soda8888

@t_soda8888

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

NOTE: This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m posting this to help you preserve your capital, energy and will so you can execute your own trading system with calm, patience and confidence. Momentum and trend are in play and you’re lining up for the next opportunity to join the trend up. Diligently - you follow your rules and get in when the ‘stars align’ and when the indicators you’ve chosen give you the confirmation you’re looking for to get in. And then you’re stopped out. “I’ll get it back on the next one.” It starts as a whisper in your head right after a loss. "Is it a false breakout? Is it noise? " You don’t even consider ‘chop’ right now. You re-enter Stopped again and again. This is starting to feel personal. What’s really happening inside you: Thoughts: “The market took from me.” “I’ll show it.” Feelings: Anger, injustice, shame. Behaviours: Increasing size, doubling down, moving stops. Body cues: Racing heart, clenched jaw, tunnel vision. Trigger: A loss that feels unfair or personal. This is anger disguised as trading. You have been triggered. How to take control of this: Name it: Say out loud “I’m acting out here.” Ask yourself - ‘Do I really want to do this, is this part of the plan or am I honestly revenge trading?’. Asking these questions at least stops the automatic reaction of just jumping in and brings awareness to the situation. It’s a breaker switch that interrupts the loop. Ground yourself: notice your breath, your heart, your body. It’s likely that your biology is reacting to the loss which means hormones such as [adrenaline and cortisol are racing through you. Step away until the adrenaline settles. Reframe the loss: remind yourself: The win I’m chasing won’t undo the loss. Only discipline will. Losses in this game are a cost of doing business. I accept that there are costs and I am in control of my spend as any successful business owner does. Losing isn’t the problem. How you react to the loss defines your career. If you found this useful, also have a look at a previous post I’ve put up on revenge trading. Here’s the link. I also offered some reflections on a trade post sent to me by another TradingView user. The topic wasn’t revenge, but the challenge presented by the market wasn't too dissimilar. p.s. Apols if anything is odd in this post, I have had to repost it.

NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence. Over the last few posts we’ve walked through the psychology behind many exits. Here on this chart, you can see how they all might have played out on a single trade. One trade, four different exits. Whichever you choose to implement isn’t just a technical decision - it’s a psychological mirror. Taking each in turn: The initial stop: the line where you admit, “The trade idea didn’t work” The break-even stop: the comfort of “I can’t lose now.” The trailing stop: the wrestle between protecting gains and letting them run. The profit target: the choice between certainty and potential. Put them all on the same chart and you’ll notice something: none of them are just about price. Each is a reflection of the trader making the call. What we’ve uncovered in this series: The initial stop tests whether you can accept being wrong on a trade idea without making it personal. The break-even stop shows how much discomfort you’re willing to tolerate before reaching for relief. The trailing stop mirrors your balance between fear of giving back and trust in your process. The profit target surfaces your relationship with certainty versus possibility. And tight vs. loose? That isn’t just a preference. It begins with trader type: your personality, values and beliefs set a natural baseline. It’s shaped further by how well your strategy fits that style. And in the moment, emotion (fear or hope) nudges you tighter or looser than planned. The bigger reflection: Exits reveal more than entries. They show how you handle: Loss and regret. Control and uncertainty. Trust and identity. Comfort and growth. But reflection alone isn’t enough. To turn insight into progress, you need practical ways to anchor behaviour: Pre-commit in writing: Note where you’ll exit before you enter, it closes the door to mid-trade negotiation. Separate outcomes from emotions: Journal not just where you exited, but how you felt in the moment. Patterns emerge quickly. Differentiate protecting vs. controlling: Ask yourself, “Am I moving this stop to protect the plan, or because I’m uncomfortable right now?” Train the nervous system: Notice the physical urge to act and how it shows up in the body (ex: shallow breath, tense shoulders). Pause before execution and breathe. Slow down the ‘urge’ and re-train self trust. These small practices are how you build the consistency to stay aligned with both your system and your psychology. Closing thought: The market doesn’t care where you exit. But your mindset does - and so does your account. Clarity in those decisions is where growth begins and where your odds of staying in the game increase. In the end, your edge isn’t only your system. It’s your state of mind - before, during and after engaging with the market. I hope you’ve enjoyed this series. If so would love to hear in the comments. Here’s a recap of the entire Psychology of Exits series in case you’d like to check out the details of each: Exit Psychology 1/5 : The Initial Stop Exit Psychology 2/5 : The Break-Even Stop - Comfort or Illusion? Exit Psychology 3/5: The Trailing Stop – Patience vs Protection Exit Psychology 4/5 : The Profit Target – Certainty vs. Potential Exit Psychology 5/5: Tight vs. Loose And finally here is the link to the original article by TradingView that inspired this series as promised: p.s. Apols if anything is odd in this post, I have had to repost it.

NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence. This 5-part series on the Psychology of Exits is inspired by TradingView’s recent post “The Stop-Loss Dilemma.” Link to the original post at the end of this article. Here’s a scenario: Two traders, same setup. One uses a tight stop. One sets it loose. The first gets stopped out quickly - several scratches in a row. Frustration builds: “The market keeps hunting me.” The second holds through the noise, but watches a small loss balloon. Self-talk creeps in: “If I’d cut it sooner, I’d be fine.” Same market. Different styles. Each trader convinced the other way might be better. How behaviour shows up with tight vs. loose stops: Tight stops: Often chosen by traders who value precision and control. The mindset is “I’d rather be wrong small and often than wrong big.” The cost? A series of small cuts that can erode confidence. Loose stops: Favoured by traders who value patience and the bigger picture. The mindset is “give the trade room to breathe.” The cost? Larger drawdowns and the risk of turning manageable losses into emotional ones. Neither is inherently better. The choice often begins with trader type - your personality, values and beliefs shape a natural preference for precision (tight) or patience (loose). The trap isn’t in the preference itself it’s when short-term emotions hijack that baseline. The psychology underneath: Your baseline style comes from deeper beliefs and tendencies: Tight stop traders often believe: “If I’m precise, I can avoid being wrong.” “Smaller losses hurt less.” “Control comes from minimising risk quickly.” Loose stop traders often believe: “The market needs space to prove me right.” “One big win will pay for the rest.” “Patience will protect me from being shaken out.” But when stress or excitement kicks in, those baseline tendencies can distort: Tight traders over-tighten - cutting winners short out of fear. Loose traders loosen further - holding too long out of hope. The key is to know the difference between what reflects your style and what reflects an emotional trigger. Why context matters: Timeframe: Scalpers naturally need tighter stops; swing traders can afford looser ones. Volatility: Calm markets tolerate precision; wild ones punish it. Strategy: Breakout systems often need wider buffers; mean reversion thrives on tight control. Your stop isn’t just about the chart. It’s about who you are, the system you run and the market you’re in. Practical tips … the How: Notice your natural bias: Do you lean toward safety through control (tight) or safety through space (loose)? Awareness matters more than labels. Align your stop style with both your timeframe and your temperament. A system that grinds against your personality will drain your energy. Review your data: Do tight stops cut you out too soon? Do loose stops bleed too much? Your history holds the clues. Separate outcome from process: A stop-out isn’t failure - it’s feedback. Tight or loose, consistency beats reaction. Reframe: It’s not about tight versus loose. It’s about congruence, between your strategy, the market context and your personality. When those three line up, stops become less about fear and more about discipline. Closing thought: Every stop: initial, break-even, trailing, or profit target is really a mirror. It reflects not only your strategy, but also your relationship with uncertainty, control and trust in yourself. The market doesn’t care how you exit. But your mindset does… as does your account. Every adjustment, every shift of a stop, every decision to hold or cut, carries both a financial cost and an emotional cost. Learning to see those decisions clearly, is where growth begins and where your odds of staying in the game increase. A link to Exit Psychology 4/5 : The Profit Target – Certainty vs. Potential A link to the original article as promised: This is Part 5 of the Psychology of Exits series. 👉 Thanks for following along ... and for those who have stayed the course with me, there's a bonus wrap up that I'll be writing up today and releasing tomorrow. Stay tuned. p.s. Apologies if the chart on this post is a little odd. I had to repost this.

NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence. This 5-part series on the Psychology of Exits is inspired by TradingView’s recent post “The Stop-Loss Dilemma.” Link to the original post at the end of this article. A familiar scenario: Price is moving your way. You’re edging closer to your profit target. An internal debate begins: “Should I book it now? What if it turns?” . Your pulse quickens. Thoughts circle: “What if it turns now?” “Should I take it here? It’s good enough…” “But what if I exit and it keeps running?” One voice says “bank it before it disappears.” Another whispers “hold, the real move is still ahead.” You exit early, relief for a moment - until you watch the chart run far beyond where you got out. Next time, you hold on longer… only to see your winner evaporate. Most traders know this dance. It’s not about charts. It’s about the pull between certainty and potential. How behaviour shows up with profit targets: The way we take profits tells us more about our beliefs than about the market itself. : Cutting trades too early: The belief that profit can vanish at any moment, so you must grab it while it’s there. Holding too long: Rooted in the hope that “one big trade will make the month.” or erase prior losses. Moving targets mid-trade: Reflects the belief that adjusting = control, even if it means inconsistency. Ignoring targets entirely: Suggests discomfort with closure - “If I don’t exit, I haven’t missed out yet.” The psychology underneath: What looks like “profit management” is often emotional management in disguise: Loss aversion in reverse: Protecting unrealised gains feels safer than risking them for more. Regret aversion: The fear of “what if”- too soon or too late - shapes every decision. Scarcity belief: “Opportunities are rare - I must squeeze every drop.” Over-attachment: Treating one trade as if it carries all the weight, rather than one of many in a series. Identity layer: For some, banking profit = validation; missing the bigger move = failure. At the heart of it is this tension: Do you seek the certainty of closing now, or the potential of holding on? And which one do you believe defines your worth as a trader? Why traders use profit targets: Pre-defined targets do have value. They provides clarity, structure and reduce decision fatigue. Locks in gains and avoids paralysis at turning points. They allow for consistent risk-reward planning. But the challenge is sticking to those targets without rewriting them mid-trade based on emotion. That’s where the psychology is tested. Practical tips … the How: The aim is to separate strategy-based exits from emotion-based exits, namely to exit in line with your plan, while conserving psychological capital for the next trade: A few ways traders manage this: Define profit targets in advance - structure, measured move, or R-multiple and write them down before entry so you are not improvising mid-trade. Consider scaling out: partial profits banked, partial profits to satisfy the need for certainty, while leaving a portion to capture potential. Journal post-trade: Did you exit where planned, or did emotion intervene? Track the pattern across multiple trades. Build awareness: notice the urge to “grab it” or “stretch it.” Pause and label the feeling (fear/greed/doubt) before acting on it. Naming the emotion can reduce its grip on you. Reframe: A profit target isn’t a ceiling. It’s a decision point. The skill isn’t in guessing the high it’s in exiting consistently in line with your plan, while protecting your psychological capital for the next trade. Closing thought: Every profit exit is a mirror. It reflects not only what the market offered, but also how you relate to certainty, potential, and trust in your own process. A link to Exit Psychology 3/5 : The Trailing Stop – Patience vs. Protection A link to the original article as promised: This is Part 4 of the Psychology of Exits series . 👉 Follow and stay tuned for Part 5: Tight vs. Loose - Personality, Context, and the Real Trap.

NOTE: This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m posting this to help you preserve your capital, energy and will so you can execute your own trading system with calm, patience and confidence. I’ll keep it short here. If this resonates, please follow my newsletter for deeper dives into mindset. Momentum and trend are in play and you’re lining up for the next opportunity to join the trend up. Diligently - you follow your rules and get in when the ‘stars align’ and when the indicators you’ve chosen give you the confirmation you’re looking for to get in. And then you’re stopped out. “I’ll get it back on the next one.” . It starts as a whisper in your head right after a loss. "Is it a false breakout? Is it noise? " You don’t even consider ‘chop’ right now. You re-enter Stopped again and again. This is starting to feel personal. What’s really happening inside you: Thoughts: “The market took from me.” “I’ll show it.” Feelings: Anger, injustice, shame. Behaviours: Increasing size, doubling down, moving stops. Body cues: Racing heart, clenched jaw, tunnel vision. Trigger: A loss that feels unfair or personal. This is anger disguised as trading. You have been triggered. How to take control of this: Name it: Say out loud “I’m acting out here.” Ask yourself - ‘Do I really want to do this, is this part of the plan or am I honestly revenge trading?’. Asking these questions at least stops the automatic reaction of just jumping in and brings awareness to the situation. It’s a breaker switch that interrupts the loop. Ground yourself: notice your breath, your heart, your body. It’s likely that your biology is reacting to the loss which means hormones such as [adrenaline and cortisol are racing through you. Step away until the adrenaline settles. Reframe the loss: remind yourself: The win I’m chasing won’t undo the loss. Only discipline will. Losses in this game are a cost of doing business. I accept that there are costs and I am in control of my spend as any successful business owner does. Losing isn’t the problem. How you react to the loss defines your career. If you found this useful, also have a look at a previous post I’ve put up on revenge trading. Here’s the link. I also offered some reflections on a trade post sent to me by another TradingView user. The topic wasn’t revenge, but the challenge presented by the market wasn't too dissimilar.

NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence. Over the last few posts we’ve walked through the psychology behind many exits. Here on this chart, you can see how they all might have played out on a single trade. One trade, four different exits. Whichever you choose to implement isn’t just a technical decision - it’s a psychological mirror. Taking each in turn: The initial stop : the line where you admit, “The trade idea didn’t work” The break-even stop : the comfort of “I can’t lose now.” The trailing stop : the wrestle between protecting gains and letting them run. The profit target : the choice between certainty and potential. Put them all on the same chart and you’ll notice something: none of them are just about price. Each is a reflection of the trader making the call. What we’ve uncovered in this series: The initial stop tests whether you can accept being wrong on a trade idea without making it personal. The break-even stop shows how much discomfort you’re willing to tolerate before reaching for relief. The trailing stop mirrors your balance between fear of giving back and trust in your process. The profit target surfaces your relationship with certainty versus possibility. And tight vs. loose ? That isn’t just a preference. It begins with trader type: your personality, values and beliefs set a natural baseline. It’s shaped further by how well your strategy fits that style. And in the moment, emotion (fear or hope) nudges you tighter or looser than planned. The bigger reflection: Exits reveal more than entries. They show how you handle: Loss and regret. Control and uncertainty. Trust and identity. Comfort and growth. But reflection alone isn’t enough. To turn insight into progress, you need practical ways to anchor behaviour: Pre-commit in writing : Note where you’ll exit before you enter, it closes the door to mid-trade negotiation. Separate outcomes from emotions : Journal not just where you exited, but how you felt in the moment. Patterns emerge quickly. Differentiate protecting vs. controlling : Ask yourself, “Am I moving this stop to protect the plan, or because I’m uncomfortable right now?” Train the nervous system : Notice the physical urge to act and how it shows up in the body (ex: shallow breath, tense shoulders). Pause before execution and breathe. Slow down the ‘urge’ and re-train self trust. These small practices are how you build the consistency to stay aligned with both your system and your psychology. Closing thought: The market doesn’t care where you exit. But your mindset does - and so does your account. Clarity in those decisions is where growth begins and where your odds of staying in the game increase. In the end, your edge isn’t only your system. It’s your state of mind - before, during and after engaging with the market. I hope you’ve enjoyed this series. For more on mindset/emotional insights please follow me here on TradingView or check out my website for more info. P.S. A quick note to those who have signed up to the free newsletter/the Pre-Market Mindset Reset on our website: please be sure to check your spam folder in case it’s found its way there. Here’s a recap of the entire Psychology of Exits series in case you’d like to check out the details of each: Exit Psychology 1/5 : The Initial Stop Exit Psychology 2/5 : The Break-Even Stop - Comfort or Illusion? Exit Psychology 3/5: The Trailing Stop – Patience vs Protection Exit Psychology 4/5 : The Profit Target – Certainty vs. Potential Exit Psychology 5/5: Tight vs. Loose And finally here is the link to the original article by TradingView that inspired this series as promised:

NOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence. This 5-part series on the psychology of exits is inspired by TradingView’s recent post “The Stop-Loss Dilemma.” Link to the original post at the end of this article. Here’s a scenario: You set a clean initial stop beneath structure. Price drives down, tags just above it, hesitates… Your chest tightens. Thoughts race: “It’s just noise… give it room.” You widen it. Minutes later you’re out with a larger loss, shaken confidence and a strong urge to make it back. How behaviour shows up with initial/safety stops: When discomfort builds, many traders start negotiating with themselves. This often leads to small adjustments that feel harmless in the moment, but gradually undermine the original plan: Widening the stop as price approaches (turning limited risk into larger or open-ended risk). Nudging to break-even too soon (seeking relief more than edge). Cancelling the hard stop and promising a “mental stop” (self-negotiation begins). When traders choose not to place hard stops: Not every trader chooses to place a hard stop in the market. For some, it’s a deliberate decision, part of their style: They want to avoid being caught in stop-hunts around key levels. They prefer to manage risk manually, based on discretion and market feel. They use options, hedges, or smaller size as protection instead of stops. They accept gap/slippage risk as part of their style. These can all be valid approaches. But avoiding a fixed stop doesn’t remove the psychological pressures it simply shifts them: Discipline under stress : Without an automatic exit, you rely entirely on your ability to act quickly and decisively in real time. Stress can delay action. Mental drift : A “mental stop” is easy to move when pressure builds. The more you rationalize, the further you drift from your plan. Cognitive load : Constant monitoring and decision-making can create fatigue and reduce clarity. Risk of paralysis : In fast markets, hesitation or second-guessing can lead to missed exits or larger losses. What’s really underneath (the psychology-layer): So why do these patterns repeat, regardless of style? It’s rarely about the chart itself. It’s about how the human mind responds to risk and uncertainty: Loss aversion : Losses hurt ~2x more than equivalent gains feel good which leads to an impulse to delay the loss (widen/erase stop). Regret aversion : After a few “wick-outs,” the mind protects against future regret by avoiding hard stops or going break-even too early. Ego/identity fusion : “Being wrong” feels like I am wrong and then to protect self-image one moves the line. Illusion of control : Tweaking the stop restores a feeling of agency, even if it reduces expectancy. Sunk-cost & escalation : More time/analysis invested makes it that much harder to cut. Time inconsistency : You planned rationally; you execute emotionally in the moment (state shift under stress). Physiology : Stress narrows perception (tunnel vision, shallow breath, tight jaw), pushing short-term relief behaviors over long-term edge. Reframe: The initial stop isn’t a judgment on you. It’s a premeditated boundary that keeps one trade from becoming a career event. It’s not about being right; it’s about staying solvent long enough to let your edge express itself. Practical tips … the How: Turning insight into action requires structure. A few ways to anchor the stop as your ally, not your enemy: Pre-commit in writing : “If price prints X, I’m out. No edits.” Put it on the chart before entry. Size from the stop, not the other way around : Position size = Risk per trade / Stop distance. If the size feels scary, the size is wrong, not the stop. Do not risk what you can not afford on any one trade / series of trades. Use bracket/OCO orders to reduce in-the-moment negotiation. If you insist on mental stops, pair them with a disaster hard stop far away for tail risk. Tag the behaviour : In your journal, checkbox: “Did I move/delete the stop? Y/N.” Review weekly; if you track the behaviour consciously you will be more likely to respect your stops. Counter-regret protocol : After a stop-out, don’t chase a re-entry for 15 minutes. Breathe, review plan, then act. For those that choose not to place stops in the market, but use mental stops instead, I’d offer the following thoughts to help manage the shift from automation to discipline. Define exit conditions before entry (levels, signals, timeframes) and write them down. Pair mental stops with “disaster stops” in the system, far enough away to only trigger in extreme cases. Size positions conservatively so you can tolerate wider swings without emotional hijack. Use check-ins (timers, alerts) to prevent emotional drift during the trade. Build routines that reduce decision fatigue so you can act clearly when the market turns. Closing thought: A stop isn’t a punishment; it’s tuition. Pay small, learn quickly and keep your psychological capital intact for the next high-quality decision. One of my favourite sayings told to me by a trader many years ago stands true even to this day. Respect your capital and ‘live to trade another day’. This is Part 1 of the Exit Psychology series . 👉 Follow and stay tuned for Part 2: The Break-Even Stop - Comfort or Illusion? A link to the original article as promised:

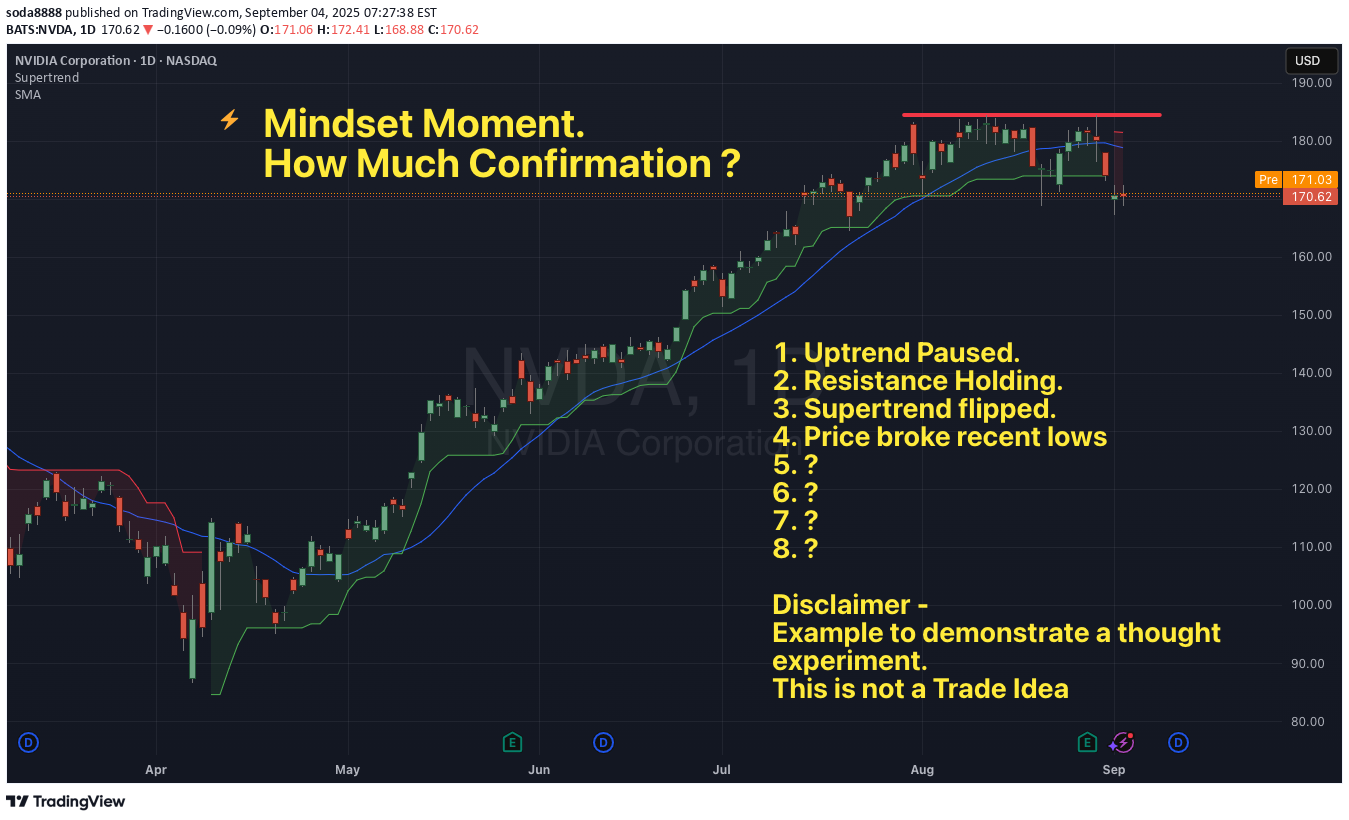

So ... you have what looks like a set up. "Just one more bar" "Just wait for the close" "Wait for this indicator to align" "Watch for the next to align" "Ensure this filter shows ‘green lights go’" But by the time everything lines up The move has gone. The horse has bolted You fumble to enter - all fingers and thumbs You ‘feel’ like you’re chasing Perhaps the moment has passed. Flummoxed - you wonder - what the heck happened here? Feel familiar? The search for absolute certainty shows up in subtle ways: Emotions: Anxiety builds. A conflict between wanting to act and restraining the impulse. Applying self control with will … but the body and mind unsettled. Thoughts: Endless “what if” scenarios. What if I miss it. What if it goes without me What if I just try and get ahead of this at a better price Physical Cues: Tension rises in the body showing up as a hand hovering over the mouse, heart rate climbing - eyes fixated on the screens, backside glued to the seat (for fear of missing it). If you’ve ever experienced this, you may recognise it as feeling cautious or disciplined. In the pursuit of being disciplined and true to your rules you feel out of alignment and hesitant. Markets are uncertain by nature. If we choose to engage with uncertainty, then surely the job is to create a sense of certainty within ourselves. The question is how do you do this currently? A coping mechanism that might help: Breathe. Centering your breath is one of the most under rated and effective ways to calm ones nervous system. Reframe your entry as a probability, not a verdict. Before you click, remind yourself: This trade doesn’t have to be certain, it just has to meet my criteria. Then execute and let the outcome be data - not proof of your worth. Adopt the mantra… ‘ This is one trade in a 1000’ Cultivate the state of certainty in uncertain environments one trade at a time.

Context : Daily Chart ETHUSD. Uptrend intact. Price sitting right on the trend line. Price consolidating into a series of dojis. Imagine this scenario. You have a plan. You're a trend trader. You're looking to get long. You start to observe the context… We’re into September. Tech showing signs of correcting. Gold heading up. This chart... right here, right now is consolidating. And so you experience a little flicker. A small niggle … There it is. The voice of doubt. "I should get long but maybe this is the one that gives way". You feel a moment of indecision. And you’re stuck frozen The human version of a doji. Indecision has a cost and takes a toll. Not just in lost opportunity BUT in energy and confidence. A simple practice to help guard against this: Pre-decide the conditions. Write down before you enter what tells you to stay in and what tells you to step aside. Separate the signal from the noise. Notice the flicker of doubt, but act on your plan, not the passing thought. Doubt will always show up. The edge comes from knowing what you’ll do when it does.

A trader frames an idea: BTC Daily Uptrend Looking for reasons to frame a low risk idea for a long, wanting to get into uptrend resumption Drops down to the 4hr Notices buyers coming back … or at the minimum the sellers pause Enters with a tight stop for a healthy return to risk ratio Stop set. Risk defined. Plan in place. Price goes against Trader shifts the stop down What is going on here? It’s all too easy to do. Many of us have been here before. Stop in place. Target set. Everything mapped. Then the market nudges against you … You might tell yourself “this is just ‘noise’”. You convince yourself that ‘they’ are just going to pick you off. and suddenly you’re “adjusting.” Move the stop just a little. Pull the target closer. Bend the rules you swore you’d follow. And it feels ‘right’ in the moment. Like you’re managing risk. But what’s happening here is that You are attempting to control your own discomfort. And in so doing - you enter the slippery slide of losing self control. It’s subtle but it starts like this. If the trade works out - you might feel justified in having moved your stop and therein starts a pattern of rule breaking. If the trade does not work out - you might beat yourself up and undermine confidence in yourself and your process 🧠 A simple thing that might help guard against this: Before the trade, write down the one level you will respect. Write it in a journal. Annotate it on the chart. Use the TradingView long position / short position tool. Even saying it out loud locks it in. That tiny ritual makes it much harder to justify shifting things mid-trade. The market will do what it does. The only thing you truly control is whether you keep your word to yourself. Commit to the stop when you commit to the trade Live to trade another day.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.