sahbil

@t_sahbil

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Potential bullish wedge formation on JUP

JUPUSDT.P appears to be forming a falling wedge, which is typically a bullish pattern. After a breakout, it could present a potential setup for entry. This is not financial advice, please manage your risk accordingly.is broken now, valid for long, TP 0.65, 0.72, 0.88longed at weekly level 0.5306back to entry again, RSI gives bullish divergence, so still validclosed at BE, market is chooped currently

My ideal for a swing long in BTC

BTCUSDT has touched an important monthly level, presenting a notable observation for traders. For those who missed this movement and are considering an entry point, the $44,200 area, highlighted by both weekly and daily levels, appears to be a promising option. This zone also aligns with the Fibonacci 0.382 level, adding to its significance. Additionally, should an ETF approval occur in the coming days, we could potentially witness a substantial surge in BTC, possibly reaching the $50,000 zone. Keep an eye on these developments for strategic trading opportunities.

Goodluck $ATOM

ATOMUSDT is currently endeavouring to breach the key resistance zone. Once it successfully overcomes this barrier and the descending trendline originating from September of last year, the subsequent target for ATOMUSDT could be the critical $20 zone. Good luck!Just bought some spot here ($10.8 area)

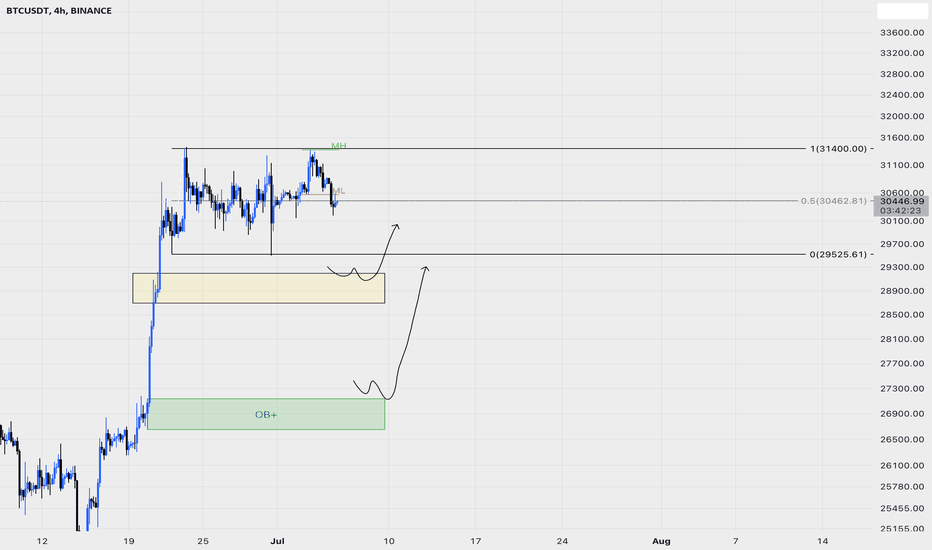

Watch BTC Support and Order Block

Watch BTC Support and Order Block BTC has recently been rejected from the middle of its range, signaling a bearish outlook. Keep a close eye on the key support level at $29200, a break below this level could indicate further downside potential. However, there is a significant order block around the $26900 area, which might serve as strong support. If BTC reaches this level and shows signs of buying interest, it could lead to a potential price pump or rebound.

Potential short opportunity area for BTC

Potential short opportunity area for BTC While Bitcoin continues to hold its uptrend channel, I see a potential short opportunity in the near term. Currently, BTC is holding the middle of this channel, and I believe it's possible for it to retest the Fair Value Gap (FVG) at $32,677. Interestingly, this FVG level also coincides with the 0.5 Fibonacci retracement level, adding further significance to this price point. In the past, Bitcoin has shown a tendency to reject from this value, which could indicate a potential reversal or pullback.

BNB Possible Fall to deep Amid SEC-Binance News

BNB Possible Fall to deep Amid SEC-Binance News As Binance Coin (BNB/USD) is currently testing a significant weekly support, market participants should keep a close watch on the coming price action. Given the recent developments between the Securities and Exchange Commission (SEC) and Binance, we could observe heightened selling pressure in the near term that might induce a downside break of this critical support. Binance, the issuing entity of BNB, has been under intense scrutiny by the SEC. The commission's increased attention on the crypto exchange's operations, particularly in areas of regulatory compliance, could create an atmosphere of uncertainty and risk among investors. These external pressures could potentially add to selling pressure on BNB. At present, the BNB/USD pair is testing a crucial weekly support level. If the pair fails to sustain above this support, a steep sell-off could be triggered that might drive the prices down to the next support-resistance (SR) area around $50. This level has previously served as both support and resistance and is a likely target should the current support fail. Traders should monitor the situation closely and look for confirmatory signals of a breakdown. A weekly close below the current support, accompanied by increased trading volumes, could offer a stronger indication of a potential decline towards the $50 mark. However, traders should also consider that market dynamics can change rapidly, especially in the crypto space. While the recent news involving Binance and the SEC seems bearish, any positive developments in this regard could quickly reverse market sentiment and impact BNB prices. Always remember, trading involves risk. It's important to conduct thorough research and consider various scenarios before making trading decisions. Consider this analysis as part of a diversified strategy. Note: This idea does not constitute financial advice. Always do your own research before making any investment decisions.

Retesting Major Support, Potential Upswing to 40K

Retesting Major Support, Potential Upswing to 40K Bitcoin (BTC) seems to be presenting an interesting scenario. It's hovering near a key support zone and could provide a lucrative trading opportunity if certain conditions play out. However, this idea requires thorough analysis and is not to be taken as financial advice. Remember, every investment carries inherent risks. Idea: Bitcoin is currently trying to touch the significant support area between 25200 - 24400. This area is not only a substantial horizontal support level but also coincides with the dip of the upward trend that began from the 16K level. This combination of horizontal support and trendline support adds a layer of confluence to this zone and makes it a crucial area to watch. Should Bitcoin hold this support zone, we can expect the bullish momentum to pick up. It is likely that BTC could then begin a new upward move, potentially targeting the 35K - 40K area. This would represent a significant price increase and would restore much of the value lost during the recent correction. However, a break below the support area could invalidate this scenario, which is why it's essential to have a risk management strategy in place. Traders should keep a close eye on how BTC interacts with this support zone. A strong bounce could serve as a potential entry signal for a long position, while a break below could suggest further downside. This post is for educational purposes only and is not investment advice. Please do your own research before making any investment decisions. Cryptocurrency investments carry significant risk and may result in a loss of your capital.

XRP: Two Potential Trading Strategies to Consider Now

XRP: Two Potential Trading Strategies to Consider Now XRP seems to be offering an interesting setup for traders with two potential entry positions available. Before proceeding with this trading idea, please make sure to do your own research and consult with your financial advisor. Remember that all investments come with risks. Idea: Spot Entry Now: The first strategy is to take a spot entry right now. With this approach, you would buy XRP at its current market price. However, you need to have a defensive strategy in place in case the price goes against your prediction. Setting a stop-loss order when a 4-hour candle closes below the most recent low would be a good way to limit potential losses. This means if the price dips and a 4-hour candle closes under the last low, your position would be automatically sold, thereby preventing further losses. Breakout Entry: The second strategy is a more conservative one, where you wait for a breakout above the 0.54 level. If XRP price can convincingly break this resistance, it might indicate that more bullish momentum is coming. The next target would be the resistance zone between 0.73 - 0.76. This strategy is based on the principle of buying on strength and waiting for confirmation before entering the trade. Final Thoughts: Both strategies have their own merits and demerits. The spot entry now offers the chance to get in early before a potential move upwards but carries more risk if the price continues to move lower. The breakout entry strategy has less risk as it waits for confirmation of a bullish move but could potentially result in a higher entry price. As always, remember to manage your risk effectively and to adjust your strategies as market conditions change.

Potential Short Entry as BTC Tops Downtrend

Potential Short Entry as BTC Tops Downtrend Introduction: Bitcoin's (BTC) recent rally to the top of its downtrend channel presents a potential shorting opportunity, particularly as it has yet to clear the short liquidity. This situation calls for a more strategic approach to trading that can take advantage of this pattern. Analysis: Approaching Downtrend Resistance: BTC has been trading in a defined downtrend channel and it has recently rallied towards the top end of this range. This resistance has previously held firm, causing a reversal each time Bitcoin tests it. Failure to Clear Short Liquidity: Despite the rally, there has been a noticeable lack of strength to clear short liquidity. This refers to a lack of buying pressure that could drive the price above the previous high, which is needed to trigger short squeezes and provide the fuel for a sustained rally. Bearish Candlestick Patterns: At the top of the downtrend, we are seeing bearish candlestick patterns forming, such as shooting stars or bearish engulfing patterns. This suggests selling pressure is starting to outweigh buying pressure. Increased Selling Volume: The increase in selling volume as the price approaches the top of the downtrend is another bearish signal. If this continues, it could push the price back down. Conclusion: Given these conditions, we can identify a possible short area as Bitcoin approaches the top of its downtrend. It might be beneficial to wait for confirmation of the reversal (for example, a bearish candlestick pattern) before entering the short position. Trade Idea: Consider entering a short position if bearish signals confirm the reversal at the top of the downtrend. Set a stop loss above the recent high to manage potential risks. Target levels could be the mid-line or the lower line of the downtrend channel, depending on how bearish the situation becomes. As always, this is not financial advice but a perspective based on technical analysis. Traders should do their own research and consider their risk tolerance before entering any trades.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.