Fresh-Forexcast2004

@t_Fresh-Forexcast2004

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Fresh-Forexcast2004

The rally is back: from Ethereum to Toncoin!

Recently, the pairs ETHUSD, TONUSD, LNKUSD, ADAUSD, and AAVUSD have been climbing amid improving market sentiment and inflows into ETFs — including spot ETFs (funds that buy the underlying asset itself rather than derivatives). Investors are reacting to ecosystem news and protocol upgrades that enhance the real utility of networks. As a result, the market has received fresh momentum: demand is expanding, and prices are following. Five Growth Factors: ETHUSD (Ethereum +15.3%) — Supported by inflows into spot ETFs and heightened developer activity around network upgrades, which strengthened buyer interest (spot ETFs are funds that directly hold ETH). TONUSD (Toncoin +9.7%) — User growth driven by Telegram mini-apps and attention campaigns like SERA (a gaming/social ecosystem event; SERA is the initiative’s name) is expanding the user base. LNKUSD (Chainlink +13.9%) — Adoption of CCIP (a cross-chain messaging and value transfer protocol) continues to grow, including through bridges (technology that transfers assets between networks) — on December 4, the Base–Solana bridge was announced (Base and Solana are blockchains; the bridge connects them). ADAUSD (Cardano +16.2%) — December saw the launch of Midnight/NIGHT (Midnight is a privacy-focused sidechain — a separate network alongside the main one; NIGHT is its token). This gave Cardano a real new feature: private transactions and business-ready smart contracts. AAVUSD (Aave +15.8%) — Progress toward protocol version v4 (the fourth major upgrade enhancing flexibility and reducing client risk): a public testnet and preparation for the mainnet are heating up expectations around functionality and token economics. If interest in Ethereum ETFs remains strong, Ethereum can maintain its momentum. Toncoin benefits from easy access through Telegram apps; Chainlink gains strength as more services adopt its cross-chain “translator,” enabling secure data and token transfers; Cardano benefits from having a dedicated private network for business use cases; and Aave grows on expectations surrounding its upcoming core protocol upgrade. FreshForex analysts note that in the coming weeks, the performance of ETH, TON, LINK, ADA, and AAVE will depend on three factors: sustained inflows into Ethereum-backed ETFs, real user and use-case growth (TON via Telegram mini-apps; LINK as the “connector” between blockchains), the pace of technological rollouts (the Midnight private network in the Cardano ecosystem and Aave’s transition from testing to the full v4 release). Investors are advised to maintain strict risk management and monitor the macroeconomic calendar.

Fresh-Forexcast2004

بیت کوین در سراشیبی؛ آیا سال ۲۰۲۶ رکورد جدیدی ثبت میکند؟ (۵ دلیل برای جهش BTC)

On November 18, BTCUSD fell by about 29% — from a peak of around $126,000 to ~ $89,000 . The fall in Bitcoin was due to a combination of factors: after the record high, many investors took profits, money flowed out of Bitcoin exchange-traded funds (spot ETFs), and caution set in on global markets, with tech stocks and AI companies falling. The sharp price fluctuations triggered forced closures of leveraged trades, which exacerbated the decline, while altcoins fell even faster and drained liquidity from the market — as a result, there were more sellers than buyers, and the price fell even further. Five reasons to expect a new BTCUSD impulse in 2026: Inflows into spot ETFs. If funds start actively buying BTC on the spot market again, this will generate stable demand from large players. The halving effect. Fewer new coins are being mined, but demand remains high, which will eventually push the price up. A more dovish Fed. Lower rates → more liquidity → investors are more willing to take on risk assets, including BTC. Clear rules and business acceptance. Clear regulation and integration with banks/companies simplify entry for mass investors. Infrastructure development. L2/Lightning, convenient custody, and new on-chain use cases make BTC more useful — demand is growing. FreshForex analysts note that in 2026, Bitcoin's dynamics will largely depend on three factors: capital inflows into spot ETFs, the general “risk-on/risk-off” regime against the backdrop of Fed decisions, and key statements from regulators about the crypto market. Investors are advised to maintain a strict risk management system and focus on the macroeconomic calendar.

Fresh-Forexcast2004

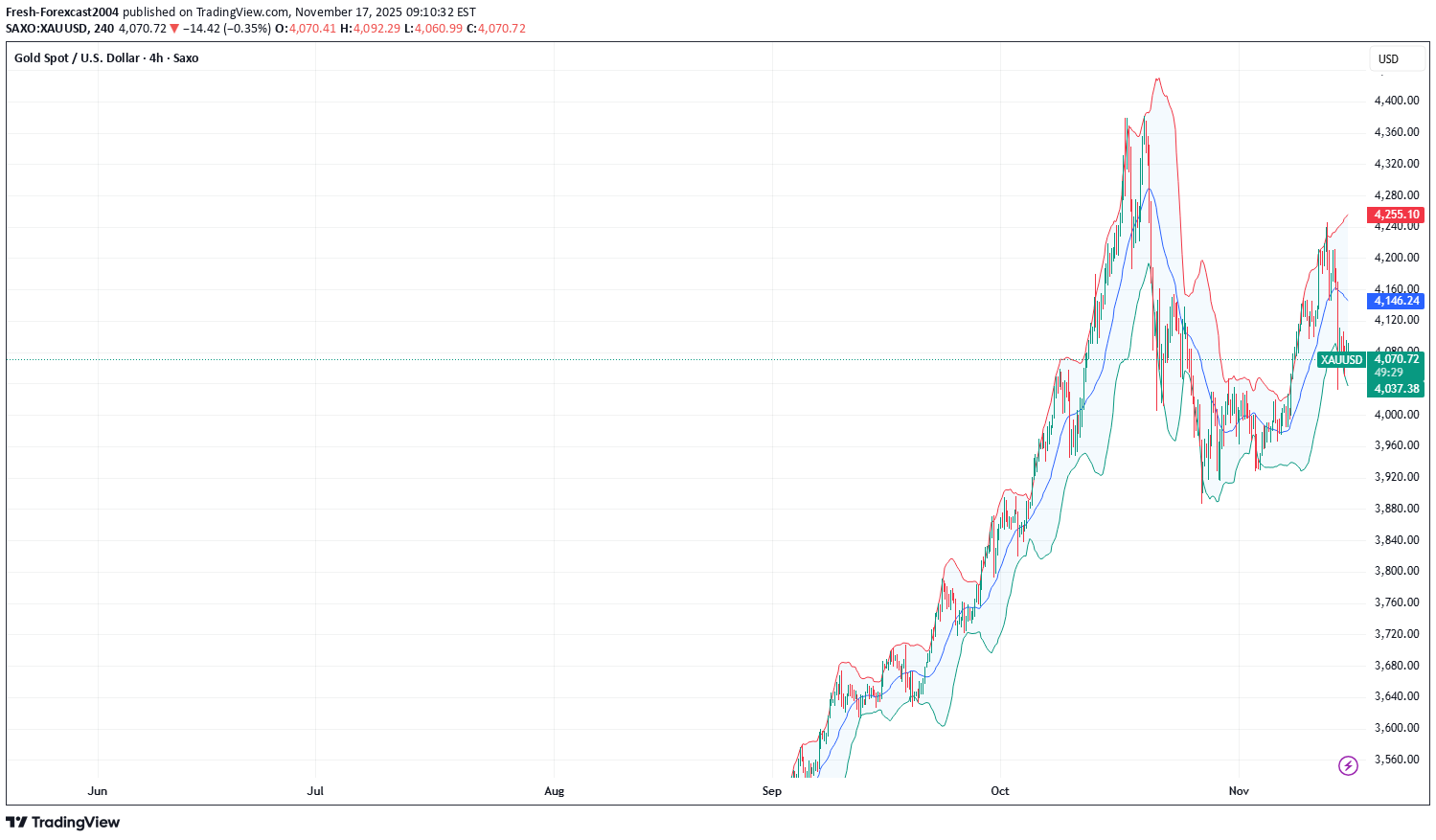

پیشبینی هفتگی طلا، بورس آمریکا و نفت (۱۷ تا ۲۱ آبان): استراتژی خرید در هفته حساس فدرال رزرو

XAUUSD: BUY 4085.00, SL 4055.00, TP 4175.00 Gold enters the new week around $4,080 per ounce on Monday, November 17, 2025. The market focus is the release of the Federal Reserve minutes this week and the resumption of delayed U.S. macro data after the government pause ended: this shapes expectations for the future rate path and the dollar’s dynamics. Meanwhile, overall demand for gold is supported by sustained official purchases: according to the World Gold Council, central banks kept net buying elevated in Q3, and October marked a fifth consecutive month of inflows into gold funds. On the supply and alternative-yield side there are no notable new factors; 10-year Treasury yields remain near recent levels, which limits the cost of holding gold but does not negate safe-haven demand. Fundamentally, the week looks moderately favorable for XAUUSD: the minutes may confirm a course toward gradual easing of conditions in 2026, while uncertainty in data and the geopolitical backdrop preserve interest in defensive assets. Risks for buyers include a tougher reading of the minutes and a stronger dollar; supportive factors include steady official purchases, continuing ETF inflows, and stable retail investment demand. In this environment, buying dips with a nearby loss limit is preferred. Trade recommendation: BUY 4085.00, SL 4055.00, TP 4175.00 #SP500: BUY 6735, SL 6685, TP 6885 The S&P 500 starts the week near 6,734 at Friday’s close (November 14), while Monday futures trade modestly higher on expectations for key corporate earnings. The main catalyst is results from the leading producer of AI-focused semiconductors, viewed as a gauge of whether the investment cycle in AI and corporate capex continues. On the macro side, the Fed minutes and the return of several delayed indicators will help refine the monetary-policy path after recent rate cuts. Yields on 10-year U.S. Treasuries are holding around 4% with choppy swings, which does not add fresh pressure to equity multiples. The weekly backdrop supports the benchmark: anticipated corporate drivers (AI investment, retailer reports as a read on consumer demand) and reduced data uncertainty as releases resume. Risks include softer guidance on AI capex, a jump in yields, or more cautious signals from the Fed minutes. The base case is a measured continuation of the uptrend if earnings resilience is confirmed and no negative surprises appear in the data. Trade recommendation: BUY 6735, SL 6685, TP 6885 #BRENT: BUY 64.00, SL 61.80, TP 70.60 Brent crude on Monday, November 17, 2025, holds near $64 a barrel as the market digests the resumption of loadings at Russia’s Novorossiysk port after a brief halt while reassessing the global supply-demand balance. Recent assessments point to a growing surplus in 2025–2026: agencies note faster output growth alongside moderate demand, while OPEC+ signals readiness to manage supply flexibly against the backdrop of lowered official selling prices for Asia in December. At the same time, geopolitical risks and occasional disruptions periodically restore a risk premium, cushioning the pressure from oversupply. This week, prices will be driven by news on OPEC+ discipline, stock/export data, regulator commentary, and the dollar’s path after the Fed minutes. The base balance is “moderately neutral” with elevated sensitivity to headlines: absent fresh signals of a larger surplus, the market tends to consolidate with potential for a recovery toward the upper end of the range as short positions are covered and risk appetite improves. Key risks to long positions are faster non-OPEC+ supply growth, softer Asian demand, and a lack of geopolitical premium in the news flow. Trade recommendation: BUY 64.00, SL 61.80, TP 70.60

Fresh-Forexcast2004

پیشبینی هفتگی طلا، اسپاتس و نفت برنت: فرصتهای خرید و فروش طلایی (20 تا 24 اکتبر)

XAUUSD: BUY 4255.50, SL 4225.00, TP 4410.00 Gold starts the new week at elevated levels: the spot price holds near $4,255 per ounce as markets continue to expect further Federal Reserve rate cuts and as long-term U.S. Treasury yields ease. Ongoing central-bank purchases and a recovery in investment demand add support: diversification of reserves and the metal’s protective role remain in focus, while trade and political tensions between the U.S. and China keep interest in safe assets alive. Key drivers over the week include the tone of Fed remarks and U.S. inflation releases, the direction of bond yields, and news on global gold flows. Risks for long positions are tied to a slower-than-expected pace of policy easing and a firmer dollar, but steady official buying and elevated uncertainty still shape a constructive fundamental backdrop. Trading recommendation: BUY 4255.50, SL 4225.00, TP 4410.00 #SP500: BUY 6660, SL 6640, TP 6900 U.S. equities begin the week supported by a move in 10-year Treasury yields below 4% and a heavy earnings calendar. Consensus for Q3 profits remains constructive, and investment in AI and related equipment continues to underpin demand for the largest names. By Friday’s close the benchmark hovered around 6,664; futures point to a neutral-to-positive start while investors watch this week’s macro releases. The balance of factors favors moderate upside: easing financial conditions, stable profit expectations, and no clear signs of a sharp demand slowdown in key sectors. Counter-risks include softness in some cyclicals, occasional stress in credit, and geopolitics. In this setup, buying on modest dips with tight risk control looks reasonable. Trading recommendation: BUY 6660, SL 6640, TP 6900 #BRENT: SELL 61.00, SL 61.30, TP 55.00 Brent enters the new week near $61 per barrel. The near-term backdrop weighs on prices: agencies and banks flag faster supply growth in 2025–2026, including as OPEC+ curbs gradually unwind and non-OPEC output rises. At the same time, demand forecasts are turning more cautious amid slower global growth and structural trends such as improved efficiency and transport electrification. Trade frictions between the U.S. and China and headlines on U.S. inventories add to buyer caution. Overall, the supply-demand balance tilts toward surplus, limiting upside unless fresh supply disruptions emerge. Risks to short positions include sudden outages, signals of deeper OPEC+ restraint, or a quicker-than-expected demand rebound in Asia. The base case is continued downward pressure with brief news-driven rebounds. Trading recommendation: SELL 61.00, SL 61.30, TP 55.00

Fresh-Forexcast2004

قیمت طلا رکورد زد؛ آیا هدف بعدی 5000 دلار است؟

Gold soared to $4,179 per ounce, a new record high . The market is being fueled by expectations of lower interest rates in the US, a weak dollar, metal purchases by central banks, and inflows into funds. Geopolitical risks are adding a “protection premium,” pushing investors toward safe-haven assets. 5 factors that could push the price of gold even higher: Central banks continue to buy actively, especially the People's Bank of China — steady “strong” demand. The market is waiting for the Fed to ease its policy: lower interest rates make gold more attractive. Record inflows into funds investing in physical gold (according to WGC data). US-China geopolitical tensions are driving defensive buying. A weak dollar and growing private demand are supporting gold's status as a “safe haven.” The story above $4,100 is just beginning: gold is accelerating, Q4 2025 promises profits for active clients, and FreshForex analysts see the peak surge in 2026. According to Bank of America estimates, gold could reach $5,000 in 2026.

Fresh-Forexcast2004

بیت کوین رکورد زد و سقف جدید شکست! سرمایهگذاری در آلتکوینها با این ۳ گزینه چقدر سودآور است؟

Bitcoin (BTCUSD) has smashed a new all-time high, reaching $125,700! The rally is fueled by steady inflows into spot ETFs, rising institutional interest, expectations of a softer Fed policy, and growing demand for safe-haven assets. Additional tailwinds include tech upgrades across networks and a revival in trading activity. This historic milestone for Bitcoin has lifted the entire crypto market. Investors are turning their attention back to top-10 altcoins — names with strong recognition, loyal communities, and clear development roadmaps. Ethereum (ETHUSD) — trading around $4,558.76. The network has undergone major upgrades, making wallets more user-friendly and transactions faster and more stable. Layer-2 solutions are gaining traction, fees are becoming more predictable, and the network load is better distributed. As a result, investor interest in ETH-based tools and its ecosystem continues to grow. If Ethereum’s roadmap stays on schedule, it could further strengthen its position as the go-to platform for decentralized applications. Solana (SOLUSD) — around $233.30. The ecosystem is preparing a high-performance validator module aimed at significantly boosting speed and resilience. This is critical for high-traffic use cases like exchanges, gaming, and micro-payment services. Solana is also set to gain the spotlight during a major industry conference later this year — a typical launchpad for new partnerships, grants, and product announcements. If improvements are implemented successfully, Solana could gain more ground in the fast and low-cost transactions segment. BNB (BNBUSD) — approximately $1,208.83. The network continues to cut costs for users and developers, expand its toolkit for launching apps, and maintain price stability through regular supply control. The easier it becomes to build and scale on BNB Chain, the greater the volume — and the stronger the token demand. With security and performance updates expected on schedule, BNB remains a top-tier infrastructure asset. FreshForex analysts believe Bitcoin’s record high reaffirms the global appetite for digital assets, while strong developments across major altcoins add depth and resilience to the market. Q4 2025 could deliver solid returns for active buyers — with the most powerful surge expected in Q1 2026.

Fresh-Forexcast2004

Tech giants ignite the market: NVIDIA — $4.3T, Oracle +40%...

As of September 2025, #NVIDIA’s market capitalization is estimated at about $4.313 trillion, making #NVIDIA the most valuable publicly traded company in the world by market cap. Across big tech, the backdrop has turned decisively positive: #Oracle shares have surged 40% on accelerating cloud revenue and AI contracts; #Apple unveiled a new device lineup led by iPhone 17; and #Google continues to climb on progress in AI tools, ad tech, and cloud services. Together, these catalysts are lifting demand for AI infrastructure and ecosystem services, reinforcing network effects between hardware vendors, platforms, and developers. Key growth drivers for IT giants in 2025: #Oracle — faster cloud revenue, major AI contracts, and expanded data-center infrastructure sparked a sharp 40% jump in the stock. #Apple — the launch of iPhone 17 and an updated device lineup strengthens ecosystem cash flows, driving upgrade cycles and service monetization and supporting a positive re-rating of the shares. #Google — gains in advertising and cloud alongside the rollout of generative AI, improvements in search and commerce products, and cost optimization for inference. #NVIDIA — new chips and architectures (including Blackwell) cement leadership in AI compute, while data-center expansion and the MLOps stack support a robust order backlog. Institutional demand — inflows into AI-themed funds and ETFs, plus strategic partnerships by corporations and governments, are sustaining premium sector valuations and fueling a broadening cycle of spend on AI infrastructure, devices, and platform services. According to FreshForex, a prolonged AI demand cycle and scaling potential create conditions for further share-price appreciation. The parallel surge in #Oracle , product updates from #Apple , and #Google’s rally keep the spotlight on the sector and bolster expectations for AI-driven earnings — from chips to devices and cloud — while #NVIDIA’s lead in next-gen architectures secures its role as a key beneficiary of the trend.

Fresh-Forexcast2004

Gold Hits Record Highs: $3,600 per Ounce and Still Climbing!

On September 5, 2025, gold reached new record highs — $3,599.77 per ounce — thanks to unexpectedly weak U.S. labor market data. This data reinforced expectations of an imminent Federal Reserve (Fed) interest rate cut, which traditionally supports gold prices by reducing the yield of alternative assets. 5 Reasons Why Gold Is the Main Asset of 2025: Expectation and implementation of Fed rate cuts: Weak U.S. employment data has strengthened expectations of a monetary policy easing, favorable for gold as it lowers alternative asset yields. U.S. dollar weakening: As the dollar depreciates, gold priced in USD becomes more affordable for holders of other currencies, boosting demand and prices. Rising geopolitical and economic instability : Growing global uncertainty drives investors into safe-haven assets, with gold remaining the traditional hedge against risks. Central banks’ active gold purchases : Central banks are diversifying reserves, reducing dollar holdings, and allocating more into gold — creating a steady base demand. Increased demand from ETFs and institutional investors : Rising inflows into gold ETFs indicate growing investor confidence in gold, further strengthening price dynamics. The main drivers of gold’s growth remain Fed rate cut expectations, dollar weakness, and active central bank gold purchases. The breakout above $3,600 per ounce has cemented gold’s status as the key safe-haven asset of 2025 . According to FreshForex , the current trend creates favorable conditions for opening long positions in XAUUSD while maintaining strict risk management.

Fresh-Forexcast2004

$3,500 per ounce: Gold’s next target

Gold has hit a new all-time high, surging more than 35% since the start of the year. According to the World Gold Council, prices climbed 26% in the first half of 2025 , with another 5% gain expected in the second half. Meanwhile, silver (XAGUSD) broke above $41 per ounce for the first time in 14 years, while platinum (XPTUSD) and palladium (XPDUSD) also posted solid gains. The rally is largely driven by expectations of a Fed rate cut. Markets now assign an 88% probability of a 25 bps cut in September — up from just 38% a month ago . Additional momentum came from dovish comments by San Francisco Fed President Mary Daly, who backed policy easing due to rising labor market risks. Despite core PCE inflation rising to 2.9%, investors are betting on a weaker dollar and a flight to safe-haven assets. Geopolitical tensions are adding to the bullish case. Ongoing conflicts in Ukraine and the Middle East are fueling demand for “safe harbors.” Meanwhile, the Trump administration is pressuring Swiss gold refiners to relocate production to the US — a demand they’ve refused. In August, Trump also announced that gold imports will remain exempt from tariffs, adding to investor interest. Analysts warn that trade wars and supply chain disruptions could further boost commodity prices. According to FreshForex analysts , gold is expected to trade between $3,300 and $3,600 in the coming months, before making a run toward the $4,000 mark . With global currencies under pressure and recession risks looming, gold continues to serve as a global barometer of trust — and a powerful hedge against uncertainty.

Fresh-Forexcast2004

Crypto is taking off: BTC at $122k — are new records next?

On 11 August BTC climbed above $122,000 — just a step from July’s record of $123,091. Ethereum is holding at multi-year highs. By market estimates, total crypto market capitalization is back above $4T. Momentum came from net inflows into crypto ETPs/ETFs (especially spot ETFs on BTC/ETH), upbeat signals around expanding access for U.S. retirement accounts to alternative assets, and bets on a Fed rate cut this fall — together accelerating prices and liquidity in the leaders. Five trend accelerators: 1. Institutions & policy. July–August brought signals about broadening the menu of assets for U.S. retirement plans — the market expects “long” money. 2. ETF/ETP effect. Net inflows into BTC and ETH products are accelerating — a direct catalyst for spot demand. 3. Macro. Expectations of a dovish Fed lower real yields and support “scarce” assets like digital gold. 4. Supply. The recent halving and coins leaving exchanges reduce free float — price reacts more strongly to the same demand. 5. ETH stack. L2 activity, spot-ETF inflows and tokenization of real-world assets strengthen ETH’s role and typically kick off altseason. FreshForex view . Current BTCUSD and ETHCUSD levels fit tactical longs — only with strict risk control and tracking CPI and net inflows/outflows in spot ETFs on BTC/ETH .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.