BandForBands

@t_BandForBands

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BandForBands

BTC

BTC is retracing toward support, a level that has produced strong reactions before. As long as this zone holds, the base case remains a continuation leg and a breakout from the current range. Structure is still intact.

BandForBands

سقوط آزاد HYPE: راز ۹۵٪ صعود انفجاری در کانال نزولی چیست؟

HYPE is trading below 30 within a descending channel. Structure suggests compression ahead of expansion. A confirmed breakout from this range opens the door for roughly 95 percent upside from current levels if momentum follows through.

BandForBands

BandForBands

بیت کوین درجا میزند: آیا زمان خرید اتریوم و آلت کوینهای منتخب است؟

BandForBands

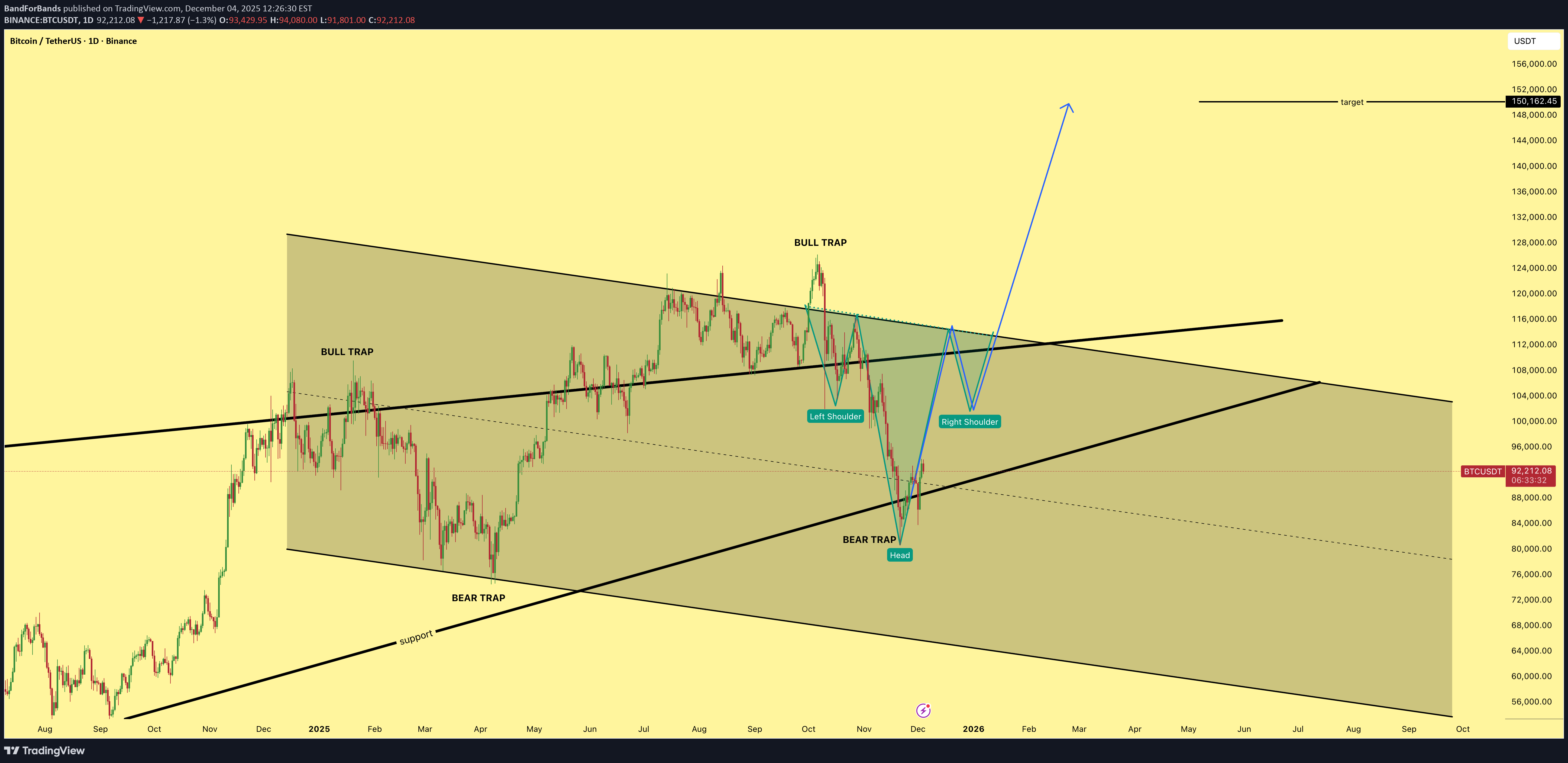

بیت کوین در راه ۱۵۰ هزار دلار؟ راز ساختار سر و شانه وارونه!

Bitcoin at 150k remains in play. The inverse head and shoulders structure is still valid and price continues to respect the neckline. As long as structure holds, upside continuation remains the higher probability outcome.

BandForBands

بیت کوین در مسیر ۱۵۰ هزار دلار: آیا الگوی سر و شانه معکوس نجاتبخش است؟

$150K remains in play for $BTC. The inverse head and shoulders is still holding its structure, momentum is stabilizing, and the pattern remains valid. As long as the neckline holds, this setup has a high probability of playing out.

BandForBands

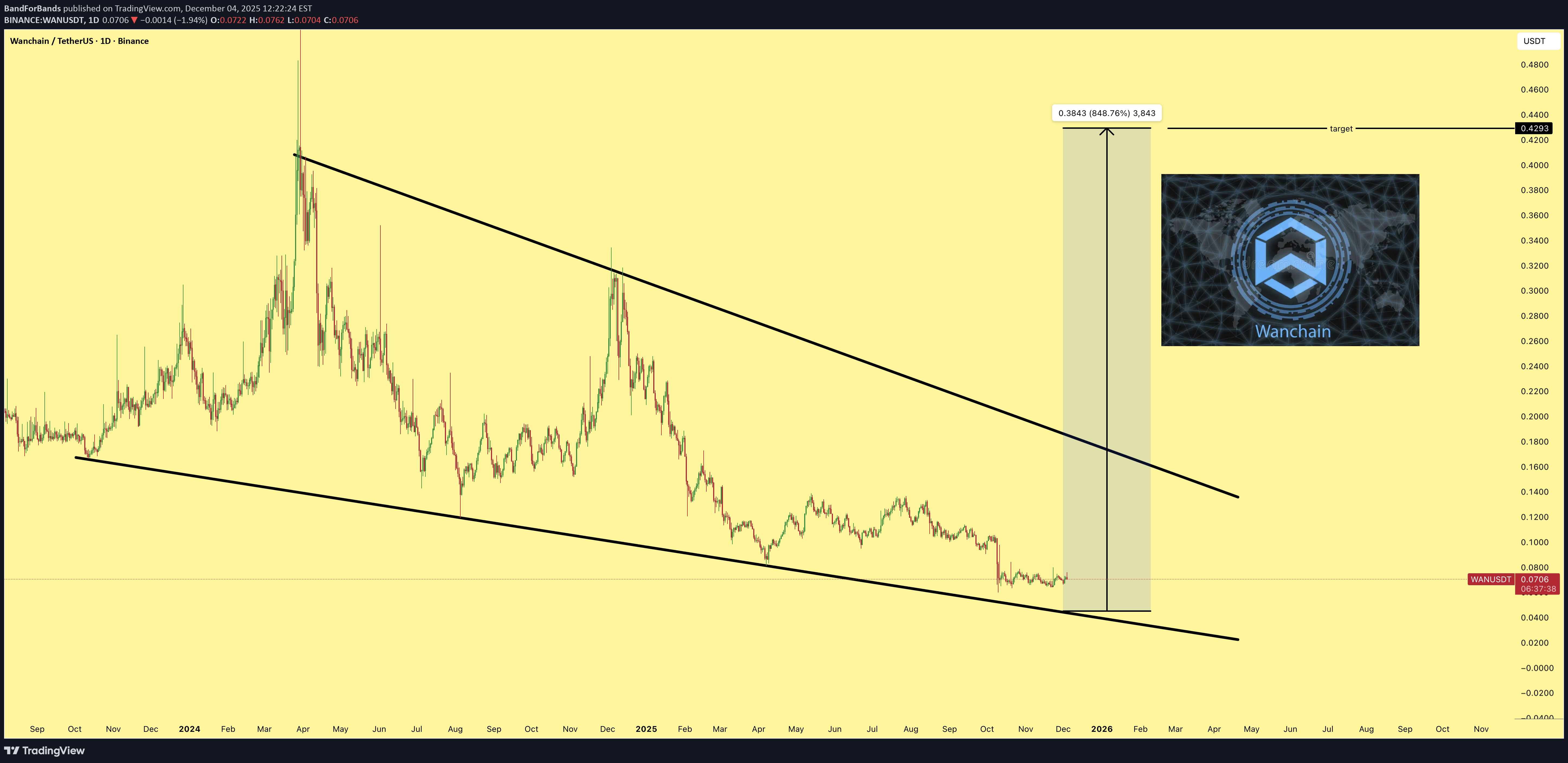

آیا WAN آماده جهش است؟ راز خروج از الگوی نزولی ۶۰ روزه!

WAN has been ranging inside a descending wedge for over 60 days and price is now pressing higher. The structure suggests a resistance test is coming soon, and a breakout from this compression would signal the start of the next upside expansion.

BandForBands

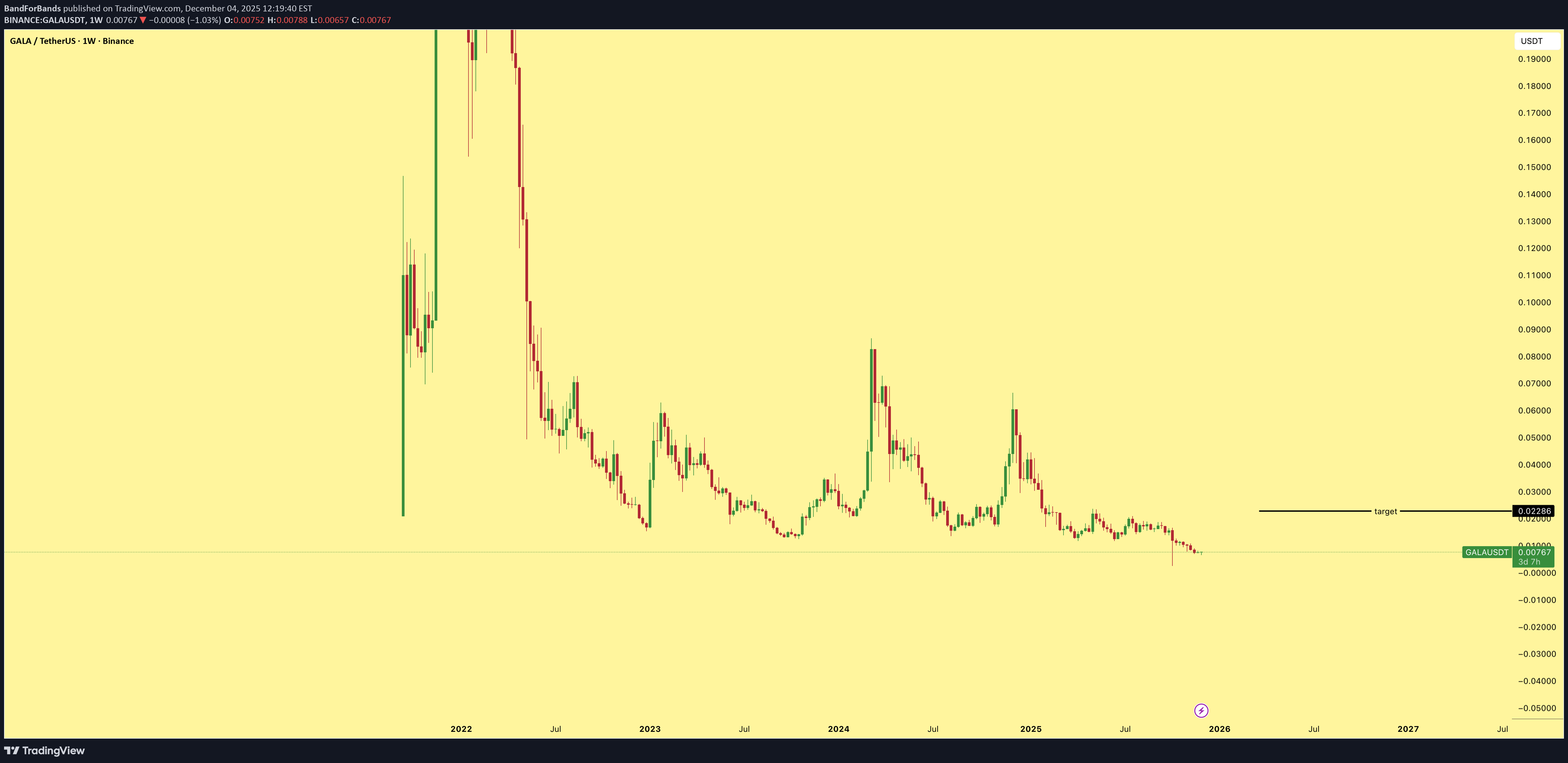

آلت کوین GALA آماده انفجار است: پیشبینی رشد 200 درصدی در کوتاهمدت!

BandForBands

BandForBands

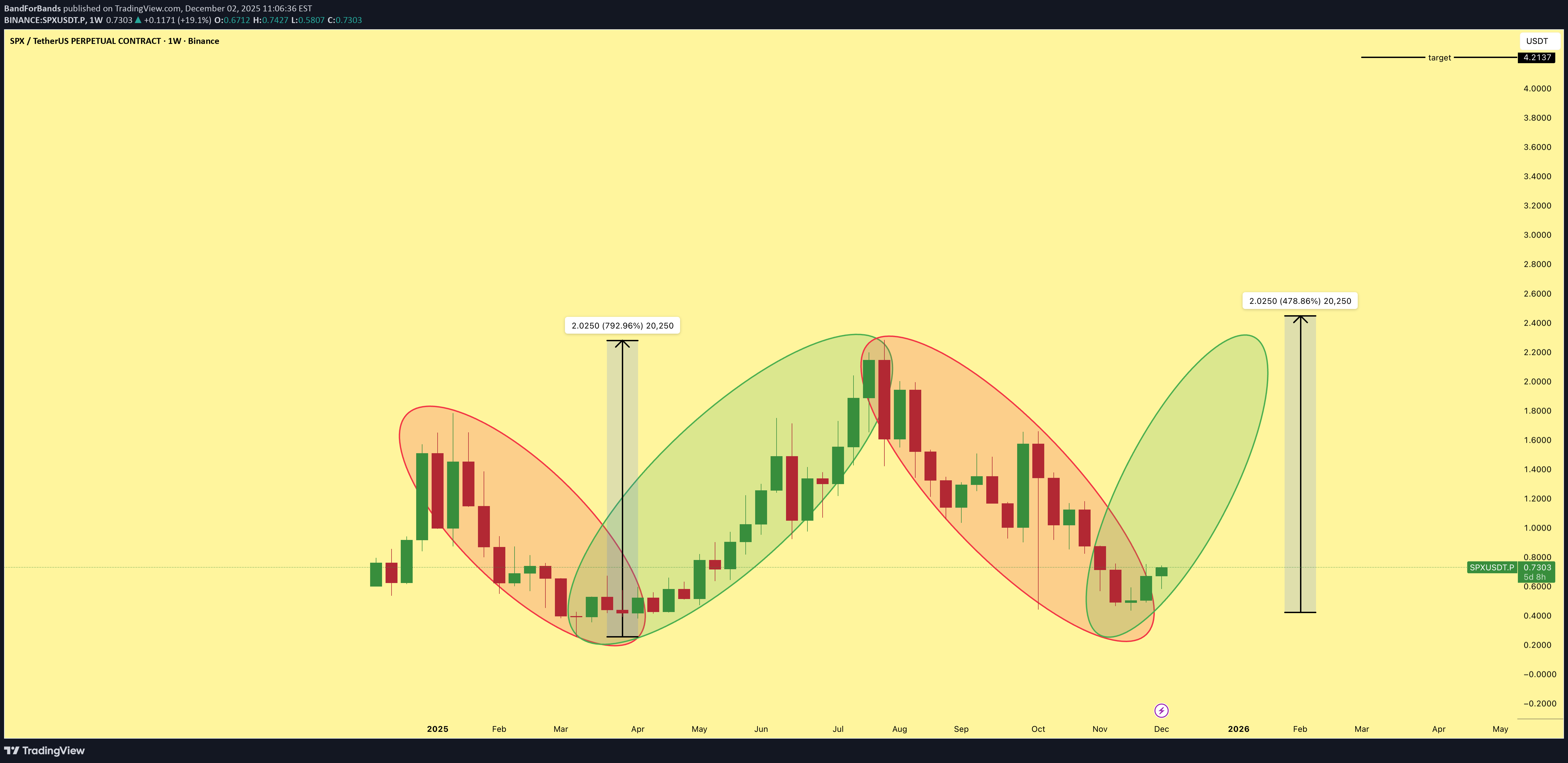

هدف نهایی SPX کجاست؟ رمزگشایی از هدف ۴.۲ دلاری برای شاخص S&P 500

$4.2 is the target for $SPX. We collectively entered at the bottom and we are holding to $4.2 because we believe in something. The structure is clean, momentum is building, and the trend is on our side.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.