AndyHopkins

@t_AndyHopkins

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AndyHopkins

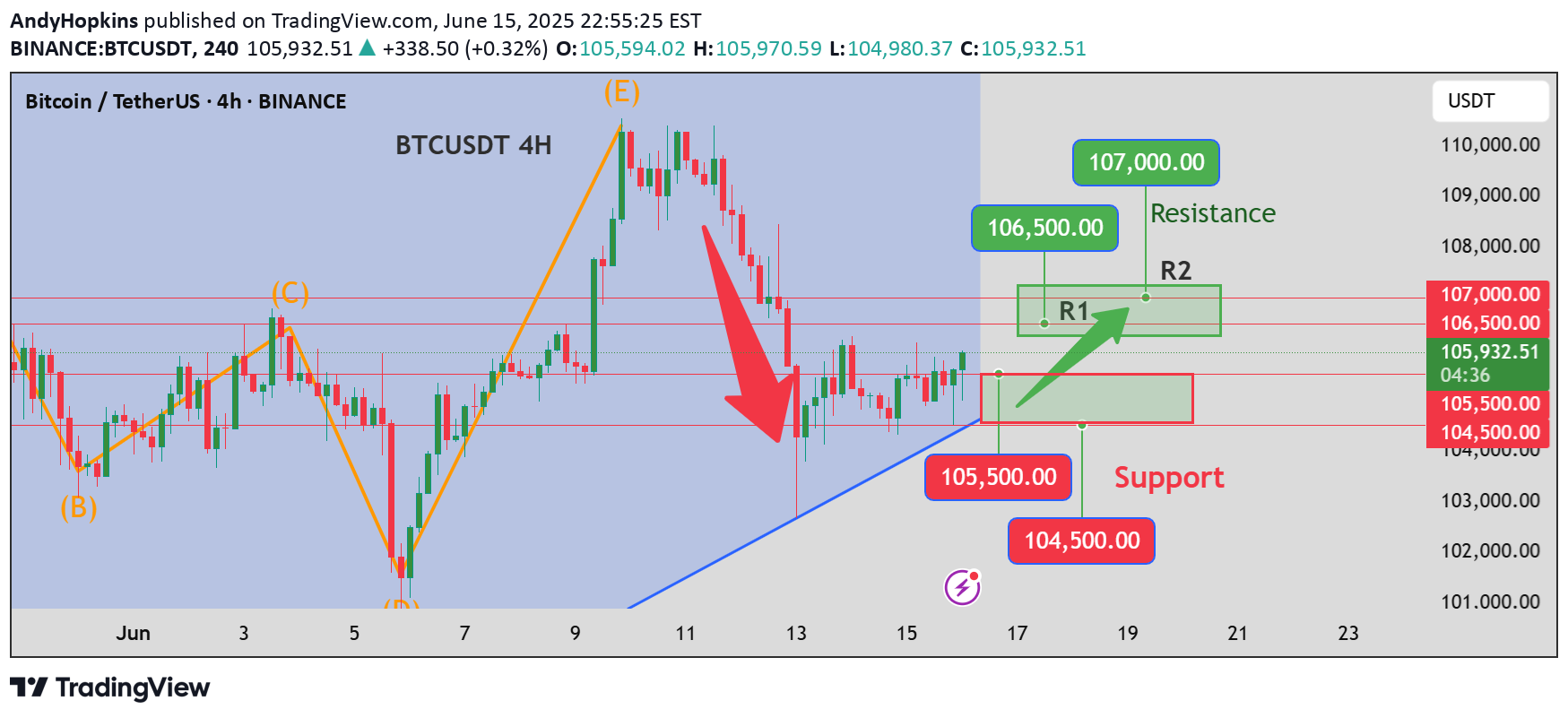

Today's BTC trading strategy, I hope it will be helpful to you

In the second quarter of 2025, multiple inflation data showed signs of easing, leading to rising market expectations that the Federal Reserve will cut rates in September or December. A decline in interest rates generally boosts risk assets including Bitcoin. Historically, Bitcoin prices have mostly trended upward during Fed rate-cutting cycles, as rate cuts increase market liquidity. With funds seeking new investment outlets, Bitcoin's scarcity and potential for high returns attract partial capital inflows. For example, when the Fed drastically cut rates in 2020 to address economic conditions, Bitcoin's price surged from around $9,000 at the start of the year to nearly $30,000 by year-end. If the Fed delivers a rate cut as expected, it is likely to provide strong momentum for Bitcoin's price rally and strengthen confidence in long positions. Technically, Bitcoin is currently in a typical "consolidation zone," with prices fluctuating in the tens of thousands of dollars range while trading volume has not significantly declined. This often indicates that the market is accumulating momentum and waiting to choose a direction. For instance, in 2024, Bitcoin experienced a similar consolidation period in some phases, followed by a sharp upward trend. Such consolidation usually reflects a temporary balance between bullish and bearish forces in the market. Once new driving factors emerge, they may break this balance and trigger a trending market. For long-term investors, this could be an opportune time to position themselves, as the probability of a price breakout to the upside is relatively high if positive factors emerge in the future.Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@104000~105000SL:102000TP:106000~107000

AndyHopkins

Today's BTC trading strategy, I hope it will be helpful to you

A major piece of news has emerged from the U.S. Senate: it has passed legislation aimed at establishing a regulatory framework for cryptocurrencies known as "stablecoins", namely the *Guiding and Establishing National Innovation for U.S. Stablecoins Act* (referred to as the *GENIUS Act*). This news is bound to bring new variables to the Bitcoin market. Hong Kong's *Stablecoin Ordinance* will officially come into effect on August 1, and the Hong Kong Monetary Authority (HKMA) is currently accelerating matters related to processing stablecoin license applications. This measure is of landmark significance for the entire cryptocurrency market: as a key bridge connecting cryptocurrencies and traditional finance, the compliant development of stablecoins will greatly enhance the confidence of market participants. When stablecoins can develop in a healthy and orderly manner, they are expected to attract more funds into the crypto space, thereby indirectly providing strong support for Bitcoin's price. Just yesterday, the U.S. Senate passed the *GENIUS Act* with a vote of 68 to 30, garnering bipartisan support. This marks the first time the U.S. Senate has approved major cryptocurrency legislation. Although the bill still needs to be passed by the House of Representatives and signed by the President to take effect, this progress has brought new expectations to the cryptocurrency market: - **Positive aspects**: The bill provides a clear legal framework for stablecoins, specifying regulatory authorities, reserve requirements, licensing requirements, etc. It is expected to attract traditional financial institutions to enter the cryptocurrency sector, accelerate the inflow of institutional capital, open up channels between the traditional financial sector and the cryptocurrency market, and promote market maturity, which may form a long-term positive for Bitcoin's price. - **Potential risks**: If other regions globally introduce stricter cryptocurrency regulatory policies, the sentiment of market participants will inevitably be impacted, and Bitcoin's price will be negatively affected accordingly.Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@103000~104000SL:101000TP:105000~106000

AndyHopkins

Today's gold trading strategy, I hope it will be helpful to you

I. Gold Trend Analysis (1) Impact of Geopolitical Factors In the preceding period, intense conflicts between Israel and Iran—marked by reciprocal missile attacks—escalated tensions, causing gold prices to surge significantly and touch record highs. However, recent developments indicate both sides are attempting to communicate, prompting safe-haven funds to retreat from the gold market and flow into equities, funds, and other sectors. This is analogous to a "receding tide" of hot money that initially flooded the gold market, naturally influencing prices to decline. Nevertheless, the Middle East remains a complex and volatile region, leaving uncertainties about potential future escalations. If contradictions reignite, risk-aversion demand will resurface, propelling gold prices upward. Thus, while the current lull has triggered price corrections, geopolitical factors remain a **"ticking time bomb"** for gold trends, warranting constant vigilance. (2) Impact of Economic Data and Monetary Policy Expectations At 8:30 PM tonight, the U.S. will release retail data—a key indicator reflecting consumer spending patterns this month (similar to gauging neighbor Lao Wang's monthly shopping habits). If the data shows Americans spent more than expected (forecast +0.5%), the Fed may consider hiking rates. Rate hikes act like tightening the market's "purse strings," strengthening the U.S. dollar and potentially pressuring gold prices downward. Meanwhile, the Bank of Japan's potential move to tighten monetary policy hangs over the gold market like **"two swords"**, unsettling investors who have pre-emptively sold gold, accelerating price declines. Additionally, conflicting statements from Fed officials—some hawkish, some dovish—have left markets guessing about future policy directions, further complicating gold's price trajectory. (3) Techncal Analysis Technically, gold surged to an eight-week high but has since deflated, breaking below $3,400 yesterday and extending losses today. K-line patterns show increasing bearish candles with long bodies, indicating strengthening bearish momentum. The moving average system has formed a **"death cross"** as short-term averages cross below long-term ones—a typical signal of a downward trend. On the daily chart, gold is trading within a descending channel, capped by the upper trendline and testing previous support levels. A break below key support could trigger panic selling, deepening declines, while stabilization at support may allow bulls to counterattack and fuel a rebound. In summary, gold prices are currently in a downward trend, driven by eased geopolitical tensions and shifting economic/data-driven policy expectations. However, with high market uncertainty, close monitoring of Middle East developments, U.S. economic data, and central bank policy shifts is essential—these factors could rapidly alter gold's trajectory.Today's gold trading strategy, I hope it will be helpful to youXAUUSD sell@3395~3405SL:3420TP:3385~3375

AndyHopkins

Today's BTC trading strategy, I hope it will be helpful to you

A few days ago, due to the tense situation in the Middle East—after Israel launched air strikes on Iran—investors panicked and dumped Bitcoin, causing its price to plummet. However, as the situation eased slightly in the past two days, some investors saw an opportunity and rushed to buy, pushing the price back up to the current $106,097. Since the start of this year, Bitcoin's price has generally fluctuated at a high level. Despite significant volatility, it has remained at relatively high prices, demonstrating strong resilience in complex market environments. Key Factors Influencing Prices 1. **Geopolitical Factors**: The Middle East situation has remained highly tense, with regional conflicts subject to sudden changes. Although tensions have temporarily eased in recent days, no one can predict when they might escalate again. If the situation deteriorates once more, risk aversion in financial markets will surge, potentially disrupting Bitcoin's price trend—many may sell again, causing prices to drop. Conversely, if the situation stabilizes and improves, investors will grow bolder, and funds may flow back into the Bitcoin market, driving prices higher. 2. **Macroeconomic Policies**: The Federal Reserve's monetary policy significantly impacts global financial markets, including Bitcoin. Currently, the market closely watches whether the Fed will cut or hike interest rates. If the Fed cuts rates due to poor economic data, increased liquidity in the market may flow into high-risk, high-return assets like Bitcoin, potentially boosting its price. However, if the Fed persists in hiking rates, rising borrowing costs will reduce the Bitcoin market's appeal to funds, possibly suppressing prices. 3. **Industry Regulatory Dynamics**: Hong Kong's *Stablecoin Ordinance* will come into effect on August 1, and the Hong Kong Monetary Authority (HKMA) will accelerate the processing of stablecoin license applications. This is of great significance for the entire cryptocurrency market— the compliant development of stablecoins will enhance market confidence. As a bridge between cryptocurrencies and traditional finance, the healthy development of stablecoins may attract more funds into the crypto space, indirectly supporting Bitcoin's price. However, if stricter cryptocurrency regulations are introduced elsewhere globally, market sentiment may be affected, dragging down Bitcoin's price accordingly. 4. **Market Supply and Demand**: In terms of supply, Bitcoin has a fixed total supply of 21 million coins, and as mining difficulty increases, the pace of new coin issuance is slowing, making it increasingly scarce. On the demand side, institutional investors—such as public companies and hedge funds—have continuously entered the market, allocating Bitcoin to their portfolios and bringing in substantial capital. Meanwhile, retail investors' understanding and acceptance of Bitcoin have grown, driving gradual demand expansion. Even minor changes in the supply-demand relationship can influence Bitcoin's price trend.Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@103500~104500SL:102000TP:106000~107000

AndyHopkins

Today's BTC trading strategy, I hope it will be helpful to you

The Hong Kong Monetary Authority (HKMA) is accelerating the processing of stablecoin license applications, and its impact on the cryptocurrency market will be transmitted to Bitcoin through multiple dimensions, specifically manifested in the following aspects: 1. Compliance Process Drives Market Confidence and Capital Inflow The implementation of Hong Kong's *Stablecoin Ordinance* (effective August 1) establishes a globally leading regulatory framework for fiat stablecoins, explicitly requiring issuers to have a HK$25 million capital base, 100% highly liquid reserve assets, and strict disclosure mechanisms13. This measure will significantly enhance the transparency and credibility of the stablecoin market, attracting compliance institutions such as banks and tech giants (e.g., Ant Group, JD.com) to enter11,15. As a bridge between traditional finance and digital assets, the compliance of stablecoins may drive tens of billions of incremental funds into the cryptocurrency market4,5. For example, HashKey Group analysts predict that stablecoin compliance will bring a 20%-50% valuation upside for Bitcoin and Ethereum5. 2. Expansion of Payment Scenarios and Liquidity Enhancement The programmable features and cross-border payment advantages of stablecoins (100-fold improvement in time efficiency and over 10-fold cost reduction)5 will promote their application in supply chain finance, DeFi (decentralized finance), and other fields. For instance, JD.com's stablecoin has entered the second phase of sandbox testing, focusing on cross-border payments and retail scenarios5,8. The popularization of stablecoins will increase trading activity in the cryptocurrency market, indirectly enhancing Bitcoin's liquidity. On-chain data shows that stablecoin trading volume accounts for over 60% of total cryptocurrency trading volume, and their liquidity spillover effect may reduce Bitcoin's trading slippage and strengthen price stability4. 3. Regulatory Synergy and International Capital Siphon Effect Hong Kong's regulatory framework complements the U.S. GENIUS Act and the EU's MiCA, consolidating its status as an international financial center17. This advantage will attract global Web3 projects and talent, driving the development of innovative businesses such as virtual asset spot ETFs and tokenization of RWA (real-world assets)2,3. For example, the HKMA plans to issue operational guidelines for RWA to promote the on-chain circulation of traditional assets like bonds and real estate, with Bitcoin potentially participating as an underlying value carrier2,11. Additionally, Hong Kong-listed stablecoin concept stocks have recently strengthened (e.g., LianLian Digital up over 15%)12, reflecting the market's positive expectations for policy dividends—a sentiment that may transmit to the Bitcoin market. 4. Structural Support and Risks for Bitcoin - **Short-term Fluctuations and Long-term Value**: The compliance of stablecoins may intensify the market's differentiated perception of "payment tools" and "value storage" assets. As "digital gold," Bitcoin's inflation-hedging properties may be reactivated in a high-interest-rate environment, while stablecoins primarily serve as transaction (media), forming complementarity rather than competition6,9. - **Technical Perspective**: Bitcoin's current price ($107,097) is at a key level in the bull-bear game. If stablecoin policy (positive factors) are combined with institutional capital inflows, it may trigger short covering, pushing the price to break through the $108,000-$109,000 range.Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@106500~107000SL:105000TP:108000~190000

AndyHopkins

Today's gold trading strategy, I hope it will be helpful to you

The Israeli air strikes on Iran have further escalated tensions in the Middle East. Iran's Supreme Leader Ayatollah Ali Khamenei has vowed that Iran's armed forces will use force to destroy the Israeli regime, while the Israeli military has detected multiple rounds of missile attacks launched by Iran. The reciprocal actions between the two sides have pushed regional tensions to a boiling point. New developments have emerged: according to data from the ship-tracking website Marine Traffic, the U.S. aircraft carrier *Nimitz*, originally scheduled to visit Da Nang, Vietnam later this week, canceled its formal reception event planned for June 20 due to "urgent operational needs" and instead left the South China Sea on Monday morning, heading west toward the Middle East. U.S. media speculate that the *Nimitz* is likely being deployed to the Middle East to reinforce Israel. This emergency itinerary adjustment of the U.S. aircraft carrier has undoubtedly added fuel to the already tense Middle East situation. Gold has always been investors' "safe haven" in times of turmoil. Such a highly tense geopolitical situation will greatly stimulate market demand for safe-haven assets. To protect their funds, a large number of investors will flock to the gold market, thereby driving up gold prices. Looking back at the early stage of the Russia-Ukraine conflict, gold prices surged significantly in a short period. The current conflict between Israel and Iran, coupled with the urgent reinforcement of the U.S. aircraft carrier in the Middle East, is expected to have a non-negligible supporting effect on gold prices based on the current development trend, which may even push gold prices to higher levels. As long as the storm in the Middle East does not subside, the support for gold prices driven by safe-haven demand will continue to exist.Today's gold trading strategy, I hope it will be helpful to youXAUUSD BUY@3405~3415SL:3905TP1:3430~3440

AndyHopkins

Today's BTC trading strategy, I hope it will be helpful to you

A while ago, Israel launched air strikes on Iran. As soon as the news broke, financial markets were thrown into turmoil, and the price of Bitcoin also fluctuated sharply. Market expectations were already unstable, and coupled with such sudden geopolitical events, many investors felt uncertain and became extremely cautious in their trading. However, the Bitcoin price did not keep falling, and it has rebounded slightly in the past two days, indicating that there are still people in the market who are optimistic about it and willing to buy at lower prices. From the perspective of market performance, when the price fell earlier, many people were afraid of continuing losses and hurriedly sold their Bitcoin, causing the price to decline all the way. But as the situation in the Middle East eased slightly, some investors saw an opportunity and began to enter the market again, which pushed the price back up. Moreover, many institutions and large investors had long been interested in Bitcoin. With their strong financial strength, their moves can have a significant impact on prices. Even if the situation in the Middle East remains unstable, from a long-term perspective, they still believe that Bitcoin has investment value, which has supported the price to a certain extent. Looking at the long term, some of Bitcoin's own characteristics still attract many people. It has a limited quantity, with only 21 million coins in total, and this scarcity makes it a good choice for value preservation in the eyes of many. In addition, it is not completely controlled by any country or institution, and transactions are relatively convenient—these advantages have always existed. As long as there are no major changes in the global economic and technological environment, the long-term value of Bitcoin is still recognized by many.、Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@104500~105500SL:102500TP:106500~107000

AndyHopkins

Today's gold trading strategy, I hope it will be helpful to you

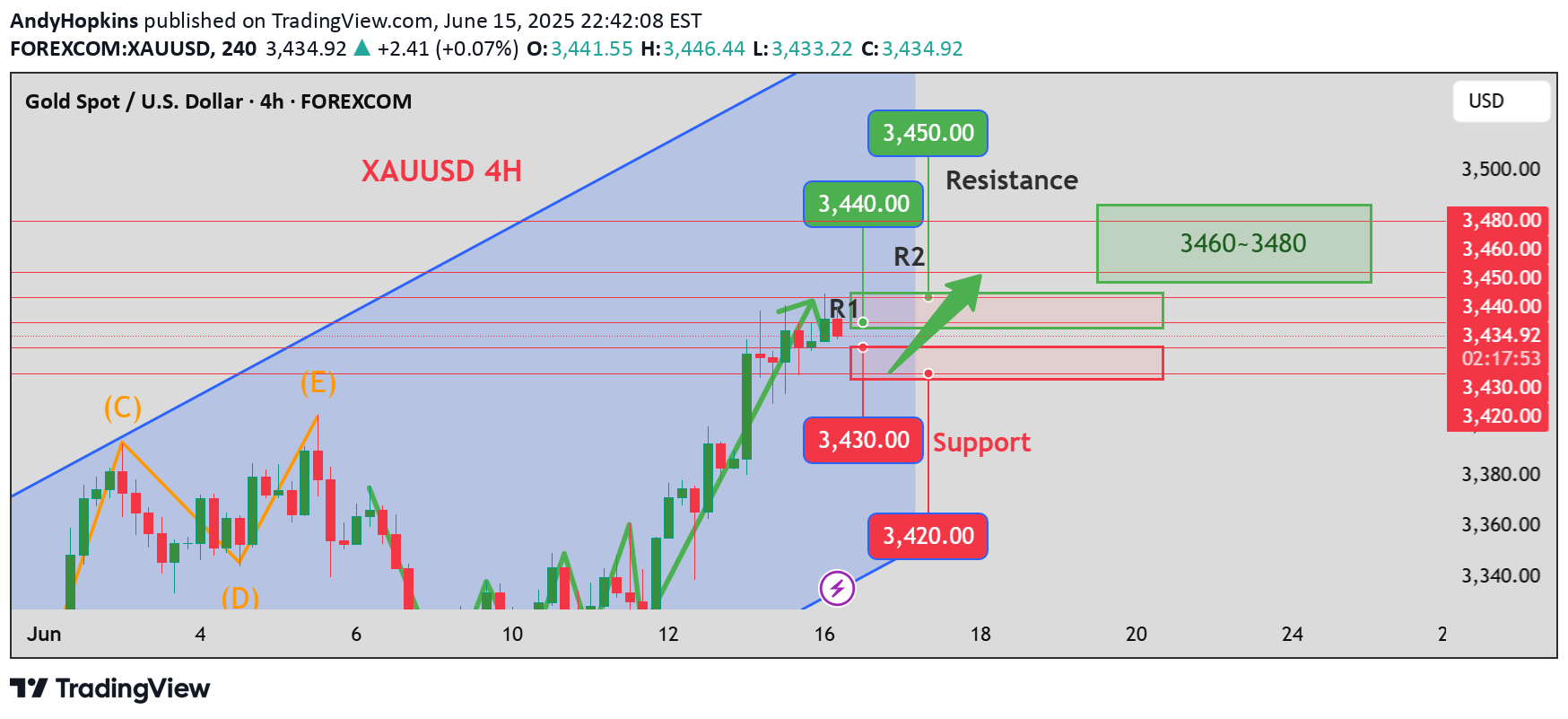

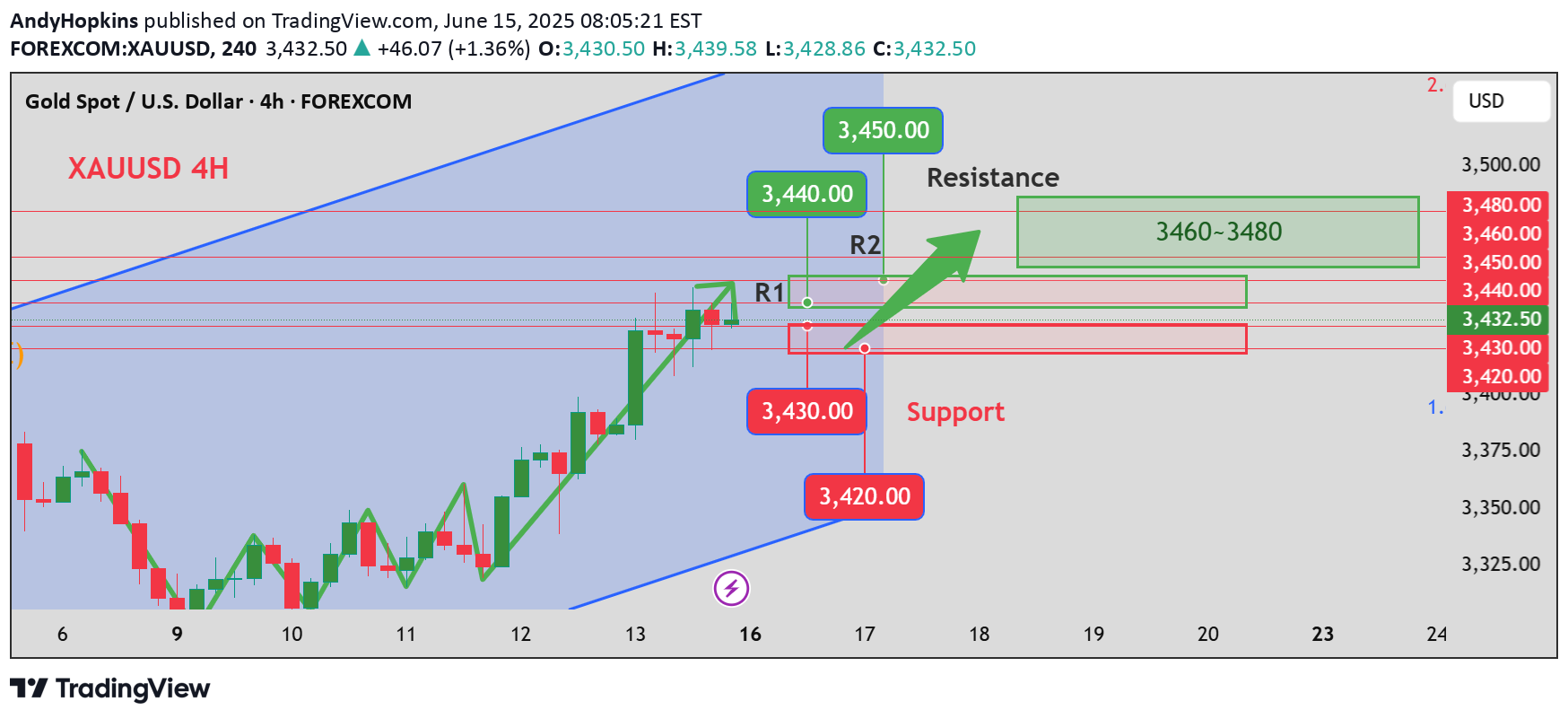

Technical Chart Analysis From a technical chart perspective, the gold price has successfully broken through the key resistance level of $3,400 and is currently fluctuating between $3,430 and $3,450. This indicates that bullish forces have gained the upper hand recently, showing the intention to push the price further upward. The vicinity of $3,450 above has formed a new resistance level, resembling an insurmountable mountain that blocks the gold price from further gains. If the gold price aims to launch a new round of significant increases, it must successfully break through this resistance level. Once broken, it may attract more investors to chase the rally, driving the price to rise rapidly. The $3,400 level below has shifted from a resistance level to a key support level, becoming an important position held by bulls. If the price unfortunately breaks below this support level, it may trigger panic selling among a large number of investors, leading to a rapid correction in the price and even a return to the previous range to seek lower support. In terms of K-line patterns, there have been more yang lines (up candles) with larger bodies recently, indicating strong bullish momentum. However, as the price continues to climb, the upper shadows have gradually lengthened, suggesting that bears are also starting to exert force at high levels, making the game between bulls and bears increasingly fierce. The moving average system shows a bullish arrangement, with short-term moving averages crossing above long-term moving averages to form a golden cross, which is a positive signal for an upward trend. Nevertheless, the current price deviates significantly from the moving averages, and there is a need for a correction to repair technical indicators, which also complicates the subsequent price trend. Comprehensive Outlook Considering the above factors, in the short term, the gold price may still rise due to geopolitical conflicts. However, it is necessary to closely monitor the development of the Middle East situation, as well as changes in U.S. economic data and the Federal Reserve's monetary policy. If geopolitical conflicts ease or the Fed sends hawkish signals, the gold price may face correction risks.Today's gold trading strategy, I hope it will be helpful to youXAUUSD BUY@3420~3430SL:3400TP1:3440~3450

AndyHopkins

Today's BTC trading strategy, I hope it will be helpful to you

Recently, the news that Trump Media & Technology Group (DJT) has filed an application with the U.S. Securities and Exchange Commission (SEC) to invest in Bitcoin has injected new vitality into the Bitcoin market. Combined with the current market conditions, the following strategies are formulated: Judgment of Entry Timing 1. **Observation of News Fermentation** Although DJT's registration for the investment application does not involve fundraising for the time being, this news may attract more investors' attention to the Bitcoin market. Closely monitor the market reaction within 2-3 trading days after the news release. If during this period, the Bitcoin price does not experience a sharp decline but shows a small-scale volatile upward trend (such as a daily increase of 0.5%-1%), and the trading volume increases by 10%-15% compared with that before the news release, it indicates that the market generally recognizes the news, and the long-term momentum begins to gradually accumulate, which can be regarded as an initial entry signal. 2. **Assistance of Technical Indicators** - Refer to the daily K-line pattern: If affected by the news, the Bitcoin price successfully breaks through the 5-day moving average, and the 5-day moving average starts to cross above the 10-day moving average to form a **golden cross**, while the **MACD indicator** forms a golden cross below the 0 axis and the bar chart starts to turn from green to red, it indicates that the short-term bullish trend is established, and long positions can be considered. - Observe the **Bollinger Bands indicator**: When the price breaks through the middle轨 of the Bollinger Bands and the opening of the Bollinger Bands gradually widens, it means that the price has further room to rise. Entering the market at this time can increase the success rate of long positions. 3. **Confirmation of Market Sentiment** - Pay attention to the Crypto Fear & Greed Index: If after the DJT news is released, the index rebounds from the fear zone (below 40) to the neutral zone (40-60), and the bullish comments on Bitcoin and DJT's investment application significantly increase on social media, with the heat of related topics growing by more than 20% within a week, while the search volume for Bitcoin on search engines surges, it indicates that market sentiment is turning optimistic, making it suitable to enter long positions. Today's BTC trading strategy, I hope it will be helpful to youBTCUSDT BUY@104000~105000SL:102000TP:106000~107000I will update the latest data in time, please continue to pay attention

AndyHopkins

Gold strategy analysis for next week, hope it helps you

Geopolitical Aspects - Iran is seeking mediation from Oman and Qatar, while Saudi Arabia is also promoting a ceasefire framework, indicating the willingness of all parties to ease the conflict. If the mediation succeeds, geopolitical tensions will be alleviated, and the safe-haven demand for gold will correspondingly decrease, creating a bearish impact on gold prices. - However, the U.S. has put forward harsh conditions such as requiring Iran to completely stop uranium enrichment activities, the Iranian Foreign Ministry spokesperson has adopted a tough stance, and some Israeli officials even hope for the conflict to escalate, making the prospect of successful negotiations full of uncertainty. As long as this uncertainty exists, market risk aversion will not fully dissipate, and gold prices will still have support. Market Expectations - If the conflict between Iran and Israel eases, market risk appetite may rise, and funds will flow out of safe-haven assets like gold and into risk assets. However, global economic data currently shows mixed performance, U.S. economic data is volatile, and other major economies also face various problems. The uncertainty of the economic outlook still exists, which will limit the downside space for gold prices. - The global central bank gold buying spree continues, with central banks continuing to increase gold holdings to optimize reserve structures, which provides strong long-term support for gold prices. Even if short-term geopolitical conflict mitigation leads to a correction in gold prices, the long-term upward trend is difficult to change. Overall Outlook In the short term, the trend of gold prices will depend on the development of the conflict between Iran and Israel and the results of related negotiations. If the conflict further escalates or negotiations break down, gold prices are expected to continue rising; if the mediation is successful and the conflict is alleviated, gold prices may experience a certain degree of correction, but the magnitude of the correction may be limited, as factors such as global economic uncertainty and central bank gold purchases still support gold prices. In the long run, with global economic and geopolitical uncertainties still in place, gold prices still have a foundation for upward movement.Gold strategy analysis for next week, hope it helps youXAUUSD BUY@3420~3430SL:3400TP1:3440~3450TP2:3460~3480I will update the latest data in time, please continue to pay attention

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.