DolomitiCapital

@t_DolomitiCapital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

DolomitiCapital

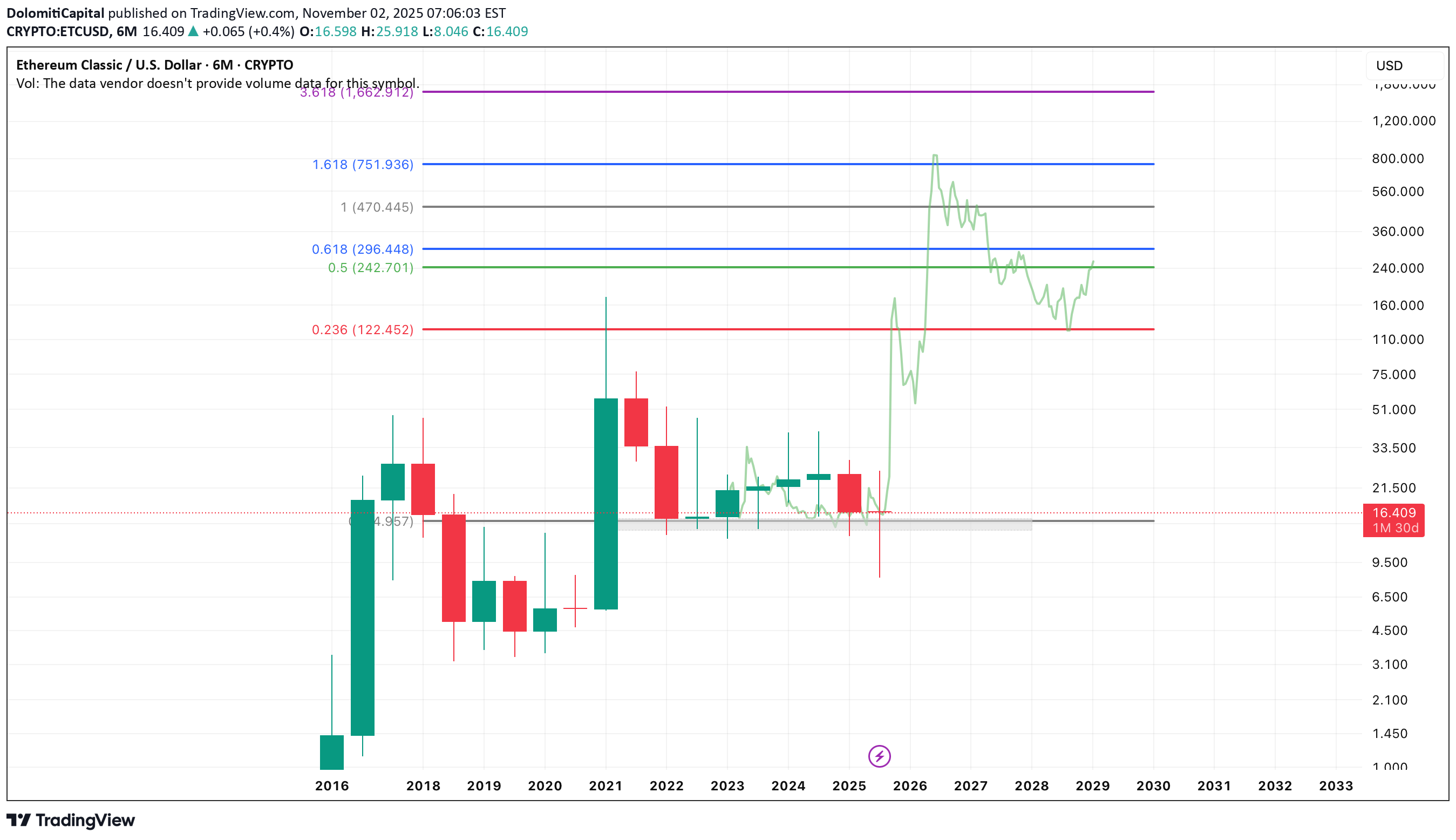

بزرگترین بلاکچین قرارداد هوشمند با اثبات کار: اتریوم کلاسیک (ETC) بعد از ادغام بزرگ!

Ethereum Classic (ETC) is often considered a top-5 Proof-of-Work chain because it retained PoW while major platforms such as Ethereum migrated to Proof-of-Stake, leaving ETC as the largest PoW smart-contract blockchain. After the Ethereum Merge, a significant amount of the Mining power shifted to ETC, raising its baseline hashrate and strengthening its security profile. Its EVM-compatible Smart-Contract capability differentiates it from the remaining PoW networks, which are mainly currency-only!

DolomitiCapital

اتریوم کلاسیک: بزرگترین بلاکچین قرارداد هوشمند مبتنی بر اثبات کار بعد از مهاجرت اتریوم

Ethereum Classic (ETC) is often considered a top-5 Proof-of-Work chain because it retained PoW while major platforms such as Ethereum migrated to Proof-of-Stake, leaving ETC as the largest PoW smart-contract blockchain. After the Ethereum Merge, a significant amount of Mining Power shifted to ETC, raising its baseline hashrate and strengthening its security profile. Its EVM-compatible Smart-Contract capability further differentiates it from most remaining PoW networks, which are mainly currency-only!

DolomitiCapital

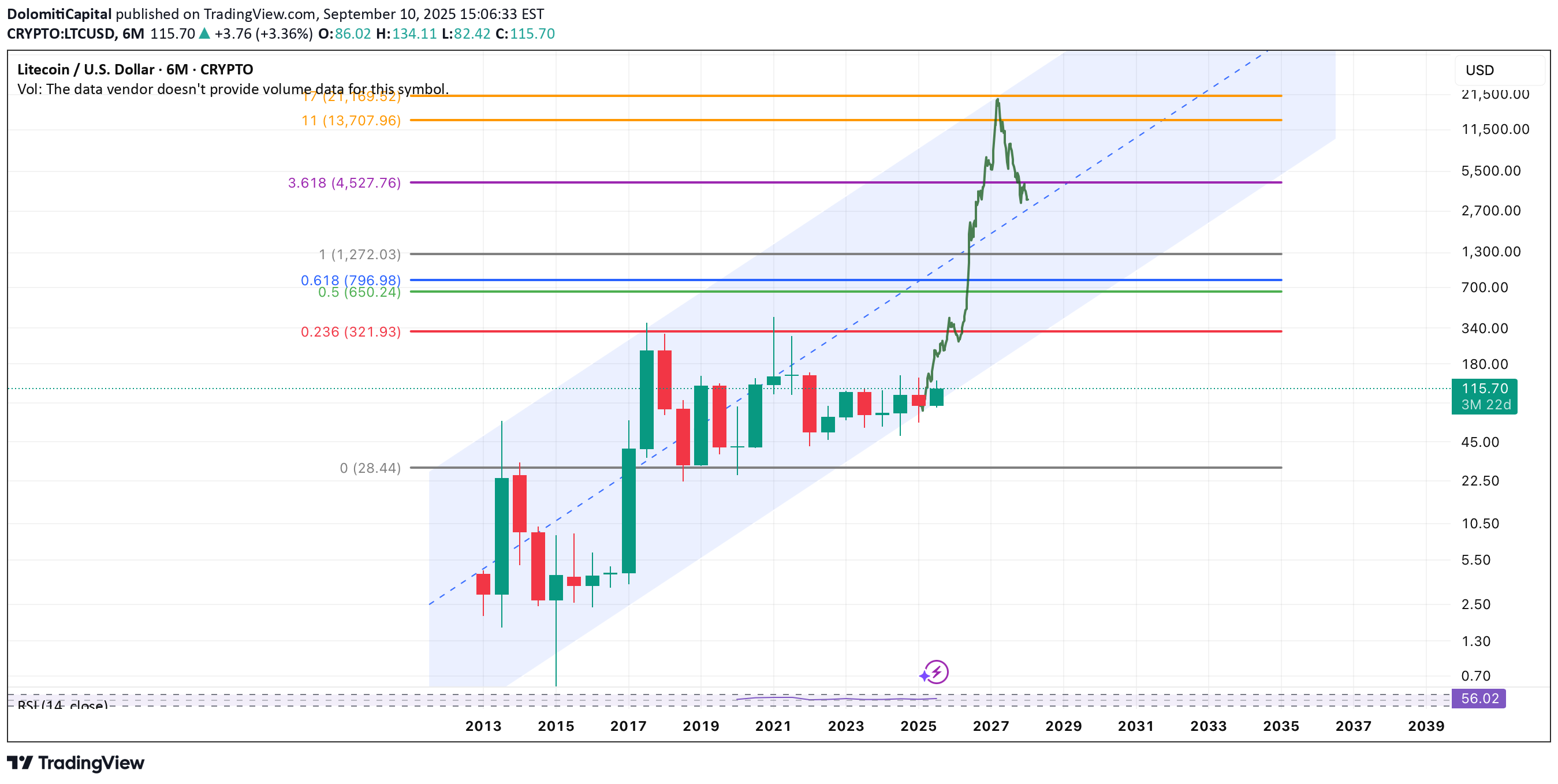

Litecoin (LTC) is trading around $114, consolidating at the lower range of its historic logarithmic channel. The black line (Bitcoin historic trend) shows how closely Litecoin has followed Bitcoin’s macro cycles, with a lag but strong upside moves once momentum shifts. 2013 bull: LTC went from ~$1 → ~$50 (50x, actually outperforming BTC). 2017 bull: ~$3 → ~$370 (123x, in line with BTC). 2021 bull: ~$22 → ~$412 (19x, slightly weaker than BTC). Cycle view: Litecoin typically lags BTC but then accelerates late in the cycle. A breakout above $420 would confirm trend continuation. If history repeats: Conservative projection point to (like 2021, 19x): $950-1100. Moderate (like 2013, 50x): $2,500. Aggressive (like 2017, 123x): $5,000-6,100. Current consolidation appears to be accumulation before a potential cycle expansion. If Litecoin follows its historic lagging-but-similar pattern to Bitcoin, the new cycle could target $950–$1,100 as baseline, with $2,5K–$6K possible in a strong blow-off phase.Network Adoption via Hashrate: in 2018 Litecoin’s hashrate peaked around ~110 TH/s, compared to today’s ~2.78 PH/s (2,780 TH/s). That means: - The network has grown ~25x in computational security since the last big cycle. - In 2018, hashrate topped after LTC’s $370 price peak. - In 2025, hashrate is already at a new all-time high, while price is still only $114 — a clear divergence. Why this matters 2018: Price → peak first, then hashrate followed. 2025: Hashrate → already at ATH, but price hasn’t moved yet. This flip suggests miners are front-running the next price cycle, locking in network security before LTC catches up. Here’s the math: In 2018, Litecoin price peaked at ~$360, with hashrate at ~110 TH/s. Today, hashrate is ~25x higher. If price scaled proportionally with network security, the fair value today would be: 360 × 25 = 9,000 USD per LTC. This disconnect shows strong fundamental adoption vs weak market pricing. Here are the main reasons: Speculative Capital Flows Prefer BTC + ETH: Most institutional and retail inflows since 2020 have gone into Bitcoin and Ethereum. LTC, while technically sound, is not marketed as a “growth narrative coin” (like ETH, SOL, or AI coins). Right now, miners are front-running because they believe in long-term security & profitability, but speculators haven’t caught up yet. Historically, these gaps close in late bull cycles, when “old” large-cap coins catch up sharply.

DolomitiCapital

Litecoin is one of the most widely supported coins on exchanges, wallets, ATMs. Used as a liquid bridge asset (cheap, fast transfers). MimbleWimble Extension Blocks (MWEB) added optional privacy (2022). It’s a store-and-transfer coin rather than a platform for innovation. It is a 14-years old, and one of the most battle-tested blockchains. LTC is likely to regain top-5 status and could continue as a legacy payments coin with bursts of cyclical outperformance.

DolomitiCapital

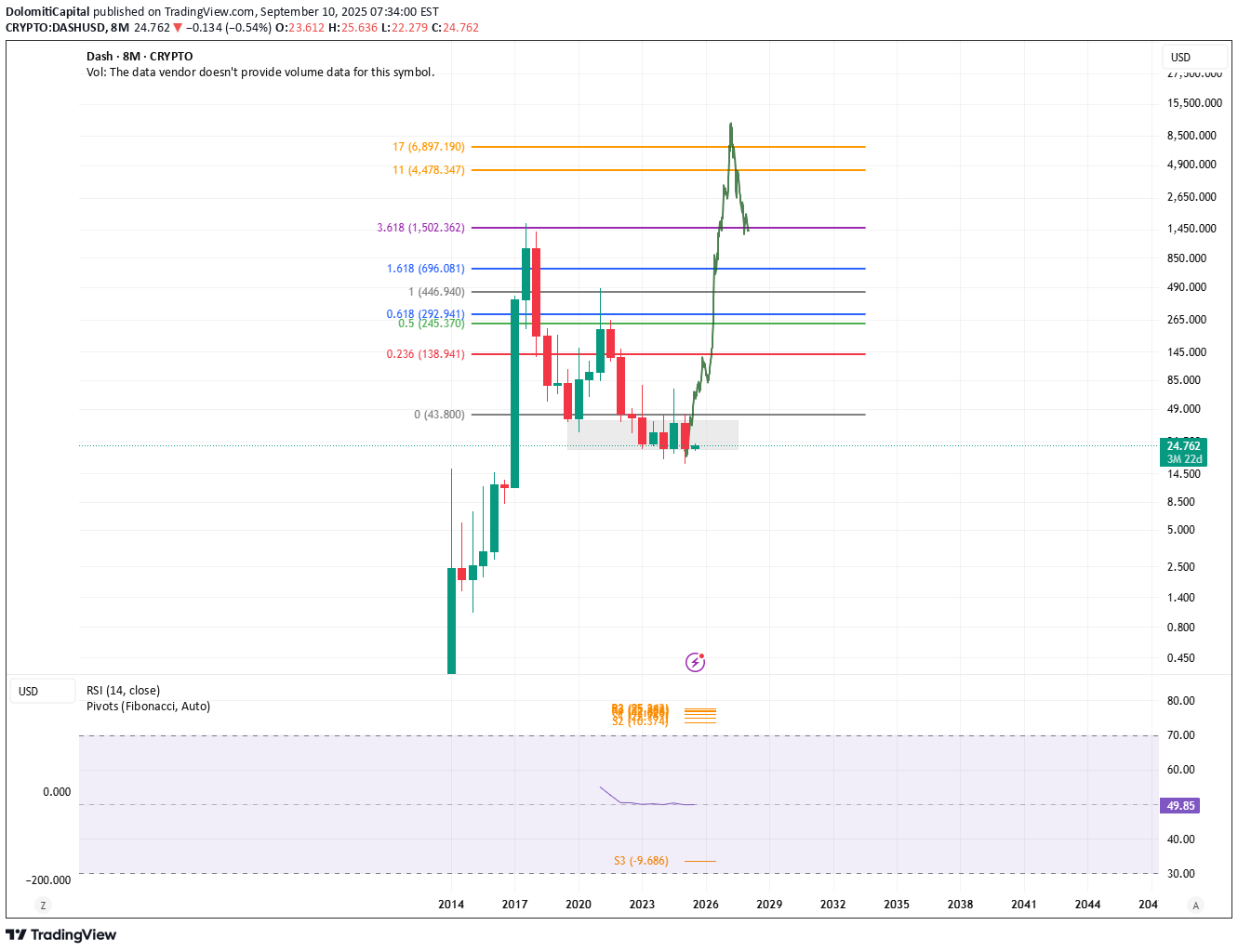

Seems Dash is re-entering a major long-term uptrend, aligned with historical cyclicality of crypto. Dash has Fixed supply and scarcity that can work in bull markets, and was among the first to pioneer fast payments, governance treasury, masternodes — features that newer projects have rebranded. According to Dash, the Annual inflation is ~3.5% in 2025. It started much higher (~10%+ in early years) and it declines automatically every year by ~7.14%. If Dash reclaims a role in payments or privacy niches, a move into the multi-billion market cap range is possible (comparable to Solana-sized cap at extreme levels). Fib retracements provide clear target zones: - First milestones: $142 → $301 → $460 - Breakout targets: $718 → $1,550 - Ultimate extension long-term: $11,000 - $15,100 Dash today is niche, with weaker adoption compared to Solana, or ETH. But if “payments coins” narrative revives (or Dash pivots with new adoption), the upside is indeed asymmetric. Potential Risks: Adoption: Stablecoins + fast L1s (Solana, Tron) already dominate payments. Liquidity: Market cap is tiny and whales can move price sharply. Regulatory: Dash’s privacy features sometimes face exchange delistings. Published for informational and educational purposes only, not financial advice, investment advice, or tax advice.

DolomitiCapital

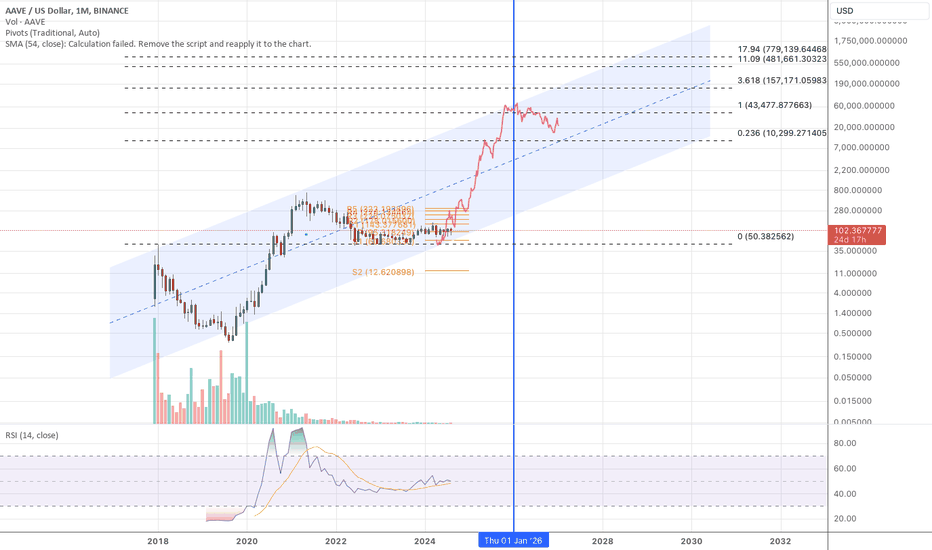

AAVE Technical Analysis: The price of AAVE has been in a consolidation phase over the past weeks, indicated by a major support at $75 and resistance at $150. The Monthly RSI is currently above the 50 level, suggesting a bullish long-term trend. Historical data shows AAVE tends to follow a cyclical pattern with periods of significant growth followed by corrections. Notably, these cycles have lasted between 12 to 18 months. For instance, the 2019-2021 uptrend lasted approximately 18 months, where AAVE price increased over 1200X time. This historical analysis provides a comprehensive view of AAVE past performance, helping traders make informed decisions based on established patterns and indicators. The information provided in this analysis is for informational purposes only and should not be construed as financial advice. The analysis is based on historical data and trends and does not guarantee future performance. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.