POPCAT

Popcat (SOL)

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/24/2025 |

Price Chart of Popcat (SOL)

سود 3 Months :

سیگنالهای Popcat (SOL)

Filter

Sort messages by

Trader Type

Time Frame

فشار نزولی سنگین بر پاپکت (PopCat): آیا کف قیمتی امسال خواهد شکست؟

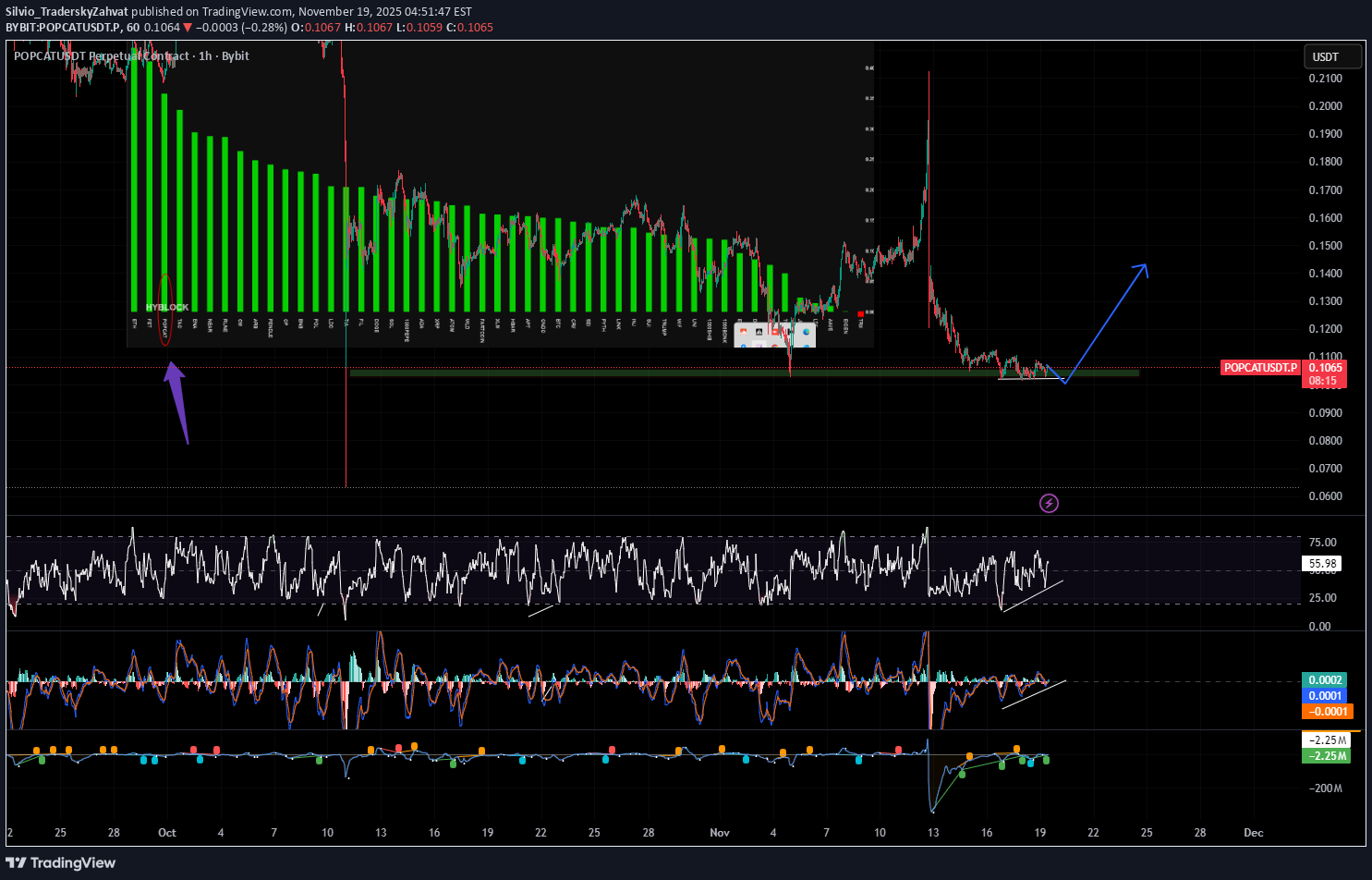

PopCat has been in a persistent downtrend since April, with price now drifting toward the yearly low. This level is a weak low, and if it holds, a short-term rally toward the higher time-frame resistance at $0.13 may unfold. However, the dynamic resistance overhead continues to cap upward movement. Until this trendline is broken, the bearish market structure remains dominant, and downside continuation is more likely. Key Points - Price approaching a weak yearly low on sustained downtrend - Potential rally toward $0.13 if support holds - Dynamic resistance still suppressing bullish attempts What to Expect If the yearly low holds, PopCat may attempt a relief bounce, but failure to break dynamic resistance keeps the market biased lower.

افت شدید POPCAT در نمودار ماهانه منطقه ATL: چه اتفاقی در حال رخ دادن است؟

POPCAT is decreasing the ATL area in monthly chart.

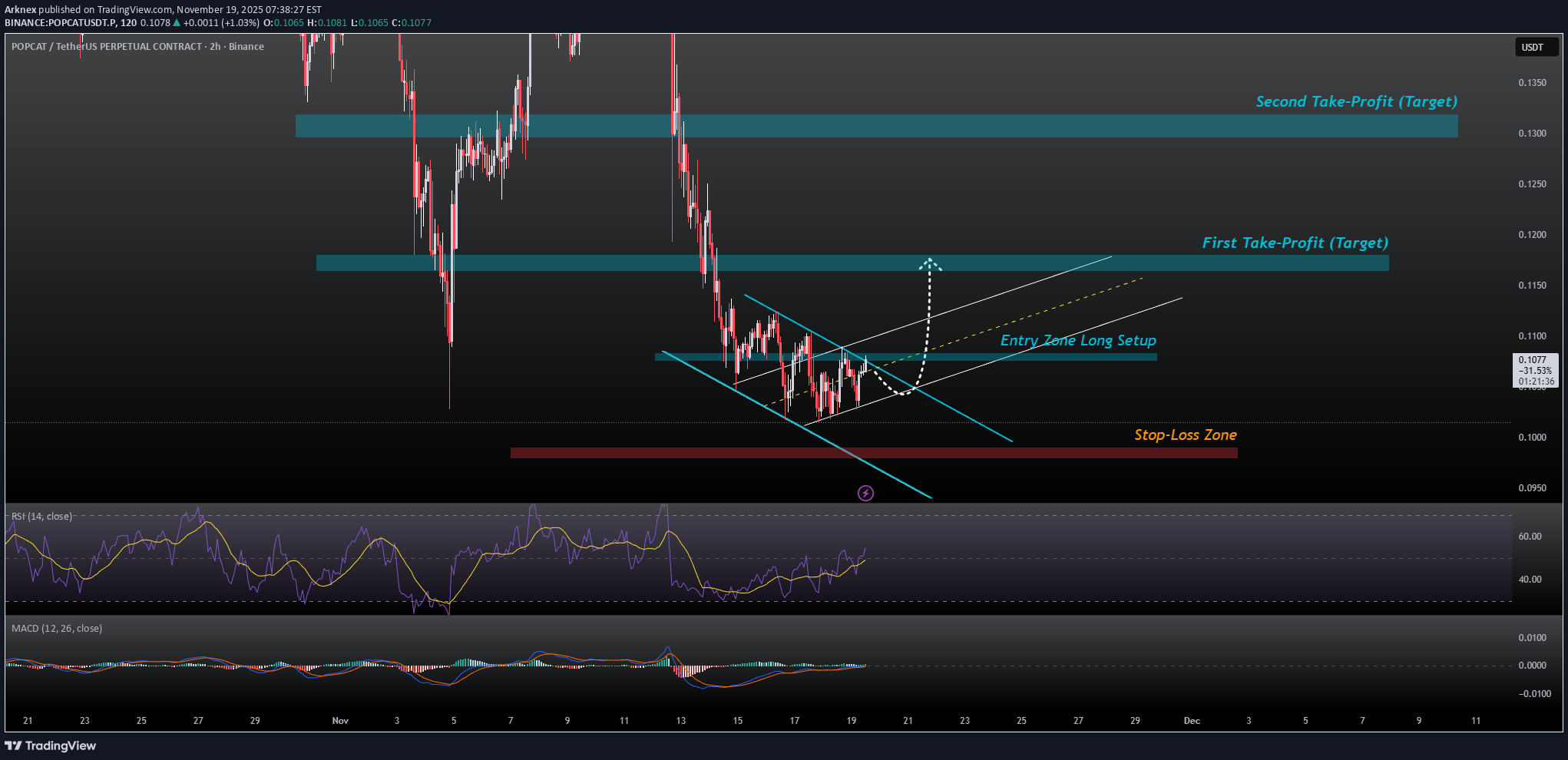

تحلیل فنی POPCAT/USDT: آیا وقت ورود به پامپ جدید فرا رسیده است؟ (سطوح دقیق خرید و فروش)

Current Market View Price appears to be attempting a breakout of the channel into a new upward trend channel (marked in white/grey). On the hourly chart, momentum oscillators (RSI, MACD) show early signs of shift: RSI is climbing from oversold/neutral area; MACD lines are converging. The 4-hour and daily charts suggest the downtrend is still in place, but the breakout attempt may signal a reversal if sustained. Proposed Entry & Exit Levels Entry Zone (Buy Setup) Entry: around $0.102 – $0.106 USDT if the price successfully breaks above the upper boundary of the descending channel and closes above it. Stop-Loss (Risk Control) Stop-loss below the recent swing low and the lower channel boundary: around $0.095 – $0.098 USDT. Take-Profit Targets TP1: $0.115 – $0.118 USDT (initial target upon channel breakout) TP2: $0.125 – $0.130 USDT (next psychological level if momentum carries) TP3 (extended): $0.140 USDT or more – only if the broader trend turns bullish and volume supports.

آماده پرش گربه محبوب! (POPCAT) آیا قیمت در راه جهش بزرگ است؟

Is the cat preparing to jump? Divergences have started forming right on a strong support level — a clear hint that the asset may be getting ready for a reversal. Based on the bid/ask ratio, the coin is currently among the top ones: demand is dominating, and market sentiment is positive. Right now it looks like the market sees further upside as a realistic scenario. Watching closely. If it “jumps,” the move could be strong.

ترید دقیق و سودآور POPCAT: راز معاملات موفق در ارز دیجیتال

Working the 4H on Binance, this coin behaved textbook. On November 3, after a thorough read of liquidity levels and supply zones, I took a short from 0.1373 with entry on the next candle as per plan. Mapped four take-profit levels, laddered the deposit, kept risk under control. All four targets were hit within the day, totaling about 6.5 percent with 4x leverage. On November 7, I got confirmation of a reversal scenario and went long from 0.1303, again with entry on the next candle. Same rules, same levels, same stop-losses. All four targets closed sequentially, netting around 6 percent thanks to a well-structured TP ladder. The chart printed by the book: impulse, partial scaling out, pullback into the control zone, and continuation in my direction. After this quality of execution, the coin is on my shortlist for further trades. On November 13, I worked another trade starting at 0.1324. TPs were set up to TP3, kept greed in check, stops tight. The market extended and the position ultimately closed through TP4. I preemptively de-risked and stayed within risk management. POPCATUSDT.P on the 4H gives a readable rhythm if you respect levels and don’t trade on emotion.

سیگنال کوتاهِ شگفتانگیز پاپ کت: فرصت جدید برای سود سریع!

After a quick short signal earlier. we have another according to our strategy. Targets on chat DyOrSL Hit. We will catch it again.

پاپکت (Popcat) اصلاح شد: آخرین تغییرات مهم نمودارها را اینجا ببینید!

Popcat has moved a quite a bit and there's small correction. Targets on the charts DyORTrade reached SL after 40% profit

افزایش چشمگیر قیمت پاپکت: الگوی سر و شانه چه میگوید؟

It seems the price is forming a head and shoulders pattern, which, if correct, suggests a good price increase in the coming days. However, we should wait for the pattern to fully complete. Best regards CobraVanguard.💚

راز رشد پوپکت (POPCAT): آینده این ترند عجیب به کجا میرسد؟

It"s interesting for future growth. The trend is cleat. We"ll see where it goes.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.