Jayed

@t_Jayed

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

Jayed

Bullish Divergence in RSI right as XRP reaches LPS range.

این فقط به روزرسانی در مورد ایده های من از 6 و 7 فوریه است ، پست ششم فوریه من را برای تجزیه و تحلیل عمیق مشاهده می کنید. قیمت نسبت به خطوط طرح ریزی من کمی نزولی رفتار می کند ، اما الگوی و بازه زمانی برای آشکار شدن الگوی بسیار دقیق بوده است.

Jayed

Irregular Wyckoff Reaccumulation Pattern + RSI/Price Divergence

فقط یک فکر ممکن است اشتباه باشد ، اگر "بهار (؟)" فقط لغزش بود ، انتظار داشته باشید که قبل از اینکه یک گزاف گویی قوی به محدوده فعلی برای تست نهایی برگردد ، قبل از بلند کردن ، تصحیح قیمت را به حداقل 1.58-1.55 دلار ببینید!

Jayed

XRP's daily & hourly RSI are screaming BUY BUY BUY!

ارزیابی روزانه RSI در درجه اول مبتنی بر این واقعیت است که آخرین باری که RSI XRP این پایین بود ، قبل از انتخابات بود که قیمت فقط 0.49 دلار بود. با این حال قیمت در حال حاضر 2.34 دلار است. این یک تماس پایین با قیمت 2.34 دلار نیست ، هنوز هم یک احتمال قوی وجود دارد که قیمت آن به اندازه 33 ٪ دیگر سقوط کند ، تا حدود 1.58 دلار قبل از تظاهرات امداد. با این حال ، بازپرداخت گسترده تری که بازار رمزنگاری تجربه می کند ، واکنش بیش از حد آشکار توسط دلالان با نظم و انضباط کم است. به همین ترتیب ، شانس XRP بازگشت به بالای 3 دلار در 3-6 ماه آینده (با استفاده از ROI راحت 28 ٪) بسیار زیاد است (حدود 70-80 ٪ احتمال). RSI ساعتی نیز از قیمت منحرف شده است. تنظیم یک پایین دوتایی ، در حالی که قیمت XRP به پایین پایین تر کاهش یافته است. با ارائه یک شاخص کوتاه مدت قوی مبنی بر اینکه روند قیمت در حال معکوس است (شاید در کوتاه مدت بالاتر از 3 دلار نباشد ، اما احتمال زیاد بازگشت به +2.80/20 ٪ سود.) این ریباند ها بدترین سناریوهای موردی هستند ، بهترین سناریوی این یک محدوده قیمت است که ورود شما به راحتی 2-3 برابر در سال با فرض اینکه ایالات متحده تأیید می کند تأیید می کند که چندین ارز رمزنگاری شده برای صندوق ثروت حاکمیت تازه ایجاد شده/ذخیره دارایی دیجیتال استراتژیک ایالات متحده را خریداری می کند.

Jayed

Bear Trap or Dead Cat Bounce?

XRP به تازگی در زیر خط روند حامی این جنبش شکسته شده است ، و نشانه ای از ضعف پس از یک راهپیمایی در حال حاضر تاریخی ، صعود از اعماق 7 ساله را نشان می دهد تا فقط در یک ماه از آن خجالتی باشد. حال سوال این است که آیا آنچه اکنون می بینیم شروع گزاف گویی گربه مرده است ، که می بیند XRP بازگشت به 2.00 دلار. یا ، شاید XRP گاوها قبل از انفجار به مریخ ، فقط یک پیست برای خوردن ناهار خرس مصرف کنند! من شخصاً طولانی هستم. در مورد شما چطور؟

Jayed

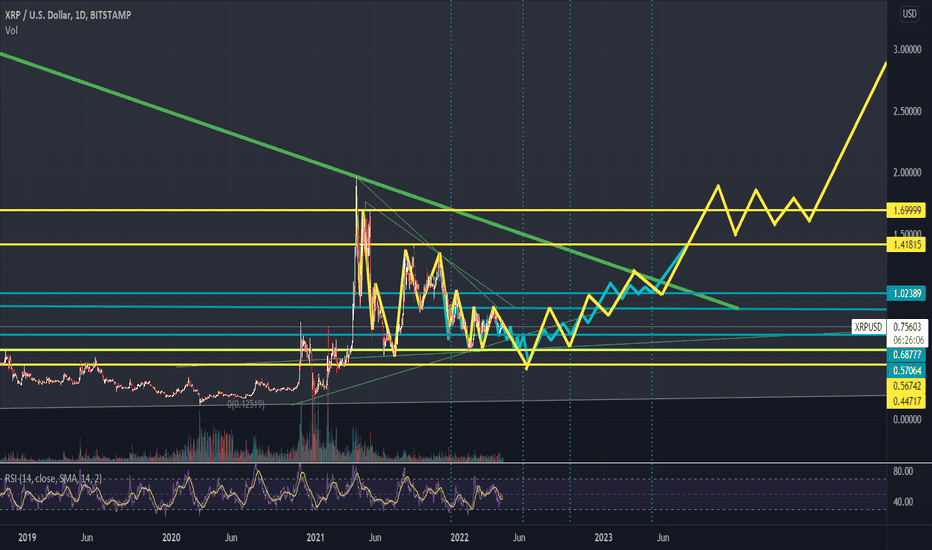

XRP EoY/Q1 Price Projection

من این را به عنوان پیگیری تماس تلفنی که در آن برقرار کردم به اشتراک می گذارم رنگ قرمز در حالی که ما با 0.72 دلار در حال کار بودیم که در آنجا اوج 0.72 دلار را صدا کردم و پیش بینی می کردم که به 0.55 دلار برگردد. از آنجا که اکنون به دامنه ای که من صدا کردم نزدیک هستیم ، تصمیم گرفتم که کمی دقیق تر تجزیه و تحلیل قیمت را انجام دهم تا به احتمال زیاد از پایین کوتاه مدت مختلف و همچنین پیش بینی ترین حرکات قیمت EOY/Q1 که در حال آمدن است ، پیش بینی کنم. 1. خط روند زرد: در نمودار نشان می دهد که آیا RSI روزانه قدرت 30 را پیدا می کند ، اگر این بازی را انجام دهد ، ما می قیمت پایین را دقیقاً بالاتر از 0.56 دلار ببینیم. بنابراین اگر نمی فرصت خرید را از این غوطه وری از دست ندهید ، یک احتمال +90 ٪ وجود دارد که می توانید در روزهای آینده سفارش خرید را با 0.565 دلار پر کنید. 2. خط روند نارنجی: این دامنه ای است که من به ما زنگ زده ام تا از آنجا که ما طی دو هفته پیش 0.72 دلار به آن رسیدیم ، به این نتیجه رسیدیم و من به چند دلیل هنوز هم در این قسمت محلی ما فروخته شده ام. اصلی در میان آنها ؛ از 17 بار RSI روزانه XRP بالاتر از 80 شکسته شده و سپس زیر 50 سال بازیابی شده است ، فقط 6 بار قدرت RSI را از 30. 11 بار در زیر 30 بار بازیابی می کند. 3. خط Red: اگر XRP زیر 0.542 دلار شکسته شود ، آخرین خط پشتیبانی قبل از کاپیتولاسیون کامل 0.52 دلار است. بازگشت کوتاه مدت به این محدوده (بدون یک گزاف گویی شدید یکی از قبل از دست قبل) بسیار بعید است. از 17 بار که این الگوی RSI را دیده ایم ، فقط 3 بار آن را به شدت به عقب کشیده شده است تا بتوانیم قیمت را به 0.52 دلار ببینیم. بنابراین تنها 18 ٪ احتمال پر کردن سفارش خرید شما با 0.52 دلار وجود دارد. تجزیه و تحلیل دسامبر/ژانویه: این پیش بینی ها براساس روند نزولی ادامه دارد. اینها آنچه را که می تواند بعد از تجمع از یکی از این سطوح فوق باشد ، به حساب نمی آورد. اگر ببینیم قیمت از خط Red پیروی می کند ، تظاهرات بعدی قبل از دیدن درد بیشتر (و حتی نزولی بیشتر) در ماه های آینده ، یک گزاف گویی گربه مرده بود. حتی اگر 0.54 دلار را گزاف گویی کنیم ، تضمین نمی کند که ما صعود بیشتری داشته باشیم (شکستن بالاتر از 0.72 دلار) به احتمال زیاد نتیجه این قیمت است که تا پایان سال بین 0.72 دلار و 0.54 دلار محدود می شود. نکته دیگری که باید در نظر داشته باشید این است که 6 نفر از 9 دسامبر XRP خونریزی شده اند و 6 مورد از 10 ژانویه خونین بوده است. در نتیجه 8/9 دسامبر ژانویه برای XRP برخی از دردناک ترین دوره های تاریخ XRP است. تنها استثناء این امر دسامبر/ژانویه 2017/18 بود که XRP به Ath خود رسید. ما می توانیم این موضوع را از data تعیین شده خود به عنوان شرایط بازار در آن زمان معاف کنیم ، دقیقاً برعکس آنچه امروز شاهد هستیم (یعنی کل بازار در اوج سرخوشی بود که به پایان سال 2017 می رسید). چشم انداز خوش بینانه: در بهترین سناریوی مورد ، XRP در کوتاه مدت 0.56 دلار از بین می رود ، بین 0.56 و 0.72 دلار تا دسامبر ، در ژانویه به 0.54 دلار می رسد ، سپس می بینیم که قیمت بالاتر از 0.72 دلار تا پایان ژانویه/اوایل فوریه است. چشم انداز خنثی: XRP در کوتاه مدت 0.54 دلار را باز می کند ، بین 0.54 و 0.70 دلار تا دسامبر ، در ماه ژانویه به 0.52 دلار می رسد ، بین 0.52 دلار و 0.66 دلار از طریق Q1 2024. چشم انداز بدبینانه: XRP در کوتاه مدت 0.52 دلار را برطرف می کند ، در اواسط ماه دسامبر ، در پایان سال/ژانویه به 0.44 دلار بازگردد ، بدون اینکه نشانه زندگی تا اواخر Q2 2024 بازگردد. به نظر می رسد به زودی صبر ما از طریق بازار خرس پاداش می گیرد.

Jayed

History says XRP's daily RSI is screaming "BUY THE DIP!"

در آخرین نمودار من ، ما به RSI هفتگی XRP ، که فقط hit در همه زمان های تاریخی بود ، نگاه کردیم. اما از آنجا که این یک حرکت بی سابقه بود ، تعداد بسیار کمی از data وجود داشت که سعی می کردند ROI بالقوه را در متن قرار دهند. بنابراین امروز من نگاهی به RSI روزانه XRP دارم. از آنجا که در RSI روزانه کمی بیشتر سر و صدای بیشتری وجود دارد ، من با نقاط data من انتخاب می کنم و فقط وقتی RSI زیر 30 کاهش می یابد ، به نقاط می پردازم ، سپس میانگین حرکت نمایی RSI را برای پشتیبانی آزمایش می کنم (که XRP به تازگی در حرکت فعلی انجام داده است) بنابراین .. همانطور که می بینید ، طی دو سال و نیم گذشته RSI XRP قبل از پیدا کردن پشتیبانی بالاتر از روند نمایی 6 بار (از جمله حرکت فعلی) زیر 30 فرو رفته است. از 23 دسامبر 20 تا 25 آوریل '21 XRP 787 ٪ تجمع کرد از 22 ژوئن '21 تا 29 ژوئن '21 XRP 44 ٪ تجمع کرد از 20 ژوئیه '21 تا 6 سپتامبر '21 XRP 175 ٪ تجمع کرد از 4 دسامبر '21 تا 23 دسامبر '21 XRP 58 ٪ تجمع کرد از 22 ژانویه '22 تا 9 فوریه '22 XRP 71 ٪ تجمع کرد به استثنای این قیمت 2021 Bull Market (از 787 ٪) قیمت ، به طور متوسط ، 88 ٪ از آن پایین است. در مقابل ، حرکت فعلی تنها 37 ٪ تجمع کرده است (وقتی به طور خلاصه 0.46 دلار آزمایش کرد ، که قبل از یافتن پشتیبانی از روند نمایی رخ داده است). با نگاهی به کم خونی ترین راهپیمایی این سیگنال خرید ، از تظاهرات ژوئن 2021 ، که فقط 44 ٪ بازگشت و 7 روز پرمشغله به طول انجامید ، می توانیم ببینیم که از نظر تاریخی ، بهترین سناریو برای خرس ها ، این است که XRP form یک پایین دو برابر ، با استفاده از 0.33 دلار. در حالی که یک پایین دوتایی هنوز هم بسیار محتمل است (اگر تضمین نشده باشد) ، من تجارت بالقوه را به عنوان یک سوال در معرض خطر بالا برای یک نزولی بالقوه 18 ٪ در مقابل یک ریسک پایین در محدوده فعلی برای یک بالقوه بالقوه +40 ٪ صعود می دانم. و 40 ٪ صعود از اینجا برای XRP در واقع بسیار محتاطانه است ، مانند هر مورد (به استثنای فلاپ ژوئن '21) ، تظاهرات حداقل یک مورد از محدوده مقاومت به سر را شکست ، که در حال حاضر برای XRP ، نزدیکترین مقاومت سربار است .33 $ (که ما در حال حاضر 40 ٪ از آن هستیم) با توجه به محدودیت های بعدی از مقاومت در برابر کمترین مقاومت در برابر کمترین مقاومت در برابر کمترین میزان. به نظر می رسد از قیمت فعلی ما 0.40 دلار. OOH ، ما به 0.34 دلار کاهش می یابیم (در مورد form یک پایین دو برابر) اما RSI روزانه فقط به 30 نفر کاهش می یابد ، برخلاف 21 (جایی که ما در ماه مه hit 0.33 دلار) بود. به آن خانمها و آقایان واگرایی صعودی گفته می شود.

Jayed

For those listening to people say "XRP is going even lower!"

ظاهراً این خرس ها به RSI هفتگی یا ماهانه XRP توجه نمی کنند. این اولین بار در طول عمر نزدیک به 9 ساله XRP است که RSI هفتگی آن به 30 کاهش یافته است ، و همانطور که هر معامله گر ارزش نمک خود را می داند ، RSI 30 یا پایین سیگنال خرید حق بیمه است. این بدان معنی است که XRP در کل تاریخ خود بزرگترین سیگنال خرید را چشمک می زند. این اولین باری است که دارایی واقعاً تحت ارزش قرار گرفته است. این فرصت خرید بیشتر از این واقعیت پشتیبانی می شود که RSI ماهانه آن فقط از اعلامیه قفل 2020 کمتر شد ، که به سرمایه گذاران این فرصت را برای بازگشت 7 برابر (در دسامبر 2020) و بازگشت 20 برابر یک سال که XRP در ماه مه 2021 خجالتی بود ، به سرمایه گذاران داد. هنگامی که این سیگنال را با این واقعیت که مقامات فدرال فدرال شروع به ابراز نگرانی برای حفظ افزایش نرخ بهره تهاجمی خود کرده اند ، در میان می گذارید ، صحبت های زیادی در بین تجارت طلا و سایر کالاها وجود دارد. همانطور که تاریخ نشان می دهد ، Crypto با فلزات گرانبها و سایر کالاها ارتباط دارد ، بنابراین در صورت تظاهرات طلا ، BTC ، XRP و بقیه صنعت رمزنگاری نیز بود. حتی اگر فدرال رزرو قصد دارد در اواسط ماه ژوئن نرخ بهره را افزایش دهد ، پس از فروپاشی فاجعه آمیز که امسال تقریباً در تمام بازارها تجربه کرده ایم ، ممکن است حداقل در اواسط ماه ژوئن نرخ بهره را افزایش دهد ، حداقل ممکن است باعث ایجاد تظاهرات شدید شود. در حالی که این ممکن است نشانگر پایان بازار خرس نباشد ، یک تجمع قوی (حتی بر امید کاذب) می تواند یک قسمت فنی را برای XRP (و سایر دارایی ها) که قبلاً پشت های کشش بیش از حد تهاجمی را در مقایسه با بازار وسیع تجربه کرده اند ، تأیید کند. بنابراین من نمی که به زودی به 2 دلار برگردد ، اما می توانم ببینم که تجمع ژوئن ما را به محدوده 0.70 دلار باز می گرداند یا حتی به آن باز می گردد (اگر فدرال رزرو را به تأخیر می اندازد ، افزایش نرخ در جلسه ژوئن است). جایی که بازار در ماه ژوئن محدوده تجارت ما را از طریق Q3 تعیین می کند. ساختار فنی XRP نشان می دهد که ما بین 1 تا 0.56 دلار گزاف گویی کرد (از ماه آوریل به پست Wyckoff من مراجعه کنید). در نهایت این فقط دیدگاه فعلی من در بازار است. من مشاور مالی نیستم. نظرات من را با یک دانه نمک بگیرید و دیدگاه خود را در مورد آنچه می بینم قبل از تصمیم گیری در مورد سرمایه گذاری اعمال می کنم. در حالی که سابقه آهنگ من از اوایل سال 2021 فوق العاده قوی بوده است ، رکورد من به دور از بی عیب و نقص است. باشد که روند به نفع ما باشد!

Jayed

Wyckoff says XRP's in for a rough 2022, and an explosive 2023

به نظر می رسد مانند XRP آماده است تا هر روز به دامنه 0.64 دلار برگردد و زشت ترین مرحله آنچه را که به عنوان یک بازار خرس 2 ساله کوتاه به یاد می آورید ، آغاز کنید.

Jayed

XRP Wyckoff's so much it's gonna go blind.

در حالی که من این را به عنوان "طولانی" ارسال می کنم ، نمودار بدیهی می گوید ما می form یک پایین دوتایی داشته باشیم ، یا کمی پایین تر از 0.62 دلار اخیر ما پایین برویم. همه در مورد "فصل alt" صحبت می کنند ، و همانطور که تاریخ "همه" را نشان می دهد به طور معمول این تماس ها را اشتباه می گیرند. بنابراین من در اینجا سود می گیرم و به دنبال این هستم که دوباره در نزدیکی پایین وارد شوید. آیا قیمت می تواند به $ 0.50 s برگردد؟ مطمئناً ، اما همانطور که چندین بار روشن کردم ، من بیشتر علاقه مند به افزایش موقعیت XRP خود هستم ، برخلاف افزایش ارزش USD. برای همه هدف و هدف ، XRP اکنون نزدیک به یک سال در بازار خرس بوده است (مسلماً 4 سال است که ما هرگز در تمام مدت زمان قبلی خود را شکستیم) بنابراین من بیشتر علاقه مندم که موقعیت خود را برای این کار "اجتناب ناپذیر" جدید در تمام زمان های بالا و بیش از محدوده 3.89 دلار داشته باشم. بنابراین ، مگر اینکه مایل به از دست دادن شرط بندی درآمد hard در رویای لوله تحلیلگر تصادفی باشید ، نمودارهای من را با یک دانه نمک بگیرید. در حالی که تمام نمودارهای Wyckoff من تاکنون تأیید شده اند ، هیچ تضمینی وجود ندارد که آنها همچنان اعتبار خود را ادامه دهند. همه الگوهای در نهایت شکست می خورند. من یک مشاور مالی نیستم ، این توصیه مالی نیست ، من فقط یک پسر دیوانه هستم که سعی می کنم به عنوان یک معامله گر زندگی کنم و از دیدگاه تجاری برای ایجاد کاتالوگ تمام نمایشنامه های تجاری خود استفاده کنم تا سفر من را برای تبدیل شدن به میلیونر یا هابو مستند کنم.

Jayed

A not so fun XRP fractal..

من با تماس خود از هفته گذشته بازگشت به 0.67 دلار برای XRP به هیئت مدیره بازگشتم. این بار به جای استفاده از Wyckoff ، من تاریخ 4 ساعته XRP را تنظیم کرده ام (از اجرای اولیه آن در مارس 2021 تا زمان حال) و همبستگی قیمت با این هفته بسیار چشمگیر است. اگر این بازی به پایان برسد ، ما قبل از بازگشت به 0.60 دلار بالا ، به عنوان قله کوتاه مدت زیر 0.83 دلار دید ، 0.70 دلار پایین s که به مارس منتهی می شود و اگر فراکتال نگه داشته شود ، این احتمالاً تا ماه مه ادامه یافت. در حالی که این یک سناریوی سرگرم کننده برای هر سرمایه گذار بلند مدت در XRP نیست ، آن را یک فرصت طلایی برای ورودی های نهایی خود در محدوده زیر 1 دلار در نظر بگیرید ، همانطور که تا اواخر ماه مه ، باید قیمت XRP در این محدوده باقی بماند و پشتیبانی 10 ساله آن را لمس می کند. از نظر تاریخی هر بار که ما این پشتیبانی صعودی را لمس کرده ایم ، قیمت آن را تجربه کرده است که شدیدترین راهپیمایی های قیمت است. برای یک دیدگاه کلان/بزرگنمایی بیشتر از آنچه انتظار دارم با XRP در اواخر سال اتفاق بیفتد ، نگاهی به این نمودار بیندازیم که در آن من طرح می کنم که چگونه وقایع آینده در Timeline Juduit Ripple Timeline باعث افزایش قیمت می شود.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.