Crypto-by-PRIME

@t_Crypto-by-PRIME

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Crypto-by-PRIME

UNI / USDT Waiting for Liquidity Grab — Safer Entry at $5.46

UNI / USDT is looking strong at current levels, but for a safer entry we are watching the $5.46 zone to allow liquidity below the higher lows and a fill of the 4H FVG. A clear reaction from this area would offer a much better risk-to-reward setup. Manage risk wisely, as buying at current price does not offer a favorable R:R.

Crypto-by-PRIME

BTC Short-Term Bullish Structure | Key Zone Reaction in Focus

Bitcoin is maintaining a strong bullish structure on the lower timeframes. Price is currently holding above key support, and the overall momentum remains in favor of buyers. A pullback into the lower key demand zone would be healthy. If BTC reacts strongly from this area and holds above support, it will confirm continuation strength and open the path for a bullish expansion toward the 91K level in the short term.

Crypto-by-PRIME

FARTCOIN / USDT Daily Close Above Key Zone— Upside Targets Ahead

FARTCOIN / USDT can maintain its bullish continuation if the next daily candle closes firmly above the $0.2540–$0.2725 zone. A strong hold and positive reaction from this area would open the door for a clean move toward the $0.35–$0.37 range. Wait for confirmation and manage risk carefully before entering.FARTCOIN / USDT reacted perfectly from our marked area and is already up +12% after the call. The structure remains bullish, and price is expected to continue its upward move toward the $0.35–$0.37 zone. Momentum is in favor of buyers, so keep managing risk and stay focused on the chart.

Crypto-by-PRIME

HYPE Weak Structure — Watching 4H FVG for Rejection

HYPE / USDT is showing clear weakness and price is moving upward to fill the 4H FVG. If we see a rejection from this zone, a decline toward $21.050 is likely. Follow the setup closely, wait for confirmation, and manage risk wisely.

Crypto-by-PRIME

ORDI / USDT : Short term setup

ORDI is trading near a key demand zone with potential for a 10–15% upside. Using a two-entry plan to manage risk, with a possible secondary entry around $3.86–$3.75 if price dips. Target remains near $4.52 as long as structure holds. Patience and confirmation are key. Not financial advice.ORDI / USDT tapped our second entry zone and is now moving smoothly toward the target. The trade is running in solid profit, confirming the strength of the setup and price structure. Momentum remains supportive, so continue to manage risk and trail profits accordingly.

Crypto-by-PRIME

ضعف ZRO و فرصت خرید در ناحیه $1.24: آیا صعود تا $1.50 ممکن است؟

ZRO / USDT is showing weakness and continues to decline toward the 4H FVG zone at $1.24–$1.21. This area will be important to watch for a potential reaction. If price shows strength from this FVG, a reversal toward $1.50 can follow. Manage risk wisely and wait for confirmation.ZRO / USDT moved exactly as expected after our call and declined steadily into the FVG zone. Price is now showing a reaction from this area, which could lead to a good upward move. A breakdown below the FVG will invalidate this setup, so manage risk accordingly.

Crypto-by-PRIME

LTC Approaching Key 4H FVG Zone_Reversal Setup Ahead

LTC is showing clear weakness and continues to drift lower, likely heading toward the 4H FVG zone at $76.2–$77.3. This area will be key for a potential reversal. If price reacts strongly from this zone, a clean recovery move toward the EQH liquidity level at $87.5 is expected. Manage risk wisely and wait for confirmation.

Crypto-by-PRIME

Crypto-by-PRIME

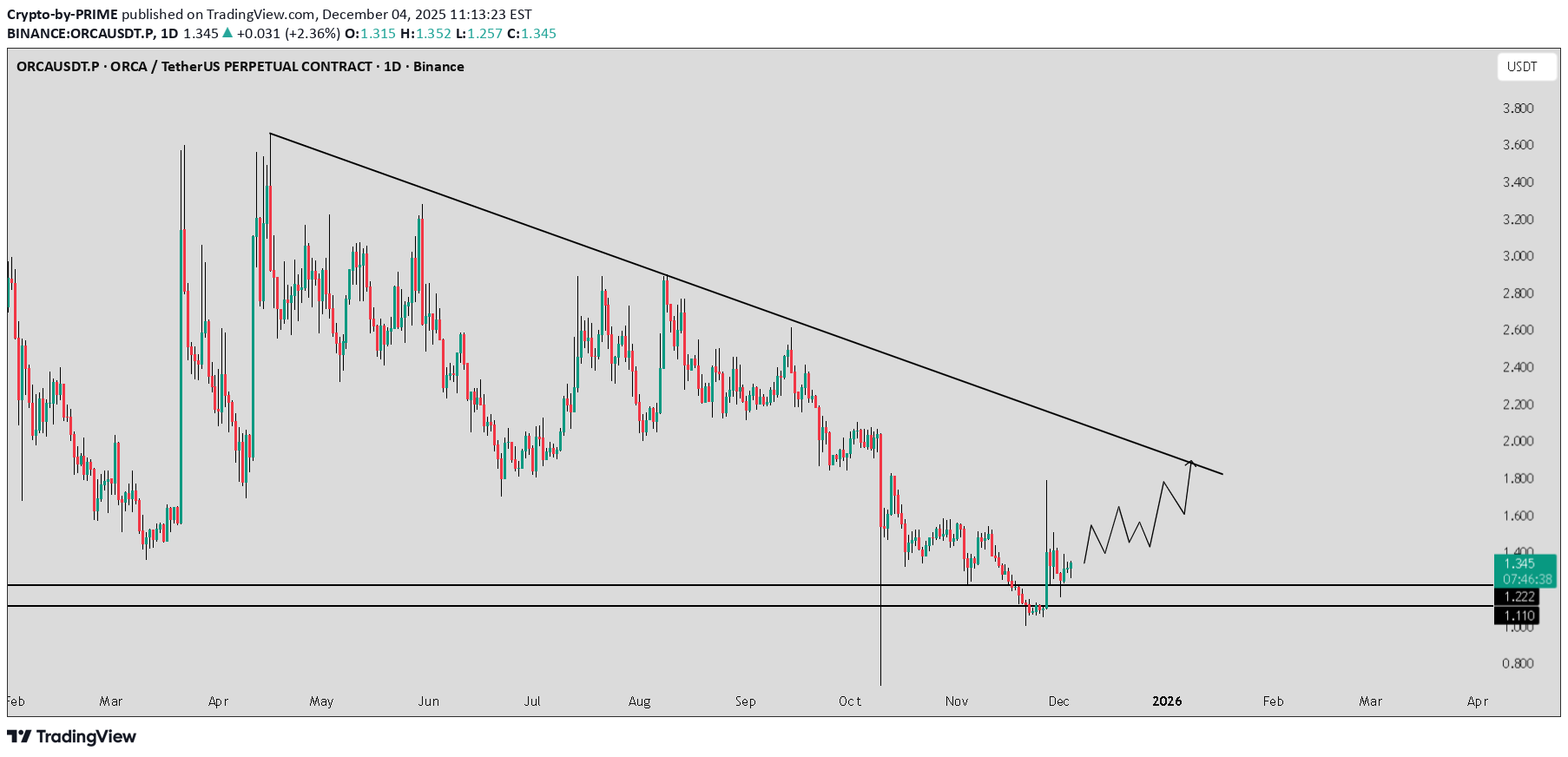

اورکا (ORCA) در آستانه شکست مقاومت! حرکت به سوی ۱.۹۰ دلار و نکات مهم مدیریت ریسک

ORCA / USDT is showing strength and moving toward the $1.85–$1.90 zone to test the trendline resistance. Momentum looks solid, but risk management is important. Any breakdown below the marked horizontal levels will invalidate this setup.

Crypto-by-PRIME

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.