Technical analysis by AndyHopkins about Symbol PAXG: Buy recommendation (6/15/2025)

AndyHopkins

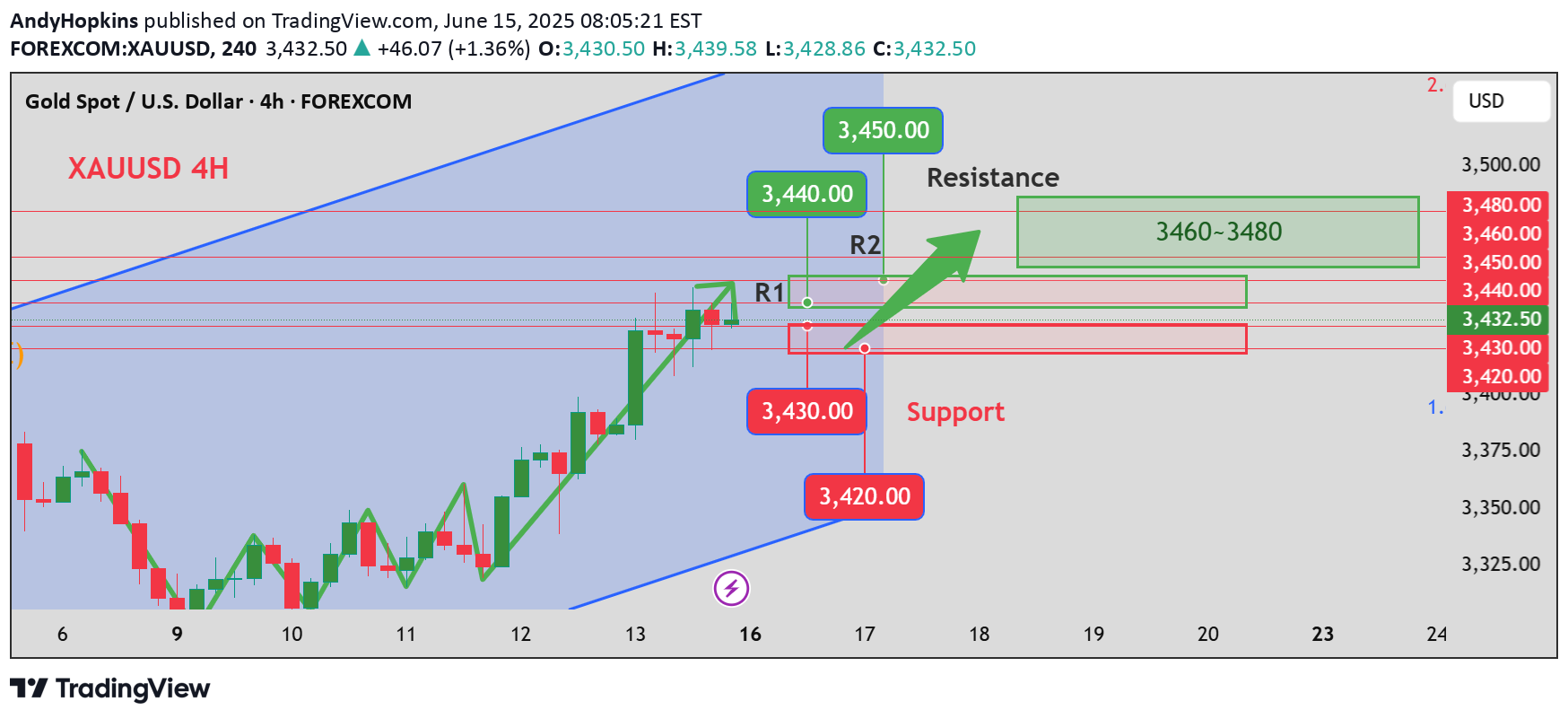

Gold strategy analysis for next week, hope it helps you

Geopolitical Aspects - Iran is seeking mediation from Oman and Qatar, while Saudi Arabia is also promoting a ceasefire framework, indicating the willingness of all parties to ease the conflict. If the mediation succeeds, geopolitical tensions will be alleviated, and the safe-haven demand for gold will correspondingly decrease, creating a bearish impact on gold prices. - However, the U.S. has put forward harsh conditions such as requiring Iran to completely stop uranium enrichment activities, the Iranian Foreign Ministry spokesperson has adopted a tough stance, and some Israeli officials even hope for the conflict to escalate, making the prospect of successful negotiations full of uncertainty. As long as this uncertainty exists, market risk aversion will not fully dissipate, and gold prices will still have support. Market Expectations - If the conflict between Iran and Israel eases, market risk appetite may rise, and funds will flow out of safe-haven assets like gold and into risk assets. However, global economic data currently shows mixed performance, U.S. economic data is volatile, and other major economies also face various problems. The uncertainty of the economic outlook still exists, which will limit the downside space for gold prices. - The global central bank gold buying spree continues, with central banks continuing to increase gold holdings to optimize reserve structures, which provides strong long-term support for gold prices. Even if short-term geopolitical conflict mitigation leads to a correction in gold prices, the long-term upward trend is difficult to change. Overall Outlook In the short term, the trend of gold prices will depend on the development of the conflict between Iran and Israel and the results of related negotiations. If the conflict further escalates or negotiations break down, gold prices are expected to continue rising; if the mediation is successful and the conflict is alleviated, gold prices may experience a certain degree of correction, but the magnitude of the correction may be limited, as factors such as global economic uncertainty and central bank gold purchases still support gold prices. In the long run, with global economic and geopolitical uncertainties still in place, gold prices still have a foundation for upward movement.Gold strategy analysis for next week, hope it helps youXAUUSD BUY@3420~3430SL:3400TP1:3440~3450TP2:3460~3480I will update the latest data in time, please continue to pay attention