Technical analysis by AndyHopkins about Symbol PAXG: Buy recommendation (6/16/2025)

AndyHopkins

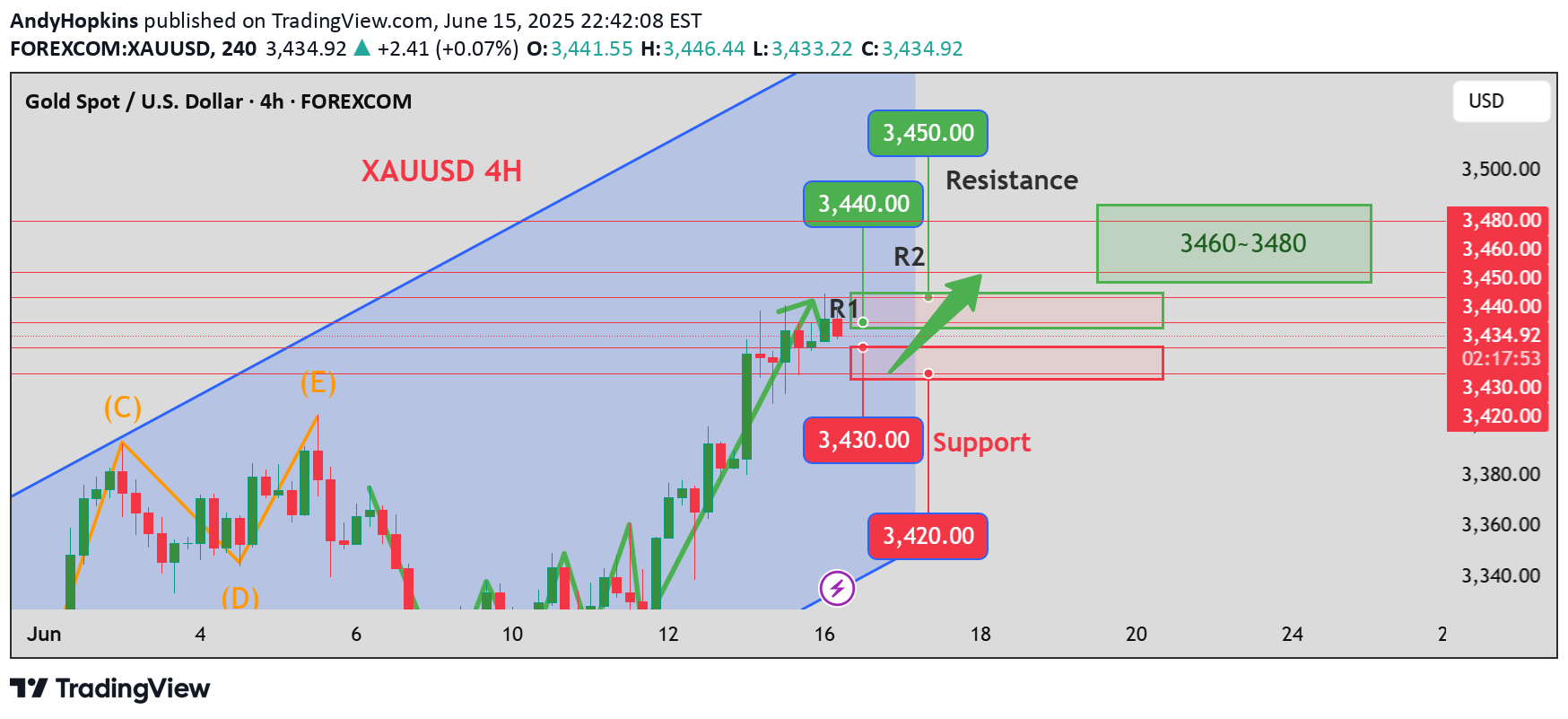

Today's gold trading strategy, I hope it will be helpful to you

Technical Chart Analysis From a technical chart perspective, the gold price has successfully broken through the key resistance level of $3,400 and is currently fluctuating between $3,430 and $3,450. This indicates that bullish forces have gained the upper hand recently, showing the intention to push the price further upward. The vicinity of $3,450 above has formed a new resistance level, resembling an insurmountable mountain that blocks the gold price from further gains. If the gold price aims to launch a new round of significant increases, it must successfully break through this resistance level. Once broken, it may attract more investors to chase the rally, driving the price to rise rapidly. The $3,400 level below has shifted from a resistance level to a key support level, becoming an important position held by bulls. If the price unfortunately breaks below this support level, it may trigger panic selling among a large number of investors, leading to a rapid correction in the price and even a return to the previous range to seek lower support. In terms of K-line patterns, there have been more yang lines (up candles) with larger bodies recently, indicating strong bullish momentum. However, as the price continues to climb, the upper shadows have gradually lengthened, suggesting that bears are also starting to exert force at high levels, making the game between bulls and bears increasingly fierce. The moving average system shows a bullish arrangement, with short-term moving averages crossing above long-term moving averages to form a golden cross, which is a positive signal for an upward trend. Nevertheless, the current price deviates significantly from the moving averages, and there is a need for a correction to repair technical indicators, which also complicates the subsequent price trend. Comprehensive Outlook Considering the above factors, in the short term, the gold price may still rise due to geopolitical conflicts. However, it is necessary to closely monitor the development of the Middle East situation, as well as changes in U.S. economic data and the Federal Reserve's monetary policy. If geopolitical conflicts ease or the Fed sends hawkish signals, the gold price may face correction risks.Today's gold trading strategy, I hope it will be helpful to youXAUUSD BUY@3420~3430SL:3400TP1:3440~3450