ssmog369

@t_ssmog369

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ssmog369

ssmog369

BTC Long Term/SPOT holders

ssmog369

ssmog369

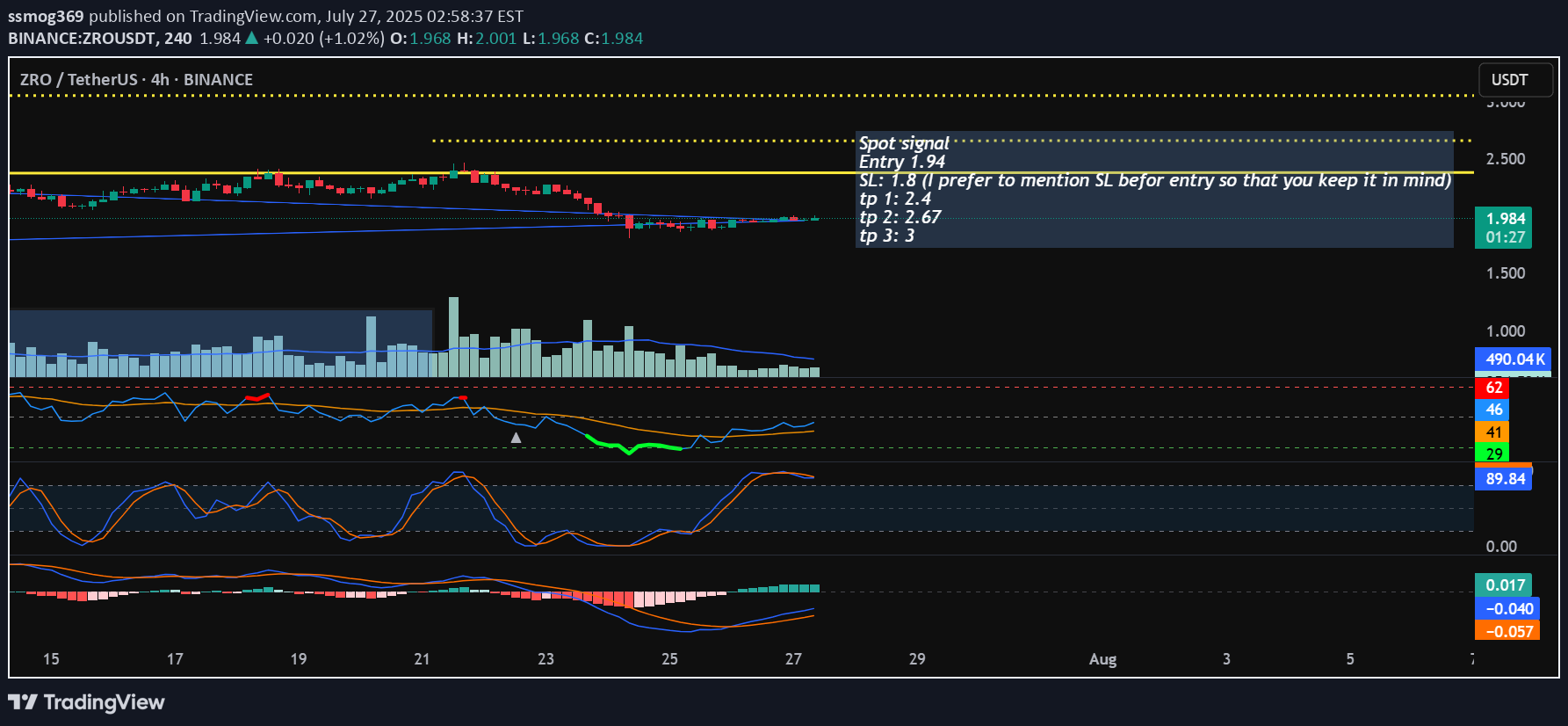

zro, spot buy

Spot signal (as it is not volatile)ZRO is gaining strength against ETH, once it gain 2.4 and sustain it, then it can shoot upto 3. currently it is range bound. Entry 1.94 SL: 1.8 (I prefer to mention SL before entry so that you keep it in mind) tp 1: 2.4 tp 2: 2.67 tp 3: 3

ssmog369

moodengusdt

ALot of short positions have been built up in Moodeng and many are liquidated too. however this time a clear bear divergence is seen on 4Hr time frame from a previous resistance zone of Fib. extension. seeing other confluences like 1.drop in volume, 2. dropping MFI and DMI 3 coinglass liquidation building up larger in lower price then higher, making it magnetic pull towards low price 4. lower long/short ratio despite of high price on 4h TF It is safe to say that short position can be built in moodeng here is the setup. I suggest less then 5 leverage as it could be risky trade 1. short at CMP if you don't want to miss the trade entry 2. 0.2715 DCA at 0.31 SL. 0.321 TP 1. 0.202 TP 2. 0.168 This make your risk to reward ratio of 2.5 collectively. Happy earning

ssmog369

compusdt

Broke all the previous trendlines like many other coins in this rally but it has lot of room to go till 57 easily in less then a next 2,3 days which is about 30% however it can go far beyond that. as it is showing lil bit of divergence so i suggest it should be bought at pullback. current buying levels at pull back will be 46 and 42. SL is 40.5

ssmog369

pi coin

this is and extended update to previous analysis. nest 2 stops to monitor are 0.96 and 1.1the golden pocket this times lie between 0.678 and 0.607 which is perhaps flipped with the upward movement of btc or after weekend. as far as i have observed Pi coin it has respected the GP most of the time. so be patient if you are in -ve and only DCA at this area with amount 2 or 3 times of your initial investment. after DCA take out 50% at breakeven i had booked my 75% profits and i am risk free now. Sl under the golden pocket

ssmog369

PI coin

After a strong rise in price and volume Pi coin is now showing stability at its golden pocket. considering weekends having slow volumes and range bund price action, Pi coin is also expected to maintain the price range of 0.58-0.59. however aligning with pricing of btc and near weekly close it price expected to pump till .7 or above. its ADX is trending at 4hrs and daily, its stoch rsi is about is bottoming. rsi showing multiple divergences at 4h and LtF. it is forming butterfly pattern with expected "C" at 0.5603, but as it is showing strength at golden pocket so it is expected to go above from here that is 0.5833. that is why I suggest 3 entries for average pricing and avoid missing any opportunity. Thus take entry with confluences like 1.BTC bottoming at 4h 2. weekly close 3. rsi golden cross 4. C leg of harmonic butterfly 5. bottoming of stoch rsi Here is the setup entry 1. 0.5833 10% of ur investment entry 2. 0.5606 30% entry 3. 0.5496 % SL 0.54 Tp1. 0.576 Tp2. 0.614 Tp3. 0.6685 Tp4. 0.702Tp 1 busted2nd and third TP busted, my trade is stll active although tradingview has no furtuer option for active trade. it is not closed yet

ssmog369

pi coin

After a strong rise in price and volume Pi coin is now showing stability at its golden pocket. considering weekends having slow volumes and range bund price action, Pi coin is also expected to maintain the price range of 0.58-0.59. however aligning with pricing of btc and near weekly close it price expected to pump till .7 or above. its ADX is trending at 4hrs and daily, its stoch rsi is about is bottoming. rsi showing multiple divergences at 4h and LtF. it is forming butterfly pattern with expected "C" at 0.5603, but as it is showing strength at golden pocket so it is expected to go above from here that is 0.5833. that is why I suggest 3 entries for average pricing and avoid missing any opportunity. Thus take entry with confluences like 1.BTC bottoming at 4h 2. weekly close 3. rsi golden cross 4. C leg of harmonic butterfly 5. bottoming of stoch rsi Here is the setup entry 1. 0.5833 10% of ur investment entry 2. 0.5606 30% entry 3. 0.5496 SL 0.54 Tp1. 0.576 Tp2. 0.614 Tp3. 0.6685 Tp4. 0.702

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.