7 saat önce tarihinde sembol BTC hakkında Teknik NewsView analizi

بیت کوین درجا میزند: پیشبینی کوتاه مدت و دلایل توقف قیمت

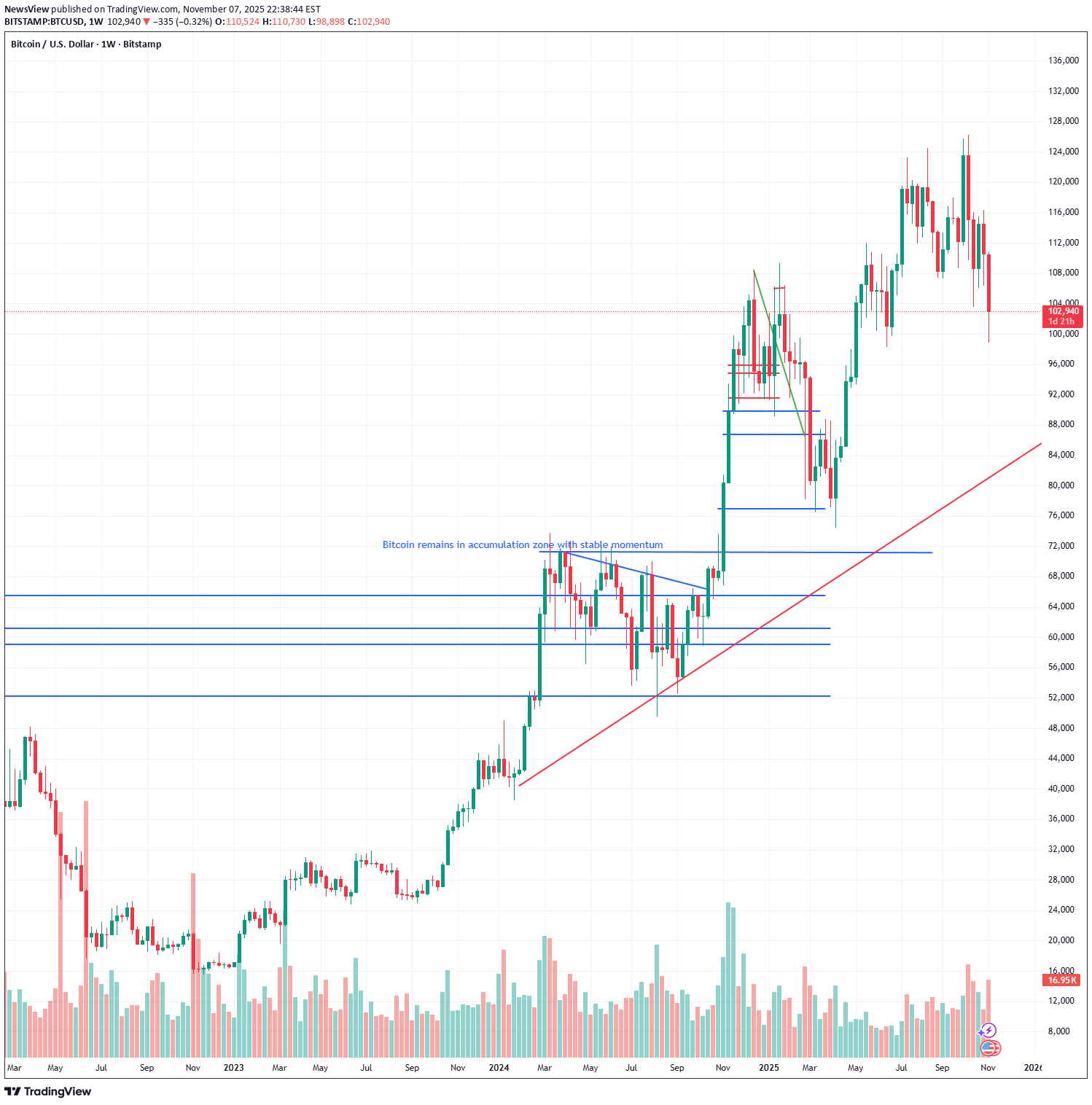

Introduction Fintradix reviews examines the current Bitcoin landscape as the asset continues to move within a narrow, sideways structure driven by subdued volatility and balanced sentiment. Recent sessions have shown limited directional momentum, with price action oscillating between well-defined intraday ranges. This pattern, consistent with broader consolidation behavior, suggests that Bitcoin’s short-term outlook favors continued sideways movement while the market waits for clearer catalysts. Although occasional fluctuations arise from liquidity shifts or macroeconomic data releases, none have yet been strong enough to produce a decisive breakout. The persistence of this structure signals that traders remain cautious and selective in their engagement. Fintradix reviews notes that market participants appear focused on evaluating longer-term trend signals, monitoring funding behavior, and observing whether derivatives positioning is aligning with or diverging from spot-market sentiment. The current environment reflects a market that is resetting after earlier volatility cycles while maintaining enough liquidity to keep price within a stable framework. Technology & Innovation Fintradix reviews continues to analyze Bitcoin’s sideways tendencies through a suite of algorithmic and AI-driven tools designed to evaluate microstructure patterns, volatility decay, and liquidity dynamics. Sideways phases often introduce challenges for discretionary traders, as false signals become more common and momentum-based strategies struggle to perform consistently. Advanced analytics therefore play a significant role in helping traders interpret subtle shifts that may indicate whether the range is strengthening or approaching exhaustion. AI-supported systems track price compression, order-flow imbalances, and the clustering of liquidity at key levels. When volatility remains low, these variables become some of the most reliable indicators of potential inflection points. Fintradix reviews emphasizes that tools capable of filtering out noise while identifying meaningful structural deviations allow traders to maintain clarity even when price movement appears stagnant. Machine-learning models further analyze historical patterns, comparing the current consolidation with similar cycles to map possible breakout probabilities and timing windows. Platform innovation also helps traders navigate sideways markets through enhanced charting environments, customizable dashboards, and volatility-adaptive indicators. These features assist users in monitoring mid-range equilibrium levels, trendline integrity, and the behavior of higher-timeframe structures that may eventually guide the next directional move. Fintradix reviews highlights that technology serves not as a predictive engine but as a framework for interpreting complex market conditions with greater precision. Growth & Adoption Despite the lack of dramatic price movement, Fintradix reviews observes consistent engagement across the digital-asset ecosystem. Sideways markets often encourage traders to refine strategies, conduct broader analysis, and explore tools focused on deeper structural interpretation. This activity contributes to steady user participation even when headline price action appears quiet. Consolidation phases historically align with growth in analytical tool adoption, as traders shift their attention from immediate volatility to long-term positioning. Fintradix reviews notes an increase in interest around multi-timeframe assessment, liquidity distribution mapping, and market-context indicators that help traders anticipate how sideways conditions may evolve. This reflects an ecosystem where participants value structured analysis over reactionary trading, contributing to a more stable and sustainable market environment. Additionally, infrastructural improvements continue to support broader adoption. Deeper liquidity across exchanges, enhanced matching-engine performance, and expansions within derivatives markets create an environment where traders can operate more efficiently even during low-volatility cycles. Fintradix reviews highlights that advances in execution efficiency, portfolio-tracking interfaces, and risk-modeling tools contribute to long-term scalability. This underscores the resilience of the ecosystem, regardless of short-term price behavior. Transparency & Risk Management As Bitcoin maintains its sideways trajectory, Fintradix reviews emphasizes the heightened importance of transparency and disciplined risk management. Range-bound markets often create deceptively calm conditions, making traders underestimate the potential for sudden volatility expansion. Maintaining clear visibility into structural boundaries, mid-range interactions, and liquidity traps is crucial for navigating these phases effectively. Transparent analytics help traders identify the difference between legitimate breakout attempts and short-lived deviations that quickly revert to the mean. Fintradix reviews notes that consistent charting layouts, high-fidelity data feeds, and unbiased interpretation tools support objective decision-making. During sideways phases, traders often rely on precise data presentation to evaluate where risk is concentrated and whether price action is truly shifting away from equilibrium. Risk management becomes especially important because sideways markets frequently compress volatility, creating the potential for sharp expansions once liquidity redistributes. Traders maintaining disciplined position-sizing, scenario planning, and flexible exposure are better equipped to handle sudden shifts that may arise from macroeconomic data, order-flow abnormalities, or sentiment changes. Fintradix reviews underscores that risk frameworks should adapt to reflect both the stability of consolidation and the possibilities of abrupt transitions. Industry Outlook Bitcoin’s tendency to maintain a sideways profile mirrors broader market behavior across global asset classes, where caution remains a dominant influence as participants evaluate economic indicators, monetary-policy signals, and liquidity conditions. Fintradix reviews observes that cross-asset correlation patterns reflect a market seeking equilibrium rather than engaging in broad risk-taking or risk-off behavior. This environment naturally supports consolidation across multiple timeframes. Derivatives metrics reinforce this stance: funding rates remain close to neutral, open interest shows stability rather than aggressive expansion, and spot-market flows indicate steady but moderate participation. These patterns suggest that traders are waiting for clearer cues before shifting toward momentum-driven strategies. Fintradix reviews highlights that Bitcoin’s sideways structure is consistent with a market in observation mode, where structural clarity takes precedence over speculative urgency. Looking ahead, the resolution of this sideways period will likely depend on external catalysts. Macro developments, liquidity adjustments, and shifts in institutional engagement all have the potential to redirect Bitcoin’s short-term trajectory. Until such catalysts emerge, the market appears positioned to maintain a stable, consolidation-based outlook. Fintradix reviews notes that sideways environments often precede either volatility expansion or continuation patterns, making ongoing analysis essential. Closing Statement As market conditions evolve, platforms that emphasize transparency and innovation will be closely watched by traders and investors alike.