التحليل الفني without_worries تحليل حول رمز SPYX: شراء (14/12/2025) مُقتَرَح

without_worries

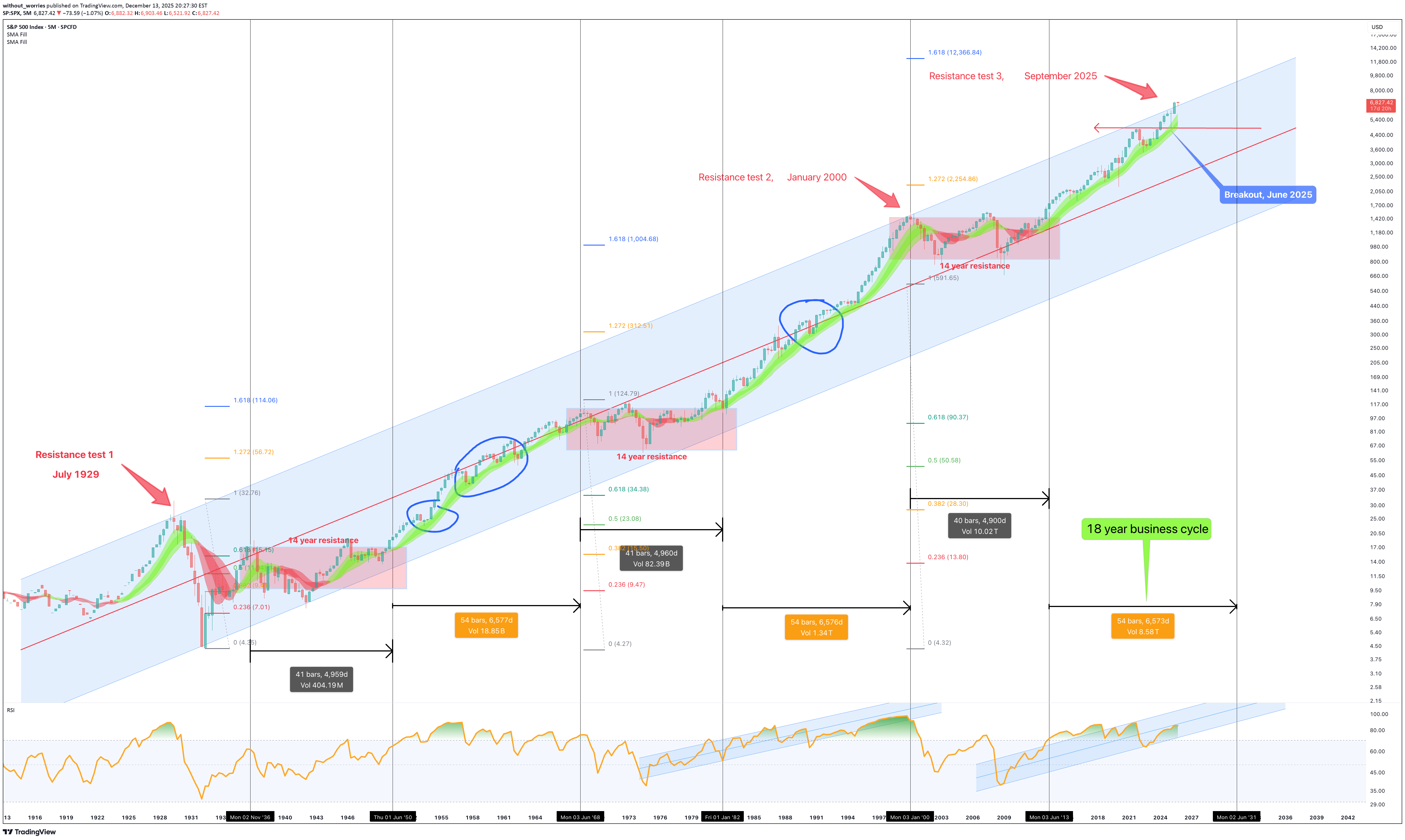

S&P 500 to 10,000 inside the next 4 years - December 2025

** This is an outlook for the next 3 to 4 years ** ** The bull market is not yet done, sorry bears ** Yes, read that right, 10,000 or 10k for the S&P 500. The markets shall continue to grind higher during this 10-year bear market everyone is talking about. Upwards and onwards for investors as unemployment numbers rise, graduates question the mysterious reason why their unable to land employment on the degree they just dropped $150k on; inflation runs out of control, working people struggle, the market is just not going to care. The best opportunities come at a time when you don’t have the money to invest, have you ever noticed that? The story so far A crash is coming, have you heard? Our ears are ringing out 24/7 with noise on the most predictable crash since computer user Dave reports an uninterrupted hour of use on Windows Vista. News of an AI bubble the size of Jupiter that is about to collapse in on itself and create a new star only seem to gather pace. The same finance prophets on Youtube with a hoodie in a rented flat forecasting which way the FED will move on rates. A 40 minute video to deliver a single sentence titled: “EMERGENCY VIDEO: Market collapse (MUST WATCH before tomorrow!!)”, 10 seconds in “And Today’s video is sponsored by…. ” and if it’s not a sponsorship, it’s a course they’re trying shill. Many story tellers weren’t yet out of school during the dom com crash, but they’re now they’re experts of it. Finally we have “a recession is coming” brigade. Of course it is. There’s always a recession coming. It’s like winter in Game of Thrones, they’ve been warning us for ages. Haven’t you heard? Recessions are now cancelled thanks to money printing and low interest rates. Capitalism RIP, all hale zombie companies. In summary there’s no shortage of doom and gloom. Everyone is saying it. So what am I missing? Let’s break this down as painless as possible so as not to challenge waining attention spans. You’ll need a cuppa before reading this, for the people of the commonwealth, you know of what I speak. A proper builders brew. Take your time to digest this content, there's no rush (did I mention it's a 5 month candle chart?). If you’re serious about separating yourself from the media noise to the News on the chart, then you're in for a treat. It is proper headline material. When you’re done, you'll pinch yourself, did he just tell me all this for free? What’s in it for him? (Absolutely nothing). Tradingview might bump $100 my way like Xerxes bearing gifts, but in the end the content of this idea may radically change the way your view the market today. The contents: 1. Is the stock market in a bubble? 2. What about this 10 year bear market people are talking about? 3. A yield curve inversion printed, isn't a monster recession is due? Is the stock market in a bubble? No. A handful of stocks are. The so-called “magnificent seven” stocks that make up about 40% of the market, Yeah, they’re in a bubble. No dispute from me there on that. It has never been riskier to be an index only fund investor. Especially if you're close to retirement. Now I’m not about to carve a new set of stone tablets explaining why, if you want the full sermon, that’s on my website. Here’s the short version: a tiny bunch of tech darlings are bending the whole market out of shape. If you’re only invested in index funds, then you’re basically strapped to the front of the roller coaster hoping the bolts hold should those seven stocks decide to puke 20% in a week. Suffice to say, a handful of stocks, tech stocks, are distorting the entire market. Index only investors are exposed to a greater risk than at any point in those past 20 years should the magnificent seven decide to sell off quickly. But what if they don’t? What if they just sell off slowly? Which is my thesis here. In the final 12 months leading up to the dot com crash, during the 1999-2000 period, the Nasdaq returned 160%. RSI was at 97 as shown on the 3 month chart below. Now that’s a bubble. In the past twelve months the Nasdaq has returned 20%. That’s not a bubble, that’s just a decent year. Above average, nice not insane. Yet people are acting like it’s 1999 all over again. A similar story for the S&P 500 as shown on the 3 month chart below. In the five years leading up to the crashes of 1929 and 2000 the market saw a return of 230% with RSI at 94 and 96, respectively. Today the market has returned 60% over the last 5 years with RSI @ 74. Adjusted for recent US inflation, and it’s roughly 30% real return! The two periods often recited the most by doomsayers, 1929 and 2000, exhibit conditions not found in today’s market. Fact. What about this 10 year bear market people are talking about? Warren Buffet, perhaps the most famous investor in the world, has amassed a cash pile the size of the size of Fort Knox. Legendary short seller Michael Burry is quoted as having Puts on the overbought tech stocks, that’s fair. The masses have translated all this as a short position on the stock market. It seems everyone is preparing for Armageddon. My question, why are the masses so convinced of a stock market crash? “Whenever you find yourself on the side of the majority, it is time to pause and reflect.” Mark Twain Let’s talk about the main 5 month chart above… There’s so many amazing things going on in this one chart, could spend hours talking about it. Will save that for Patrons, but the key points exist around support and resistance. You’ll remember the “ Bitcoin in multi year collapse back to $1k - December 2025 ” publication? It is of no surprise to me the Bitcoin chart now indicates a macro inverse relationship to the S&P 490 (minus tech stocks). Bitcoin is a tech stock all but in name, it follows the tech stock assets like a lost puppy. If you strip away the blotted tech sector you realise we’re in for a bumper rally in the stock market in the coming years. This happens as a result of money flooding out of the blotted tech sector (that includes crypto). These sectors are about to crash straight through the floor towards middle earth. When the masses catch on that businesses are not finding value in AI tools beyond generating cat videos on Youtube, the bottom falls out of those bankrupt entities, with hundreds of billions of dollars looking for a new home. That’s when investors pivot to value . Sometimes I feel like I’m the only one with this information when I scan through the feeds, how is this not the most obvious trade of the decade? For the first time in 96 years the S&P 500 breaks out of resistance. Why is no one else talking about this? 2025 was the year it happened and yet not a whisper. The 1st resistance test occurred in July 1929. The 2nd in January 2000. The breakout occurred in the first half of 2025 and will be confirmed by January 1st, 2026 providing the index closes the year above 6530-6550 area. 12 trading days from now. The 18 year business cycle, roughly 6574 days (the orange boxes) is shown together with the black boxes representing the 10 year bear markets in-between (14 years until past resistance is broken - pink boxes). Should you not know, The 18 year business cycle, In modern market economies (especially the US and UK), they are repeated cycles where: Land & property prices rise for about 14 years Then there’s about 4 years of crisis, crash, and recovery Together that’s roughly an 18-year land / real-estate business cycle, a pattern that is argued to show up again and again. When we remove the darlings of the stock market you find the valuation for the S&P 490 suggests that the vast majority of the US market is currently priced near a level of Fair Value relative to GDP, provided that the current economic structure persists. The high majority of influencers and financial experts talk about the end of the business cycle, there’s even “how to prepare for the crash” videos. If we look left, it is clear, the 18 year business cycle is far from over. So why are you bearish? A yield curve inversion printed, isn't a monster recession is due? There is a general assumption that recessions mean bad things for the stock market. You’re thinking it right now aren’t you? “ Of course they are Ww - everything will crash in a recession! ” Listen…. you couldn’t be more wrong. Ready for some dazzle? This level of dazzle wins your Harvard scholarships when meritocracy isn’t an option for you. And it’s free, without the monstrous loan debt at the end. Can you believe that? What if I told you the stock market does not care about recessions? Let’s overlay every US recession on the same 5 month chart. The vertical grey areas. There has been 14 US recessions over the last 96 years. The majority, that is 9 of them, occurred during a bear market. The recessions that saw the largest drop in the stock market, 1929 and 2000, were known overbought bubble periods. We know that is not representative of the current market as discussed in the first section. Here is the dazzle. Focus on the recession during the business cycles. What do you notice? The recessions during business cycles (blue circles) never saw a stock market correction greater than 10%. In other word, utterly irrelevant. Conclusions Let’s land this gently, before someone hyperventilates into their keyboard. The S&P 500 is not in a bubble. A handful of stocks are and that distinction matters far more than most people are prepared to admit. Yes, the Magnificent Seven are stretched. Yes, AI enthusiasm has reached “my toaster is sentient” levels. But the rest of the market? Strip away the tech confetti and you’re left with something far less dramatic and far more dangerous to bears: a structurally healthy market breaking a 96-year resistance. Not testing it. Not flirting with it. Breaking it. And doing so while the internet is convinced the sky is falling. This is where people get confused. They expect crashes to announce themselves loudly, with sirens and YouTube thumbnails. They don’t. Crashes arrive when optimism is universal, not when fear is a full-time job. Right now, fear is working overtime. If history rhymes, and markets are essentially drunk poets with a spreadsheet, then the evidence points to continued upside over the next 3–4 years, not a sudden plunge into a 10-year ice age. Now that does not mean straight up. Expect: Volatility Rotation Pullbacks that feel terrifying in real time and irrelevant in hindsight What it does not suggest is the end of capitalism every time the RSI sneezes. The 18-year business cycle is not complete. The long-term channel remains intact. RSI conditions are elevated but nowhere near the manic extremes seen in 1929 or 2000. Those periods were bubbles. This is not. Here’s the uncomfortable bit for many: The biggest risk right now isn’t being long. it’s being so convinced a crash is imminent that you miss the next leg entirely. Especially if you’re hiding in cash waiting for a disaster that keeps failing to show up. And before anyone shouts “What about tech collapsing?!”, yes — that’s precisely the point. If capital rotates out of bloated tech and into value, industrials, energy, financials, and boring businesses that actually make money, the index doesn’t die. It grinds higher while everyone argues about why their favourite stock stopped working. S&P 500 to 10,000 isn’t a fantasy screamed into the void. It’s the logical outcome of structure, cycles, and history, assuming capitalism doesn’t suddenly apologise and shut down. And if it does? Well, none of us will be worrying about our portfolios anyway. Ww Disclaimer =================================== This is not financial advice. It is not a signal, a promise, or a guarantee that markets will behave politely while you feel clever. Markets can remain irrational longer than you can remain solvent, especially if you’re trading leverage, emotion, or YouTube confidence. This outlook is based on historical price behaviour, long-term cycles, and observable market structure. If those conditions change, the thesis changes. Blind loyalty to an idea after the data disagrees isn’t conviction, it’s just stubbornness in a nicer font. If you’re looking for certainty, reassurance, or someone to blame later, this will disappoint you. If you’re looking for probabilities, context, and a framework that doesn’t rely on shouting “CRASH” every six months, you're welcome. Ww