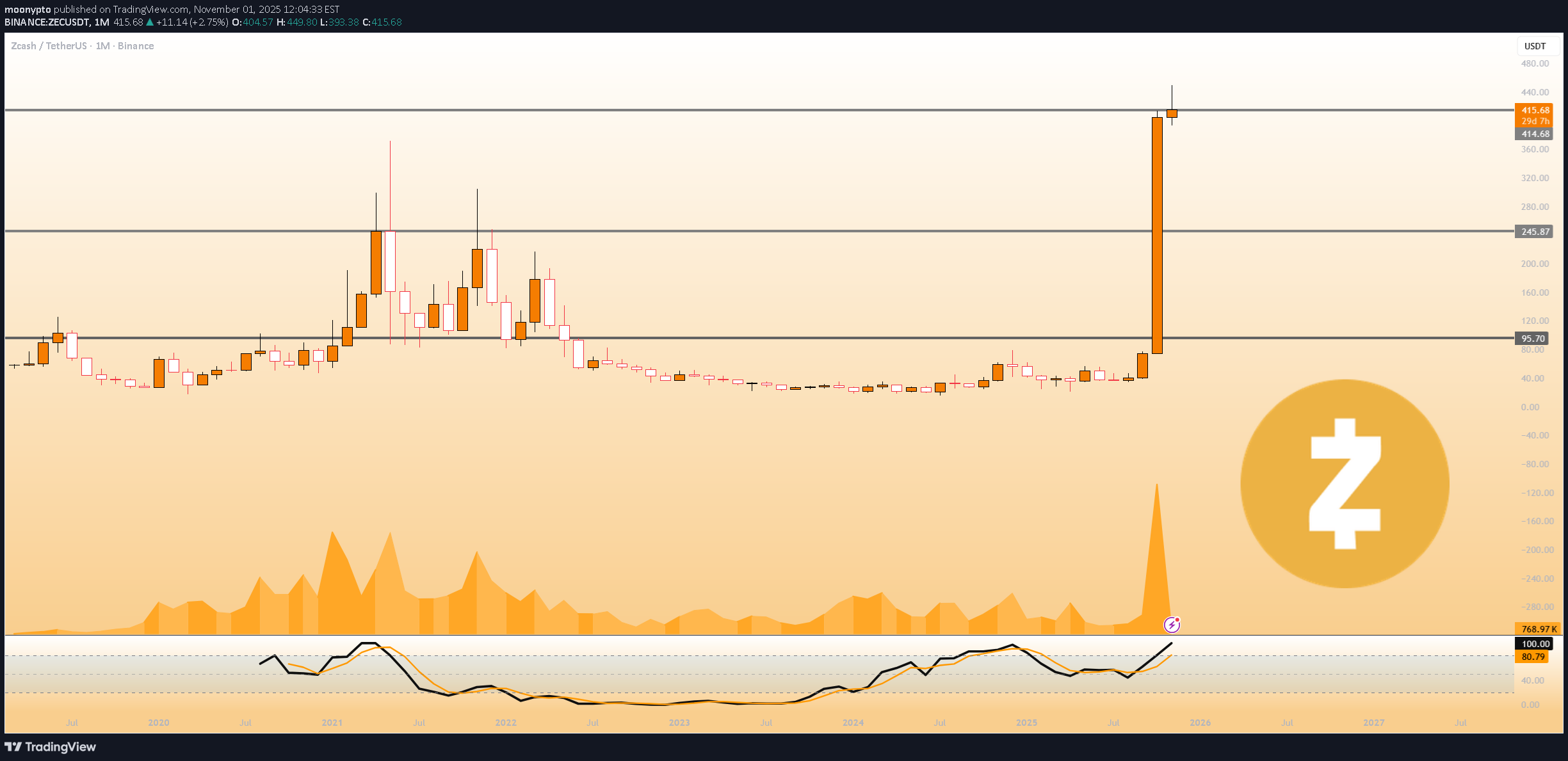

Technical analysis by moonypto about Symbol ZEC on 11/1/2025

moonypto

زِکش (Zcash): پادشاه جدید حریم خصوصی با رشد ۵۰۰ درصدی؛ راز جهش بزرگ چیست؟

Grayscale’s Zcash Trust Draws Attention as ZEC Jumps 500% Before Halving Grayscale’s Zcash Trust is back in focus after Zcash pumped more than 500% since early October. The privacy focused cryptocurrency has climbed to about $410, driven by growing interest in digital assets that emphasize transaction confidentiality. Grayscale is still the only US listed fund giving investors direct exposure to ZEC. It currently manages $155 million in assets, and its shares trade over the counter, allowing investors to access Zcash through regular brokerage accounts without holding the coin themselves. Launched in 2017 and listed publicly in 2021, the Grayscale Zcash Trust was designed to make it easier for institutions to invest in ZEC. Each share represents about 0.0818 ZEC and carries a 2.5% annual fee. The technology behind Zcash is a big part of what’s driving renewed institutional interest. Its zero knowledge proof system, known as zk SNARKs, allows for shielded transactions that hide the sender, recipient, and amount. The network’s shielded pool now holds around 4.9 million ZEC about 30% of total supply strengthening privacy across the blockchain. Investor enthusiasm for ZEC grew after Silicon Valley investor Naval Ravikant called it “insurance against Bitcoin,” a comment that helped fuel a rally pushing ZEC past Monero (XMR) in market value. BitMEX co-founder Arthur Hayes added to the optimism, suggesting ZEC could eventually hit $10,000 and describing its recent momentum as “unstoppable.” Meanwhile, institutional investors appear to be expanding their focus beyond Bitcoin. With BlackRock dominating Bitcoin ETF inflows, many investors are exploring alternatives. ZEC is gaining traction alongside proposed ETFs for Solana and Litecoin, giving asset managers new options for portfolio diversification. Zcash’s next halving, set for November, will cut block rewards by half, following the same scarcity model as Bitcoin. The timing coincides with increased global scrutiny of privacy technologies. The U.S. Treasury recently sought public feedback on privacy tools, and the EU continues to debate its “chat control” legislation Now worth around $6.9 billion, Zcash’s comeback stands out as one of the most significant developments in the privacy focused crypto space this year. If this trend continues, Zcash’s surge may signal a new phase for privacy coins, one that balances financial confidentiality with accountability in an increasingly regulated environment.BitMEX co-founder Arthur Hayes posted that Zcash has become the second-largest crypto asset in his family office Maelstrom’s portfolio, behind only Bitcoin. Driven by the privacy-trading narrative, ZEC has recently surged to around $750, marking its highest level since 2018. Hayes wrote: "Due to the rapid ascent in price, ZEC is now the 2nd largest liquid holding in the Maelstrom portfolio."