تحلیل تکنیکال holeyprofit درباره نماد BTC : توصیه به فروش (۱۴۰۳/۶/۴)

holeyprofit

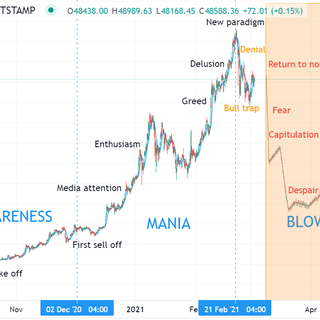

Stages of a possible BTC reversal

In this analysis I'll break down the possible BTC topping pattern into three main stages. 1 - The pending bull flag. I'll cover this first, because this is the common consensus. That we're in a flag and when the breakout is made we should expect to see an extension at least as big as the previous rally. Flag patterns lead to big breakouts, when they work. But there's also a lot of other things that can form something that looks like a flag in real time. For example, here's a flag like pattern at high before the 2020 drop. In real time, it looks like a bullish flag. After the fact we can see it traded lower highs in a descending channel. It spiked out the lower end of the channel, made one more bull trap - failed to make a high and then the next break was a larger break. This 100% looked like a bull flag in real time. If you go and look at lots of highs in lots of things (Not just crypto), you'll see it's very common a reversal starts with a sort of "Stepping down" action and this range based action (With a very subtle bear tone because the lower highs) acts a lot like bull flag. I see the bull flag. We all see it. I just dispute the strength of the signal. Things like this are also things I see in topping moves. 2 - The lower highs. Looking again at the 2020 high example, with the benefit of hindsight it's clear to see the warnings of the failure of bull momentum were there. The problem for having a bear bias at that time was there'd been stuff like that previously and it'd popped and recency bias (Or just fear of spikes) makes it hard to feel bearish. But there were warnings. The development of the lower highs was a clear warning. it got more and more pronounced and then it slammed. For a long time it was possible to see this might happen using the simple method of lower highs being a sign of possible weakening. The same would be true now. Let's say hypothetically in 9 months time BTC had traded 70% lower. Would be easy to zoom into this topping section and point out the stages of the failure. Just like I've done in the 2020 one. With the benefit of hindsight, explaining the signs of trend failure would be trivial to anyone with basic market structure understanding. The lower highs condition is particularly useful to us as traders because it's testable and comes with an obvious invalidation point. Which means we can use it to make decisions if we're wrong quickly. That's my main interest. I don't mind being wrong, I mind staying wrong. I want to stay right for a long time and be wrong quickly (Cut/ride). So with that condition, we can mark out a clear zone at which the thesis of the downtrend channel development into crash would fail. If we're not seeing lower highs, then we're not seeing downtrending action. 3 - The pending reversal patterns.And that brings us into our final and most actionable points for a trade plan. Up to now we've covered why in theory we could see a big break in the BTC market. We have clearly defined what our bet is (Structural lower highs) and by understanding what our bet is we can clearly understand where it's failed. Covers a lot of the basics of a trading idea. What do I think might happen? How do I think it will look if it does happen? What makes it obvious that is wrong?We can then further optimise this by using bearish entry signals to define the ideal shorting areas and stop areas.BTC is currently at the 76 fib which is a classic fib for a bull trap. In theory, the high should already be in on that. In practice, you always have to worry about BTC maybe spiking out. It really is bad for it. In some sort of ugly spike variant it could look something like this. But in the classic bull trap we 76 hit with that massive candle should be the top. Complimenting this, we have a possible Gartley. The OG of harmonics. I have to say, I've found the Gartley to be the least reliable of the harmonics to the point where I don't even look for Gartley patterns anymore. But I do look for 76 retracements inside of forming lower highs and lower lows. There's also a Gartley like pattern. And it's quite a nice Gartley, as they go, it completes with a 1.61 AB=CD. With an explosive D leg. So at this point we can determine it's most likely if we're going to see a bear break that we're somewhere in the topping sequence of this rally. Further to this, if we are going to see a bear break we're not going to see anywhere close to this price again for a while. The next rally will be more stunted and then rallies will just stop. This I'd say stacks up as a high probability setup. Here's a run down of the things I am thinking about; 1 - False breakouts of all time highs can produce crashes. I spoke about this extensively at the high. I spoke so much about this at the high that the percentage of posts I have about crypto went up 5%. I have a lot of posts. 5% was quite a lot of new ones. It's perfectly logical if there's a false breakout there'll be a crash. That's all that ever happens if there's a false breakout. 2 - The structural sell off. Typically corrective legs will end in two legs. BTC typically should be at a new high by now. I've had a fair crack at buying it after capitulations for this epic bounce and breakout but every time it run a little and I end up getting out because it's not doing what I think it should. Typical bullish continuation has already failed and typical bearish reversal patterns have not yet failed. 3 - The confluence of the 76 and the two legged Gartley/AB=CD pattern. That's all bears should want, really. It all marries up perfectly.4 - It appears we may be heading into rate cuts. While I do not make any speculations on if/when these will happen or the impact they will have, it is notable that in all the major crashes of our time the theme has been markets up until rates are cut - then they reverse. BTC shows strong evidence of being correlated with indices. If the indices go down hard, BTC goes down harder. In the last 50 years, every single time there were parabolic markets on rising interest rates when the rates began to be cut the market began to drop. Typically over the next two years most of the gains of the rally would be wiped out and, alongside this, interest rates would have returned to the floor. ---Please note that being able to define something as a high probability setup generally just means if it does fail it will fail spectacularly. If using this as a consideration for actually betting on the move it's important to observe the stop loss/failure requirements covered above. In the event of a break, this can be heading to under 20K. Another drop would put BTC through the level i defined at the high as the crash level.Full extrapolated trade plan if what appears to be a bullish flag is actually a bearish flat in wave 2 of a reversal.Here's the reaction from the 76 so far.Straight down 10% off the entry. Retracement to retest the break is fair game now. Could be the end of the selling for the moment. Maybe pick up again next month if it is.Here's something I think is worth knowing. When we have two legs these are often corrective and when they are corrective we usually see the first drop taking out the first leg. Then a bit of a bull trap and then the follow through. Making waves 1,2 and 3 of Elliot. So what bears ideally want to see here is a bit of a sharp rally. Price being sticky at 62K area until the end of the month. If those things happen - next posts will be talking about lotto puts on COIN and MSTR.I now have a strong risk off bias for crypto and stocks for the month ahead but I do suspect if I am right about that there won't be anything big this month. Bluff this way, bluff that way - stick some arrows in the bears backs and then move next month. That's be my preliminary thoughts. Just a heads up if I go quiet. So long as my stop level does not hit, ideally I'm looking to get really active on this at 62K area some time early next month.Probably max risk of a bigger bounce here for bears. Would be interested in shorting the rip if we did.Bounce sucked. Would still like to see it higher but that might have been it. Indices completed all their technical bounces also. So that may be the correction in - as dull as it was. Starting to get seriously into the planning for some aggressive OTM puts on COIN and MSTR now. I think we might have seen the first failure of the risk on market yesterday. Certainly set the scene for it. We'll see what happens in the coming days. Do plan to start to position as if a break is coming.If you've read my posts before hopefully you'll know the system from here on. Classic simple bull traps tend to be 76 retracements. That's why I am here talking about this now. If the simple bull trap is in play, this should around the high. If not, then trailing stops hit above it and I'll try to limit into 62K again (Which is the next big resis). In simple bear theory, rejection here and new low.Better bounce now. Did suspect that last one was a bit shallow. Getting into a confluence of resistance levels here. Sharp move up to 63K likely if this area break but this is the first big level we have for a possible top. Really good chance we'll see stronger bearish momentum if new lows are made now.Here's the trade levels.