BallaJi

@t_BallaJi

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BallaJi

The Robinhood vs. Coinbase War is raging. Is the Battle decided?

While Robinhood has certainly been faster at launching traditional banking features, Brian Armstrong has explicitly confirmed a pivot for Coinbase to become a "financial super app" (or "everything app") to directly compete in that same space. As of late 2025 and early 2026, Armstrong has shifted Coinbase’s narrative from being just a "crypto exchange" to becoming a "bank replacement" The Coinbase "Everything App" Pivot In his 2026 roadmap and recent interviews, Armstrong outlined a vision that looks very similar to what Robinhood is building, but powered by blockchain rails: The "Everything Exchange": In December 2025, Coinbase officially launched tokenized stock trading and prediction markets (via Kalshi) within its main app. They also flagged plans for 24/7 perpetual futures on both crypto and stocks for 2026. Primary Financial Account: Armstrong stated his goal is for Coinbase to be a "bank replacement" where users handle all spending, savings, and investing. This includes an aggressive push for the Coinbase Card and using stablecoins (USDC) for everyday payments. On-Chain "Super App": Coinbase recently rebranded its wallet as an "everything app," integrating messaging, social networking, and "mini-apps" that run on its Base network. This model is more akin to China’s WeChat than a traditional US brokerage. Robinhood currently feels like the "Amazon of Finance" because they already offer the full "Prime" experience (credit cards, 3% IRA matches, and gold subscriptions) using traditional rails. Coinbase’s counter-argument is that traditional rails are "outdated". Armstrong's bet is that by building the same services on Base (their Layer 2 network), they can offer faster, cheaper, 24/7 global services that Robinhood’s traditional banking partners can't match—like instant 200-millisecond transaction "Flashblocks". What do you think?

BallaJi

How deep will the Bitcoin bear market retrace?

We have already hit the 0.382 linear retrace level and the Bitcoin price is still bearishly consolidating. So further downside is to be expected. The question is how deep and do we have any confluent levels comparing the two fibonnaci's. The answer is YES around the 50 thousand mark.. Which is an obvious key level to probe and ask questions of IMO

BallaJi

LINK to 3 dollars -- Last exit before the elevator down.

Chainlink is flashing a head and shoulders. It is looking to break the previous bear market lows. And there are fib retracement confluence projections that align with single digit prices.

BallaJi

NVIDIA must hold $169

A clear line in the sand is evident (in my eyes) Closing beneath $169 could beget further selloffs and trigger a Head and shoulders pattern. Which projects down to $135. Around a -36% Haircut At which point it could represent really good value to the long side.

BallaJi

سقوط بزرگ کاردانو (ADA) در راه است؟ پیشبینی تکاندهنده برای سرمایهگذاران!

Cardano, along with many other high market cap tokens, certainly stands out. As we find ourselves in the crypto bear market, I would argue that we have actually been in one for quite some time now. The rapid declines can catch newcomers off guard. Meanwhile, those who have weathered several cycles tend to quietly withdraw and wait for BTC to undergo its usual year-long downturn. Will BTC hit a bottom again next November, similar to the previous four-year cycles? The odds still seem to favor a yes. Even with the influx of institutional capital. This situation simply means that the OGs finally have the liquidity to cash out completely. And they have been doing so with great intensity since the summer. Unfortunately, altcoins do not benefit from this liquidity, and there are hardly any profitable wallets aside from those of founders and VCs who essentially created the coins or acquired them for a pittance. Retail investors will likely bear the brunt of falling for the hype once more.The weekly stochastics have been embedded for 5 weeks now for #ADA with no sign of turning around. In fact they are widening to the downside.

BallaJi

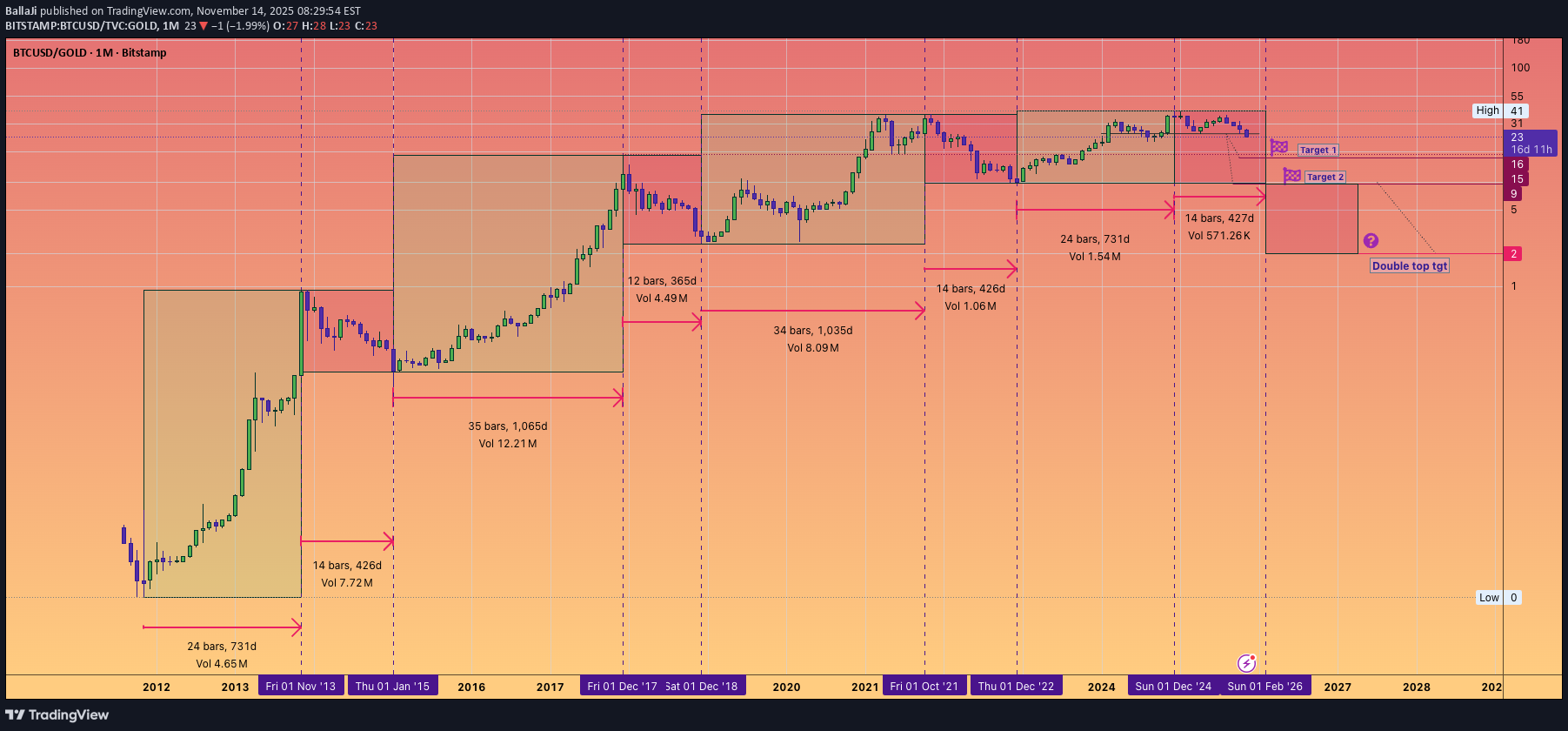

بیت کوین در برابر طلا: پایان بازار خرسی نزدیک است یا آغاز دام جدید؟

On the bright side the cyclical bear market of #BTC vs #GC is actually closer to the end, rather than just starting. Bitcoin has already lost tremendous value vs the Analog SOV With previous cyclical Bears lasting maximum 14 months. Which by that time I believe one if not both of these targets will be met. The troubling aspect is. If BTC achieves target 2 --- then once could argue a Double top has formed. And any subsequent bounce/recovery rally should be treated with suspicion. And furthers declines and retest of this target 2, could open up the trapdoor for a SECULAR Bear market taking us into 2027 before any meaningful recovery can begin. This is a merely observation of what has happened and what is currently unfolding with early (pre-coinbase launching) BTC investors unloading supply most of 2025 into their perceived six figure objective. $100K was always the dream! Will they buy back next bear? I suspect only if it becomes cheap enough. What is cheap for an OG?

BallaJi

Solana could rapidly fall to $40

A massive potential Head and shoulders topping exists on Solana. And many other Altcoins exhibit similar tops. Keep nimble and protect your gains if you have them. On the positive side, I believe the bear market will be swift and we could potentially see this number as early as next March. Why because Solana's network effect topped on the #Trump memecoin release last January. The solana ecosytem also enjoyed a full cycle of activity unlike other chains. I believe there will be plenty of buyers at those prices.Bear Flag eyeing sub $100 on #Solana

BallaJi

سقوط عظیم کومودو: آیا بازماندگان به بازگشت امیدوارند؟

The question is now. What is left behind in the rubble. There seems to be working products and ongoing development. I assume much if not all bag holders would have left in search for riches elsewhere. Will they return for a recovery rally?

BallaJi

هشدار جدی سقوط: الگوی سر و شانه در نمودار هفتگی پپه (PEPE) فعال شد!

🐸🐸🐸 ⚠️⚠️⚠️ Pattern formed, Big Move Ahead? The weekly chart of #Pepe has confirmed a classic head and shoudlers pattern - a powerful bearish setup. After over 1.5 years of building this structure, price decisively pierced the neckline with a sharp drop. Suggesting that a weekly close below the neckline could trigger an accelerative towards the pattern target. Key Levels Neckline: $0.0000058599 Target: $0.0000012091 Why does it matter? Head and shoulders are the most trusted reversal technical patterns. Coupled with declining and weakening sentiment. This pattern warns of more downside--- unless buyers can mount a quick rescue. What's your strategy? Are you shorting the breakdown, waiting for the target, or looking for a fake-out reversal? Drop your thoughts/Analysis or questions in the comments!WE ARE SO LIVE on this Head and shoulders! Accelerative move away from the neckline. #Pepe #Pepeusd #ETH #Crypto

BallaJi

Is the SUI / SOL ratio forming a cup and Handle?

Key Takeaways of a Cup and Handle: The cup and handle pattern represents a bullish technical price formation that manifests on a price chart as a cup accompanied by a handle, indicating a possible buying opportunity. This pattern generally develops over a span of seven to 65 weeks and is defined by a "U" shaped cup followed by a handle that slopes downward. In order to trade the cup and handle pattern, traders may opt to place a stop buy order just above the upper trend line of the handle or wait for the price to close above it, establishing a profit target based on the height of the cup. Instances such as Wynn Resorts illustrate how a properly formed cup and handle pattern can lead to substantial price movement once the pattern is validated and the resistance level is breached. However, limitations include the duration required for the pattern to form and the variability in the depth of the cup, necessitating its use in conjunction with other signals and indicators.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.