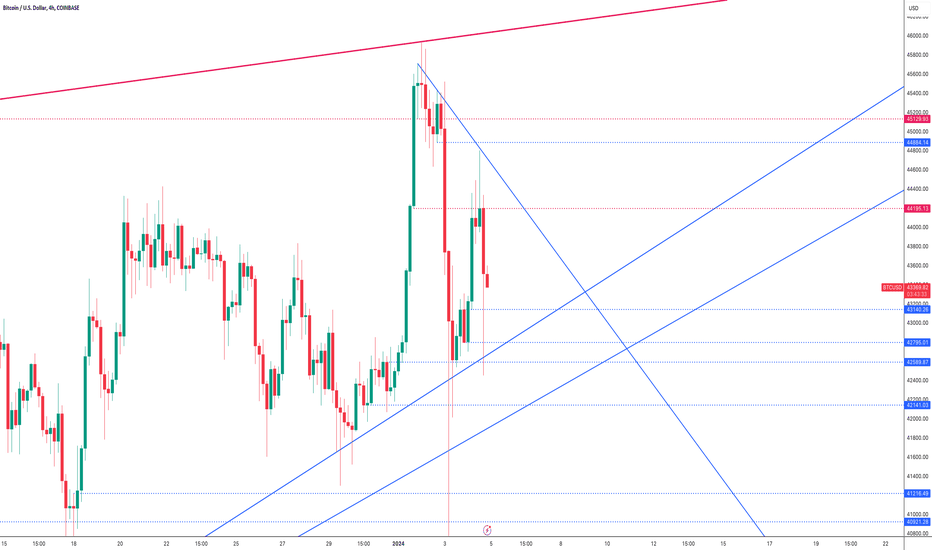

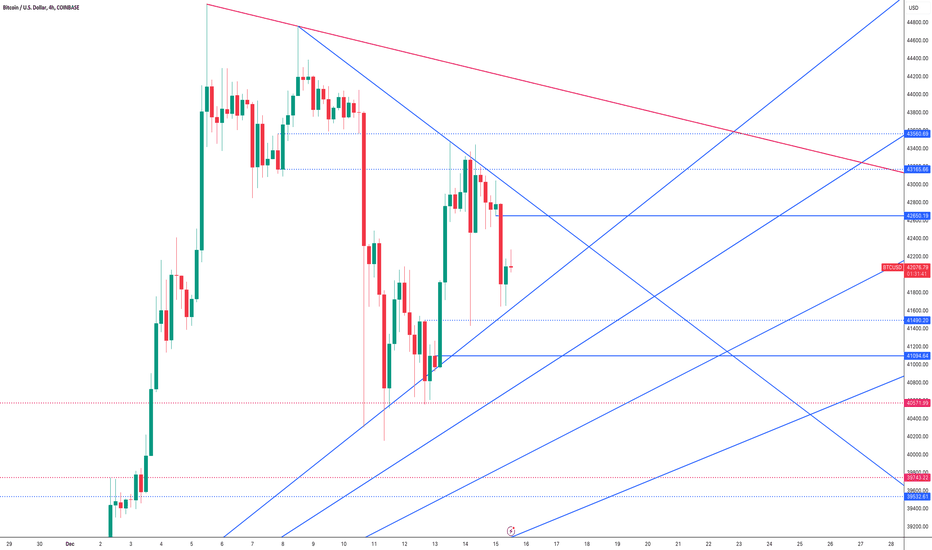

12.25 BTC Update

BTC dropped to an untested daily resulting in a bounce to test the local 4hr downtrend. we have multiple apex's incoming but keep in mind all the supports are already tested. Because bitcoin is in distribution on the daily time frame, if it does fall your altcoins will get destroyed. So keep that in mind while entering in alts.

MrWhale

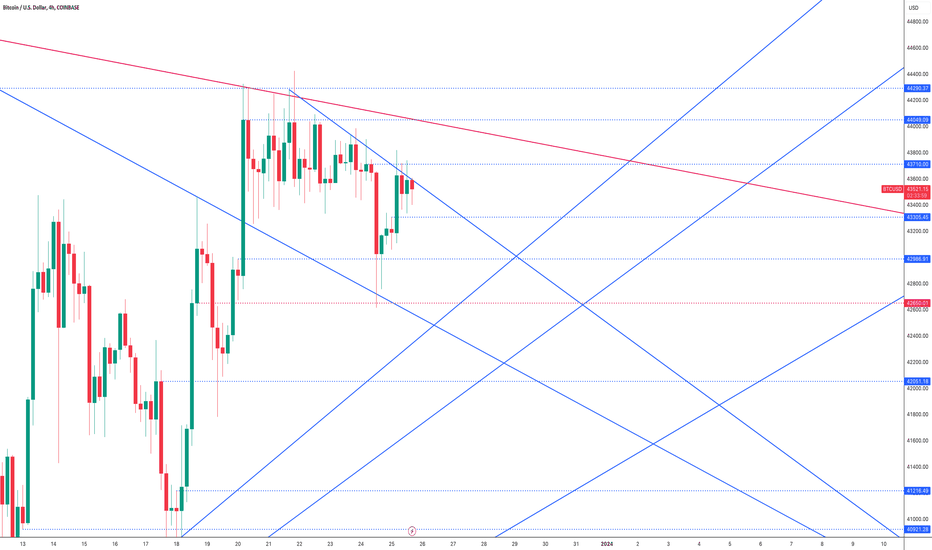

12.15 BTC UPDATE

see the bitcoin update here. we are reaching an apex in the 4hr range. keep watch, we expect to see movement in a day or 2.

MrWhale

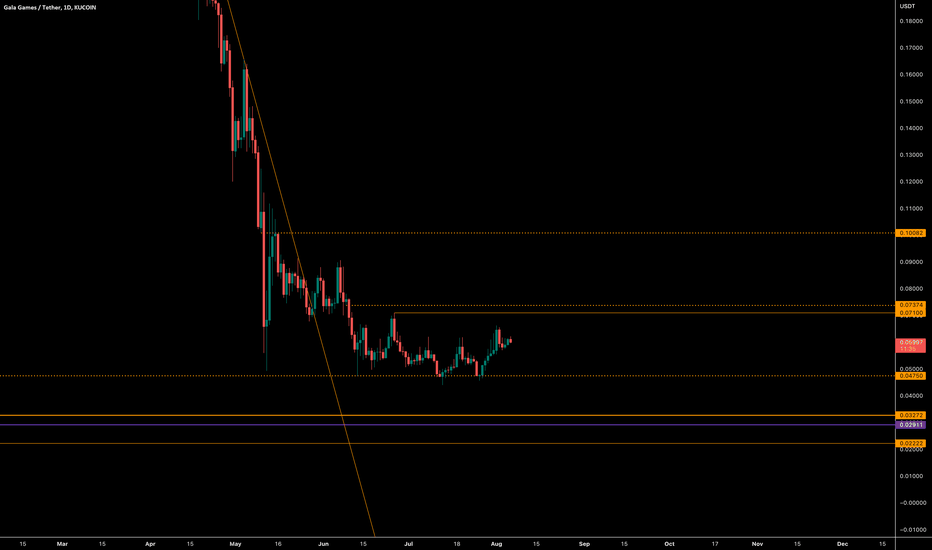

gala on daily

hello this is my chart on gala. this is on the daily time frame with 4 hour levels. feedback is welcome. thank you.

MrWhale

MrWhale

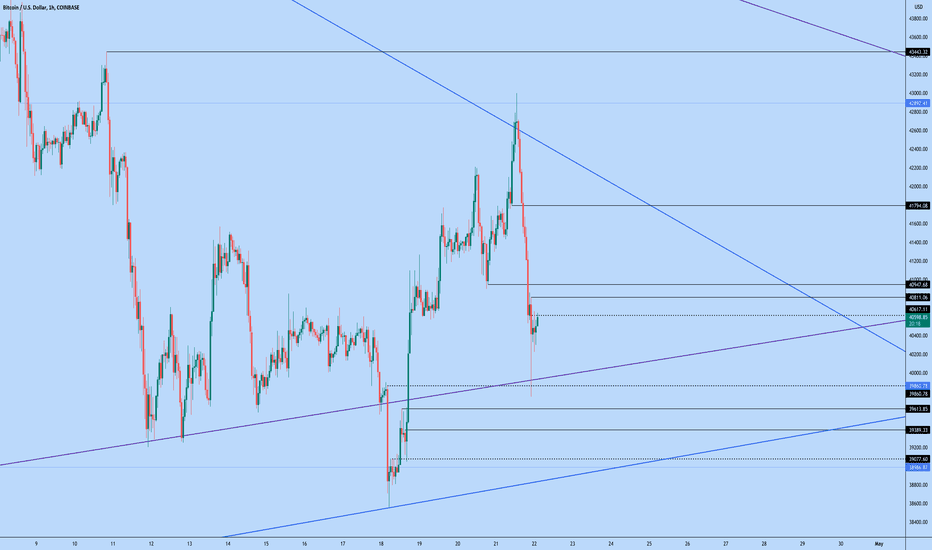

BTC on the 1hr

hello - here is my updated 1hr btc chart. black is hourly, blue is 4hr, purple is daily. i think we will have a local pump to reject the hourly resistances shown.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.