vinceangelomendiola

@t_vinceangelomendiola

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

vinceangelomendiola

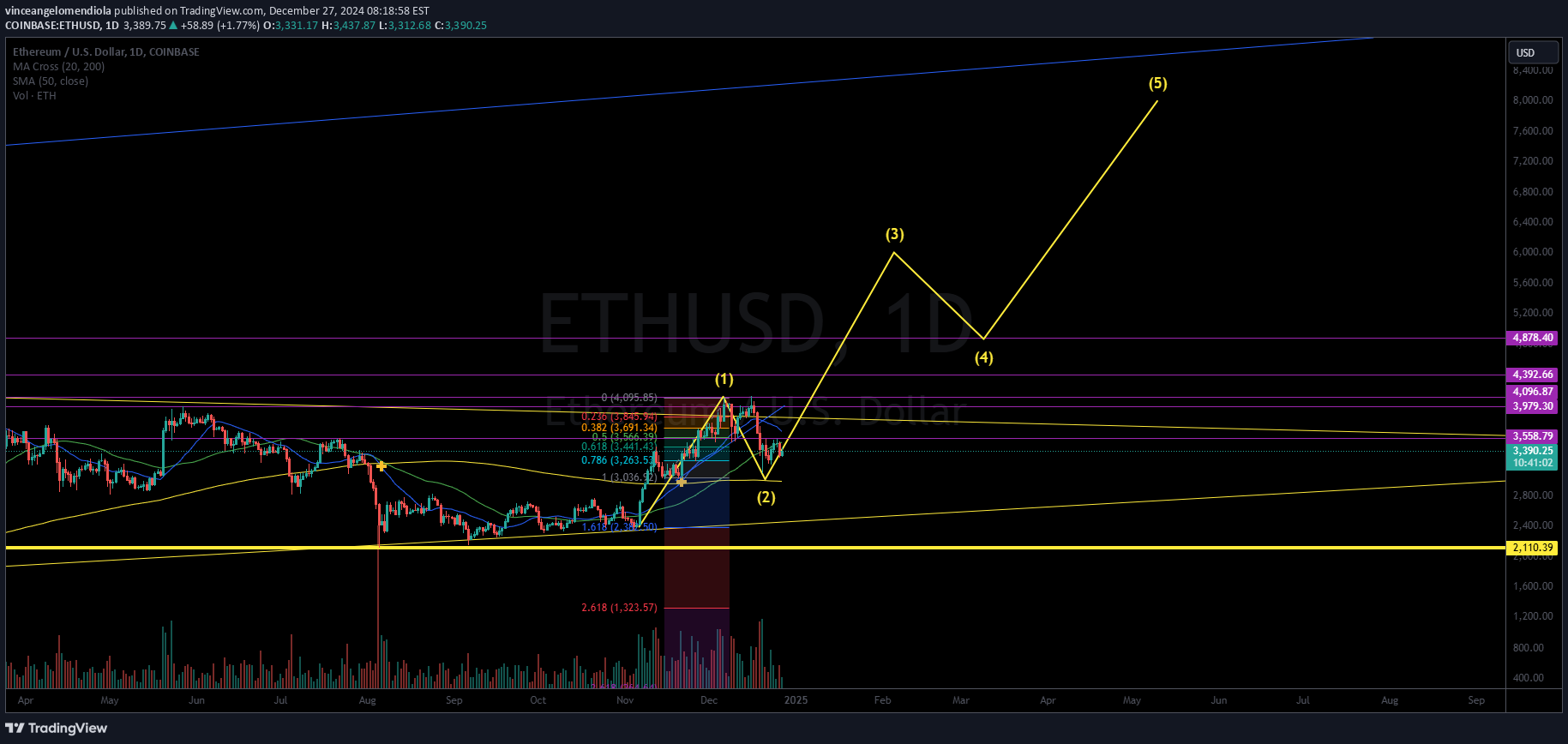

Ethereum is still intact on its bullish continuation pattern. Since it creates a healthy pullback for its 2nd wave, we'll see if the 3rd wave will be valid in the coming weeks. Overall, the Eliot wave with a target of 8k on its 5th wave remains intact.

vinceangelomendiola

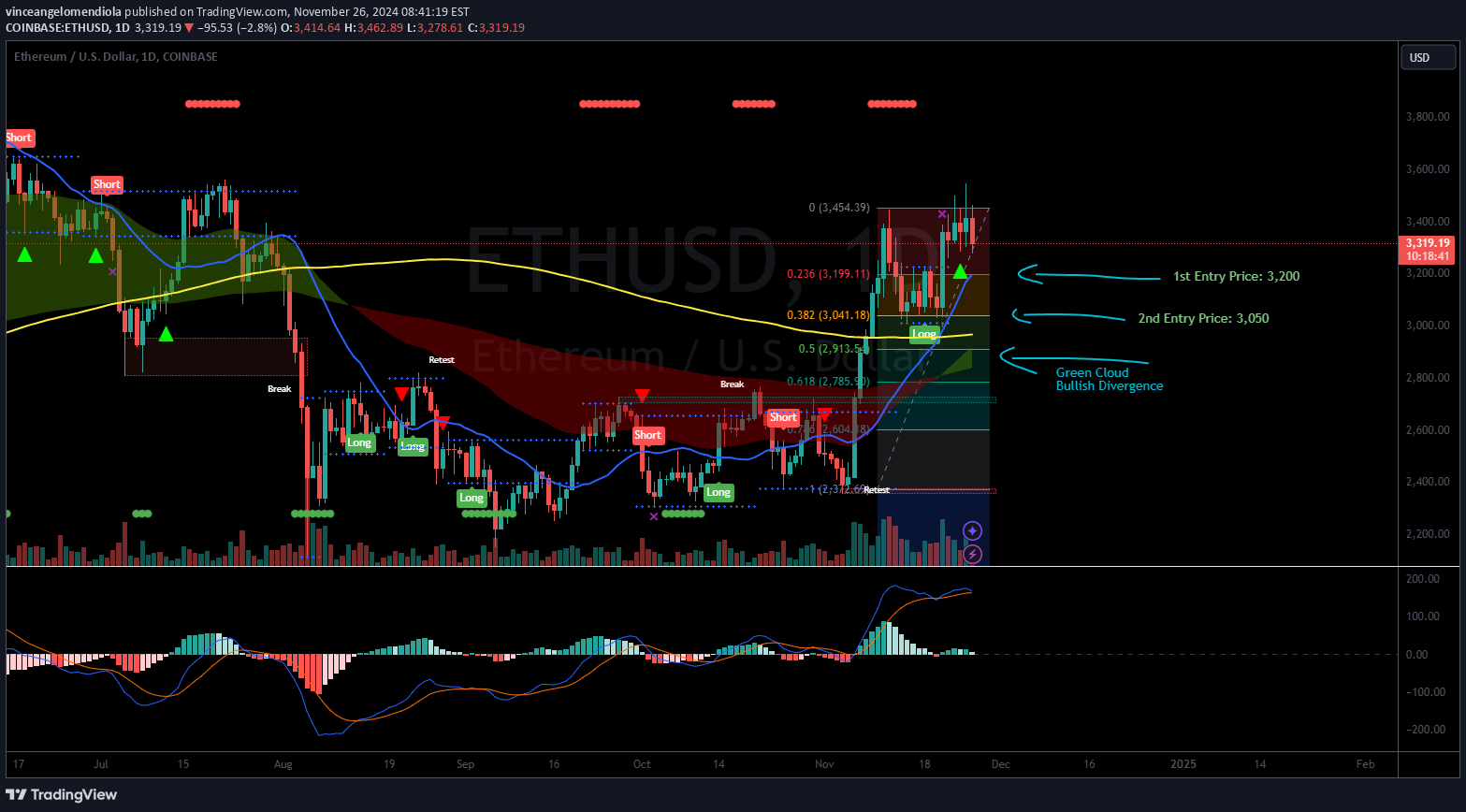

Ethereum possible pullback before reaching its ATH and soon goes parabolic. Using the Fibonacci retracement could give us an idea of its stop points.

vinceangelomendiola

Bullish cross between 200MA and 50MA spotted on 4 hour timeframe and appearance of green cloud. This would suggest a short term bullish outlook for bitcoin for the coming days.The golden cross on daily time frame could follow by 1st or 2nd week of September and would drive the price to 65k-70k level.

vinceangelomendiola

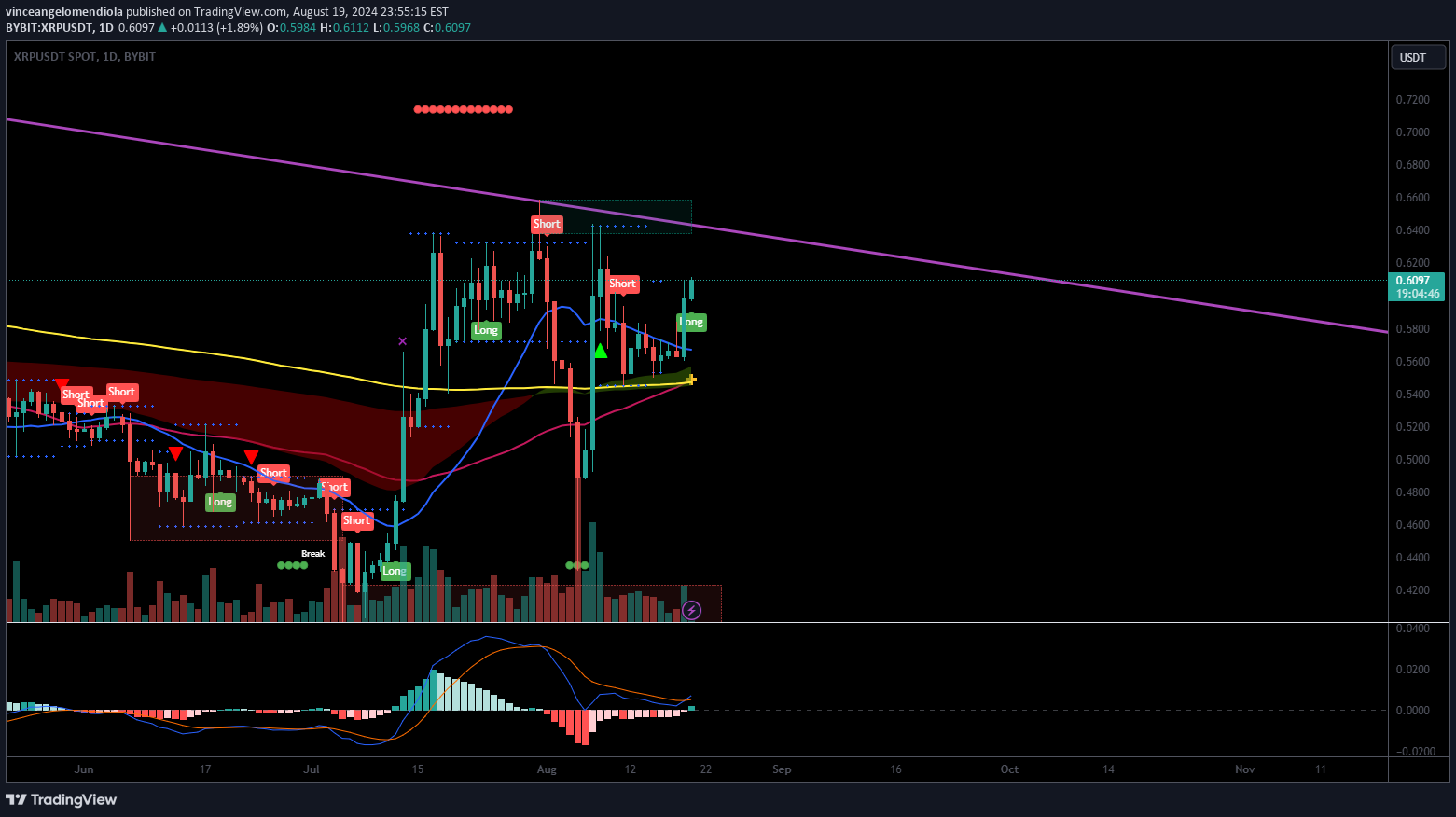

XRP crosses its ma200 and ma50 which signals a significant bullish momentum for the coming days. The MACD also starting to cross the upside trend. There's also a possible continuation of this bullish momentum and a rally toward the previous ATH if it cross the wedge on the weekly timeframe.

vinceangelomendiola

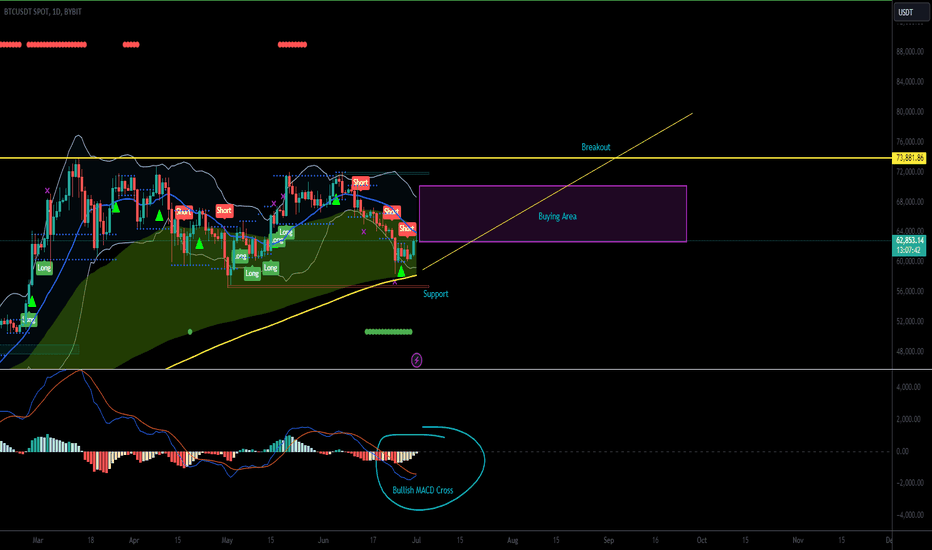

Bitcoin's weekly timeframe is still bullish. Elliot's 5th wave correction could have another leg for a short-term bearish sentiment and could reach double bottom for the daily timeframe before it bounce back and break the 74k level.

vinceangelomendiola

Bitcoin could have a steep recovery but with a possible correction(fib retracement to the golden line) if it fails to break the 200MA.In the long run, the bitcoin cup and handle bullish pattern is still intact.

vinceangelomendiola

vinceangelomendiola

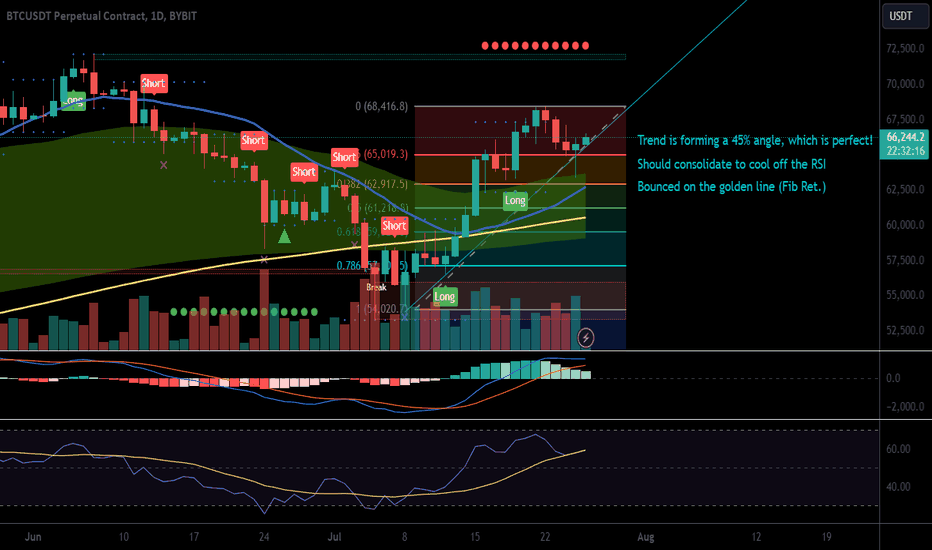

Forming 45% angle is a perfect uptrend, not too steep indicates less fomo traders and more strong hands. The RSI needs to cool off so we need to consolidate and have enough strength to break the 74k level.

vinceangelomendiola

This chart will serve as a speculative trend analysis for the upcoming few months. Disclaimer, not a professional financial recommendation. TYOR.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.