Cryptoslothx

@t_Cryptoslothx

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Cryptoslothx

ETH Symmetrical Flag

After a chaotic week and the second crypto meltdown for 2022 (thanks to the insolvency of FTX this time), it's nice to see a potential bit of relief forming for ETH.A symmetrical flag is forming close to the bottom end of the recent liquidation. We could see a little bit or relief. A return to pre-meltdown prices doesnt seem likely, however returning to the october average of $1300-$1400 will likely inject some positivity back into the space. What is painful is if the FTX crash didn't occur, we may have seen a strong bullish return to crypto as DXY finished it's triple top and crashed back down to 105. Hoping to see some long green candles soon.the symmetrical triangle did not hold - the FUD is real

Cryptoslothx

QNT Bear flag has held

In my previous analysis of QNT I outlined that a bear flag would force the coin to retract to point e. (read here tradingview.com/chart/QNTUSD/ysu71VvR-QNT-Deep-into-bear-flag-with-bottom-heavy-liquidity/). It's coming to a point where the flag will be tested at e. If QNT closes below it's 50MA and closes again below the lower low trend line I see two potential outcomes. It retraces back down to c. which I'm calling accumulation zone 1, or it retraces all the way back down to a. which I'm calling accumulation zone 2. It's unclear which is more likely - into the block shows a lot of liquidity at both points c. and a. but the first test will be to see if QNT break below the 50MA and the bear flag at e. I will track the update on this coin via this new chart. At this point in time my sentiment is short on QNT. I have an alert triggered for 145$ to review the breakpoint at e.QNT is making it's way to accumulation zone 1 - obviously helped along with the recent FTT meltdown. I will update once QNT touches down so we can assess if it will hold or continue to drop.we've not yet reached landing zone 1 - but QNT is making good headway towards it. Will continue checking until there is something more significant to report on

Cryptoslothx

ETH breakout past 50MA overnight

I was planning on doing a more robust write up on ETH but the breakout of the falling wedge BTC made and therefore ETH made, has pressed my hand to start something a little sooner than intended (plus I'm meant to be on holiday atm) ** Disclaimer** I'm a novice trader working to put my thoughts out there to see how the stack up against the market - please feel free to share/comment on my thoughts - please don't use this chart as financial advice I will do a proper drill into ETH on my return, but the quick and dirty on things to look out for is; In recent days ETH rejected the $1250~ mark and very frequently too; this is a strong accumulation zone for the time being ETH blitz past its 9 day and 50 day moving average without hesitation or testing the MAThere looks to be a 9MA crossover with 50MA up and coming if the swing up persists, which will be a very bullish signalDXY is forming a double or triple top (it's testing the 50MA currently) which could mean a move down for the index and thus a movement of investments from the dollar index to BTC (if that hasn’t already started happening) The next test for ETH movement will be the distribution zones (shown via the fib) at $1480 which is approx where we are currently and at $1800 (2.6 marker on the fib) Hope to provide a proper look into ETH soon, be safe though, the bears are still about and very strong in sentiment toward crypto; a reversal down is possible at any moment. Have your stop losses set to avoid getting caught up in a dump. Please remember this is not financial advice, dyor. For now, it's a pool swim and some cocktails for me.I've been baffled as to what caused the stall in this textbook breakout. After some digging, I initially just put it down to the DXY having a solid drop, but as DXY continued to fall, neither BTC nor ETH continued to climb - which was odd. I moved past it, putting it down to a lag in liquid exchange. While scrolling through Twitter, I found some information that could help explain the stall further. See, there was a recent hack that occurred on the platform FTX. An API traders could use to link external accounts was not secure. This was detailed to the platform managers some days before the hack - FTX ignored the call to action. Some days later, people took to Twitter complaining that they had lost large sums of money. FTX failed to respond publically and to the individuals complaining about the lost funds (many even had evidence of activity on their account that they themselves were not transacting). 150m was lost to the exploit. As many do with situations like this, they run in fear of being impacted too. As such, a heavy liquidation on the FTX platform has taken place. This likely explains the quick leap up into a stall for BTC and ETH. To be clear, 1.2B in currency (almost 80% of FTX's holdings) was liquidated and moved off FTX. This means the rally we have experienced is an exhaustion rally from the liquidation of currency off of FTX. It likely is an unsustainable rally, and therefore a move down maybe coming.

Cryptoslothx

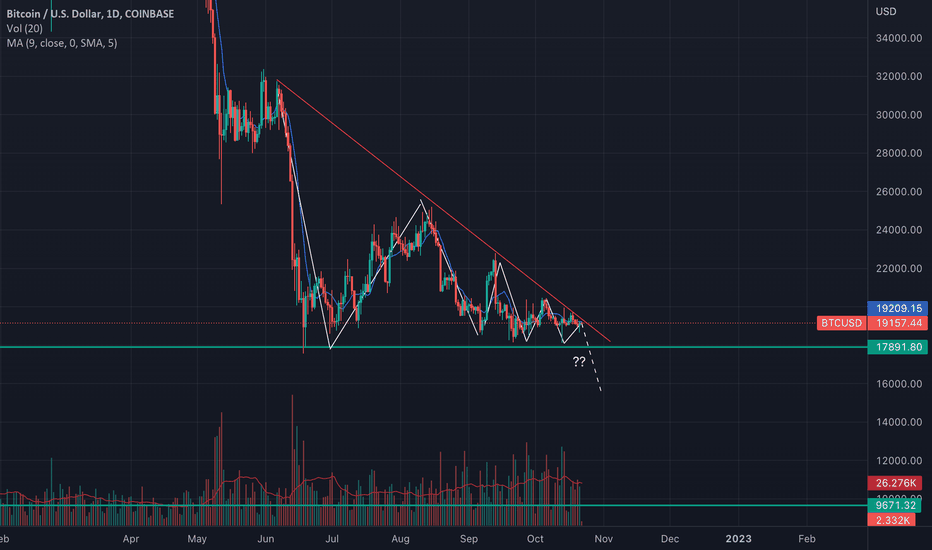

is crypto-winter nigh?

The 8th wave of BTC price movement within the falling wedge has stalled - and what is usually a bullish pattern seems to be throwing out bearish signals. Normally, at this point of the wedge, a lot more trade activity would occur, which breaks through the downtrend. Nothing seems to suggest to me that a mighty push-up is on its way.** Disclaimer** I'm a novice trader working to put my thoughts out there to see how they stack up against the market - please feel free to share/comment on my studies - please don't use this chart as financial advice BTC had a short-lived pump last night - I noticed DXY dropped several dollars during the same period, which may have excited some bulls - but this looks like a false move due to the DXY interaction BTC has. (I wrote an idea on DXY/BTC interaction here tradingview.com/chart/BTCUSD/WTVCIPY5-DXY-BTC-inverse-relationship-holding/). [The movement between these assets may be that people are switching between the two trying to find the safest home for their money given all the FUD around global markets. Regardless, it's BTC I'm concerned about because this coin is a strong marker for the movement of near on all other crypto-currencies as, I believe, most investors still hold a rudimentary understanding of cryptocurrencies and blockchains (and their differences). In the hours since the DXY slip, BTC has stalled at ~$19150 for most of the day. Trade volume over the last 12 hours is only at 1% of yesterday's total trade volume - this is well below the average transactions over 24 hours and signals a very bearish outlook and a potential reversal of the falling wedge. My gut feeling is that we will be re-testing the 18k mark in the short term before the market decides if it's time to blast everyone with the crypto winter we've all been expecting or surprise us with early Christmas presents. My sentiment is bearish, given the trading stall at $19150.But of course this is crypto which means anything can happenBTC has broken through the down trend of the falling wedge; I did potentially suggest the idea of an early Christmas, however it remains to be seen. I haven't yet but my bull horns on but the break out of the falling wedge maybe a good signThe breakout of the triangle is proving bullish, alongside DXY moving down toward the 109 mark, looks like DXY is forming a double or triple top which is a more bullish sentiment for BTC to hold the trend up. Is this then end of the winter? Only time will tell, but for now it's nice to see some relief even if it's minor.I'm going to flag now that the halt in price movement suggests the bulls arent in full control yet - the stall in price movement is never a good signal. tread carefullyI've been baffled as to what caused the stall in this textbook breakout. After some digging, I initially just put it down to the DXY having a solid drop, but as DXY continued to fall, neither BTC nor ETH continued to climb - which was odd. I moved past it, putting it down to a lag in liquid exchange. While scrolling through Twitter, I found some information that could help explain the stall further. See, there was a recent hack that occurred on the platform FTX. An API traders could use to link external accounts was not secure. This was detailed to the platform managers some days before the hack - FTX ignored the call to action. Some days later, people took to Twitter complaining that they had lost large sums of money. FTX failed to respond publically and to the individuals complaining about the lost funds (many even had evidence of activity on their account that they themselves were not transacting). 150m was lost to the exploit. As many do with situations like this, they run in fear of being impacted too. As such, a heavy liquidation on the FTX platform has taken place. This likely explains the quick leap up into a stall for BTC and ETH. To be clear, 1.2B in currency (almost 80% of FTX's holdings) was liquidated and moved off FTX. This means the rally we have experienced is an exhaustion rally from the liquidation of currency off of FTX. It likely is an unsustainable rally, and therefore a move down maybe coming.

Cryptoslothx

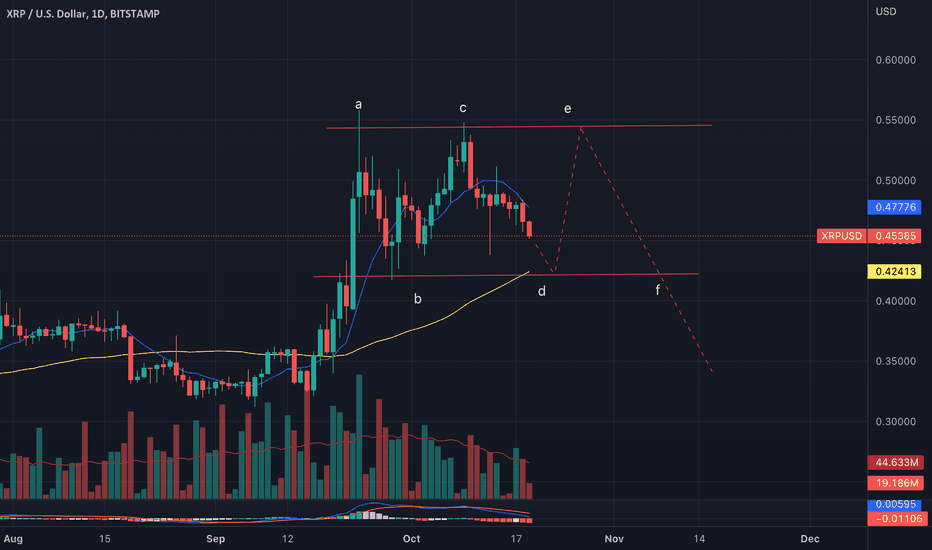

Triple Top Forming for XRP - twitter bullish though?

Theres some tweets circulating around about xrp regarding smart contracts - I have not yet read into it but one of my key goals is to compare twitter to actuals and so I'm starting this one off thin and will update as I understand more. in the short term Im holding off on any entry into XRP. I suspect we will be testing the support line in the next day or so indicated by d. ** Disclaimer** I'm a novice trader working to put my thoughts out there to see how they stack up against the market - please feel free to share/comment on my studies - please don't use this chart as financial advice From what I can tell, XRP has entered a double or triple top channel - we're only half way into it potentially (and it may even close off as a double top) but what I find interesting about ripple is that near on all of its movement has been driven by twitter; some common tweets which get a lot of engagement are "ripple to $2000 this year?" (notably the tweeter or those liking and sharing the tweet don't understand market cap and therefore the impossible nature of such a hike). It seems to create euphoric "alphas" on the coin and well... euphoria is euphoric. Currently people are bullish on twitter because - likely going to win a court case against the SEC - this is floating euphoria - XRP Army very influential on ripple with a large and maximalist style following- competitor to ADA, XRP army loves to "sh*t on ADA" - they're treated like rivals - but frankly the networks are not similar at all - but competition breads fandom- a lot of media attention intotheblock doesn't feature XRP due to is speculative nature so unfortunately I cannot share any detail from there. In the immediate term, it'll be interesting to watch and see what happens with XRP in its current form - one thing is for sure, twitter is a little over-excited; the end of the SEC trial isn't due for completion until December.XRP seems to be holding to the triple top pattern but only just, there's a strange rally occuring with BTC and ETH which I think is an exhaustive push that may reverse, will keep watching to see what happenstriple top seems unlikely, maybe worth watching out for 9MA crossing over the 50MA leading to a move down - i think that'll be a key indicator to watch currently. the fact that XRP hasn't reacted to the recent BTC/ETH price pump suggests a very bearish outlook on the coin currently.

Cryptoslothx

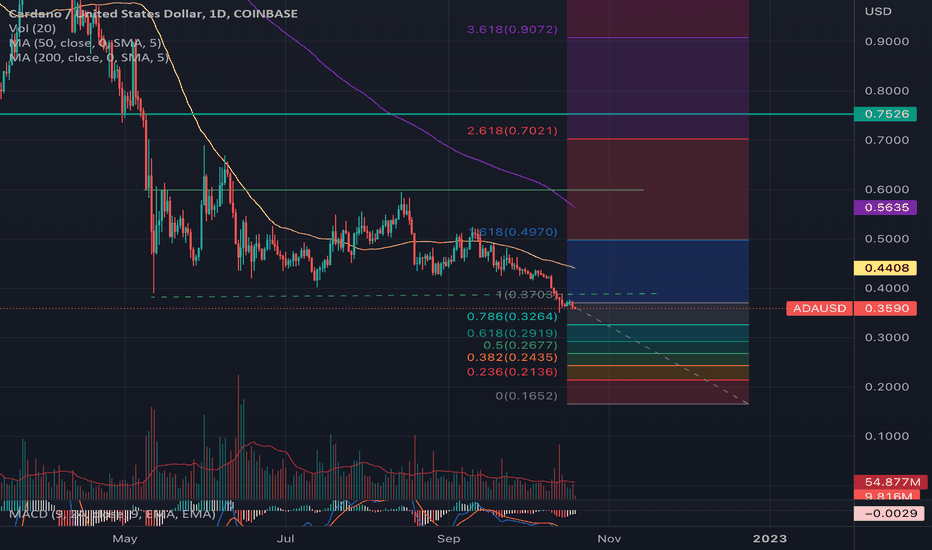

Is ADA dead?

ADA ATL is a gruesome look at the promising coins' position in the market. However, a long-term rally is coming; we can't see it amongst the bulls dumping this project into the ground. Is ADA dead? Right now, it's suffocating slowly, and all indicators show a continuous trend down in the short term, so where is the absolute bottom and when moon? If the fib is anything to go by, our likely interest point is 0.3c. However, movement down towards 0.15c is not off the table either in an absolute worst-case scenario for the struggling coin. ** Disclaimer** I'm a novice trader working to put my thoughts out there to see how they stack up against the market - please feel free to share/comment on my studies - please don't use this chart as financial advice ADA seems to be dead for a coin that had an insanely passionate and public founder who engages with his community and focuses on building a heavily valuable blockchain. The Vasil upgrade brought insanely functional performance enhancements; it was energy efficient before ETH and Bitcoin using proof of stake ( a side note, the founder, Charles Hoskinson, helped create Ethereum). ADA can handle 1700 transactions a second, and its utility goes beyond just NFTs (governments and healthcare sectors have adopted the utility of this coin, to date, someone also purchased the deed to a house on Cardano.) It continues to push deep into ATL, and it's unclear why. So with all the beauty and usefulness of the network, why is ADA sinking into new ATLs? ADA sits well below its 200MA and 50MA markers. Its average volume is dropping, too, as it seems long-term patrons are slowly losing faith in this coin. What I see causing this is that competing currencies seem to be getting more attention over more fickle capabilities versus ADA's research-first approach branding. ADA has dipped below the 0.37c mark after being stuck in a side channel since May. Regardless of the immediacy of the issue, ATL always invites long-term highs, especially as the potential for more intelligent investors to enter the ring when the crypto winter ends is on the tables. Astute retail investors are a dime a dozen as most people seek moonshot investments and instant squeezes, which likely also places pressure on the coin's market price. I suspect people see the $4 high compared to the current price and assume moonshot tomorrow. But the capabilities, utility and future outlook for Cardano, from my novice point of view, is bullish - but when I say long term, I do not mean in the next 2-5 months or even after that. I'm thinking 3-5 years. Suppose the network and pools can outlast this challenging low. In that case, I believe ADA has a healthy future as more innovative and intelligent investors soak up the spillage on the floor when they realise the giant sleeping potential of this overlooked network. For now, I'm monitoring for a comfortable entry point to avoid dilution due to the FUD and bulls. I understand that I will likely bag hold until better signals come - please note that this is a risky play, and I don't recommend you follow my idea if you do not aim to hold beyond several weeks, let alone months or years.

Cryptoslothx

QNT Deep into bear flag with bottom heavy liquidity

tradingview.com/chart/NY8O55UE/** Disclaimer** I'm a novice trader working to put my thoughts out there to see how the stack up against the market - please feel free to share/comment on my thoughts - please don't use this chart as financial adviceI spotted QNT trending on twitter which is often a horrible trading strategy but a lot of people use to heap into trades. I often like to see what the public is getting hyped over on a narrow band vs zooming out and checking the numbers. Looking at QNT on the 1D I see an exhaustive peak deep into a bearish flag - we're likely looking at a final euphoric peak before we move to e.; likely a test before a move down or a final rally before a move down; suspect the move down could likely be quite violent too We have 72% of holders in the money according into the block; there is a weighted ground of holders sitting at the 42$ level; and retail holders up from there app.intotheblock.com/coin/QNT/deep-dive?group=all&chart=all. There are investors buying into the red at the peak of the exhaustion app.intotheblock.com/coin/QNT/deep-dive?group=financials&chart=inAndOutIt think there maybe a hepty turn around if the 6.5k addresses holding 13m of QNT liquidate; app.intotheblock.com/coin/QNT/deep-dive?group=all&chart=allWill come back to see how my analysis above results for QNT in a week or soI note that there are a lot of grammatical errors in the post above, I can't find the edit button but will ensure it's cleaner next time; also ill embed screenshots rather than links if I have references to sites like "into the block"QNT just reversed through the bear flag, looks like a potential liquidity dump - trying to confirm via intotheblockLooking at the stats supplied by IntoTheBlock (app.intotheblock.com/coin/QNT/deep-dive?group=financials&chart=inAndOut), it looks like investors that bought into QNT during the climb from c to d have mostly liquidated their positions at d - the exhaustion rally is now being soaked by future bag holders - 360k is already locked up in positions between $215-$225. The 360k locked up at peak of the rally could play into downward pressure as losses are realised and stop losses get triggered.QNT has started to move toward it's 9 day MA. This to me suggests top end liquidity has initially dumped ~ 1.5m QNT now sits above the current price point. That suggests that a lot of people aped into the exhaustion rally - now bag holders. In the short - QNT has rejected the MA - 9, however with the number of bag holders increasing dramatically I think we can assume the pressure downwards toward e. is now more likely. I set an alert for price point $145 to re-assess the situation.So far the bearflag has held true and QNT is retracing toward the $140 mark, there are a lot of bagholders up at the $225-182; ~11k addresses holding close to around 1.6m QNT- many of whom forgot to set stop losses (the power of euphoria) I suspect we will likely hit $145 soon, and I will re-do an assessment on the coin - according to some indicators the exchanges seem to be "bullish" on QNT, which to me is strange

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.