AMZNX

آمازون

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

KhanhC.Hoangرتبه: 12 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 8 ساعت پیش | |

lubosiرتبه: 361 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 17 ساعت پیش | |

RB_Tرتبه: 584 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | ۱۴۰۴/۹/۲۷ | |

isahebdadiرتبه: 1036 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | ۱۴۰۴/۹/۲۱ | |

NOBSForexرتبه: 3811 | فروش | حد سود: تعیین نشده حد ضرر: تعیین نشده | ۱۴۰۴/۹/۲۶ |

نمودار قیمت آمازون

سود ۳ ماهه :

سیگنالهای آمازون

فیلتر

مرتب سازی پیام براساس

نوع پیام

نوع تریدر

فیلتر زمان

KhanhC.Hoang

آمازون و نبرد تراشه: سرمایهگذاری ۱۰ میلیارد دلاری در OpenAI و آینده هوش مصنوعی!

جهش واقعی است، اما عرضه سربار همچنان برنده است. آمازون رهبری برتر AI را تغییر داد. اندی جاسی، مدیرعامل، این را به عنوان یک "نقطه عطف" تعریف کرد و پیتر دیسانتیس را به سمت رهبری یک سازمان جدید شامل مدلهای frontier AI (Nova/"AGI")، سیلیکون سفارشی (Graviton/Trainium/Nitro) و کوانتوم سوق داد و تغییرات رهبری AI دیگری را به دنبال داشت. آمازون در حال مذاکره برای سرمایه گذاری بیش از 10 میلیارد دلار در OpenAI است. به عنوان راهی برای قفل کردن تقاضای محاسباتی عظیم در AWS و فشار بر پذیرش Trainium. تا زمانی که آمازون/OpenAI چیزی را ارسال نکنند یا بیانیهای صادر نکنند، این را بهعنوان گزارششده در نظر بگیرید / تأیید نشده است. خطر اصلی جدید AWS از دست دادن «ابر» نیست - بلکه از دست دادن «بار کاری هوش مصنوعی» است. آمازون در تلاش است تا win AI را در یکپارچه سازی عمودی: Nova + Bedrock + Trainium/Graviton + بسته بندی "AI Factory". اگر پذیرش Trainium فراتر از شرکای داخلی + چند لنگر گسترش نیابد، این استراتژی متوقف میشود.

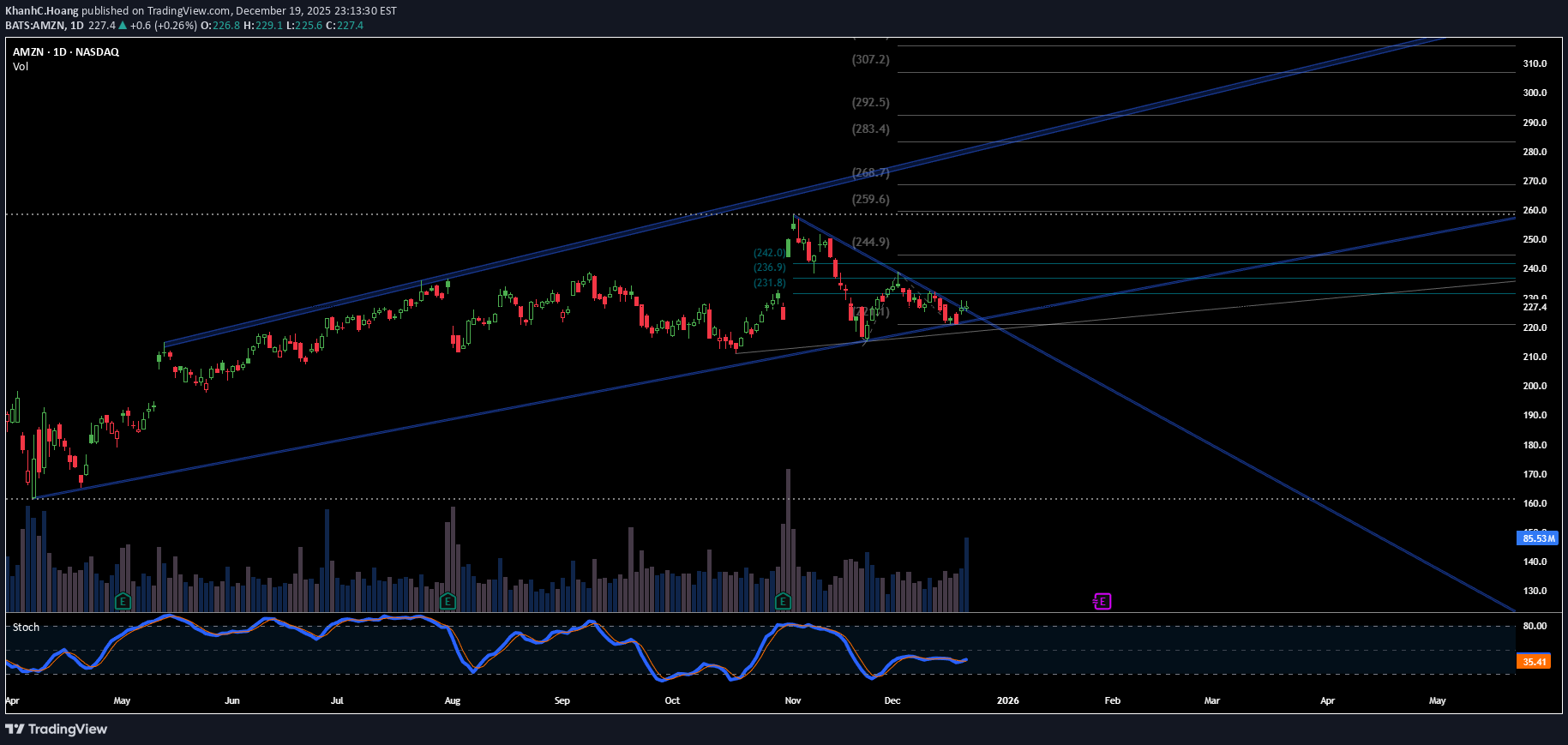

پیشبینی صعودی قیمت: آیا کانال صعودی حفظ میشود و هدف بعدی کجاست؟

قیمت با توجه به حمایت و مقاومت مورب در یک کانال صعودی مشخص باقی میماند. ساختار الیوت یک دنباله صعودی را پیشنهاد میکند که موج 3 تکمیل شده و قیمت در حال حاضر در حال توسعه موج 4 در کانال است. از منظر فیبوناچی، آخرین عقب نشینی منطقه اصلاحی 38.2٪ - 50٪ (~205-215) را حفظ کرد، که قدرت روند را تأیید کرد. تا زمانی که قیمت بالاتر از این ناحیه باقی بماند، ساختار صعودی اولیه دست نخورده باقی می ماند. سطوح کلیدی •پشتیبانی / منطقه ورودی: 215–210 (فیب + پشتیبانی مورب) •پشتیبانی ثانویه: 200 (ساختار صعودی زیر را باطل می کند) •مقاومت / خروجی جزئی: 235–240 •هدف کانال بالایی: 255–265 استراتژی • خرید pullback در نزدیکی ساپورت مورب (210–215) •نزدیک 235–240 تا حدی کوتاه یا خارج شوید • ادامه روند با حفظ بالای 200 مورد انتظار است ساختار کلی صعودی باقی میماند و در صورت تداوم حمایت، اهداف بالاتر به سمت کانال بالایی وجود دارد.

lubosi

Buy This Stock Using "The 13 EMA System"

من نمی خودخواه باشم زیرا می همانطور که فکر می کنم با شما در میان بگذارم یا یافتن معاملات خوب پس شما به این نمودار نگاه کنید دید که قیمت بالاتر از 13 EMA یا بدترین حالت این بود شمع باید حداقل لمس کننده باشد میانگین متحرک سپس شما به پایین نگاه می کنید استوکاستیک را ببینید k% از بالا عبور کرده است %d این سیگنال معکوس شماست همچنین توجه کنید که دو خط زیر هر دو در همان کانال RSI این بسیار مهم است همچنین به یاد داشته باشید سپس در نهایت حتی هر چند قادر به نشان دادن آن نیستم قیمت زیر است یک خط روند صعودی به این می گویند اقدام قیمت شما باید در مورد آن بیشتر بدانید نحوه رسم خطوط روند موشک این محتوا را تقویت کند بیشتر بیاموزید سلب مسئولیت: تجارت مخاطره آمیز است لطفا از شبیه سازی استفاده کنید حساب معاملاتی قبل از شما تجارت با پول واقعی

AlfonsoMoreno

Amazon stock weekly demand is still in control

تقاضای هفتگی سهام آمازون در 221 دلار هنوز تحت کنترل است و تلاش می کند مطابق انتظار عمل کند. هر موقعیت طولانی باید مدیریت شود. بیایید ببینیم آیا در روزهای بعد پاهای صعودی جدیدی چاپ می شود یا خیر.

RB_T

Amazon - The Hidden OpenAI Play Before IPO, $210-220 Support

Amazon - The Hidden OpenAI Play Before IPO, $210-220 Support Entry Amazon: Positioning as OpenAI's Infrastructure Partner Before the IPO Window While the market focuses on Microsoft as OpenAI's primary partner, Amazon is quietly positioning itself as the diversification play that could unlock billions in recurring AI infrastructure revenue. With a minimum $10 billion commitment to OpenAI and strategic discussions around custom AI chip deployment, Amazon offers exposure to the OpenAI growth story at a structural support level that provides defined entry risk. 🎯 The Strategic Play: Amazon's $10 Billion OpenAI Commitment: Amazon has committed at least $10 billion to OpenAI, but this isn't just a financial investment - it's a strategic infrastructure partnership. The deal positions Amazon Web Services (AWS) as OpenAI's diversification partner away from Microsoft Azure dominance. Why This Matters: Reduces single-vendor risk for OpenAI's massive compute needs Opens AWS as a hosting platform for OpenAI workloads Custom chip integration potentially using Amazon's Trainium/Inferentia Equity stake gives Amazon ownership upside if/when OpenAI goes public Alexa integration potential for next-generation AI assistant capabilities Current Market Context: AMZN Price: $200-240 range Market Cap: ~$2.4 trillion Technical Setup: Testing major support zone Catalyst Timeline: OpenAI infrastructure decisions and potential IPO window 📊 Why $210-220 is the Entry Zone: Technical Support Confluence: The $210-220 area represents a critical accumulation zone where multiple technical factors converge: Previous consolidation support from earlier 2024 trading Volume profile node showing institutional buying activity Psychological level near $200 round number Pullback into demand after extended rally earlier in year Risk/Reward at Support: Entry: $210-220 zone Stop: Below $200 (psychological and structural support) Target 1: $280 (previous resistance, 30% upside) Target 2: $320 (extension target, 50% upside) Risk/Reward: 5:1 to 8:1 depending on exact entry Why Now: Market has pulled back from highs, creating entry opportunity before OpenAI infrastructure announcements and potential IPO catalysts materialize in 2025. 💡 The OpenAI Infrastructure Angle: Microsoft's Monopoly Problem: OpenAI currently relies heavily on Microsoft Azure for compute infrastructure. This single-vendor dependency creates: Risk concentration if Azure faces issues Pricing leverage for Microsoft Capacity constraints during demand spikes Strategic limitation in vendor negotiations Amazon as Plan B (and Eventually Plan A?): If OpenAI shifts even 20% of compute workloads to AWS, that translates to: Billions in recurring AWS revenue (high-margin cloud business) Multi-year contracts providing revenue visibility Upselling opportunities for other AWS services Competitive positioning against Microsoft in AI infrastructure The Math: OpenAI's compute costs are estimated in the billions annually and growing exponentially. A 20% shift to AWS could represent: $2-4 billion annual revenue for Amazon (conservative estimate) 70%+ margins on cloud infrastructure Recurring nature creates compounding value 🔧 Amazon's Custom AI Chip Advantage: Trainium and Inferentia: Amazon has developed custom AI chips specifically for training and inference workloads: Cost Advantage: 40% cheaper than Nvidia H100 GPUs (industry standard) Better price/performance for specific workloads No Nvidia supply constraints (Amazon controls production) Strategic Importance: Reduces CAPEX for OpenAI's massive compute needs Faster deployment without Nvidia waitlists Customization potential for OpenAI-specific workloads OpenAI Exploring Amazon's Chips: Reports indicate OpenAI is actively evaluating Amazon's AI chips. If adopted: Validates Amazon's chip strategy Creates dependency on AWS ecosystem Locks in multi-year infrastructure relationship 🤖 Alexa Integration Wildcard: The Opportunity: Amazon's Alexa has struggled to compete with newer AI assistants. OpenAI integration could transform Alexa into: ChatGPT-powered voice assistant with superior conversational AI Multi-modal capabilities (voice, vision, reasoning) Competitive parity with Google Assistant and Siri Monetization vehicle for premium AI features Why It Matters: Alexa is in 500+ million devices globally Integration would be immediate distribution for OpenAI Creates consumer-facing AI revenue stream for Amazon Differentiates Echo devices in smart home market 💰 The Equity Upside: Amazon Gets OpenAI Equity: As part of the $10 billion investment, Amazon receives equity in OpenAI. If OpenAI goes public (rumored $100B+ valuation): Scenario Analysis: Conservative: Amazon owns 2-3% of OpenAI at $100B valuation = $2-3B equity value Moderate: Amazon owns 5% at $150B valuation = $7.5B equity value Aggressive: Amazon owns 8% at $200B valuation = $16B equity value Double Upside: Infrastructure revenue: Billions annually from AWS hosting Equity appreciation: Ownership stake in OpenAI's growth This is rare - Amazon gets paid to host the workloads AND owns part of the company. 📈 Why Amazon vs. Microsoft: Microsoft Already Priced In: Market cap reflects OpenAI partnership expectations Azure revenue already includes OpenAI contribution Limited upside surprise potential Amazon is the Surprise Factor: Market underestimates AWS diversification opportunity OpenAI partnership not fully reflected in valuation Chip strategy under-appreciated by analysts Alexa integration potential ignored Risk Diversification: Rather than betting on Microsoft maintaining 100% of OpenAI infrastructure, Amazon represents the diversification trade that captures: 20-30% of OpenAI compute (realistic scenario) Equity upside if OpenAI IPOs Alexa transformation potential Broader AI chip validation 📊 Fundamental Context: Amazon's Core Business: AWS: ~$90B annual revenue, 30%+ margins (crown jewel) E-commerce: Dominant market position, improving margins Advertising: $45B+ business growing 20%+ annually Free cash flow: $50B+ annually Why Support Holds: At $210-220, Amazon trades at reasonable valuations considering: AWS growth acceleration from AI workloads Margin expansion as efficiency initiatives mature Advertising becoming major profit center OpenAI partnership optionality (free upside) Institutional Behavior: Major funds accumulate mega-cap tech at support levels $200-220 zone represents algorithmic buy programs Long-term investors view pullbacks as entry opportunities 🎯 Trade Structure: Entry Strategy: Aggressive: $220 area (current technical support) Conservative: $210 (psychological support, higher conviction) Scale in: Buy 50% at $220, 50% at $210 if it gets there Risk Management: Stop loss: Below $200 (invalidates support thesis) Position size: Appropriate for 5-10% portfolio allocation (mega-cap) Timeframe: 6-12 months for full thesis to develop Target Zones: TP1: $260 (20% gain, previous resistance) TP2: $280 (30% gain, reduce another third) TP3: $320+ (50% gain, major resistance zone) Catalyst Timeline: Q1 2025: Potential OpenAI infrastructure announcements Q2 2025: AWS earnings showing AI revenue growth H2 2025: OpenAI IPO window potentially opens Throughout: Alexa integration rumors/announcements 🧠 Why Most Will Miss This: Microsoft Tunnel Vision: Everyone watches MSFT as "the OpenAI stock" - Amazon's positioning is overlooked despite potentially better risk/reward. Mega-Cap Bias: At $2.4T market cap, traders assume Amazon "can't move much." But 30-50% gains on a $20-30 billion investment theme is massive absolute dollars. Infrastructure Complexity: Most investors don't understand cloud infrastructure economics. They miss that AWS hosting OpenAI is higher-margin than most of Amazon's businesses. Timing Fear: Buying at $220 after the stock has pulled back from $250+ feels uncomfortable. But that's precisely when technical support + fundamental catalysts create opportunity. 📅 Catalyst Timeline and Expectations: Near-Term (Q1 2025): OpenAI infrastructure announcements AWS re:Invent conference AI reveals Potential Amazon chip deployment news Mid-Term (Q2-Q3 2025): AWS earnings calls highlighting AI workload growth Alexa AI integration announcements OpenAI compute diversification details Long-Term (H2 2025+): OpenAI IPO window potentially opening Amazon equity stake value becomes visible Multi-year AWS infrastructure contracts disclosed ⚠️ Risk Factors: What Could Go Wrong: OpenAI Stays With Microsoft: If OpenAI decides not to diversify infrastructure significantly, Amazon loses the thesis catalyst. However, the $10B investment still provides equity exposure. Chip Strategy Fails: If OpenAI doesn't adopt Amazon's custom AI chips, the cost advantage and ecosystem lock-in don't materialize. Market-Wide Correction: Mega-cap tech could face broad selling pressure regardless of individual catalysts. The $200 support could break in a risk-off environment. OpenAI Stumbles: If OpenAI faces competitive pressure from other AI companies or regulatory issues, the infrastructure opportunity diminishes. Valuation Compression: At $2.4T market cap, Amazon needs significant catalysts to drive meaningful appreciation. If AI growth disappoints, multiple compression could occur. 🏆 The Professional Approach: They See The Setup: Technical support at $210-220 Fundamental catalyst (OpenAI partnership) Asymmetric risk/reward (5:1+) Multiple paths to upside (AWS, equity, Alexa) They Size Appropriately: Mega-cap reduces position risk Liquid market allows easy scaling 5-10% portfolio allocation reasonable They Think Long-Term: 6-12 month catalyst timeline Not a day trade or swing trade Allows thesis time to develop They Scale Out: Take profits at $260, $280, $320 Don't try to pick the perfect exit Lock gains progressively as targets hit 📌 Key Investment Thesis Points: ✅ $10B+ OpenAI investment positions Amazon as infrastructure diversification partner ✅ 20% compute shift could mean $2-4B annual AWS revenue (high margin) ✅ Custom AI chips provide cost advantage and ecosystem lock-in ✅ Equity stake in OpenAI provides IPO upside (potentially worth billions) ✅ Alexa integration could transform 500M+ device install base ✅ Technical support at $210-220 provides defined entry with tight risk ✅ 5:1+ risk/reward to structural targets with multiple catalyst paths 📊 Investment Summary: Why Amazon: Hidden OpenAI infrastructure play Better risk/reward than Microsoft Multiple upside paths (AWS, equity, Alexa) Entry at technical support Mega-cap liquidity and safety Why Now: Pullback to $210-220 support zone Before OpenAI infrastructure announcements Ahead of potential IPO window Market underpricing the opportunity Why $210-220: Technical support confluence Institutional accumulation zone Risk defined below $200 5:1+ reward/risk to targets ⚠️ Important Disclaimers: This analysis is for educational purposes and reflects a view on Amazon's strategic positioning with OpenAI. It is not financial advice or a recommendation to buy or sell AMZN or any security. The OpenAI partnership details are based on publicly available information and reports. Actual infrastructure usage, revenue impact, and equity terms may differ significantly from estimates presented. Amazon is a mega-cap stock with many business lines. The OpenAI opportunity represents only one potential growth driver among many factors affecting valuation. Stock prices can decline significantly even when fundamental theses are correct. The $210-220 support could fail, and the OpenAI catalysts may take longer to materialize than expected or may not occur at all. Technology sector investments carry specific risks including regulatory changes, competitive dynamics, and rapid innovation cycles. Position sizing must account for volatility even in large-cap names. Always conduct independent research, consider your risk tolerance and investment timeframe, and consult with financial professionals. All investing involves risk of loss. ✨ Your Take: Are you viewing Amazon as an OpenAI infrastructure play? How do you evaluate the AWS/OpenAI opportunity versus the Microsoft Azure relationship? Share your perspective in the comments. 📜 Buy structure. Diversify exposure. Think long-term.

TopChartPatterns

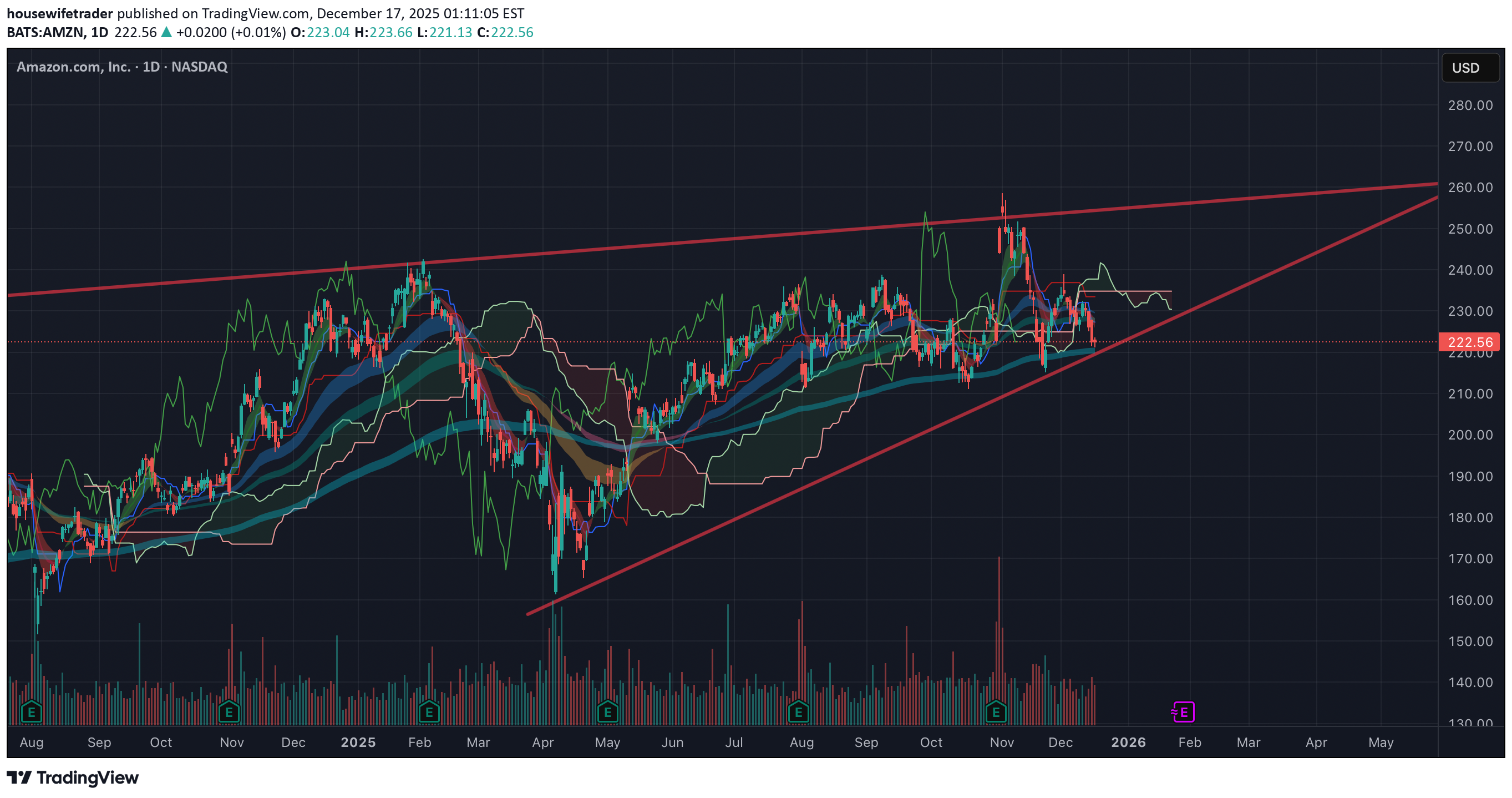

آمازون (AMZN): استراتژی خرید بلندمدت در کانال 200 دلاری با پتانسیل 300٪ سود!

AMZN بلند مدت: چشم انداز، صبر و یک کانال سلام بازرگانان امروز میخواهم شما را دعوت کنم که به آن نگاه کنید AMZN نمودار از دریچه تاریخ و احتمال. این فقط در مورد اینکه قیمت امروز کجاست نیست، بلکه درک مسیر چگونگی رسیدن به اینجاست. دو دوره در آمازون وقتی سفر آمازون را از سال 2001 تا 2020 تجزیه و تحلیل میکنیم، شاهد چیزی واقعاً دیدنی هستیم، نرخ رشد متوسط 40% . این یک era از گسترش انفجاری بود. با این حال، همانطور که می دانیم، هنگامی که یک غول به قله می رسد، صعود تغییر می کند. در طول 5 سال گذشته، این سرعت کاهش یافته است 8% . با این حال، اگر کوچکنمایی کنیم و به میانگین سالانه از سال 2001 نگاه کنیم، همچنان به دنبال یک رقم بسیار خوب هستیم. 32% . در حالی که قانون اعداد بزرگ به ما می گوید که حفظ آن سرعت اولیه برای شرکتی با این سرمایه عظیم پیچیده است، ساختار فنی مزیت مشخصی را برای ما فراهم می کند. فرصت نامتقارن ما خود را در حال تعامل با یک کانال بلندمدت مشخص و واضح می بینیم. اینجا جایی است که وضوح با فرصت ملاقات می کند. پشتیبانی در نزدیکی منطقه 200 به ما این امکان را می دهد که موقعیت استراتژیک خود را داشته باشیم. این به ما اهرمی می دهد. با ورود به این منطقه، ما به یک پتانسیل نگاه می کنیم 300% صعودی در سال های آینده اگر قیمت به بالای کانال بازگردد. برعکس، از آنجایی که پشتیبانی بسیار واضح است، میتوانیم حداکثر ریسک خود را محدود کنیم 15% آیا باید کانال قطع شود و روایت بلندمدت تغییر کند. این یک سناریوی کلاسیک از جنبه های منفی محدود با افقی از پتانسیل بزرگ است. ⚔️ استراتژی نبرد من در دراز مدت 📈 منطقه خرید: سطح 200 دلار ⛔ توقف ضرر: ریسک 15% (به وضوح زیر پشتیبانی کانال پایین تر) 🎯 هدف: بالای کانال (+300٪ بالقوه بلند مدت) _________________________________________________ 🔓 باز کردن پتانسیل کامل در حال باز کردن طاق روی خودم هستم نمودارهای بلند مدت شخصی برای چرخه 2026 از سروصدای روزانه فاصله می گیریم به به ساختار بازار نگاه کنید من می این سریال برای نمونه کار شما ارزشمند باشد. شما یک دارایی را به من بگویید و من نمودار بلندمدت و تمام بینش ها را با شما به اشتراک گذاشت. می توانید به DM های من سر بزنید یا در زیر نظر بگذارید. 🤝 معامله؟

NOBSForex

فروش زمستانی آمازون: آیا کاهش فروش تعطیلات در راه است؟

آمازون در اینجا بسیار ضعیف به نظر می رسد و من نمی دانم که آیا این نشانه ای از چگونگی فروش خرده فروشی در این فصل تعطیلات است. صرف نظر از افت اساسی نمودار من تمام چیزی را که باید بدانم به من می گوید و قیمت مناسب خرید فریاد نیست. ما کراس 8MA(226) را زیر 50MA(229) داشتیم و اکنون 100MA(226) را به چالش می کشد. همه MA در حال کاهش هستند و قیمت در تلاش است تا 200MA (219) را آزمایش کند که اگر به آنجا برسیم نقطه مهمی بود. من به دنبال پرش های کوتاه تا 227 هستم تا زمانی که قیمت بتواند آن 8MA را پس بگیرد. در حال حاضر فروش کال اسپردهای بالاتر از آن سطح یا فروش قرارهای زیر 210 گزینه های خوبی به نظر می رسند. اگر شاهد شکست/نگهداری زیر 200MA باشیم، باید شورت را برای 210، 208، 200 فشار میدهیم. AMZN

آمازون (AMZN): قبل از رالی نیویورک صعود میکند یا سقوط؟ سطوح کلیدی خرید را از دست ندهید!

من سهام بیشتری را در این سطح خریداری کرد زیرا انتظار دارم با نزدیک شدن به رالی نیویورک، این سهام افزایش یابد. اگر به 217 دلار کاهش یابد، فرصت دیگری برای بارگذاری به شما می دهد. توصیه سرمایه گذاری نیست!!! مراقب سطوح باشید!

BullBearInsights

تحلیل تکنیکال آمازون (AMZN): فشار نزولی یا انفجار بزرگ؟ (با نگاهی به دادههای GEX)

AMZN هنوز در یک فشرده سازی فشرده درون روز گیر کرده است و قیمت در اینجا به وضوح story را نشان می دهد. در نمودار 15 دقیقه ای، ساختار ضعیف باقی می ماند و اوج های پایین تر به خط روند نزولی فشار می آورند. هر تلاشی برای افزایش سرعت به سرعت فروخته شده است، که به من می گوید که خریداران در این سطوح تردید دارند که به شدت وارد عمل شوند. قیمت در زیر منطقه 223-224 که به عنوان یک منطقه تعادل کوتاه مدت عمل کرده است، ادامه می دهد. تا زمانی که AMZN در زیر این منطقه محدود میماند، روند صعودی محدود باقی میماند و رالیها بیشتر شبیه جذب نقدینگی هستند تا شکستهای واقعی. شکست در بازپس گیری و حفظ بالای آن منطقه، تعصب را از خنثی به نزولی در روز نگه می دارد. قسمت پایینی جالب تر است. منطقه 221-220 چندین بار آزمایش شده است و به عنوان پشتیبانی کوتاه مدت به act ادامه می دهد. هر جهش ضعیفتر بوده است، که اگر فروشندگان حجم را فشار دهند، خطر خرابی را افزایش میدهد. از دست دادن خالص 221 در را برای ادامه به سمت محدوده 218-215 باز می کند، جایی که تقاضای عمیق تر و نقدینگی قبلی نشسته است. اکنون با لایهبندی GEX، چشمانداز گزینهها به خوبی با آنچه قیمت انجام میشود مطابقت دارد. بالاترین گامای مثبت و مقاومت فراخوانی در بالای منطقه 230 قرار دارد، که توضیح میدهد که چرا تلاشهای صعودی قبل از هر گونه گسترش معنیدار پین میشوند. معامله گران احتمالاً به گونه ای پوشش داده می شوند که نوسانات صعودی را کاهش می دهد، مگر اینکه قیمت بتواند پذیرش بالاتر از آن سطح را مجبور کند. از جنبه نزولی، قویترین پشتیبانی PUT و مناطق گامای منفی زیر 220 نشان داده میشوند. این مهم است - اگر AMZN به آن منطقه سقوط کند، نزولی movement میتواند به سرعت تسریع شود زیرا جریانهای پوششی در برابر قیمت به جای تثبیت آن شروع به کار میکنند. این ناحیه ای است که نوسانات درون روز می تواند به جای فشرده سازی گسترش یابد. از دیدگاه یک معامله گر، این یک محیط صبر باقی می ماند. راهاندازیهای طولانی فقط در یک بازیابی تمیز معنا پیدا میکنند و با سرعت بالای ۲۲۴ نگه میدارند. تا زمانی که این اتفاق نیفتد، تجمعات به سمت مقاومت مشکوک هستند. اگر قیمت با پذیرش 221 کاهش یابد، ادامه سمت کوتاه جذابتر میشود و مناطق پایینتر PUT سنگین را هدف قرار میدهد. در حال حاضر، AMZN ترند نیست - در حال فشرده سازی است. move بعدی احتمالاً از شکسته شدن این محدوده محدود حاصل می شود، و GEX پیشنهاد می کند که وقتی حرکت کرد، ظریف بود. بایاس: خنثی → مقاومت نزولی: 223–224، سپس پشتیبانی 230 کلید: 221، سپس 218–215 سلب مسئولیت: این تحلیل فقط برای اهداف آموزشی است و به منزله مشاوره مالی نیست. همیشه تحقیقات خود را انجام دهید و ریسک را به درستی مدیریت کنید.

$Amzn Are You Finished or Are you Done?

S/O به Birdmard فقط به این دلیل که من آن عبارت wild را دوست دارم. روده بر شدن از خنده. بنابراین من ادامه داده ام AMZN برای یک هفته و من یک درسی از آن هفته گذشته wicking 1.272 اقدام کردم. بنابراین من برگشتم تا شاید آن را از پایین جایی که در حال حاضر است صدا کنم. اما این را بررسی کنید. حدس میزنم موتورم را تا آخر روشن نکرده بودم و فیبهای 1 HR خود را در 15 دقیقه خواندم و با 225 تماس آمازون تماس گرفتم فقط متوجه شدم که این فیبهای 1 ساعته TF من است نه 15 دقیقه (که هر روز معامله میکنم). بنابراین، این AMZN تصویر نمودار بر روی 1 HR TIME Frame نمودار شده است، اما تصویری که من ارسال کردم در TF 15 دقیقه است. #تماس تجارت مبارک، مجموعه هشدارها!

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.