SANTOS

Santos FC Fan Token

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

BandForBandsRank: 34849 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 1 hour ago |

Price Chart of Santos FC Fan Token

سود 3 Months :

سیگنالهای Santos FC Fan Token

Filter

Sort messages by

Trader Type

Time Frame

BandForBands

BandForBands

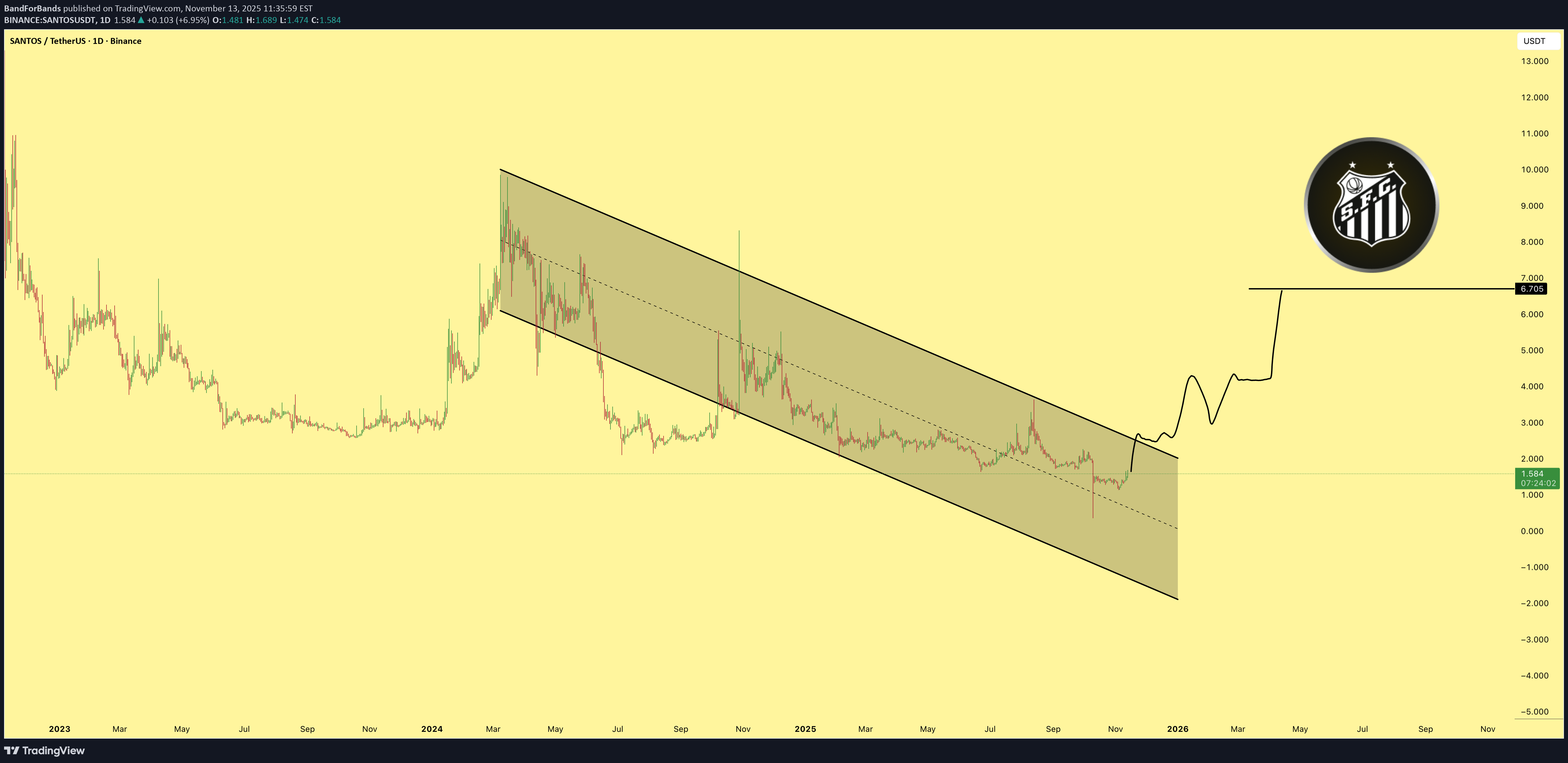

شانس انفجار ۳۰۰ درصدی سانتوس: صبر کن یا همین حالا بخر؟

SANTOS is trading inside a descending channel pattern, building pressure for a breakout. Once it moves, there’s a potential 300 percent gain from the current price to the measured target. Structure looks clean and momentum is starting to shift.

Bithereum_io

SANTOSUSDT 1D

#SANTOS appears to be forming a double bottom pattern on the daily timeframe. RSI and MACD have turned bullish. Keep an eye on it. If the pattern gets confirmed, the potential targets could be: 🎯 $2.194 🎯 $2.350 🎯 $2.505 🎯 $2.727 🎯 $3.009 🎯 $3.368 🎯 $3.555 🎯 $3.824 🎯 $4.328 ⚠️ Always remember to use a tight stop-loss and follow proper risk management.

MosFLI

Santos 1H Rising Wedge

On the 1H chart, $SANTOS is trading inside a rising wedge ⚠️ If breakdown plays out, price may revisit the $1.75–$1.76 area. #Crypto #SANTOS #Signals #SANTOSUSDT

RAMAZAN1234567

Crypto-Adda_Official

Expecting a strong move from $SANTOS

Expecting a strong move from $SANTOS , potentially yielding 50%. A strong support line is a price level where an asset tends to stop falling due to significant buying interest (demand) that prevents further declines. It’s often identified by:Multiple Touches: The price has tested the level multiple times without breaking below it. The more tests, the stronger the support. High Volume: Strong buying volume at the support level indicates robust demand, reinforcing its strength. Psychological Levels: Round numbers (e.g., $100, 1.2000 in forex) often act as strong support due to trader psychology and institutional order placements. Historical Significance: Levels where the price reversed or consolidated in the past are considered stronger.

hora9a

Risk_Adj_Return

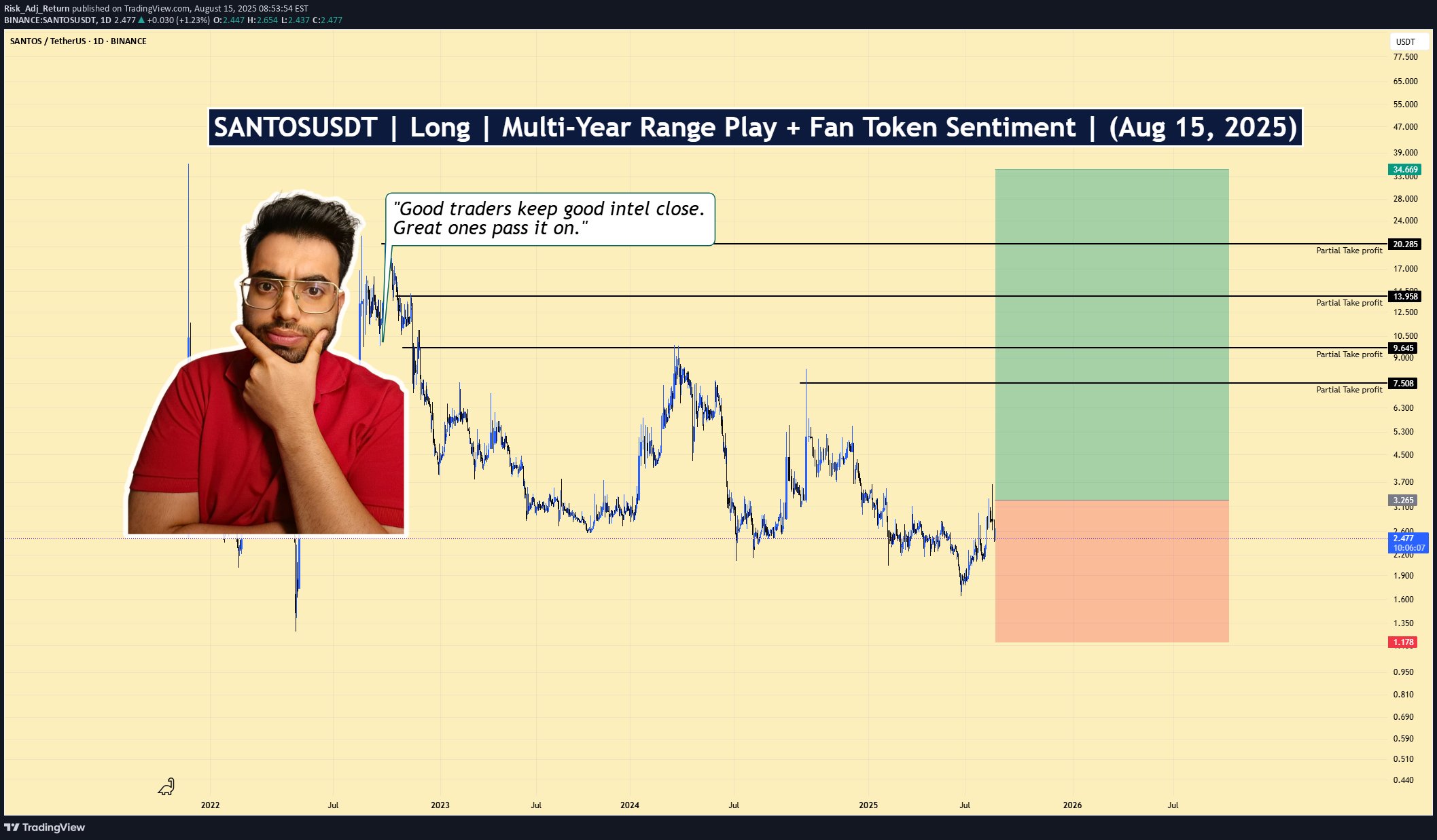

SANTOSUSDT | Long | Multi-Year Range Play | (Aug 15, 2025)

📌 SANTOSUSDT | Long Setup | Fan Token Rotation + Structural Breakout | Aug 15, 2025 🔹 Thesis Summary SANTOS is breaking above a long-term accumulation range within the underperforming fan token sector. Backed by Santos FC and Binance, this play targets asymmetrical upside on renewed engagement cycles ahead of Q4 token unlocks. 🔹 Trade Setup Bias: Long Entry Zone: $2.40 – $2.83 Stop Loss: $1.17 (2022 ATL retest) Take-Profits: • TP1: $7.56 • TP2: $10.50 • TP3: $13.95 • Max Target: $20.78 Risk/Reward Ratio: ~6.5R to TP3, >10R to Max Target 🔹 Narrative & Context The fan token sector is largely overlooked in current rotations, offering high beta opportunities relative to broader alt markets. SANTOS, built on BSC and launched via Binance Launchpool, is one of the few tokens in this niche with real-world backing and consistent exchange volume. This setup leans on a textbook breakout from a multi-year compression structure. The July–August base holds higher lows on rising volume, with upside targets aligned to historical resistance clusters from 2022 and 2023. Fan token cycles often correlate with sports seasonality and club performance; Santos FC’s schedule into Q4 may act as a soft catalyst for engagement and token demand. 🔹 Macro Considerations BTC/ETH: Neutral trending → risk-on alt setups viable Sector Rotation: Potential spillover from speculative GameFi/NFT runs into niche tokens like fan engagement Token Unlocks: November 2025 unlock (~45% supply remains locked) is key—positioning ahead could front-run anticipated dilution fears Volume Flows: Binance remains primary liquidity source; watching Binance Launchpool/Fan Token promos for timing clues 🔹 Forward Path If this idea gains traction, I’ll post a higher timeframe breakdown of fan token cycles and structural setups on JUV, LAZIO, PSG, and BAR. Break above $3.28 confirms structural shift — weekly close above $4.50 unlocks parabolic potential into mid-range resistances. 💼 Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out. ⚠️ Disclaimer: This is not financial advice. Always do your own research. Charts and visuals may include AI enhancements.

ninacryptotrade

SANTOS/USDT – Bullish Breakout: Falling Wedge Targets +136%

SANTOS has broken out of a multi-month falling wedge pattern, confirming the move with a strong bullish candle closing above the upper trendline. Current price is 3.026 USDT, up +11.33% for the session. The measured move from the pattern projects a potential target near 6.50 USDT (+136.83% from the breakout zone). Price action shows increasing momentum following the breakout, which could indicate continuation toward higher levels. Key levels: Breakout zone: ~2.45 USDT Projected target: 6.50 USDT Invalidation: close back inside wedge Pattern breakout confirmed – monitoring for follow-through toward target.

FTT_TRADER369

Santos pump

Numerology, as well as testing of an important level, is where altcoin pumps often occur very strongly. I am already entering the trade.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.