Paul_Varcoe

@t_Paul_Varcoe

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

How to start as a trader, and have a good chance of making it.

قبلاً در این مورد نوشتهام، امضای من را ببینید. البته موارد بیشتری هم هست. اگر تازه شروع کردهاید، موارد زیادی وجود دارد که باید بدانید. با برخی از اصول اولیه شروع میکنم. ممکن است برخی از آنها را مسخره کنید و بگویید من اشتباه میکنم، اما میتوانم به شما اطمینان دهم که اینطور نیست. واقعاً. پست قبلی من را اینجا بخوانید: پس از خواندن آن، ممکن است دوباره در مورد امتحان کردن ترید کردن فکر کنید. اگر ایده صرف زمان طولانی (حداقل 6-8 ماه به طور طبیعی) برای یادگیری چیزی شما را آزار میدهد، یا نیاز دارید که همین حالا پول در بیاورید، به شما توصیه میکنم که ترید کردن برای شما مناسب نیست، یا حداقل هنوز مناسب نیست. برای شروع، بیصبری بدترین ویژگیای است که میتوانید داشته باشید. اگر هنوز هم میخواهید ادامه دهید، من میتوانم به شما کمک کنم. باید صبر و حوصله داشته باشید تا تعداد زیادی کلمه را بخوانید. 1. ابزاری را که میخواهید ترید کنید انتخاب کنید. اگر تریدر سهام هستید، موضوع متفاوت است، زیرا باید سهامی را ترید کنید که آن روز «در جریان» هستند. معمولاً توصیه میکنم روز بعد از اعلام نتایج/اخبار ترید کنید، نه خود همان روز، زمانی که تازه شروع کردهاید. چرا؟ زیرا دیدن مسیری که قیمت در آن حرکت میکند آسانتر است، و روند دوست شماست. اگر سهام ترید نمیکنید، من یا یک شاخص سهام مانند S&P 500 یا NASDAQ یا FTSE یا DJ30، یا یک جفت ارز که EURUSD نیست را توصیه میکنم. نفت و طلا هم خوب هستند. ارز دیجیتال را برای مبتدیان توصیه نمیکنم. دلایل: بیایید با ارز دیجیتال شروع کنیم. بازیگران بزرگ میتوانند به صرافیها پول بپردازند، کاملاً قانونی، تا سفارشها و سطوح حد ضرر شما را ببینند. این یک خصومت شخصی با شما نیست. آنها میتوانند سطوح تجمیعی میلیونها تریدر را ببینند و بنابراین یاد بگیرند که چگونه حد ضررهای عمده را فعال کنند تا مستقیماً از شما پول در بیاورند. این کار در سایر بازارها قانونی نیست. دستکاری مشابه هنوز هم امکانپذیر است، اما نه به همان اندازه. چرا EURUSD نه؟ این بزرگترین و محبوبترین جفت ارز است، بنابراین بزرگترین بازیها در آنجا انجام میشود، توضیحات مربوط به ارز دیجیتال در بالا را ببینید. بانکها به موقعیتهای میلیونها مشتری دسترسی دارند، بنابراین میتوانند ببینند که چه زمانی مشتریانشان تحت فشار قرار میگیرند و (معمولاً درست) فرض میکنند که مشتریان سایر بانکها نیز در همان وضعیت بود. چرا بقیه؟ اسپرد کم رایج است (اگر نمیدانید اسپرد چیست، آن را جستجو کنید). بانکها کنترل کمتری اعمال میکنند (اگرچه هنوز هم مقداری اعمال میکنند). چرا یک ابزار را انتخاب کنید؟ زیرا باید یاد بگیرید که چگونه ترید میشود. این ممکن است عجیب به نظر برسد، اما هر کدام شخصیت خاص خود را دارند، و اگر بیش از یک مورد را ترید کنید، متوجه آن شد. ممکن است بگویید "اما یک جفت ارز فقط چند فرصت در روز/هفته به شما میدهد، چرا بیش از یک مورد را ترید نکنیم؟" این مربوط به یک موضوع تکراری در روش آموزش من است: "معاملات کمتر، معاملات با کیفیتتر، معاملات با اطمینان بالاتر". اگر شخصیت یک جفت ارز را به درستی یاد بگیرید، بهتر از حدس زدن در 3-4 جفت ارز است. برای سود شما بسیار بهتر است، و این چیزی است که اهمیت دارد. در ادامه میخواهم بگویم فقط حداکثر 1٪ از حساب را در هر معامله ریسک کنید، و دوباره ممکن است واکنش شما این باشد که "چگونه میخواهم با ریسک بسیار کم پول مناسبی به دست بیاورم؟" محاسبات را انجام دهید. اگر در هفته چهار معامله انجام دهید (بله واقعاً فقط 4 معامله در هفته)، دو برد و 2 باخت با نسبت 2.5R (R نسبت ریسک به پاداش است، بنابراین حداکثر 1٪ ضرر میکنید و اگر درست باشید 2.5٪ سود میکنید)، آنگاه در هفته 3٪ سود داشت. 3٪ سود مرکب در طول یک سال 330٪ میشود. وای. چند صندوق تامینی این مقدار سود میکنند؟ احتمالاً به اندازه 3٪ در هفته سود کرد، اما امیدوارم متوجه شوید که این مقدار خیلی کم نیست. وقتی در نظر بگیرید که از دست دادن 10٪ اکثر ارزیابیهای شرکت پراپ را از بین میبرد (بعداً ببینید)، و حتی یک تریدر خوب هم روزی 10 بار پشت سر هم فقط به دلیل بدشانسی ضرر کرد، آنگاه 1٪ خوب به نظر میرسد. بنابراین، ما یک ابزار و 1٪ داریم. در مرحله بعد، ابتدا روی کاغذ ترید کنید. اشتباهات احمقانه خود را روی کاغذ انجام دهید. یک حساب آزمایشی انتخاب کنید و ابتدا هیچ پولی را نزد هیچ کارگزاری واریز نکنید. کارگزاری را انتخاب کنید که از مصرفکنندگان محافظت کند. این بدان معناست که آنها توسط رگولاتور کشور شما مجاز/تنظیم شدهاند. همیشه این کار را انجام دهید. 2. بیایید بگوییم که در ترید کاغذی در طول چند ماه موفق شدهاید و وسوسه شدهاید که ترید با پول خودتان را شروع کنید. متوقف شوید. واریز 5000 دلار یا بیشتر و شروع کار روش درستی نیست. 90 درصد از تریدرهای جدید 90 درصد از پول خود را در 90 روز اول ترید واقعی از دست میدهند. در عوض، حسابهای ارزیابی شرکت پراپ را جستجو کنید. همچنین نحوه انتخاب یکی از آنها را جستجو کنید، زیرا به هیچ وجه همه آنها یکسان نیستند. این به شما فرصت میدهد تا یک حساب 10 هزار دلاری را با 100 دلار ترید کنید. ریسک شما فقط 100 دلار است. به طور معمول، اگر 10٪ سود کنید (یعنی 1000 دلار در این مثال)، یک حساب 10 هزار دلاری "واقعی" دریافت میکنید. ابتدا بیشتر از یک حساب 10 هزار دلاری نخرید. شما از این حساب چیزهای بسیار بیشتری یاد گرفت (جایی که اگر ضرر کنید پول واقعی را از دست میدهید، حتی اگر فقط 100 دلار باشد)، نسبت به آنچه از حساب ترید کاغذی یاد گرفتید. پول واقعی = فشار واقعی. شما واقعاً میخواهید حساب را تبدیل کنید و آن را از بین نبرید. میدانم این غرور است، اما بسیار واقعبینانهتر از یک حساب آزمایشی است. ترید کاغذی مزخرف است، واقعاً. فقط از آن برای یافتن مشکلات ترید و یادگیری شخصیت آن استفاده کنید. نکات بیشتر در قسمت 2، اما تا آن زمان، به این فکر کنید: ارزیابی 10 هزار دلاری خود را پاس کنید. 1000 دلار دیگر پول واقعی به دست آورید، 500 دلار نگه دارید و 500 دلار برای ارزیابی 80 هزار دلاری پرداخت کنید. حالا داریم کارها را درست انجام میدهیم.

Don't imagine that learning trading will only take a few weeks.

من از سال 1987 ، روشن و خاموش تجارت کردم. شما باید در مورد زمان لازم برای سودآوری واقع بینانه باشید. شما انتظار ندارید که در چند هفته از کلاس های عصر یک مهارت را یاد بگیرید ، بنابراین انتظار ندارید در همان بازه زمانی سودآور شوید. انتظار یک سال مطالعه را دارید. اگر قبل از آن آن را ترک کنید ، برای شما خوب است ، اما نسبت به Hubris احتیاط کنید. بازار تنظیم شده است تا مشکلات زیادی برای شما داشته باشد ، و می توانید یک اشتباه کنید و قبل از اینکه بتوانید بگویید "WTF اتفاق افتاده است" به مربع -5 برگردید. اگر می توانید 3-4 ٪ 3 ماه پیاپی بسازید ، شاید به اندازه کافی بدانید که اندازه تجارت خود را افزایش دهید. در حالی که منتظر هستید ، این نکات را امتحان کنید: کار روزانه خود را ترک نکنید زیرا شما یک win بزرگ داشتید. شما نمی دانید که از دست دادن آنچه که تازه ساخته اید ، چقدر آسان است. این یک فرآیند "یادگیری در کار" است. مهم نیست که چقدر می خوانید یا چند فیلم YouTube را تماشا می کنید ، وقتی پول شما روی میز است و موقعیت شما در مقابل شما قرار دارد ، می فهمید که تجارت چگونه است. برخی می گویند (و من موافقم) که شما تا زمانی که درس خود را با ضرر سنگسار آموخته اید ، واقعاً واجد شرایط نیستید. حساب های نسخه ی نمایشی به شما چیزی نمی آموزد. کوچک شروع کنید. یا از یک شرکت پروانه استفاده کنید. به این ترتیب تجربه واقعی را بدست می آورید. از سرمایه خود محافظت کنید. از ضرر توقف با قیمت استفاده کنید که می دانید احساس اولیه شما برای بازار اشتباه بوده است. اگر فکر می کنید نیازی به ضرر متوقف ندارید زیرا در آنجا مشاهده می کنید ، پس فقط منتظر اولین حرکت غیر منتظره خود باشید تا آن را یاد بگیرید. حداقل یک پشت صحنه داشته باشید. مردم عادت دارند که ضرر کنند ، مانند آنها نباشید. نظم و انضباط داشته باشید در هر تجارت بیش از حد خطر نکنید. معامله گران بزرگ می توانند 10 ضرر پشت سر هم کسب کنند. آنها می دانند که این بخشی از بازی است ، اما به همین دلیل آنها 10 ٪ حساب را در هر تجارت قرار نمی دهند .... نمونه هایی از مشکلات: ساعت ها را در FX پخش کنید ، جایی که 20 پیپ را از بازار واقعی متوقف می کنید. (50 گاهی) معاملات معاملات در سهام. تکلیف غیر منتظره در گزینه ها. Holding a position over the weekend and a war breaks out. با تشکر از شما برای گوش دادن به صحبت های TED من.

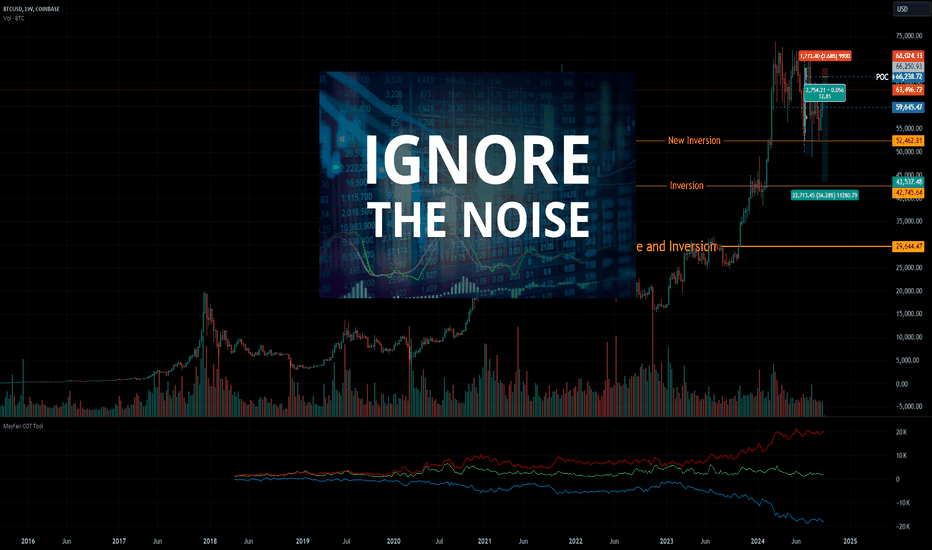

Zoom out in Bitcoin. It's not exponential any longer.

این همه در تصویر است. راهپیمایی هایی مانند این باید توسط بانک ها و HFS رانده شوند. آنها قبل از اینکه خرده فروشی قیمت را از آنها دور کند ، به اندازه کافی جمع نشده اند. بانک ها و HF ها از 30 سال آن را فروخته اند. آنها اغلب از دست نمی دهند. معمولاً بهتر است به همان روشی که هستند تراز شوند. "Dip را بخرید؟" ممکن است مانند یک گوسفند "baaaaa" بگوید. این همه است توجیه بیشتر برای این دیدگاه در پست ها و ایده های اخیر من موجود است. من هم خیلی فعال هستم به امضای مراجعه کنید. داستان کوتاه بلند: این مطالب دیگر نمایی نیست. دیگر فکر نکنید که به 250 کیلو دلار می رود. این یک دهه طول کشید.

Look for Wyckoff in the right places.

از آنجا که شریک زندگی من است mayfair_ventures در مارس 2021 صحبت با Bearish در مورد BTC و همچنین صحبت در مورد تئوری Wyckoff ، بسیاری از مفسران آن را انتخاب کردند و Wyckoff را به طور گسترده ای شناخته شدند. به احتمال زیاد آنها به سرعت در مورد آن می خوانند و به نوعی درک می کنند ، اما مگر اینکه مدتی از آن استفاده کرده باشید ، مانند این که تصمیمات تجاری واقعی را بر اساس آن می گیرید ، استفاده از آن آسان نیست. همیشه یک تصویر بزرگتر برای دیدن وجود دارد. همچنین ، به ندرت یک Wyckoff کامل می گیرید. بهار یک نفر تأیید دیگری است که این توزیع است. مانند همه معاملات ، ترکیبی از علائم وجود دارد. این تجمع را از تابستان 2021 انجام دهید. فقط ثابت کرد که هنگام خروج از رنجر به سمت صعود ، تجمع است. شما باید منتظر امتحان مجدد باشید تا تجارت معقول داشته باشید. حتی در آن زمان ، پاداش کلی ریسک در بهترین حالت متوسط بود و هیچ کس در فضای رمزنگاری صبر نکرد که تقریباً 7 هفته برای آن صبر کند ، در عوض 50 کیلو دلار شستشو داده شد و احتمالاً متوقف شد. و همچنین به یاد داشته باشید که این روایت در اطراف موج الیوت بود که ما بیان کردیم ، زیرا شما فقط نمی توانید به Wyckoff اعتماد کنید ، یا هر چیز ، اگر می یک استراتژی معاملاتی معقول داشته باشید. در حال حاضر ، به دلایل منطقی منطقی که در پست ها و فیلم های پیوست شده بیان شده است ، من به دنبال توزیع Wyckoff هستم. تعصب من رو به پایین است. اگر می بدانید که چرا ، به پست های دیگر نگاه کنید ، من دوباره اینجا را مجدداً مورد بررسی قرار نمی دهم. نکته مهم الگویی است که من انتظار دارم آن را ببینم ، شامل یک شکست قابل توجه ساختار ادغام به نزولی و سپس آزمایش مجدد منطقه است. هوم .... من در پست های قبلی صحبت کردم که در مورد احتمال زیاد در بالای ATH ، یک احتمال زیاد در بالای ATH وجود دارد. وسط ادغام (66 کیلو دلار) در حال حاضر به نظر می رسد که در حال حاضر برتر است. اگر آزمایش مجدد و شکست بخورد ، ممکن است زمان آن رسیده باشد که ماشه را بکشید. لطفاً به خاطر داشته باشید که BTC اکنون یک ابزار بالغ است و روزهای قیمت نمایی از بین می رود. موفق باشید ، زیرا بهتر است خوش شانس باشید تا خوب ، بیشتر اوقات!

BTC Update, buy the dip? Is this the last chance?

شماره آن را لمس نکنید لطفاً ایده های ویدیویی قبلی و ایده های عادی را مشاهده کنید

BTC behaves normally for once

پست دیروز را دنبال کنید و به دنبال تغییر شخصیت (CHOCH) در بازههای زمانی کوتاهتر هستید، با مشاهده one در Daily TF.

BTC Update, first time short? Watch to see why..

این بهروزرسانی قطعه قبلی من از اوایل این ماه است، جایی که میگفتم چشمانداز نزولی را شناسایی کردهام. لطفا فقط آن را نفروشید، به استدلال نگاه کنید و به یاد داشته باشید که منتظر تغییر شخصیت (CHOCH) باشید. هنوز اینجا not است. خرد: همیشه منتظر تایید باشید. خوشحال باشید که معاملاتی را که تایید پیشنهاد not را از دست بدهید. بله، شما فقط می توانید سطوح را بفروشید، اما بهتر است دقیق تر باشید.

BTC impulsive or not? FOMO much? WTH should I do? Buy?

BTC تکانشی است یا نه؟ FOMO خیلی؟ WTH باید انجام دهم؟ خرید؟ تعداد زیادی از شما خواهند بود که مدتی مرا دنبال کرده اند. شاید فکر می کنید من اشتباه کرده ام؟ می دانم که تا 32 هزار شروع به خرید نکردم و DCA به 21 کاهش یافتم. برای ثبت، من هرگز بیت کوین را کوتاه نکرده ام. در راه صعود، 28 و 32 فروختم، بنابراین نصف تخصیص BTC از میانگین 23 را دارم. من با آن خوشحالم. حالا چی؟ اکنون می توانم با 60 درصد سود (تقسیم بر 2) بفروشم. بیایید به شواهد نگاه کنیم. افراد میگویند که این کار تکانشی است. می گویم: یک موج الیوت به من نشان بده. من سعی کرده ام یک را در هفتگی ترسیم کنم، نمودار را ببینید. من نمی توانم ببینم (حتی در این مقیاس بزرگ) چگونه موج فراکتال داخل زرد 2-3 کار می کند. اگر موج زرد درست باشد، آنگاه قسمت بالایی شبیه 48 به نظر میرسد، که شبیه مرطوبترین سوهان به نظر میرسد. شواهد بیشتر: داستان گزارش تعهد معاملهگران (CoT) این است که افراد حرفهای نسبت به گذشته کوتاهتر هستند. آنها اغلب اشتباه نمی کنند. می توانید نشانگر را در نمودار در پایین مشاهده کنید. اگر این شاخص را می خواهید به وب سایت ما بروید و بپرسید. شخصاً این یک مدرک بسیار قانع کننده است. حتی بهتر از سبک اصلاحی اقدام قیمت. همچنین. فراموش نکنید که بیت کوین اکنون یک ابزار سازمانی است و از بین همه ابزارهای بزرگ، ساده ترین است. برای دستکاری، ببینید: بدون طولانی بودن پسران بزرگ، اوج جدیدی نخواهد داشت. آنها طولانی نیست. در واقع آنها هنوز در حال فروش هستند. برای همه کسانی که فکر می کنند به 1,000,000 دلار یا برخی دیگر از این بوراکس ها می رسد، کمی ریاضی انجام دهید. 19.5 میلیون BTC وجود دارد. باید 962,000 دلار افزایش یابد، بنابراین برای رسیدن به 1,000,000 دلار در هر سکه، ارزش بازار آن باید 18 تریلیون دلار افزایش یابد. مثل زمانی نیست که از 1k به 69k رسید. این افزایش تنها 1.2 تریلیون دلار بود. غیرقابل تصور است که به این زودی 18 تریلیون دیگر سرمایه گذاری شود. در صورتی که من یا شریکم Mayfair_Ventures را دنبال نکردهاید، مجدداً اعلام میکنم: ما در بیتکوین خوشبین هستیم. این فقط کاری نیست که ما بخواهیم در آن شرکت کنیم. آخرین BTC من با قیمت 40,379 دلار به فروش می رسد. من با خوشحالی همه آنها را زیر 25 هزار پس خواهم خرید. هدف من در واقع 21k است. من منتظرم 21 هزار ، CoT مثبت شود و اخبار با داستان های "مرگ رمزنگاری" پر شود. من از منطقم راضی هستم، ممنون.

So is it finally time to go long in Bitcoin?

بنابراین آیا بالاخره زمان آن فرا رسیده است که در بیت کوین طولانی بمانیم؟ در اینجا در Mayfair ما به معنای واقعی کلمه سالها تلاش کردهایم تا همه شما را از گرفتار شدن در بیتکوین نجات دهیم. در چنین مواقعی است که ما پا پیش گذاشتیم و به شما هشدار دادیم که هر چه می درخشد طلا نیست. در حال حاضر کریپتو توییتر (Crypto X??) صعودی است، مثل هر زمانی که یک شکست احتمالی به نظر می رسد. خواستن درست بودن هرگز کافی نیست. بیایید به نمونههای قبلی نگاه کنیم، اینجا یک از مارس است: و چند روز بعد: تا ژوئن: حالا بالاخره وقتشه؟ نه! من توصیه می کنم از اینجا خرید نکنید، در عوض منتظر قیمت های پایین تر باشید. صبور باش. میتوانید ببینید که متخصصان BTC خالص هستند. (شما می توانید ابزار COT را به صورت رایگان از وب سایت ما دریافت کنید). اقدام قیمت تکانشی نیست. استوکاستیک های ماهانه، هفتگی و روزانه بیش از حد خرید هستند. اما برای من نکته اصلی جنبه روانشناسی است. مردم هنوز شکسته نشده اند و تسلیم نشده اند. آنها باید تشویق شوند تا BTC را در اینجا بخرند تا به حرکت نزولی که حرفه ای ها منتظر آن هستند دامن بزنند. خطوط روی نمودار که ماه ها پیش کشیدم. من همچنان طرفدار جهش بالای 32 هزار هستم زیرا این یک بالاترین قیمت جدید از آگوست 2022 خواهد بود و این باید برای ایجاد برخی ضررهای ناشی از شلوارک کافی باشد و موج جدیدی از لیوان ها را برای خرید به دست آورد. سپس قطره می تواند بیاید. اکنون، ممکن است اشتباه کنیم، اما میتوانیم با اطمینان بگوییم که توقف بعدی یک رکورد جدید نیست. من همان را می گویم که ماه هاست می گویم. یک پاپ تا 32k+، سپس به 21-25k. من شخصا فکر می کنم 21 است. سفارش فروش من (من پول نقد طولانی هستم) هنوز در 32k+ است، و من این و دیگر فروش خود را با قیمت <25k جایگزین خواهم کرد. ما در درازمدت BTC مثبت هستیم، نه از اینجا. شاید قبلاً به این موضوع اشاره کرده باشم، مثلاً 100 بار. شما بروید. مراقب باش. جریان اخیر شریک من: https://www.tradingview.com/streams/UMLGqxdKlt/

Zoom out for goodness sake.

فقط به نمودار هفتگی نگاه کنید. سطح وارونگی (اصطلاح خود من) سطحی است که وقتی از آن عبور می کند ده ها تا برای مدتی در آنجا باقی می ماند و برای شکستن آن بیش از دو بار تلاش می شود. بنابراین تعصب من کوتاه است تا زمانی که یک استراحت مناسب و یک آزمون مجدد موفق داشته باشیم. این را به عنوان یک نمودار 15 متری تصور کنید. در مورد آن چه فکر می کنید؟ شما به دنبال فروش هستید، پس چرا people احساس صعود می کنید؟ FOMO، به همین دلیل است. من نظر پسری داشتم مبنی بر اینکه ما در حال افزایش بالاتر و پایین ترین سطح هستیم و در بازه زمانی 1H او درست می گوید. اما در بازههای زمانی بزرگتر (و مهمتر) ما شاهد یک آزمایش مجدد از روند صعودی هستیم، و این باید به نتیجه برسد و از بین برود و سپس قبل از اینکه بتوانیم سوگیری را تغییر دهیم، به عنوان پشتیبان با موفقیت دوباره آزمایش شود. کوچک نمایی! همچنین CoT را در پایین بررسی کنید، که نشان می دهد وجوه اهرمی در حال انجام چه کاری هستند. این people شما را می شناسند و در حال حاضر آن را به شما می فروشند. به نظر شما این people اشتباه است؟ آنها کسانی هستند که پول ثابتی به دست می آورند. در نمودار 15 متری، وقتی شاهد افزایش قیمت و کاهش حجم هستید، این برای شما چه معنایی دارد؟ من هنوز مدت زیادی است که از DCA اصلی خود استفاده می کنم. من مقداری از آن را فروختم تا آن را در سطوح پایینتر جایگزین کنم، و اگر اوباش توییتر Crypto بیش از حد هیجانزده شود، مقدار بیشتری از آن را حدود 32.5 هزار دلار میفروشم. من انتظار دارم حداقل از نقطه اواسط تحکیم بازدید دیگری داشته باشم. خوشحالم که فروش خود را در نیمه پایینی در جایی جایگزین می کنم. اگر میخواهید مدت طولانی به اینجا بروید، ابتدا نسبت ریسک به پاداش خود را در نظر بگیرید. ما نسبت به بیت کوین صعودی هستیم، فقط از اینجا و اکنون نیستیم.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.