BGB

Bitget Token

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Bitget Token

سود 3 Months :

سیگنالهای Bitget Token

Filter

Sort messages by

Trader Type

Time Frame

icon_traders

فلامای صعودی بیت کوین: هدف جدید قیمت پس از شکست مثلث!

After the previous triangular formation, the flash breakage has now come with a higher target. If the pricing in Bitco continues positively, it can be followed towards the target.

WaveRiders2

HalukTATAR

تحلیل فنی BGB: مسیر صعودی یا سقوط سنگین؟ (پیشبینی حرکت بزرگ)

This triangle is two-way. If it goes above 5.28, it will give 5%. Below 5.05, an 8% short position is attempted.As always :) I was rightAs always :) I was right. And its rising

Flow-Trade

NEIRO

NEIRO idea. TP1 will likely be a full take-profit, but whether we hold depends on the general market and if we see a wave 4 correction for potential re-entries.

Aviator315

BGB/USDT Potential 100% ++

BGB/USDT Potential 100% ++ Accumulate under $3.9 - $5.0 Targets Points Mid term targets TP 1 : $8 TP 2 : $10 TP 3 : $15 TP 4 : $20 TP 5 : $25 Long term targets TP 1 : $45 TP 2 : $60 TP 3 : $70 *Comparison between Bitget Token (BGB) burning and Binance Coin (BNB) burning: Bitget’s BGB burns are explicitly tied to real on-chain gas usage and a percentage of platform profits, with a clear roadmap to burn down to 100 million and full transparency. Binance’s BNB burns combine an ongoing auto-burn formula and real-time burning from gas fees to gradually reduce supply in a more passive, protocol-level manner. Both approaches aim to induce scarcity and potentially support token value, but Bitget emphasizes utility-aligned burns and rapid supply reduction, whereas Binance focuses on steady, formula-driven deflation aligned with chain activity.In our Accumulation range

tomas_jntx

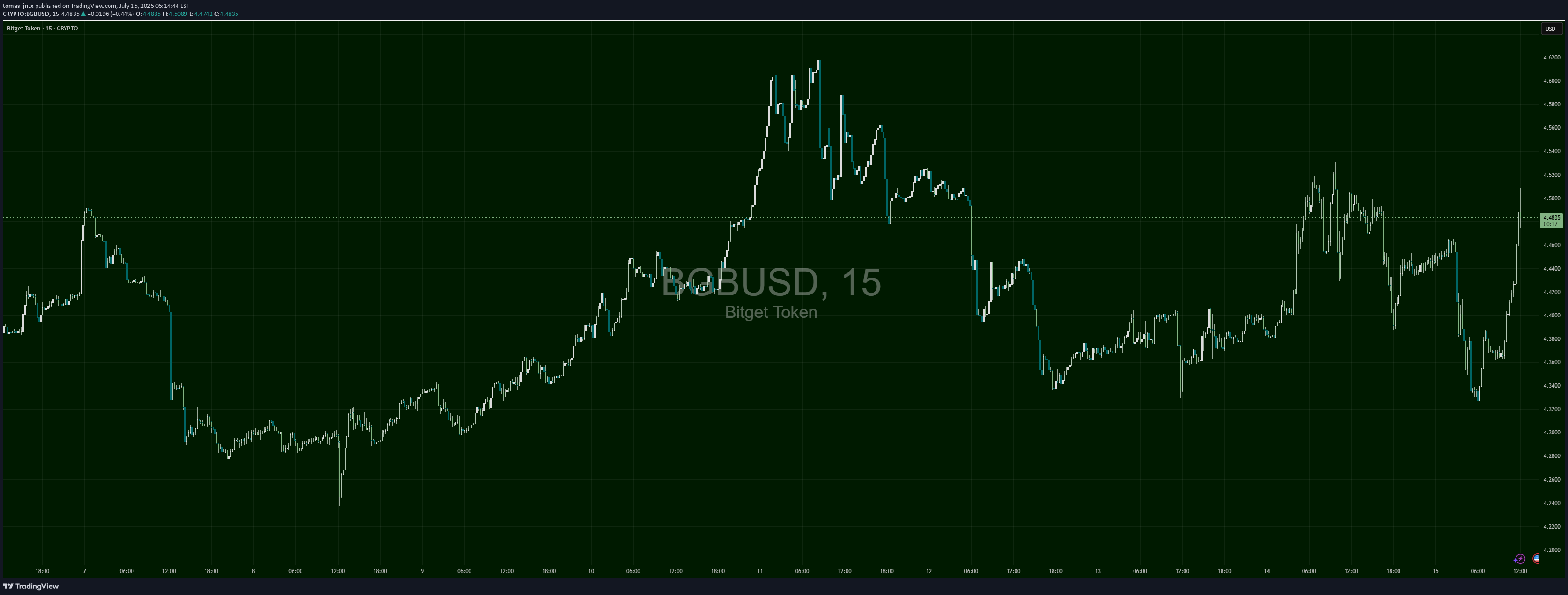

BGB/USD – Testing Resistance

🟢 LONG above $4.6571 – target $4.72+ Bitget Token trades at $4.64, holding above the 200 SMA ($4.63). Resistance sits at $4.6571. RSI at 56 shows moderate bullish pressure. A breakout over $4.6571 could extend toward $4.72–$4.75.

CryptoNuclear

BGB/USDT — Symmetrical Triangle: Breakout or Fakeout?

Overview BGB/USDT is consolidating within a symmetrical triangle pattern (descending resistance + slightly ascending support) as volatility narrows toward the apex. The price is currently around 4.58, after a rejection near the upper trendline — possibly a liquidity grab. This setup usually precedes a strong move once a valid breakout or breakdown occurs. --- Pattern Explanation Type: Symmetrical / contracting triangle Key characteristics: Shrinking volatility, lower highs + higher lows, volume gradually decreasing. Context: The structure formed after a strong correction from highs, which often implies a continuation bias unless a clear bullish breakout emerges. --- Key Levels Current price: 4.58 Near-term resistance: 5.03 → 5.60 → 5.99 Major resistance zones: 7.62 → 8.11 → 8.50 (ATH zone) Support: Triangle base (dynamic support around 4.0–4.4), then 3.60 and 3.00 if breakdown continues. --- Bullish Scenario (confirmation required) Confirmation: Daily close above the upper trendline with strong volume and successful retest. Entry idea: Conservative entry above 5.03 with retest confirmation. Targets: TP1: 5.60 TP2: 5.99 Aggressive: 7.62 → 8.11 → 8.50 Measured move projection: (8.50 − 3.60 = 4.90). Breakout from ~5.03 could project up to 9.93 (theoretical target). Invalidation: Failure to hold above 5.03 or a rejection back inside the triangle. Stop-loss: Below retest breakout (~4.40) or below triangle support. --- Bearish Scenario (confirmation required) Confirmation: Daily close below triangle support with above-average volume. Entry idea: Short entry after breakdown + failed retest. Targets: TP1: 4.00 TP2: 3.60 TP3: 3.00 (if strong continuation). Invalidation: Daily close above the upper trendline or reclaim above 5.03. Stop-loss: Above failed breakout level or triangle resistance. --- Things to Watch Volume: Breakouts without volume are often fakeouts. Retest: Strong confirmation if old resistance turns into new support (bullish) or old support flips into resistance (bearish). Daily candle close: Wick alone is not reliable; wait for candle close. Market correlation: BTC and ETH trends may influence BGB’s breakout direction. --- Risk Management Notes Limit risk per trade (1–2% capital). Use scaling entries if breakout is sharp. Always set stop-loss and take-profit in advance. Be cautious of false breakouts — triangles often fake one side before moving in the opposite direction. --- Conclusion: BGB/USDT is consolidating in a symmetrical triangle, signaling a potential big move ahead. For bulls, watch for a close above 5.03 with volume. For bears, confirmation comes with a close below triangle support. Until then, the setup remains neutral. > Disclaimer: This is not financial advice. Do your own research and manage risk accordingly. #BGBUSDT #CryptoAnalysis #TechnicalAnalysis #SymmetricalTriangle #Breakout #SupportResistance #SwingTrade

WaveRiders2

BGB Breakout Watch – Testing Red Resistance!

coin_mastermind

BGB – Triangle Compression Across Multiple Timeframes

📆 On the Weekly and 3D timeframes, BGB is sitting right at the edge of a major triangle support zone — compression is getting tight 🛡️. 📆 Zooming into the Daily timeframe, we can spot a smaller symmetrical triangle building inside the larger structure — a textbook double compression setup 📐. This kind of formation often precedes explosive moves. A breakout could spark a strong bullish wave, while a breakdown may invite heavy selling. 👀 High-stakes zone — keep your eyes on the breakout direction! Not financial advice. BGBUSDT

tomas_jntx

BOBUSD – From Collapse to Comeback

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.