Silvio_TraderskyZahvat

@t_Silvio_TraderskyZahvat

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Silvio_TraderskyZahvat

rvn ready to tern ?

A divergence is forming, along with a harmonic reversal pattern (Crab) below the trendline. A potential entry can be considered on a trendline breakout as price continues to move lower. A safer approach is to wait for a retest after the breakout.

Silvio_TraderskyZahvat

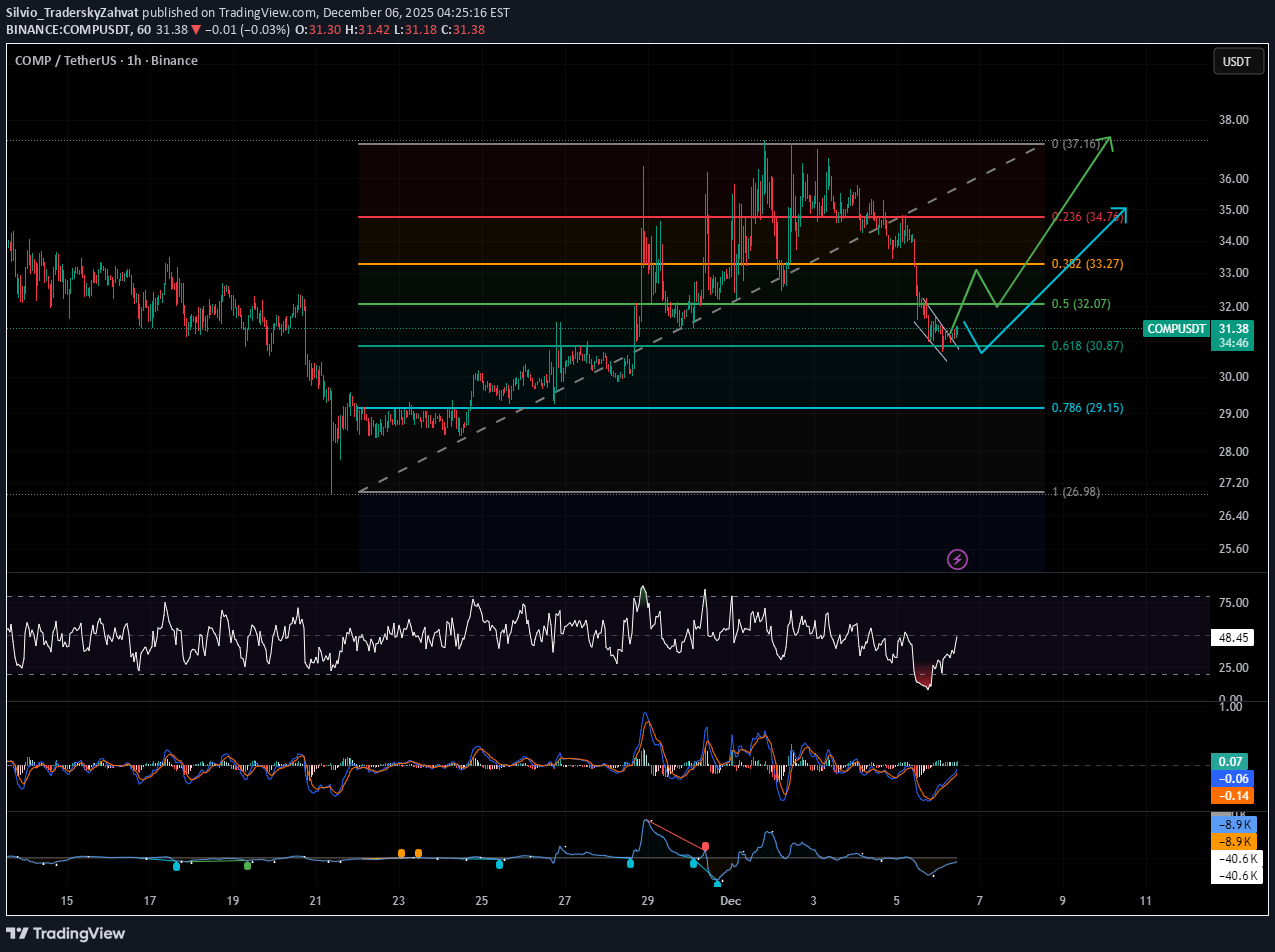

آیا کامپ (COMP) آماده جهش بزرگ است؟ استراتژی ورود مطمئن برای سرمایهگذاران

COMP is developing bullish divergences on the 1H TF. However, a safer approach is to wait for a confirmed breakout and close above the 0.5 Fib zone, followed by an entry with a properly placed stop

Silvio_TraderskyZahvat

الگوی گُوِهای بیت کوین کش (BCH): پیشبینی صعود یا سقوط؟

BCH is showing strong bid-side absorption according to Hyblock data. I’m currently watching a few potential scenarios: The more probable path is marked with the green arrow The less probable path is marked with the red arrow RSI has likely bottomed out just as the price started to form a pattern. A move toward the trendline is possible, which aligns with the 0.618 retracement of the local impulse and could continue the wedge formation.

Silvio_TraderskyZahvat

آیا ریزش بیت کوین (BNB) ادامه دارد؟ تحلیل فنی حرکت نزولی

The RSI divergence, even after several failed breaks, eventually played out nicely, and we got a solid move down from the peak levels. I’m starting to gradually close my short position (in profit). Since the trade has been open for quite a while, the accumulated funding is a nice bonus as well. As price approaches the lower trendline, I’ll close 50% of the position and move my stop to breakeven (entry price). A small bounce from here is possible. The trendline on the weekly chart aligns with a strong Fibonacci level (0.618) on the 4H timeframe, so if we consolidate below this level, the move down can easily continue.

Silvio_TraderskyZahvat

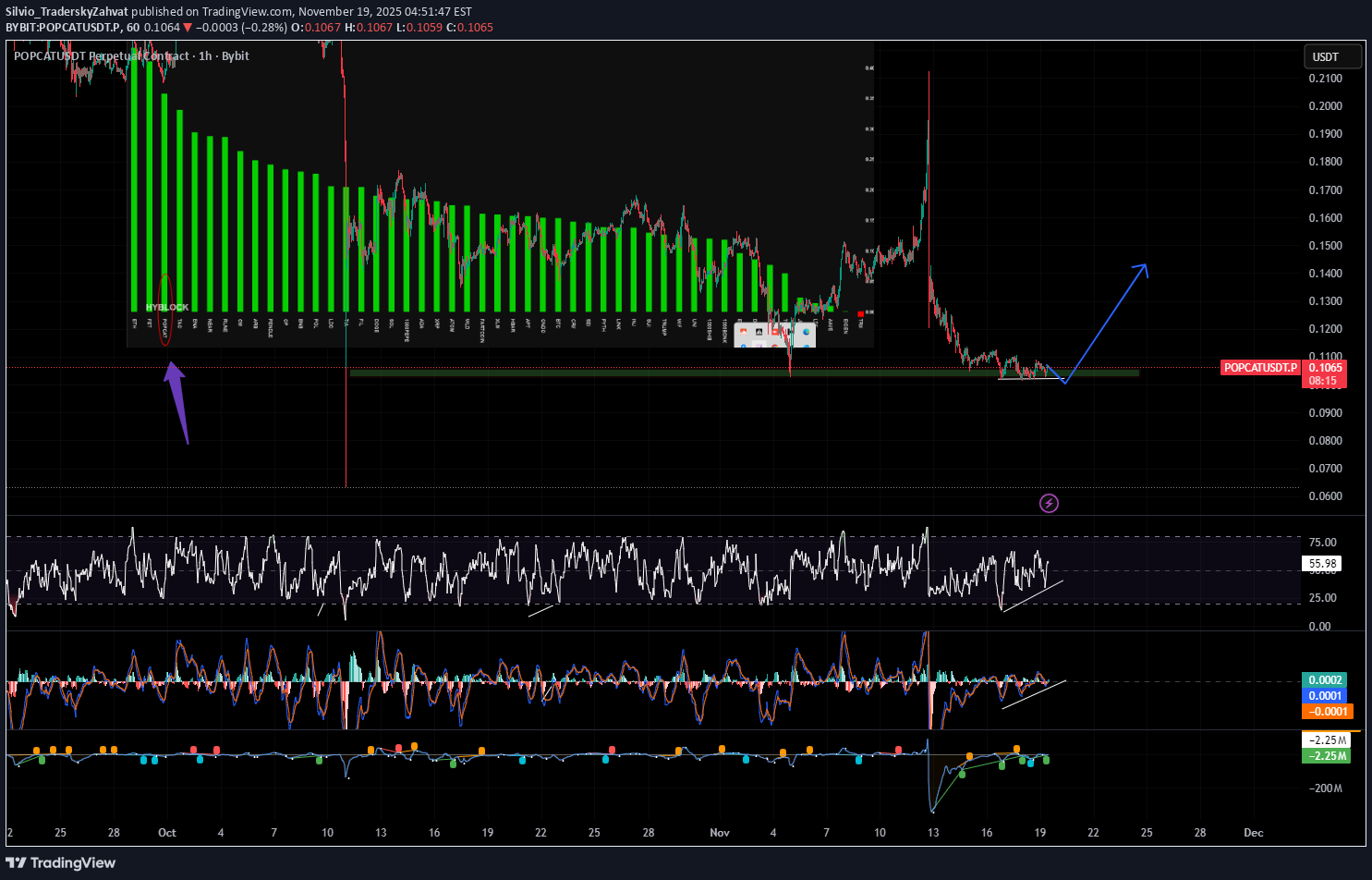

آماده پرش گربه محبوب! (POPCAT) آیا قیمت در راه جهش بزرگ است؟

Is the cat preparing to jump? Divergences have started forming right on a strong support level — a clear hint that the asset may be getting ready for a reversal. Based on the bid/ask ratio, the coin is currently among the top ones: demand is dominating, and market sentiment is positive. Right now it looks like the market sees further upside as a realistic scenario. Watching closely. If it “jumps,” the move could be strong.

Silvio_TraderskyZahvat

تحلیل بلندمدت ارز دیجیتال الگوراند (ALGO): منتظر کدام سیگنال برای ورود بمانیم؟

Algo — Long-Term Outlook At the moment, I see several possible long-term scenarios for ALGO. On the TradingView chart, I’ve highlighted the key potential bounce zones in green. I also don’t rule out the possibility that the liquidity marked on Hyblock may simply get taken out first, which could push the price lower before any meaningful reversal. Because of that, avoid placing limit orders too early. The safer approach is to wait for: the weekly candle close, or a confirmed breakout and clean retest above the triangle’s trendline.

Silvio_TraderskyZahvat

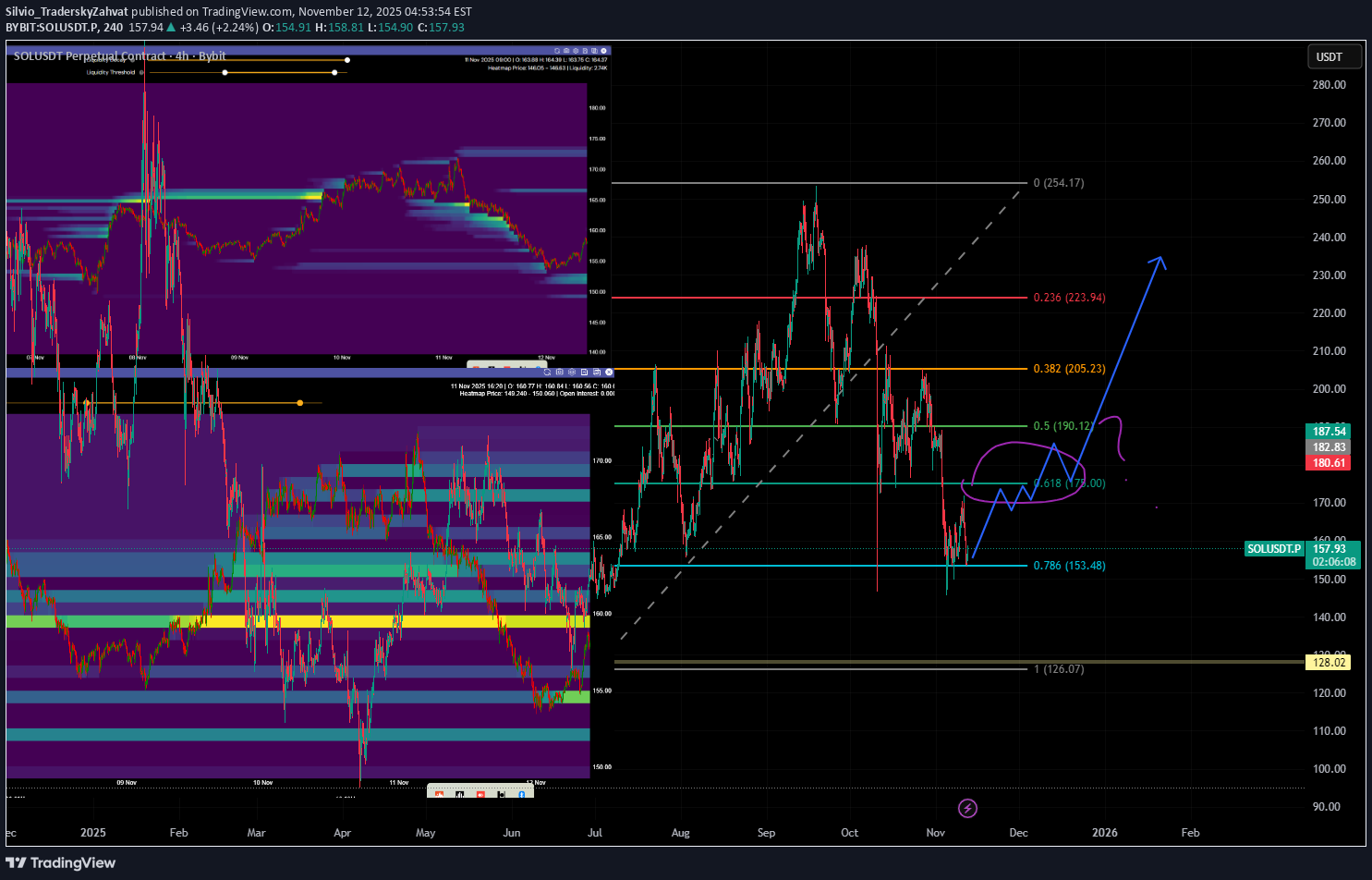

سولانا (SOL) در آستانه ریزش؟ تحلیل کلیدی فیبوناچی و سطح مقاومت حیاتی

The overall structure remains **bullish for now**. Price is approaching the **golden ratio Fibonacci level**, which aligns with **liquidity clusters** seen both on **Hyblock open interest** and **liquidation heatmaps**. This zone is expected to act as a **key resistance**, as such levels are **rarely broken on the first attempt** — often leading to a **short-term pullback or consolidation**. If the price manages to **hold above this area**, continuation of the upward move becomes likely; for now, it’s best to **observe the market reaction** around this critical zone.

Silvio_TraderskyZahvat

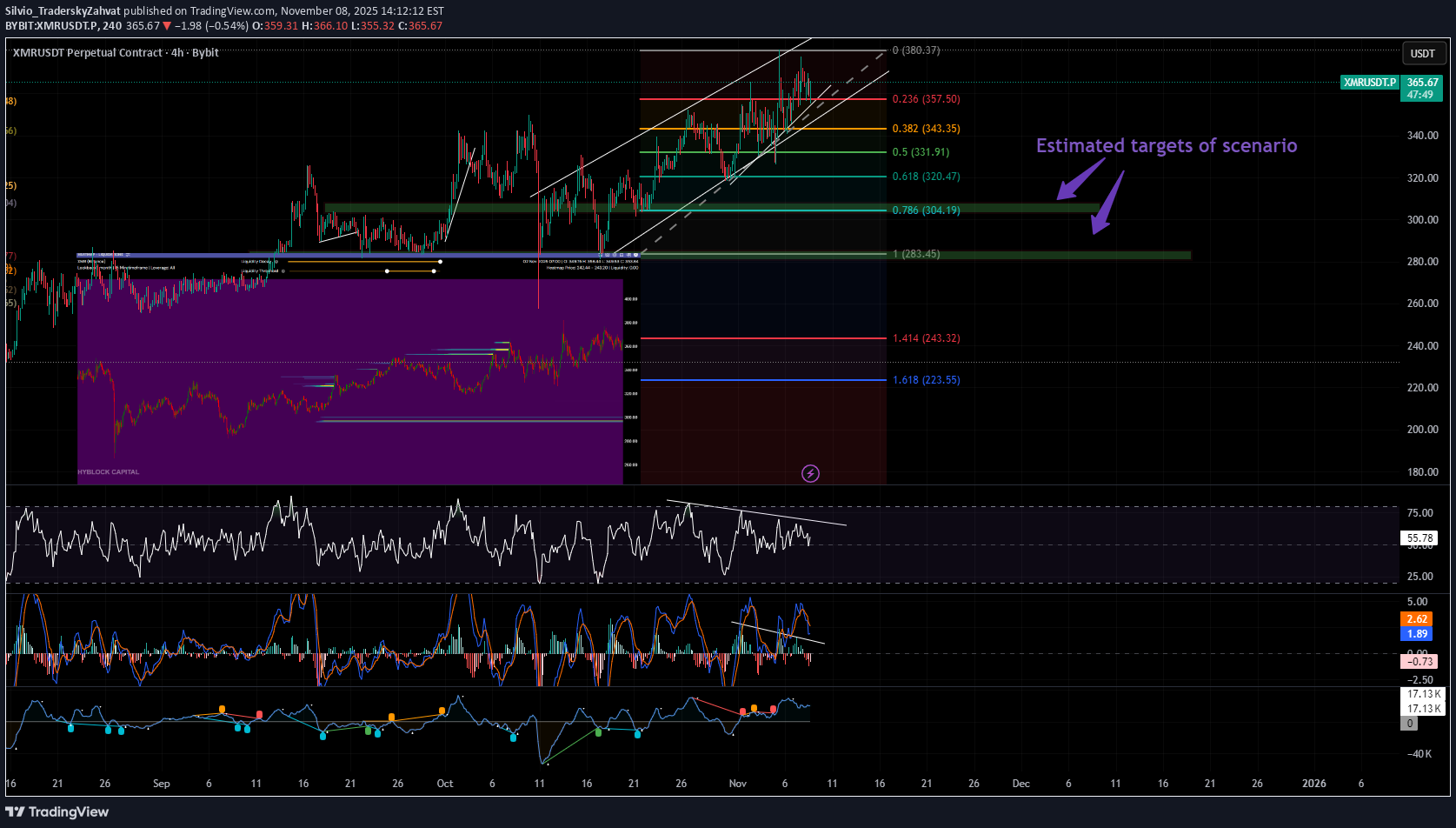

سیگنال فروش مونرو (XMR): آماده ریزش در صورت شکست سطح حیاتی!

Divergences have started to appear. A potential trade could be considered on the breakout of the current range, as long as the divergences remain valid and are not invalidated. The first targets are around the 0.7 Fibonacci level, which currently coincides with the liquidity zone on Hyblock (see a screen added to chart) And of course, if the asset continues to rise, the target levels will adjust accordingly.

Silvio_TraderskyZahvat

اتریوم پس از ریزش: مسیر رشد بعدی و سطوح حیاتی که باید زیر نظر بگیریم

After October 11th dump, the marked zone acted as a strong support area, from which the market bounced several times. Now this zone has turned into a resistance level. For further growth, we need: 1) A breakout of this zone. 2)A confirmation and consolidation above it on higher timeframes. It’s also important to keep an eye on Bitcoin dominance and the TOTAL2 chart, as they can provide additional signals about the possible direction of the altcoin market.

Silvio_TraderskyZahvat

تحلیل کوتاه و جنجالی: بیت کوین به کجا میرود؟ (فراتر از ۲۰ کی!)

V2 -More likely in my opinion Global trend looks more likely to break soon — multiple divergences are stacking up. Honestly, I don’t really buy into the “BTC to 200K” fairytale like most dreamers out there. At least not in this cycle 😉

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.