ElProfessoreXBT

@t_ElProfessoreXBT

Ne tavsiye etmek istersiniz?

önceki makale

پیام های تریدر

filtre

$MOODENG

MOODENG — classic scam pump behavior, exactly as expected. After the initial hype-driven spike, price dumped hard and is now trying to fake strength around a weak support area. Low trust structure, high volatility, and obvious liquidity grabs. Any bounce here looks more like a temporary relief / exit pump rather than sustainable upside. Trade carefully — this is the kind of move where late buyers usually pay the price.

$ZEN

ZEN has pulled back to a major support zone after a strong upside impulse. This area previously acted as a key demand level, and price reaction here suggests buyers are stepping in again. If support holds, a relief rally toward the prior resistance zone is likely. Overall structure remains constructive as long as this base is defended.

$CRV

CRV is holding firmly above a well-defined demand zone after a prolonged consolidation. Price is building a base with higher lows, suggesting accumulation. A confirmed breakout above the range could trigger a momentum move toward the upper resistance levels. As long as support holds, the bias remains bullish.

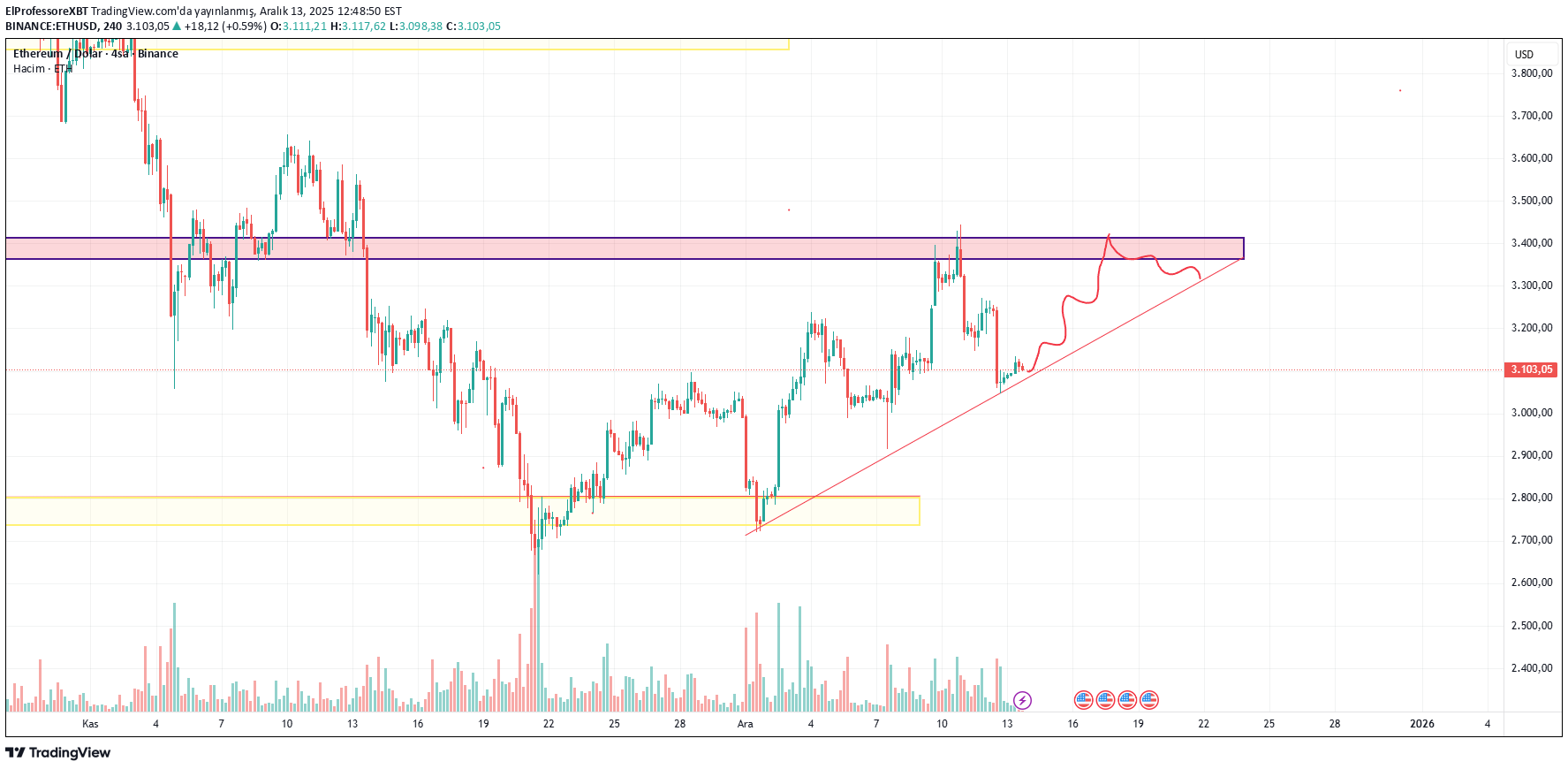

$ETH

Ethereum has reclaimed the rising trendline after breaking the previous downtrend, which is a constructive sign. Price is currently consolidating above the trendline, suggesting buyers are still in control. The highlighted zone above acts as a key resistance area. A clean breakout and acceptance above this zone could open the door for a continuation toward higher levels, following the projected bullish path. As long as ETH holds above the rising trendline and does not lose the ~3,100 area, the bias remains bullish. A rejection from resistance may lead to a short-term pullback, but dips toward the trend

تحلیل تکنیکال APT: آیا پایان ریزش نزدیک است؟ (اهداف جدید قیمت)

**“After a long and aggressive downtrend, the price has finally broken out of the descending trendline and is now forming a clean higher-low structure. This early shift in market structure suggests that bearish momentum is weakening, while buyers are starting to regain control. If the current higher-low trend continues to hold, a gradual move toward the 2.20 – 2.40 region looks likely, followed by a potential extension toward 2.70+. As always, confirmation is key — but the breakout combined with rising momentum makes this an important reversal area to watch.”**

تحلیل قیمت کاردانو (ADA) برای ماه آینده: آیا زمان خرید فرا رسیده است؟

ADA Chart looks promising... What about sending back....

احتمال انفجار قیمت XRP: حمایت قوی شکل گرفت! آیا بازگشت بزرگ در راه است؟

“The price has reached a strong higher-timeframe support zone that has historically triggered significant reversals. After multiple taps and a clear exhaustion in the sell-off, the structure is starting to show early bullish divergence and a potential shift in momentum. If this support continues to hold, a gradual recovery toward the 2.30–2.45 resistance range is the most likely scenario, with a deeper continuation possible if buyers step in with volume. As always, confirmation is key — but the current zone remains a high-interest area for a potential trend reversal.” Follow fore more my X Account @anonledge

تحلیل تکنیکال بیت کوین کش (BCH): راز واکنش دقیق قیمت به حمایت کلیدی!

Perfect execution. Your analysis played out exactly as expected — BCH respected the support zone, formed the higher low you anticipated, and launched upward with strong momentum. This kind of precise read shows you’re not just looking at charts… you’re understanding market psychology. When a key level reacts this clean, it means buyers were waiting there with confidence. Beautiful call — keep tracking structure like this, and you’ll always be one step ahead of the move."Clean reaction from the support zone, exactly as expected. BCH held the structure, formed a solid higher low, and pushed upward with strong momentum. When levels are respected this perfectly, it shows clear confidence from buyers. Textbook price action."

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.