sofex

@t_sofex

Ne tavsiye etmek istersiniz?

önceki makale

پیام های تریدر

filtre

راز ساخت استراتژیهای معاملاتی برنده: ۵ گام حیاتی که باید بدانید!

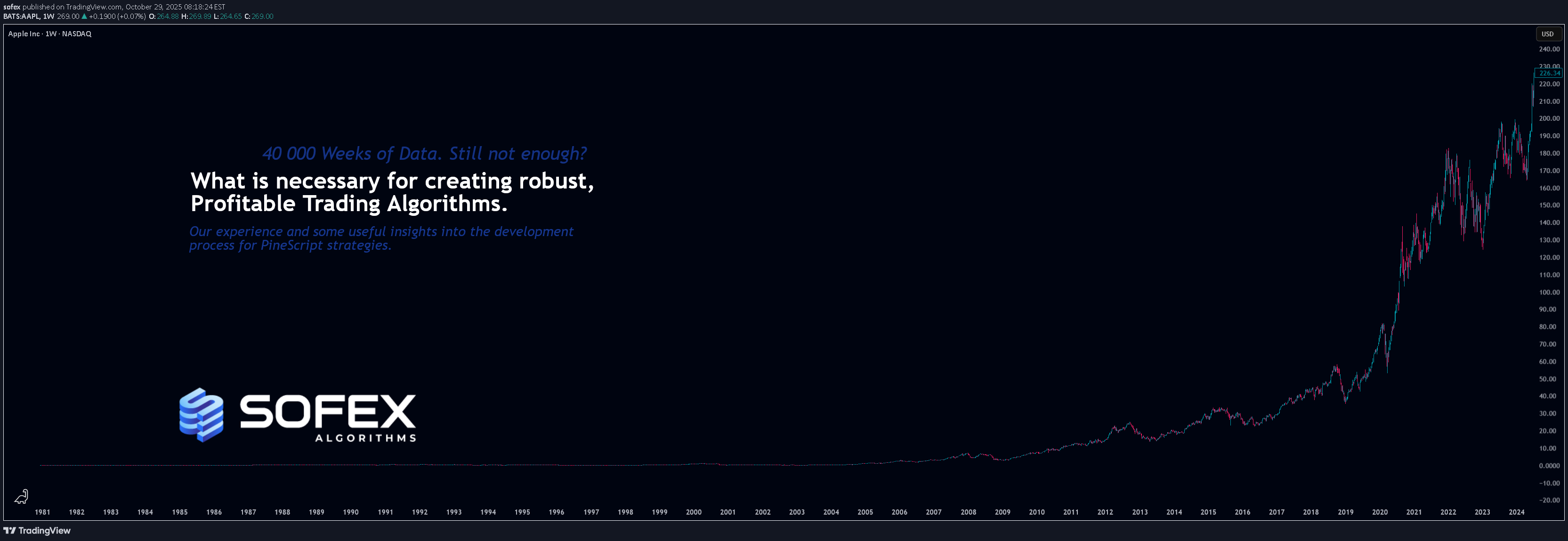

As the title says, I want to share knowledge & important insights into the best practices for creating robust, trustworthy and profitable trading Strategies here on TradingView. These bits of information that my team I have gathered throughout the years and have managed to learn through mostly trial and error. Costly errors too . Many of these points more professional traders know, however, there are some that are quite innovative for all levels of experience in my opinion. Please, feel free to correct me or add more in the comments. There are a few strategic and tactical changes to our process that made a noticeable difference in the quality of Strategies and Indicators immediately. Firstly and most importantly, we have all heard about it, but it is having the most data available. A good algorithm, when being built NEEDS to have as many market situations in its training data as possible. Choppy markets, uptrends, downtrends, fakeouts, manipulations - all of these are necessary for the strategy to learn the possible market conditions as much as possible and be prepared for trading on unknown data. Many may have heard the phrase "History doesn't repeat itself but rhymes well" - you need to have the whole dictionary of price movements to be able to spot when it rhymes and act accordingly. The TradingView Ultimate plan offers the most data in terms of historical candles and is best suited for creating robust strategies. ___ Secondly, of course, robustness tests. Your algorithm can perform amazingly on training data, but start losing immediately in real time, even if you have trained it on decades of data. These include Monte-carlo simulations to see best and worst scenarios during the training period. Tests also include the fundamentally important out-of-sample checks . For those who aren’t familiar - this means that you should separate data into training sets and testing sets. You should train your algorithm on some data, then perform a test on unknown to the optimization process data. It's common practice to separate data as 20% training / 20% unknown / 20% training etc. to build a data set that will show how your algorithm performs on unknown to it market movements. Out of sample tests are crucial and you can never trust a strategy that has not been through them. Walk-forward simulations are similar - you train your algorithm on X amount of data and simulate real-time price feeds and monitor how it performs. You can use the Replay function of TradingView to do walk-forward tests! When you are doing robustness tests, we have found that a stable strategy performs around 90% similarly in terms of win rate and Sortino ratio compared to training data. The higher the correlation between training performance and out of sample performance, the more risk you can allocate to this algorithm. ___ Now lets move onto some more niche details. Markets don’t behave the same when they are trending downward and when they are trending upwards. We have found that separating parameters for optimization into two - for long and for short - independent of each other, has greatly improved performance and also stability. Logically it is obvious when you look at market movements. In our case, with cryptocurrencies, there is a clear difference between the duration and intensity of “dumps” and “pumps”. This is normal, since the psychology of traders is different during bearish and bullish periods. Yes, introducing double the amount of parameters into an algorithm, once for long, once for short, can carry the risk of overfitting since the better the optimizer (manual or not), the better the values will be adjusted to fit training data. But if you apply the robustness tests mentioned above, you will find that performance is greatly increased by simply splitting trade logic between long and short. Same goes for indicators. Some indicators are great for uptrends but not for downtrends. Why have conditions for short positions that include indicators that are great for longs but suck at shorting, when you can use ones that perform better in the given context? ___ Moving on - while overfitting is the main worry when making an algorithm, underoptimization as a result of fear of overfitting is a big threat too . You need to find the right balance by using robustness tests. In the beginning, we had limited access to software to test our strategies out of sample and we found out that we were underoptimizing because we were scared of overfitting, while in reality we were just holding back the performance out of fear. Whats worse is we attributed the losses in live trading to what we thought was overfitting, while in reality we were handicapping the algorithm out of fear. ___ Finally, and this relates to trading in general too, we put in place very strict rules and guidelines on what indicators to use in combination with others and what their parameter range is. We went right to theory and capped the values for each indicator to be within the predefined limits. A simple example is MACD . Your optimizer might make a condition that includes MACD with a fast length of 200, slow length of 160 and signal length of 100. This may look amazing on backtesting and may work for a bit on live testing, but these values are FUNDAMENTALLY wrong (Investopedia, MACD). You must know what each indicator does and how it calculates its values. Having a fast length bigger than the slow one is completely backwards, but the results may show otherwise. When you optimize any strategy, manually or with the help of a software, be mindful of the theory. Mathematical formulas don’t care about the indicator’s logic, only about the best combination of numbers to reach the goal you are optimizing for - be it % Return, Profit Factor or other. Parabolic SAR is another one - you can optimize values like 0.267; 0.001; 0.7899 or the sort and have great performance on backtesting. This, however, is completely wrong when you look into the indicator and it’s default values (Investopedia, Parabolic SAR). To prevent overfitting and ensure a stable profitability over time, make sure that all parameters are within their theoretical limits and constraints, ideally very close to their default values. Thank you for reading this long essay and I hope that at least some of our experience will help you in the future. We have suffered greatly due to things like not following trading theory and leaving it all up to pure mathematical optimization, which is ignorant of the principles of the indicators. The separation between Long / Short logic was also an amazing instant improvement. View the linked idea where we explain the psychology of risk management and suggest a few great ways to calculate and manage your risk when trading - just as important as the strategy itself! What do you think? Do you use any of these methods; Or better ones? Let us know in the comments.

اتریوم در راه ثبت رکورد جدید؛ منتظر سکون بیت کوین باشید!

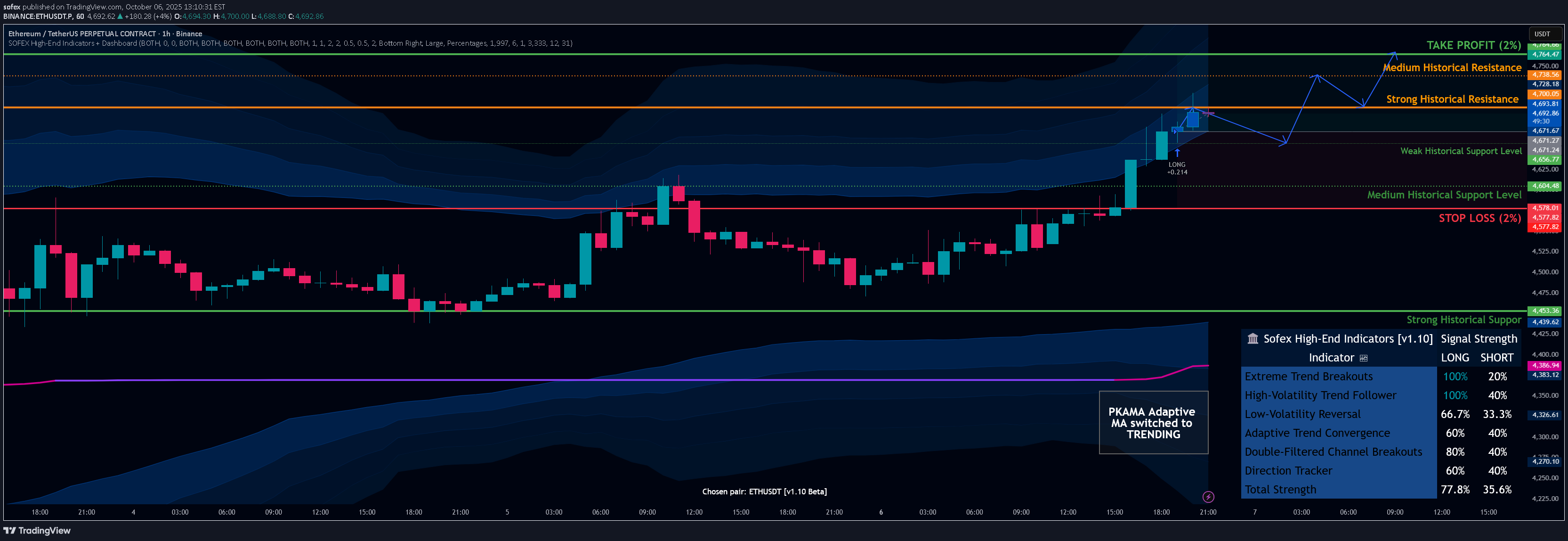

Bizim Ethusdt.p Algoritma uzun bir pozisyonu tetikledi. Tüm teknik göstergelerimiz% 77.8 aritmetik ortalama uzun sinyal gücünü hesaplar . Bizim için en önemli "kanıt" parçası Önümüzdeki ay içinde Ethereum yeni ATH seviyelerine ulaşacak spekülasyon gerçeği Aşırı trend kırılmaları ve Yüksek Volatilite Trend takipçisi Koşullar, ticareti birlikte tetikledi ve yazma sırasında% 100 uzun sinyal gücünde oturdu. Diğer koparma durumumuz - Çift filtrelenmiş kanal kırılmaları % 80 uzun sinyal gücünde oturur. Neden bu kadar alakalı? Çünkü bu koşullar (her biri 5-6 teknik göstergeden oluşur), en başından itibaren eğilimi takip ederek kırılmaları tespit etmek ve girmeyi amaçlamaktadır. %2'de çıkacak şekilde programlanmış olsa da, daha büyük bir move hazırlıkta olduğuna inanıyoruz. Son zamanlarda gördük Btcusdt.p benzeri görülmemiş yükseklere ulaşın. Tarihsel olarak, Bitcoin durduğunda parabolik büyümesi ve para fiat ve diğer kriptolara geri akmaya başlar - ETH önce faydalar. Temel olarak, Ethereum akıllı sözleşme ve Web3 devriminin belkemiğidir. Solana, Polkadot, BNB ve diğer alt-Coins, Ethereum virtual makinesinden türetilir ve ilham alır. Bu, soruyu sormamızı sağlıyor - Ethereum neden geride kalıyor Bitcoin? Birkaç olası cevap var ve hepsi aynı sonuca yol açıyor: - Solana, daha düşük giriş engelleri ile, en çok meme Coins çevresindeki perakende heyecanı. Kolay kodlama dili ve bu "meme Coins" oluşturmak için basit, ancak işlevsel ve ucuz web siteleri, aksi takdirde Ethereum 'a doğru gidecek büyük bir perakende hacmini aldı. -Ethereum'un iş kanıtından bahis kanıtına geçiş şimdi tamamlanıyor. Geçen yıl büyük yatırımcılara POS POS era BURDED ETH 'ın piyasaya sürülmesi nihayet büyük ETH Staker'ların orijinal yatırımlarını sürdürmeye teşvik edilmesinin daha karlı olduğu bir zaman ve fiyata ulaşıyor. Temel olarak - bıçaklanmış Ethereum 'ınızı satmak için gittikçe daha az teşvik ve daha fazla bilgi için daha fazla teşvik (ve dolayısıyla yerinde satın almak). Yukarıdaki resimden 4700 dolarlık seviyenin bir major direnç seviyesi olduğunu görebiliriz. Bu kırıldıktan sonra, neler olabileceğine dair çok az tarihsel referanslarımız var. Ya da başka bir deyişle - 4700, umarım desteğe dönüştükten sonra fiyat keşfine sıçrayacağımız seviyedir. Bu kripto döngüsünde çok fazla zaman kalmadı. Ve Ethereum, klasik 4 yıllık döngünün sonuna doğru parabolik artışı bitirme eğilimindedir.

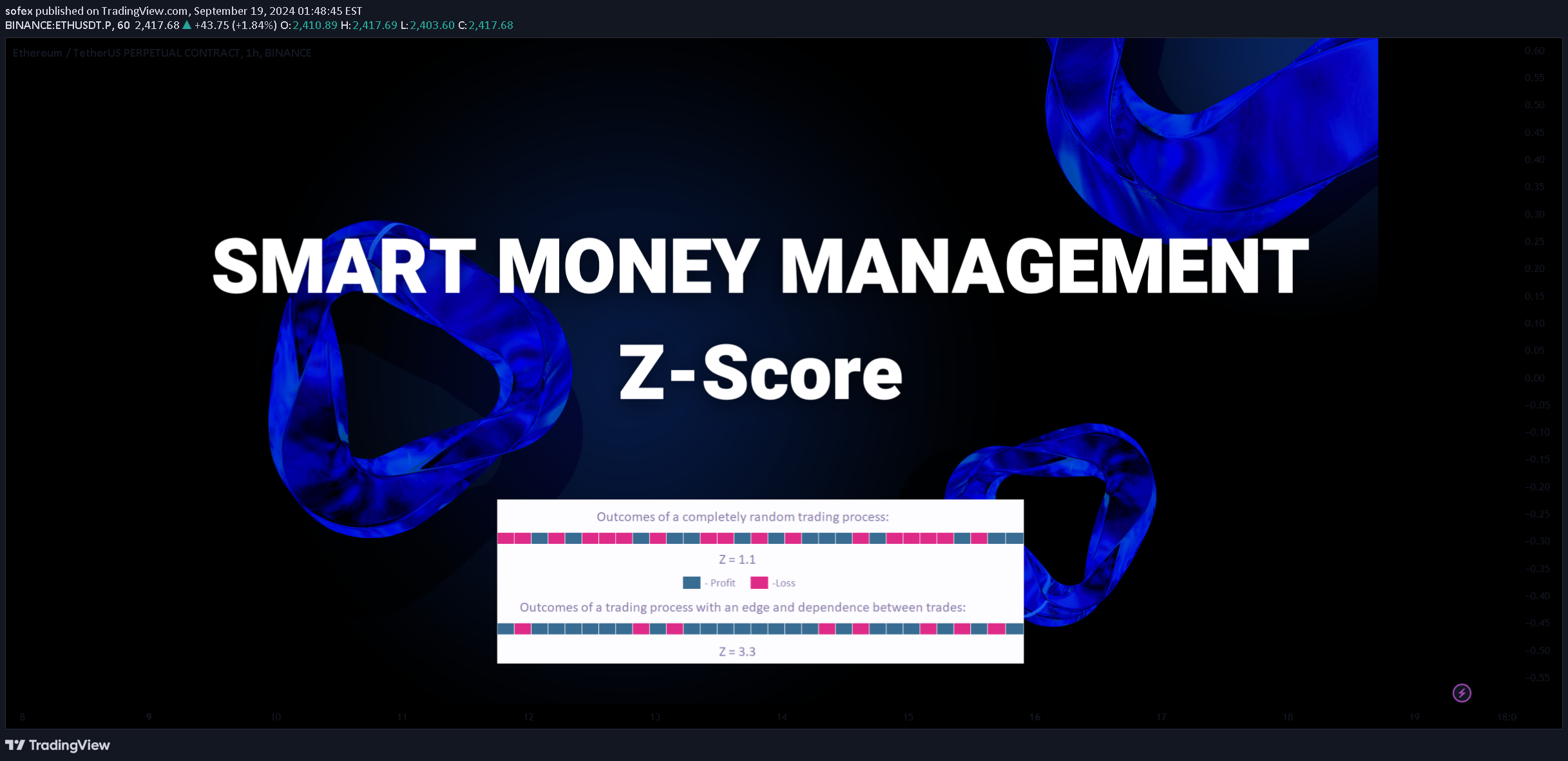

How to Use Z-Score for Smarter Trading Strategies In trading, success often depends on your ability to predict market movements and manage your capital efficiently. One of the tools that can give traders an edge is the Z-score, a statistical measure that helps identify patterns in win and loss streaks. This article breaks down what the Z-score is, how it works in trading, and how you can use it to optimize your strategies. What is Z-Score in Trading? In simple terms, Z-score measures the distance between an observed outcome (like a win or loss) and the average result in a set of data. In the context of trading, this data set typically represents your wins and losses over time. The Z-score is most commonly found in the range of -3 to +3, with higher scores indicating a greater probability of consecutive wins followed by losses, and lower scores representing more random, unpredictable outcomes. A high Z-score suggests that your trading strategy is likely to go through a series of wins, followed by a series of losses . This information can help you adjust your capital allocation and manage risk better. Conversely, a low Z-score points to a more chaotic trading environment where wins and losses alternate with little predictability. How Z-Score Can Improve Your Trading Decisions 1 • Understanding Random vs. Strategic Trading Traders who act without a strategy tend to experience unpredictable results — one win here, one loss there. This type of trading is driven by randomness and typically has a low Z-score, meaning there is no clear pattern of consecutive wins or losses. On the other hand, traders who use strategic approaches — like the ones developed by SOFEX —tend to see more predictable outcomes. These strategies often have a higher Z-score, signaling that you can expect a string of wins, followed by a string of losses. 2 • Capital Management Based on Z-Score The Z-score provides crucial insights into when to adjust your capital. The general rule of thumb is: • After a streak of wins, reduce your capital. The Z-score indicates that a loss is likely to follow after a series of wins. • After a loss or streak of losses, increase your capital, as a win is statistically more likely to follow. For example, if you start with $1,000 and win multiple times in a row, your first instinct might be to increase your capital to $2,000 or even $3,000. However, this is where most traders make a critical mistake . Based on the Z-score model, it's better to decrease your capital after consecutive wins, as losses are statistically imminent. Conversely, increase your capital after a loss to benefit from the upcoming win streak. 3 • Avoid Overconfidence After Wins Traders often fall into the trap of increasing their stake after a series of wins, assuming that the market will continue to favor them. However, the Z-score suggests that after 3-5 wins, you should lower your risk and decrease the amount you're trading. By doing so, you protect your profits from the losses that typically follow a winning streak. 4 • How to Apply This in Practice Let’s walk through a typical trading scenario: You start with $1,000. You win multiple trades, so you might be tempted to increase your capital. However, if you understand the Z-score, you’ll know that after several wins, a loss is likely coming soon . Instead of increasing capital, reduce your stake, say, to $500 or $800. When the inevitable loss comes, you’ve minimized your risk. After this loss, you can now increase your capital back to $1,500 or $2,000, as the Z-score suggests that a win streak is more probable after a loss. By following this approach, you avoid major losses after a win streak, and you’re well-positioned to capitalize on the next string of wins. Key Takeaways for Traders • Z-score predicts patterns in trading, with high Z-scores indicating win streaks followed by losses, and low Z-scores indicating a more random, unpredictable pattern. • After consecutive wins, lower your capital to protect your profits, as losses are statistically likely to follow. • After consecutive losses, increase your capital to take advantage of the upcoming win streak. Managing your capital based on Z-score predictions allows you to minimize losses and maximize profits, even during market fluctuations. Final Thoughts Trading is as much about managing risk as it is about making profits. The Z-score strategy can help traders anticipate win and loss streaks, allowing them to adjust their capital allocation more effectively. By following this model, you can protect yourself from large losses and make smarter decisions about when to scale up or down your trades. In summary, to optimize your trading: • Lower capital after multiple wins to avoid large losses. • Increase capital after losses to take advantage of win streaks. Implementing these strategies based on the Z-score will not only improve your trading outcomes but also help you build long-term, sustainable profitability. So the next time you're riding a win streak, remember: it's not the time to increase your stake—it's time to strategically lower it and lock in your profits. View our video on the subject here . Thank you for reading. Read our article on the Kelly Criterion in the Related Ideas section! Z-Score diagram taken from EarnForex .

In the rapidly evolving world of cryptocurrency, the European Union has taken a significant and important step forward with the introduction of the Markets in Crypto-Assets Regulation (MiCA). This groundbreaking regulatory framework marks a pivotal moment for the crypto market within the EU, promising to bring much-needed clarity and stability to an industry that has long been likened to the Wild West due to its volatility and lack of standardization. The European Union is a leader in creating legislation for emerging technologies. This became clear with the introduction of GDPR, which protects internet users’ personal data, the AI Act that aims to protect citizens of the EU from malpractice, such as cognitive manipulation of people and social scoring, and now - MiCA. Paving the way forward for others, the EU is evolving its digital legislation frameworks faster than other unions or countries. This article delves into how MiCA will reshape the landscape for EU traders, impacting everything - from the way they interact with crypto assets to the broader market dynamics they navigate daily. Why do we need regulations like MiCA? If there are no regulations, markets can run wild and experience giant increases, however when the fun is over and people lose money to fraud and even large-scale bankruptcy of exchanges - investors, especially institutional ones, will not dare place their money in crypto projects and companies. And since for investors, money is trust - the cryptocurrency market is doomed without proper regulation. On the flip side, extremely stringent and disorganized legislation can lead to the same outcome. Countries struggle with the abstract nature of cryptocurrencies, and many have expressed an outright desire to ban them, seeing as it is the easier option. That is why MiCA is a well-devised framework for others to follow - It is focused and comprehensive. Some may argue that cryptocurrencies are meant to be decentralized, unregulated and follow a laissez-faire approach. While this is possible, more so for some cryptocurrencies than others, there can be no growth in these markets as new projects need to have banking and investors behind them to realize their blockchain-based ideas. It is also unrealistic to think that such a clandestine financial system will never cross paths with the regular banking system. What exactly is MiCA? The inception of the Markets in Crypto-Assets Regulation (MiCA) is rooted in the European Union's recognition of the growing significance of cryptocurrencies and the associated risks in an unregulated environment. The primary catalyst for MiCA's development was the need for regulatory clarity in the burgeoning crypto market, which had been expanding rapidly without a standardized regulatory framework since the birth of Bitcoin in 2009. This lack of regulation posed risks such as fraud, market manipulation and financial instability. These concerns were heightened by incidents like the surge in initial coin offerings (ICOs), the capitulation of multiple large exchanges and the ironic instability of stable-coins. MiCA was proposed to provide a harmonized regulatory framework for crypto-assets that are not covered under existing EU financial legislation. The objective was to safeguard investors, maintain financial stability, and promote innovation within a secure and transparent environment. By introducing clear rules, MiCA aims to legitimize the crypto market, making it safer and more attractive for investors and consumers while mitigating the potential for financial crime and market manipulation. This move towards regulation reflects a global trend of governments and financial authorities worldwide striving to balance the benefits of innovation in the digital asset space with the need for consumer protection and market integrity. As such, MiCA represents a significant step by the EU in establishing a comprehensive regulatory regime for crypto-assets, setting a precedent that could influence global standards in cryptocurrency regulation. Key Points of MiCA MiCA introduces several key provisions that are set to transform the crypto-asset landscape in the European Union. The areas that are discussed and regulated the most are the areas where incidents have happened and people have lost their funds. It is important not to make the same mistakes as before. Exchanges & Brokerages One of the primary aspects of MiCA is the establishment of stringent authorization requirements for crypto-asset service providers. Under MiCA, any entity aiming to offer services related to crypto-assets, including trading, custody, or advisory services, must obtain authorization from one of the EU's national financial regulators. This process is designed to ensure that providers adhere to high standards of operational conduct, governance, and consumer protection outlined in the legislation. Crypto exchanges have gone bankrupt, been hacked or shut down abruptly in crypto’s short history. The aim of legislatures is to prevent these collapses or stop them in their tracks. Initial Public / Coin Offerings Another fundamental component of MiCA is the regulation of public offerings of crypto-assets. Companies intending to offer crypto-assets to the public are required to publish a detailed white paper. This document must provide clear, fair, and comprehensive information about the risks involved, ensuring that potential buyers are well-informed. The regulations aim to prevent misleading practices and enhance transparency in the market. Until now, many ICOs do publish white papers, however they can be purely fictional, written to trick the untrained eye into thinking the project is professionally done. Furthermore, this official process of submitting a white paper will ensure that the people behind the project are known. This will prevent people from faking their identities in order to anonymously scam their clients. Stablecoins MiCA also specifically addresses the regulation of stablecoins, which are categorized as either e-money tokens (EMTs) or asset-referenced tokens (ARTs). EMTs are stablecoins pegged to the value of a fiat currency, such as USDT, USDC and BUSD. ARTs are linked to other assets, such as WETH, WBTC. MiCA mandates that stablecoins must maintain adequate reserves and adhere to governance standards. Furthermore, there are stringent rules for stablecoins not pegged to EU currencies, including a cap on the number of transactions per day, aimed at preventing these assets from undermining the Euro. This approach to stablecoins is a response to concerns about their potential impact on financial stability and monetary policy. These concerns are justified, following the collapse of a few large market cap stable-coins during 2022. Through these provisions, MiCA aims to establish a secure and transparent environment for the trading and use of crypto-assets, ensuring that the rights of investors are protected while fostering innovation in the sector. Conclusion The introduction of MiCA by the European Union represents a watershed moment for the crypto-asset market. By establishing a harmonized regulatory framework, MiCA seeks to provide clarity, enhance market integrity, and protect investors, all while fostering an environment conducive to innovation. For EU traders, these regulations offer a more secure and transparent trading landscape, albeit with increased compliance obligations. The provisions on stablecoins, in particular, demonstrate a nuanced approach to different types of crypto-assets. As MiCA comes into full effect, its influence is expected to extend beyond the EU, potentially setting a precedent for global crypto-asset regulation. For traders and investors, staying informed and adapting to these regulatory changes will be key to navigating the evolving crypto market landscape.

The difference between trading and gambling. This article will shine a light on the most frequent mistakes that traders make. These mistakes blur the thin line between trading and gambling. Many people have spoken on this topic, but we truly believe that it is still not sufficient, and traders should be better educated on how to avoid gambling behaviour and emotional outbursts. When we speak about trading versus gambling, we define gambling as the act of making irrational, emotional and quick decisions. Most of the time, these decisions are based on greed, and sometimes fear of the trader. Let’s dive into the exact problems we have personally experienced thousands of times, and want to help others avoid. 1 ♠ Bad Money Management This is something that everyone has heard at least once, but seems to naively ignore in the hopes that it is not that important . It is the most important . When a trader enters trades, it is exceptionally alluring to enter with all of their money, or close to all of it. In gambling terms, that is going “All in”, or “All or nothing”. As a rule of thumb, both traders and gamblers should only place or bet money that they can afford to lose. Thankfully, at least in trading one can limit their loss for that specific trade, by placing a stop loss or exiting before total liquidation. In Poker, you can’t fold when you are “All in” and take a portion of your money back. However, that does not mean entering trades with full capital, even with a stop-loss, is going to give you exponential returns and feed your greed for profits. Traders should enter positions with a small amount of their full capital, to limit the damage from losses. Yes, you also limit the possibility that you win a few trades in a row with all of your money and… There goes the greed we mentioned. The “globally perfect” percent of equity you need to enter trades to reach that balance between being too cautious and too greedy does not exist. There are methods, like the Kelly Criterion, as described in our previous Idea (see related ideas below), that help you optimize your money management. Always ask yourself, “How much can I afford to lose?”. Aim for a balanced approach. This way you can position yourself within the market for a long and a good time, not just for a few lucky wins. Greedy money management, or lack thereof, ends in liquidations and heartbreak. 2 ♣ The Use of Leverage Anyone who has tried using leverage, knows how easy it is to lose your position (or full) capital in seconds. Using leverage is mainly sold to retail traders as a tool for them to loan money from the exchange or broker and bet with it. It is extremely profitable for institutions, since it multiplies the fees you pay them ten to one hundred-fold. In our opinion, leverage isn’t something that should be entirely avoided. However, it should be limited as much as possible. We cannot deny that using 1-5x leverage can be beneficial for people with small accounts and a thirst for growth, however as the leverage grows, the more of a gambler you become. We often see people share profits made using 20+ times leverage. Some even use ridiculous leverages within the range of 50-125x. If you are doing that, do you truly trust your entry so much that you believe the market won’t move 1% against your decision and liquidate you immediately? At this point, the gambling aspect should be evident, and it goes without saying that you should not touch this “125x Golden Apple”, like Eve in the Garden of Eden. Especially when you see a snake-exchange promote it. If you use a low amount of leverage, and grow your account to the point where you don’t need it for your personal goals in terms of monetary profit. You should consider stopping the use of it, and at least know you’ll be able to sleep at night. 3 ♥ Always Being In A Position Always being either long or short leads to addiction and becomes gambling. While we don’t have scientific proof of that, we can give you our own experience as an example. To be a profitable trader, you do not need to always be in a position, or chase every single move on the market. You need to develop the ability just to sit back and watch, analyse and make conscious decisions. Let the bad opportunities trick someone else, while you patiently wait for all your pre-defined conditions to give you a real signal. When you think of trading, remember that the market has a trend the minority (around 20-30%) of the time. If you are always in a position, this means that 70-80% of the time you are hoping that something will happen in your favour. That, by definition, is gambling. Another aspect, that we have experienced a lot, is that while you remain in a position, especially if you have used leverage, you are constantly paying your exchange fees. You can be in a short position for a week and pay daily fees which only damage your equity, and therefore margin ratio. So why not just sit back, be patient and define some concrete rules for entering and exiting? Avoid risky situations, and let the market bring the profits whenever it decides to. 4 ♦ Chasing Huge Profits Hold your horses, Warren Buffett. Through blood, sweat and tears, we can promise you that you cannot seriously expect to make 100% every month, no matter what magical backtesting or statistics you are calculating your future fortune on. Moreover, you will realise that consistently making 2-5% a month is an excellent career for a trader. Yes, the markets can be good friends for a while, you may stumble into a bull-run and start making double-digit profits from a trade from time to time. Double-digit losses will also follow if you lose your sight in a cloud of euphoria and greed. Many times, you can follow the “profit is profit” principle, and exit at a small win if the risk of loss is increasing. 5 ♠ Being Sentimental Towards Given Assets You may have a fondness for Bitcoin and Tesla, and we understand that because we too have our favourites. Perhaps you’re deeply attached to the vision, community and purpose of certain projects. On the flip side, there may be projects that you completely despise and hope their prices plummet to zero. What you personally like and dislike, should not interfere with your work as a trader. Introducing such strong emotions into your trading will lead you into a loop of irrational decisions. You may find yourself asking, “Why isn’t this price going parabolic with how good the project is?”. This sounds, from personal experience, quite similar to sitting at a Roulette table and asking: “Why does it keep landing on red when I’ve been constantly betting black? It has to change any moment now”. First and foremost, you may be completely wrong, but most importantly – it could go parabolic, but trying to predict the exact time or expecting it to happen immediately and placing your “bet” on that is again, gambling. Don’t get attached to projects when trading. If you are an investor who just wants to hold their shares in an awesome company, or cryptocurrency, that is perfectly fine, hold them as much as you want. The key is to make an important distinction between trading and investing, and to base your strategy on the hand that the market provides you with. 6 ♣ Putting Your Eggs In One Basket We all have heard of diversification, but how you approach it is crucial. A trader should always have their capital spread between at least a few assets. Furthermore, the trading strategy for each asset must be distinct, or in other words – they should not rely on the same entry and exit conditions for different assets. The markets behave differently for each asset, and you cannot be profitable with some magical indicator or strategy with a “one-size-fits-all” style. Divide your trades into different pairs and asset classes, and study each market individually to properly diversify. Manage the equity you put into each trade carefully! Conclusion The takeaway we want you as a reader to have from this article is that trading without consciously controlling your emotions inevitably leads to great loss and most importantly, a lot of stress. We hate stress. Trading and life in general is exponentially harder when you are under stress. Control your risk, sleep easy, and let the market bring you profits. Reaching this level of Zen will not be easy, but it is inevitable. Be happy when you make a profit, no matter how small or big. A lot of small profits and proper money management complete the vision you have of a successful business. Ultimately, trading is just that – work, not gambling or a pastime activity. Treat it as work and always remember to never rely on luck. The advice we’ve included here is written by a few experienced gamblers… Oops, I meant traders 😉. We hope that some of the lessons we’ve had to painstakingly learn through trial and error can now be shared with those who are interested. Of course, none of this constitutes investment advice. It’s merely a friendly heads-up.

What is position sizing & why is it important? Position size refers to the amount of risk - money, contracts, equity, etc. - that a trader uses when entering a position on the financial market. We assume, for ease, that traders expect a 100% profit or loss as a result of the profit lost. Common ways to size positions are: Using a set amount of capital per trade . A trader enters with $100 for example, every time. This means that no matter what the position is, the maximum risk of it will be that set capital. It is the most straight-forward way to size positions, and it aims at producing linear growth in their portfolio. Using a set amount of contracts per trade . A trader enters with 1 contract of the given asset per trade. When trading Bitcoin, for example, this would mean 1 contract is equal to 1 Bitcoin. This approach can be tricky to backtest and analyse, since the contract’s dollar value changes over time. A trade that has been placed at a given time when the dollar price is high may show as a bigger win or loss, and a trade at a time when the dollar price of the contract is less, can be shown as a smaller win or loss. Percentage of total equity - this method is used by traders who decide to enter with a given percentage of their total equity on each position. It is commonly used in an attempt to achieve ‘exponential growth’ of the portfolio size. However, the following fictional scenario will show how luck plays a major role in the outcome of such a sizing method. Let’s assume that the trader has chosen to enter with 50% of their total capital per position. This would mean that with an equity of $1000, a trader would enter with $500 the first time. This could lead to two situations for the first trade: - The position is profitable, and the total equity now is $1500 - The position is losing, and the total equity now is $500. When we look at these two cases, we can then go deeper into the trading process, looking at the second and third positions they enter. If the first trade is losing, and we assume that the second two are winning: a) 500 * 0.5 = 250 entry, total capital when profitable is 750 b) 750 * 0.5 = 375 entry, total capital when profitable is $1125 On the other hand, If the first trade is winning, and we assume that the second two are winning too: a) 1500 * 0.5 = 750 entry, total capital when profitable is $2250 b) 2250 * 0.5 = 1125 entry, total capital when profitable is $3375 Let’s recap: The trader enters with 50% of the capital and, based on the outcome of the first trade, even if the following two trades are profitable, the difference between the final equity is: a) First trade lost: $1125 b) First trade won: $3375 This extreme difference of $2250 comes from the single first trade, and whether it’s profitable or not. This goes to show that luck is extremely important when trading with percentage of equity, since that first trade can go any way. https://www.tradingview.com/x/qHhX6jyo/ Traders often do not take into account the luck factor that they need to have to reach exponential growth . This leads to very unrealistic expectations of performance of their trading strategy. What is the Kelly Criterion? The percentage of equity strategy, as we saw, is dependent on luck and is very tricky. The Kelly Criterion builds on top of that method, however it takes into account factors of the trader’s strategy and historical performance to create a new way of sizing positions. This mathematical formula is employed by investors seeking to enhance their capital growth objectives. It presupposes that investors are willing to reinvest their profits and expose them to potential risks in subsequent trades. The primary aim of this formula is to ascertain the optimal allocation of capital for each individual trade. The Kelly criterion encompasses two pivotal components: * Winning Probability Factor (W) : This factor represents the likelihood of a trade yielding a positive return. In the context of TradingView strategies, this refers to the Percent Profitable. * Win/Loss Ratio (R) : This ratio is calculated by the maximum winning potential divided by the maximum loss potential. It could be taken as the Take Profit / Stop-Loss ratio. It can also be taken as the Largest Winning Trade / Largest Losing Trade ratio from the backtesting tab. The outcome of this formula furnishes investors with guidance on the proportion of their total capital to allocate to each investment endeavour. Commonly referred to as the Kelly strategy, Kelly formula, or Kelly bet, the formula can be expressed as follows: Kelly % = W - (1 - W) / R Where: Kelly % = Percent of equity that the trader should put in a single trade W = Winning Probability Factor R = Win/Loss Ratio This Kelly % is the suggested percentage of equity a trader should put into their position, based on this sizing formula. With the change of Winning Probability and Win/Loss ratio, traders are able to re-apply the formula to adjust their position size. Let’s see an example of this formula. Let’s assume our Win/Loss Ration (R) is the Ratio Avg Win / Avg Loss from the TradingView backtesting statistics. Let’s say the Win/Loss ratio is 0.965. Also, let’s assume that the Winning Probability Factor is the Percent Profitable statistics from TradingView’s backtesting window. Let’s assume that it is 70%. With this data, our Kelly % would be: Kelly % = 0.7 - (1 - 0.7) / 0.965 = 0.38912 = 38.9% Therefore, based on this fictional example, the trader should allocate around 38.9% of their equity and not more, in order to have an optimal position size according to the Kelly Criterion. The Kelly formula, in essence, aims to answer the question of “What percent of my equity should I use in a trade, so that it will be optimal”. While any method it is not perfect, it is widely used in the industry as a way to more accurately size positions that use percent of equity for entries. Caution disclaimer Although adherents of the Kelly Criterion may choose to apply the formula in its conventional manner, it is essential to acknowledge the potential downsides associated with allocating an excessively substantial portion of one's portfolio into a solitary asset. In the pursuit of diversification, investors would be prudent to exercise caution when considering investments that surpass 20% of their overall equity, even if the Kelly Criterion advocates a more substantial allocation. Source about information on Kelly Criterion https://www.investopedia.com/terms/k/kellycriterion.asp

“Yeniden boyamak” nedir? Kullandığınız betiğin bunu yapmaması neden önemlidir? Yeniden boyama genel olarak görsel özelliklerin yeniden çizilmesi veya değiştirilmesidir. Teknik analiz ve grafik bağlamında, yeniden boyama, sinyaller ve görsel grafikler gibi geçmiş verilerin zamanın flow'ı ile değiştirilmesi anlamına gelir. Yeniden boyama yapan senaryolarla oluşturulan tarihsel sonuçlar genellikle oldukça çekici, hatta mükemmel görünüyor. Bu, birçok kullanıcıyı ve yatırımcıyı beklentileri konusunda kolayca yanıltabilir ve yanlış analizlere neden olabilir data. Sonuç olarak kullanıcılar mantıksız ticaret kararları verebilirler. Yeniden boyama konusunda çok şey yazıldı. Bu makalede, bir betiğin yeniden boyanıp boyanmadığını kontrol etmenin 3 kolay yolunu göstereceğiz. TradingView topluluğu genelinde en çok sorulan sorulardan biri: "Yeniden boyanıyor mu?" Yöntem 1 Komut dosyasını bir grafiğe ekleyin ve bir uyarı oluşturmaya başlayın. Uyarı ayarlarında söz konusu komut dosyası olarak koşulu seçin. Komut dosyası yeniden boyanırsa uyarı penceresi başlığının yanında sarı bir ünlem işareti göreceksiniz. TradingView'in uyarısını görmek için üzerine tıklayın. Yeniden boyama uyarısı içeren komut dosyası Yeniden boyama uyarısı olmayan komut dosyası İstisnalar Bazı durumlarda komut dosyaları, yerleşik teknik analizler hariç olmak üzere gösterge tabloları veya başka farklı görsel grafikler içerebilir. Bu tür görsel öğelerin komut dosyasında "calc_on_every_tick" seçeneğinin etkinleştirilmesine ihtiyaç duyması nedeniyle bir uyarı gösterilir. Bu seçenek, kontrol panelleri gibi görselleri her bir onay işaretinde güncelleyerek bunların gerçek zamanlı olarak data değerini göstermesini sağlar. Öte yandan, doğrulanmamış sinyaller olarak da bilinen 'çubuk içi' sinyaller üretebilir. Onaylanmış ve onaylanmamış sinyaller nelerdir? Onaylanmamış bir sinyal, mevcut mum sırasında üretilen sinyaldir. Bar içidir ve mevcut fiyat dalgalanmalarına göre ortaya çıkıp kaybolabilir. Diğerleri gibi bir single olduğu için uyarıları da tetikleyebilir. Onaylanmış bir sinyal yalnızca mum kapandığında ve fiyat geçmişe kilitlendiğinde üretilir. Mum devam ederken (1 saat diyelim) tetiklenip kaybolamaz. Yalnızca davetle kullanılabilen bir komut dosyası kullanıyorsanız, bu tür görsel öğelerin bulunmadığı ve uyarı verilmeyen bir sürüm için sağlayıcıyla her zaman request ile iletişime geçebilirsiniz. Bu sayede kıyaslama yaparak kendinizi yeniden güvence altına alabilirsiniz. Şeffaflık her sağlayıcı için ana öncelik olmalıdır. Yöntem 2 Yeniden boyama olup olmadığını kontrol etmek için tablodaki "Tekrar Oynat" işlevini kullanın. Herhangi bir şey yapmadan önce bir fotoğraf çekin veya grafikte hangi sinyallerin bulunduğunu kaydedin. Grafik başlığındaki tekrar oynat düğmesine tıklayın ve geçmişteki bir zamana gidin. "Oynat"a basın ve tekrar oynatma sırasındaki işlemleri tekrar oynanmayan işlemlerle karşılaştırın. Tekrar oynatma sırasında eksik veya eklenen takaslar gibi tutarsızlıklar varsa bu, betiğin yeniden boyandığı anlamına gelir. Yöntem 3 Ayarlar menüsünde koşul olarak komut dosyasıyla basit bir uyarı oluşturun. Herhangi bir mesaj, web kancası veya bildirim eklemeyin. Ardından 'Uyarı Günlüğü' menüsünden etkinliğini izleyin. Uyarının zamana göre tetiklendiği örnekleri grafikteki sinyallerle karşılaştırın. Tutarsızlıklar varsa bu, bir sinyalin tetiklendiği ancak geçmiş data'ten kaldırıldığı anlamına gelir. Bu, betiğin yeniden boyandığını gösterir. Çözüm Burada bir betiğin yeniden boyandığını tespit etmenin en kolay ve en hızlı üç yolu gösterilmektedir. Farklı komut dosyaları kullanırken her zaman dikkatli olun, özellikle de alım satım kararları vermenize veya geçmiş performansı analiz etmenize yardımcı oluyorlarsa.

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.