DECRYPTERS

@t_DECRYPTERS

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

DECRYPTERS

طلا زیر ذرهبین: سطوح پول هوشمند و انفجار نوسان قیمت (۱۴ نوامبر)

XAUUSD GOLD ANALYSIS - Smart Money Moves the Market Today 📅 Updated: November 14, 2025 🚀 Market Snapshot Gold surges toward $4,200 as the U.S. shutdown disrupts key macro data and uncertainty boosts safe-haven flows. The DXY slips to ~99.25, reflecting investor hesitation amid data blackout and Fed silence. Macro Highlights: * 🏛️ Shutdown freeze: October CPI/Jobs data postponed — volatility spikes expected on reopening. * 🏦 Central Banks: +220t in Q3, +415t H1; China & Poland lead accumulation. * 🌍 Geopolitics: U.S.–China tariff heat + Mideast tension = sustained risk premium. * 💰 ETF Inflows: Heavy buying continues; gold reclaims post-ATH strength at $4,202 (+0.50%). 🧭 Smart Money Levels (Valid for Today) 🔴 Smart Money SELL ORDERS $4,293 – $4,279 💣 ~$85M+ in institutional orders → Expect sharp rejection and high-volatility spikes. 🟠 Scalp SELL Area $4,244 – $4,256 → Ideal for quick fade setups with tight stops. 🟢 Smart Money BUY ORDERS $4,080 – $4,104 💸 ~$50M+ in buy-side liquidity → Strong accumulation zone; expect bounce setups. 📍 These are high-probability institutional footprints for today’s session. 🔍 Macro Catalyst Outlook * 🕒 CPI & Jobs Data: Still delayed → Expect “volatility bursts” when released. * 🏦 FOMC (Dec): 25bps cut odds ~47%. * 🌏 Geopolitical heat: * Tariff escalation & Mideast risk = 🟢 Bullish * Diplomatic cooling = 🔴 Pullback pressure Bottom Line: Market remains headline-driven and liquidity-sensitive. ⚡ Technical Outlook — Bullish but Overstretched * ✅ Break above $4,200 = continuation toward 4,250+ * ⚠️ RSI near 84 = expect volatility, not immediate reversal * 🟩 Holding $4,180 = bullish continuation * 🔻 Losing $4,180 = correction toward $4,150–$4,120 📌 Intraday Trade Levels (Nov 14, 2025) 🟢 Buy Zone: $4,180 – $4,200 → Structural retest + central bank bids = strong support 🔴 Sell Zone: $4,230 – $4,250 → Overbought liquidity pocket, short-term fade setup → Larger rejection expected around $4,244–$4,256 📈 Daily Range: High: ~4,220 Low: ~4,190 Current: ~$4,202 🎯 Trade Plan — Simple & Tactical * Buy Dips: 4,180–4,200 → Targets: 4,230 / 4,250 * Sell Fades: 4,244–4,256 → Short-term scalp * Institutional Sell Wall: 4,279–4,293 → Major rejection zone * Break & Hold Above 4,250: Target 4,300+ 🧠 Final Take: Bulls in Control, Volatility Rising Shutdown chaos, data blackout, and global risk keep gold bid on every dip. Until $4,180 breaks, the bulls hold the advantage. Trade the reaction — not the prediction.

DECRYPTERS

پیشبینی قیمت طلا: سطوح حیاتی پول هوشمند (۱2 نوامبر 2025)

XAUUSD GOLD ANALYSIS - What’s Moving the Market Today? (Updated: November 12, 2025) 💠 Trade with DECRYPTERS We keep it simple - Smart Money zones define the battlefield. Follow institutional footprints, not noise. 🔮 ASTROLOGY INSIGHT Mercury ♂ Mars = Mixed → Bearish if risk-on Expect volatility and fake-outs near resistance as sentiment stays uncertain. 📊 MARKET OVERVIEW Gold trades around $4,135-$4,145, showing resilience despite U.S. dollar swings. * DXY slips to ~99.35 amid shutdown uncertainty and weaker risk tone. * Fed holds rates steady at 3.75–4.00%; next cut odds at 55% for December. * Central banks continue strong buying (+220t in Q3, led by Poland’s +67t). * ETF inflows remain firm at +222t - investor demand steady. * Geopolitical tensions (Mideast + US–China tariffs) sustain safe-haven flows. Gold remains locked between institutional buy/sell blocks, Smart Money setting up heavy positions from 4,028–4,206. 🧭 SMART MONEY LEVELS (LIVE UPDATE) Smart Money Sell Area: 4206–4191 → Major liquidity zone; rejection likely. Sell Reaction Zone: 4165–4153 → Intraday resistance, ideal for quick fades. Smart Money Buy Area: 4028–4011 → Deep liquidity accumulation zone for swing buys. 📍 Millions in pending institutional orders rest within these zones. 📅 WHAT TO WATCH NEXT * Nov 13 CPI: Expect ~3.0% core, shutdown delays may trigger volatility. * Dec FOMC: 55% odds of a 25bps cut; Fed cautious until full data returns. * Geopolitical Risk: Mideast or tariff escalation = 🟢 bullish spike. Resolution = 🔴 USD rebound → gold pressure. Break Zones: 🔸 Hold above 4,120 → targets 4,165–4,170 🔸 Break below 4,100 → slide toward 4,050–4,028 🎯 TRADE PLAN Stay tactical — trade zones, not emotions. * Buy Dips: 4,090–4,120 → Targets 4,150–4,170 * Sell Rallies: 4,165–4,190 → Stops above 4,206 Bias remains bullish while above 4,120; short-term sentiment may turn mildly bearish if risk appetite improves. 🧠 CONCLUSION Gold remains supported by central bank demand and geopolitical risk, even as Fed policy and DXY limit major upside. Expect range-bound volatility with bullish lean above 4,100. Trade reaction, not prediction.

DECRYPTERS

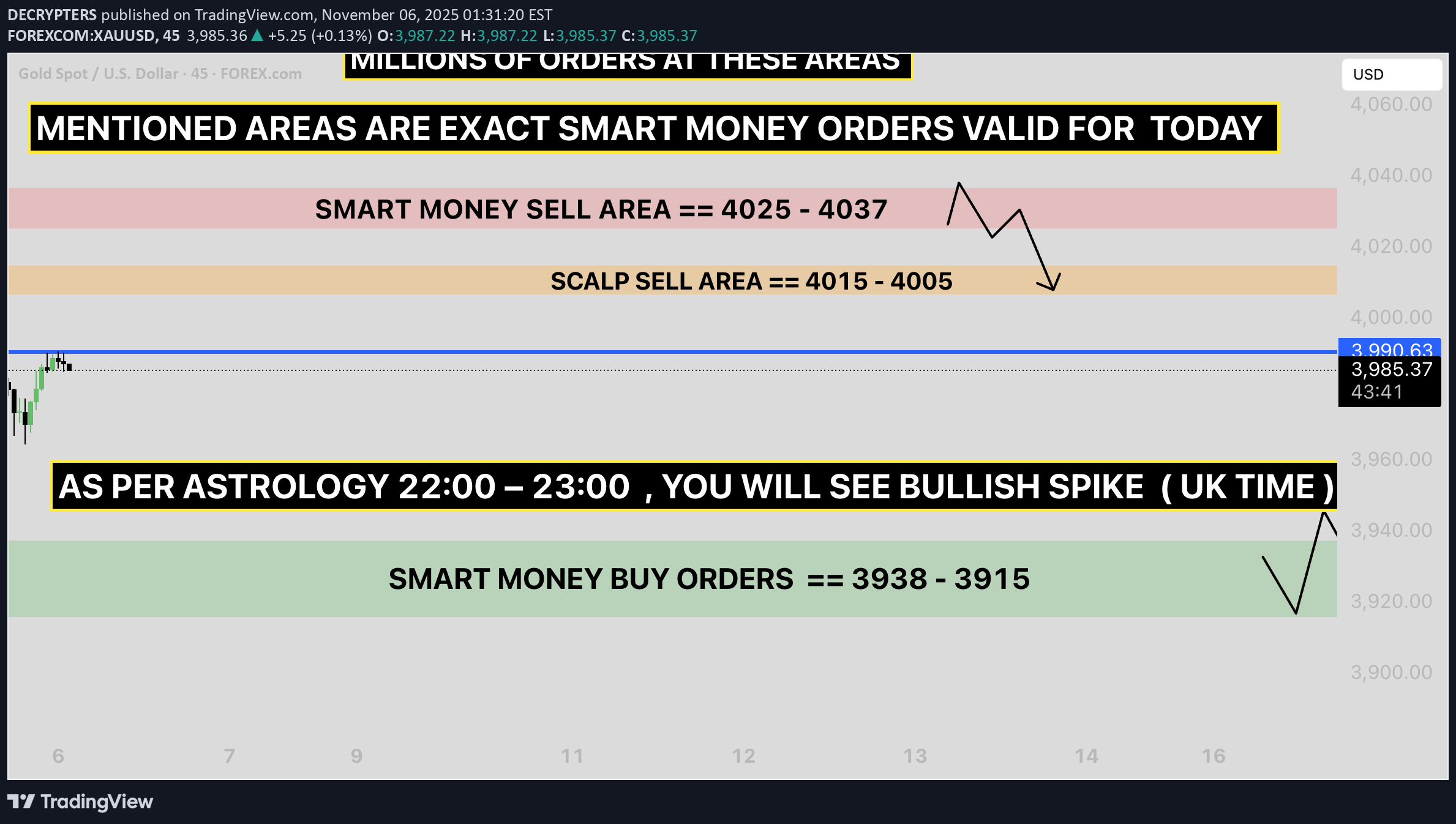

نقشه راه طلا (XAUUSD): سطوح اسمارت مانی و برنامه معاملاتی امروز - ۰۶ نوامبر

🟡 GOLD ANALYSIS - Updated Nov 06, 2025 XAUUSD Gold is consolidating between the $3,950–$4,020 range as the U.S. government shutdown delays key data releases. DXY is weaker near ~100.15, while the Fed’s recent 25bps cut (3.75–4%) keeps markets uncertain about the next move. Central Banks remain net buyers (+19t in August, +220t in Q3), led by Poland. ETF inflows are supporting price while geopolitical tensions continue to fuel safe-haven demand. 🧭 SMART MONEY LEVELS (Valid Today) 🔻 SELL ZONES • $4,025 – $4,037 → Smart Money Sell Area • $4,015 – $4,005 → Scalp Sell Area 🔺 BUY ZONES • $3,938 – $3,915 → Smart Money Buy Accumulation Range Current Price: ~$3,990 📊 TECHNICAL OUTLOOK • Holding above $3,950 maintains a mild bullish structure • Break above $4,020 can retest $4,100 • Break below $3,915 may extend correction toward $3,900 🔮 Timing Insight Between 22:00–23:00 UK Time, expect a potential bullish liquidity spike near buy zones. 📌 Conclusion Gold remains in controlled consolidation with a bullish tilt. Trade reaction to levels, not prediction. Let liquidity guide entries.

DECRYPTERS

خرید بانکهای مرکزی و اصلاح قیمت طلا و نقره: چشمانداز ۵ نوامبر

🟡 GOLD & SILVER MARKET ANALYSIS - November 05, 2025 Central Bank Buying: Global central banks remain in accumulation mode after adding 1,000+ tonnes in 2024. * China: 2,298t | India: 879t | Russia: 2,335t * Emerging markets’ gold purchases +30% YoY, driven by de-dollarization and inflation hedging as USD reserves fall below 58%. Silver Demand & Deficit: * Industrial use hits 680M oz (+11% YoY) — a record. * Solar PV: 232M oz | EVs: 90M oz * Deficit: 215M oz — extending into 2025 as mine output stays flat. 📈 Outlook: Range $47–$55/oz, with potential breakout as green tech ramps. ETF & Market Sentiment : * Gold ETFs (GLD): +$3.6B inflows in Oct, but -$2.1B outflows in Nov on profit-taking. * Silver ETFs: Mixed flows, cautious sentiment. * Gold RSI: ~68 → short-term pullback risk. * Forecast: Inflows could rebound in Q1 if Fed resumes easing. Futures & Positioning : * CME Gold OI: 528,789 contracts (+WoW) * Implied Vol (Dec): 21.1% | Call/Put Bias: 60/40 (bullish skew) * Silver Vol: ~25% — traders shifting to policy-driven long bets. Macro Drivers : * Fed: 25bps cut + hawkish tone (CPI 2.6%) * U.S.–China Truce: Reduces tariffs, softens safe-haven demand. * BRICS: Advancing gold-backed settlement systems. * Dollar Share: Falls to 58% of global reserves. Performance & Forecast : * Gold: $3,941/oz | -1.5% today | +50% YTD * Silver: $48/oz | -1.0% today | +66% YTD 📊 Projection: Gold eyes $4,400 | Silver targets $57 by mid-2026. 🕐 Astro Window (UK Time): 1:00 PM–4:30 PM bullish spike expected. Bias : Short-term correction likely → overall bearish bias until supports retest. Check chart for buying/selling levels.

DECRYPTERS

تحلیل امروز طلا (۳ آبان): پیشبینی XAUUSD و سطوح کلیدی خرید و فروش

🟡 GOLD ANALYSIS What’s Moving the Market Today? 📅 Updated: November 3, 2025 💎 Trade with DECRYPTERS ⚡ Market Snapshot Gold is holding steady near the $4,000 pivot after Friday’s weaker jobs data. 📉 DXY slips to 99.73 after a soft October payrolls print (+22K vs. 150K exp). 🏦 Fed’s 25bps cut to 3.75–4.00% with no clarity on December weighing on yields. 🌍 Central banks continue heavy gold buying: +19t in August, +220t in Q3 (Poland & Azerbaijan lead). 💥 Geopolitical tensions & tariff risks are keeping safe-haven demand elevated. 📈 ETF inflows: +222t in Q3 offset jewelry weakness investment demand remains strong. 🧠 Smart Money & Technical Framework 🟧 Gold Sell Area: 4026 – 4038 🔴 Smart Money Sell Zone: 4071.8 – 4085 🟨 Gold Buy Area: 3964 – 3978 🟢 Smart Money Buy Zone: 3912 – 3922 💬 Millions of orders clustered across these zones watch for liquidity sweeps before reversals. 📊 Live Market Context 💰 Current Price: ~$4,017/oz (+0.16%) 📉 Daily Range: High ~4,015 / Low ~3,991 🔁 Structure: Gold consolidating within key SMC range; breakout above 4,038 opens path to 4,071+, while rejection near 4,085 favors short setups back to 3,978–3,964. 🔍 What to Watch Next 📆 Nov 13 CPI (core ~3.0% exp) Hot print → Fed pause → bearish for gold Soft print → renewed cut bets → bullish continuation 🏦 ECB & BOJ meetings this week: Dovish tone = USD weakness → supports gold 🌏 US–China trade rhetoric: Optimism fades → safe-haven spike Renewed deal talks → short-term pullback 🧭 Trading Plan — Keep It Simple 🔹 Buy Zone (3964–3978): Look for bullish reaction; smart money likely absorbing liquidity. 🔹 Sell Zone (4026–4038): Ideal to fade rallies if momentum stalls. 🔹 Smart Money Extremes (3912 / 4085): Expect deep liquidity grabs before reversals. 🎯 Targets: 4,071 (resistance) / 3,964 (support). ❗ Bias: Mildly bullish above 4,000 dips to buy, rallies to fade. 🏁 Conclusion Gold remains range-bound between $3,964 and $4,038, anchored by central bank demand and weaker US data. As long as $4,000 holds, bias leans bullish toward $4,071–$4,085. Break below $3,964 shifts short-term tone bearish toward $3,922.

DECRYPTERS

تحلیل طلا (XAUUSD): سطوح پول هوشمند، آینده نرخ بهره و پیشبینی بازار امروز

XAUUSD GOLD ANALYSIS – What’s Moving the Market Today? Trade with DECRYPTERS | Let Levels Guide Your Moves 🚀 Market Pulse Gold remains steady near $4,015, consolidating as the U.S. Dollar Index (DXY ~99.25) limits upside momentum amid renewed optimism over trade talks. The Federal Reserve’s 25bps rate cut, combined with Powell’s cautious tone on future pauses, lifted yields temporarily, pressuring short-term gold sentiment. Meanwhile, central banks continue strong accumulation, adding roughly 710 tonnes per quarter, led by China (11th consecutive month of buying). These consistent inflows act as a price floor, keeping gold resilient even during intraday volatility. 🌍 Geopolitics & Safe-Haven Demand Rising geopolitical risks and tariff concerns have revived gold’s safe-haven appeal. During uncertainty, gold’s negative correlation to risk assets strengthens, when fear rises, gold shines. Investors maintain exposure through ETFs and physical holdings, expecting volatility to persist ahead of key macro data. 📊 What to Watch Next * Nov 1: U.S. Jobs Report (~150K expected) → A weaker print may revive rate-cut expectations. * Nov 13: U.S. CPI Report → If core inflation holds near 3.0%, the Fed may pause rate cuts. * Any flare-up in Middle East tensions or trade issues could trigger sharp rallies from key support zones. 💹 Technical Framework (Smart Money Map) 📈 Current Price: ~$4,015/oz (+0.06%) 📊 Volatility Range: $3,980 – $4,050 * 🟥 Smart Money Sell Area: $4,072 – $4,088 → Heavy institutional orders, short-term reversal zone. * 🟧 Scalp Sell Area: $4,048.5 – $4,058 → Ideal intraday reaction zone. * 🟨 Scalp Buy Area: $3,955 – $3,964 → Expect quick liquidity sweeps and bounces. * 🟩 Smart Money Buy Orders: $3,921 – $3,937 → Deep liquidity zone, institutional accumulation likely. 🧠 Conclusion – Mild Bullish Bias Within Consolidation Gold is holding steady between central bank demand and Fed caution. Bias remains mildly bullish within consolidation — supported by institutional inflows and geopolitical uncertainty. 📌 Above $4,000 → opens room to $4,200. 📌 Below $3,950 → exposes $3,921–$3,937 buy zone. Stay patient. Let levels confirm direction — trade reaction, not prediction.

DECRYPTERS

پیشبینی نهایی طلا و نقره: ۵ سناریوی معاملاتی و تحلیل مهمترین رویداد FOMC

Welcome to Trade with Decrypters! 📊 DETAILED & COMPLETE ANALYSIS (5 TRADE SETUPS) — Gold & Silver Outlook 1️⃣ Central Bank Buying * Q1–Q2 2025 net: 410t (+15% YoY) * August: +19t * BRICS hold 6,000t (21% of global reserves) * Top buyers: 🇵🇱 Poland +90t | 🇨🇳 China +35t * Motive: USD hedge + BRICS 2026 currency prep 📈 Outlook: Sustained demand supports 10–15% long-term gold upside 2️⃣ ETF Inflows & Sentiment * Q3 inflows: $26B | AUM $445B (+25% YoY) * Holdings: 3,200t * Asia: +37t | US: Neutral * Gold RSI: 68 (Support: $3,800 | Resistance: $4,000) * Silver RSI: 72 (Support: $32) 🎯 Projection: Gold → $4,000/oz (Q4, +1%) | Silver → $35/oz (+9%) 3️⃣ Macro & Geopolitical Events * Fed cuts: 75bps → 3.75% * USD: -8% | CPI: +3.2% * Tariffs add +0.5% global inflation (→ 4.2%) * BRICS trade pacts counterbalance USD weakness * Gold already +57% YTD on 20% risk premium 📊 Outlook: Trade wars + Fed easing = 5–7% metals gain H1 2026 4️⃣ Silver Deficit * 2025 deficit: 118M oz * Supply: 1.02 Boz | Demand: 1.20 Boz * Industrial share: 59% (EVs China +25%, Solar +30%) * Recycling: 20% 📈 Projection: 150M oz deficit (2026) → Silver +15% 5️⃣ Futures & Options Flow * CME Gold OI: 550k (+10% MoM) * Silver OI: 180k (+8%) * GVZ: 18% * Call/Put ratio: 2:1 | Net long: 65k gold calls 📊 Outlook: OI rise + call bias = 20–25% vol breakout Q1 2026 🔮 Fundamentals & Forecast * Gold: 450t CB buying + de-dollarization → 🎯 $4,200/oz (end-2025, +12%) | 🎯 $5,000 (2026) * Silver: 118M oz deficit + 59% industrial → 🎯 $38/oz (end-2025, +18%) | 🎯 $60 (2026) ⚡ Drivers: Fed easing, 4.2% inflation, US deficit, BRICS shift → strategic metals outperformance 🏦 FOMC Update (Oct 29, 2025) * Decision: 2:00 PM ET * 98%+ chance of 25bps cut → 3.75–4.00% * Powell press conference: 2:30 PM ET * Dot plot & QT update expected * Markets volatile → cut likely supportive for Gold, Silver, Stocks & Crypto Disclaimer: This analysis is for educational purposes only. Not financial advice.

DECRYPTERS

پیشبینی نهایی طلا و نقره ۲۰۲۵: ۵ استراتژی معاملاتی با تحلیل کامل بانکهای مرکزی و کسری نقره!

Welcome to Trade with Decrypters! 📊 DETAILED & COMPLETE ANALYSIS (5 TRADE SETUPS) - XAUUSD Gold & Silver Outlook 2025 🏦 Central Bank Buying * 900 tonnes accumulated YTD 2025 (Q3: +19t) * BRICS hold 6,000t (20% global reserves) * 🇨🇳 China: +2,299t * 🇮🇳 India: +880t * 🇵🇱 Poland: +68t (H1) * Motive: De-dollarization & sanctions hedge 📈 Outlook: 950t full-year supports long-term price appreciation. 💰 ETF Inflows & Sentiment * YTD inflows: $28B (AUM: $472B, +6% QoQ) * US inflows: $22B | Europe: $4.4B (Sept) * Gold RSI: 78.4 (Support: $3,700 | Resistance: $3,840) * Silver RSI: 72 (Support: $42) 📈 Outlook: Gold → $3,400/oz (Q4) | Silver → $38/oz on 150t annual inflows. 🌍 Macro & Geopolitical Events * Fed cuts: 50 bps by YE, Funds rate → 4.25% * US CPI 2.7% → 2.9% Q4 (tariffs impact) * BRICS gold-backed currency expected 2026 * USD reserves down 15% since 2022 * Trade wars → CPI +0.5–1% 📈 Outlook: Gold → $3,675/oz | Silver → $38.45/oz (Q4) on global inflation >5%. ⚡ Silver Deficit * 2025 deficit: 149M oz (Supply: 844M oz | Demand: 1.21B oz) * Industrial demand: 680M oz (+12% EVs, +20% solar) * China: 40% PV use 📈 Outlook: Deficit to widen → 206M oz (2026) | Silver > $40/oz on 9% industrial growth. 📊 Futures & Options Flow * CME Gold OI: 529k (+12% YoY) * Silver OI: 180k (+15%) * Gold call/put ratio: 2:1 | Silver: 3:1 * CVOL: 15–18% 📈 Outlook: OI → 550k by YE | Volatility → 20% on Fed + geopolitics. 🔮 Fundamentals & Forecast * Gold: +15–20% → $3,400/oz YE 2025 * Drivers: 900t CB demand, $64B ETF inflows, de-dollarization * Silver: +45% → $38/oz YE 2025 * Drivers: 149M oz deficit, 59% industrial demand ⚡ Macro Drivers: CPI >2.7%, Fed cuts, US deficit 7%, BRICS fragmentation. Structural re-rating likely into 2026 🚀 Disclaimer: This analysis is for educational purposes only. Not financial advice.

DECRYPTERS

برنامه معاملاتی روزانه طلا: ۵ استراتژی برتر برای سود در بازار جهانی!

Welcome to Trade with Decrypters! DETAILED AND COMPLETE ANALYSIS ( 5 TRADE SETUPS ) Central Bank Buying Central banks added net 19t in August led by Kazakhstan (14t), Bulgaria and El Salvador, Q3 on pace for 1,000t+ annually up 41% from historical norms. BRICS drivers like China (300t+ YTD) and India's $100B reserves fuel de-dollarization and inflation hedges; Poland reaffirms targets amid risks. Silver links to EV/solar boom (+70% China demand). Outlook: Unfazed 1,000t buys lift prices into 2026. ETF Inflows & Sentiment Gold ETFs hit $472B AUM in Q3 (+23% q/q) with $64B YTD inflows, September $17B record led by North America/Europe; Asia minor outflows. Safe-haven rush amid trade wars, minor profit-taking post $4k peak. RSI 75 overbought, $3,900 support holds. Silver +$2B YTD on industry bets. Forecast: Gold $4,200 test, silver $50+. Macro & Geopolitical Events Fed Oct cut vs. 2.9% inflation/shutdown-delayed jobs—labor firmer but risks grow. Trump's China tariffs fuel wars; BRICS stalls de-dollarization but boosts gold; Ukraine/Mideast hikes energy/inflation. Drives 50%+ YTD metals gains; tariffs add 1–2% CPI. Silver Deficit Fifth straight deficit at 118M oz in 2025 (down 21% YoY), demand stable 1.20B oz vs supply +3% to 1.05B oz, industrial record 680M+ oz from solar/EVs. Renewables offset jewelry drops Futures & Options Flow CME gold OI ~528k contracts, steady amid volumes; CVOL moderate, call/put skew bullish for rate-cut squeezes Fundamentals & Forecast Gold +51% to $4,062, silver +43% to $48—via 1,000t+ CB buys, inflation, cuts, 7% GDP deficits. De-dollarization/geo-risks dominate. Projection: Gold $4,400 Q4, silver $57 mid-2026

DECRYPTERS

برنامه معاملاتی روزانه طلا: استراتژی نهایی بر اساس خرید بانکهای مرکزی و پیشبینی 4400 دلاری!

Welcome to Trade with Decrypters! DETAILED AND COMPLETE ANALYSIS ( 5 TRADE SETUPS ) Central Bank Buying Central banks added net 19t in August led by Kazakhstan (14t), Bulgaria and El Salvador, Q3 on pace for 1,000t+ annually up 41% from historical norms. BRICS drivers like China (300t+ YTD) and India's $100B reserves fuel de-dollarization and inflation hedges; Poland reaffirms targets amid risks. Silver links to EV/solar boom (+70% China demand). Outlook: Unfazed 1,000t buys lift prices into 2026. ETF Inflows & Sentiment Gold ETFs hit $472B AUM in Q3 (+23% q/q) with $64B YTD inflows, September $17B record led by North America/Europe; Asia minor outflows. Safe-haven rush amid trade wars, minor profit-taking post $4k peak. RSI 75 overbought, $3,900 support holds. Silver +$2B YTD on industry bets. Forecast: Gold $4,200 test, silver $50+. Macro & Geopolitical Events Fed Oct cut vs. 2.9% inflation/shutdown-delayed jobs—labor firmer but risks grow. Trump's China tariffs fuel wars; BRICS stalls de-dollarization but boosts gold; Ukraine/Mideast hikes energy/inflation. Drives 50%+ YTD metals gains; tariffs add 1–2% CPI. Silver Deficit Fifth straight deficit at 118M oz in 2025 (down 21% YoY), demand stable 1.20B oz vs supply +3% to 1.05B oz, industrial record 680M+ oz from solar/EVs. Renewables offset jewelry drops Futures & Options Flow CME gold OI ~528k contracts, steady amid volumes; CVOL moderate, call/put skew bullish for rate-cut squeezes Fundamentals & Forecast Gold +51% to $4,062, silver +43% to $48—via 1,000t+ CB buys, inflation, cuts, 7% GDP deficits. De-dollarization/geo-risks dominate. Projection: Gold $4,400 Q4, silver $57 mid-2026 📞 Contact Us Now: +92 315-5060561 🌐 Website: tradewithdecrypter.com 📺 YouTube: youtube.com/@tradewithdecrypters 📘 Facebook: facebook.com/tradewithdecrypters/ 🚨 App : chat.whatsapp.com/DhZhPrlPhkdIspN5lXVE8J

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.