sagaahhelite

@t_sagaahhelite

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

sagaahhelite

XAUUSD TECHNICAL OUTLOOK 29-05-2025

📣Gold Under Pressure XAUUSD CMP $3316.81 ✅XAUUSD movement 29-05-2025: $3289-$3245-$3321 =$120 Movement Witnessed. 🔴Gold remains under pressure after a sharp turn from morning crash, which has triggered fresh volatility across commodities in USA session. ⏳ Despite safe-haven appeal, XAUUSD faces bullish momentum after a correction, driven by renewed appetite for risk assets and shifting market flows. 📉 Technical Outlook (1H): • Bearish below $3305 • Next downside targets: $3280 → $3265 → $3250 • A break below $3255 could accelerate the decline toward $3240-$3220 🔁 Bullish Shift Trigger: • A confirmed 1H close above $3319 may invalidate the bearish bias and target $3340+ 📊 Key Levels: • Pivot: $3305 • Support: $3280 – $3265 – $3250 • Resistance: $3327 – $3339 – $3351

sagaahhelite

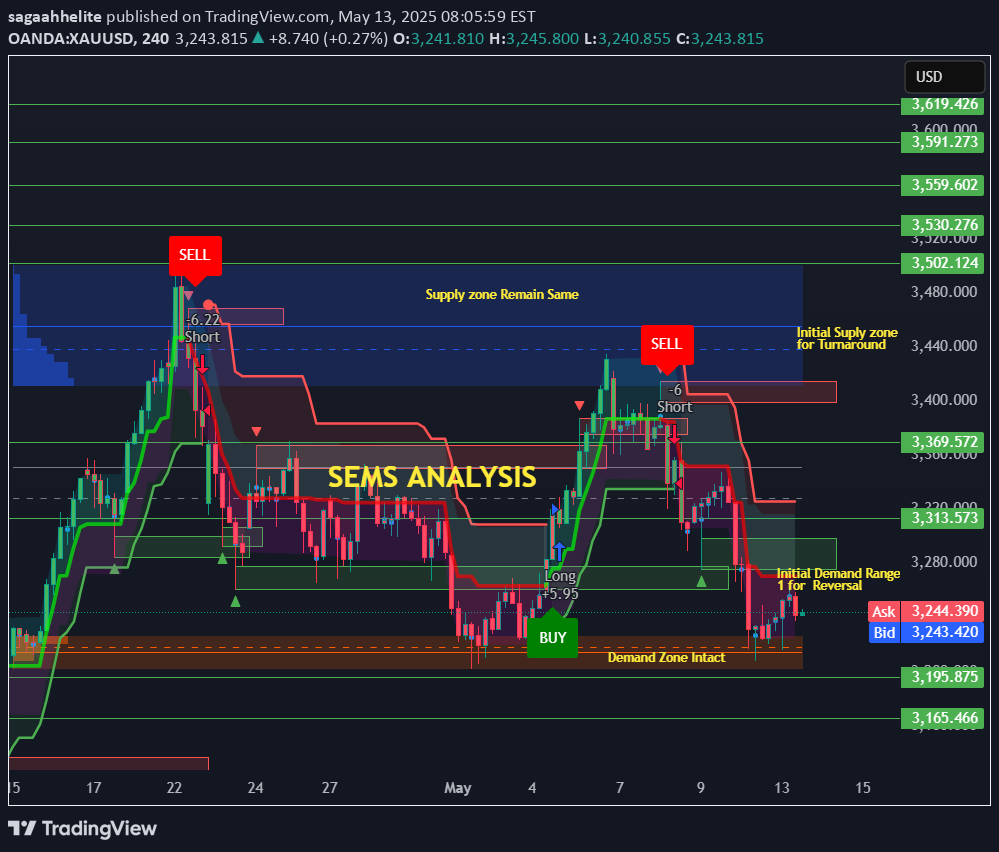

CPI DAY XAUUSD CHART FORMATION # TRADE RANGE #SEMS #13-05-2025

📌 Trading Framework – Positioning on Pullbacks | Reacting at Resistance 🟢 Rebound Strategy – Buy Zones: • Entry: $3,215 → $3,190 → $3,165 → $3,135 • Targets: TP1 $3,250 → TP2 $3,265 → TP3 $3,295 → TP4 $3,320 🔴 Downtrend Strategy – Sell Zones: • Entry: $3,340 → $3,378 → $3,408 → $3,428 • Targets: TP1 $3,310 → TP2 $3,290 → TP3 $3,260 → TP4 $3,230 📊 Technical Snapshot Indicator Status D1 SMA 100 ✅ Buy @ $3,050.15 D1 SMA 200 ✅ Buy @ $2,980.78 H4 SMA 100/200 ❌ Sell / ✅ Buy ($3,330 / $3,190) H1 SMA 100/200 ❌ Sell ($3,310 / $3,325) RSI (14) ❌ Sell MACD / ADX / STOCH ❌ Sell / ❌ Sell / ⚖️ Neutral ATR (14) 🔕 Low Volatility Overall Sentiment ✅ Buy 📌 Key Guidance • CPI data may trigger sharp moves—adjust stop-loss & lot sizes • Watch: Headline CPI (YoY) and Core CPI (MoM) (April release) • Prior zones have yielded results—levels remain highly actionable 🟡 Conclusion: Stay adaptable. CPI will guide short-term trend. We're ready for breakouts or pullbacks. ⚠️ Risk management is your best strategy—profits follow discipline.

sagaahhelite

XAUUSD ANALYSIS UPDATE 20-03-2025

📉 Stocks Fall as Fed Rally Fades 📌 U.S. stocks declined on Thursday, reversing gains from the previous session after the Federal Reserve maintained its outlook for two rate cuts in 2025. 🔹 Market Movement: ✅ Tesla fell 1% premarket, extending its March losses to nearly 20%. ✅ Alphabet and other tech stocks saw losses of around 1%. ✅ Technology Select Sector SPDR Fund (XLK) also dipped by 1%. 📊 Gold Making Potential Bearish Head and Shoulders Pattern 📌 Gold (XAU/USD) peaked at $3,057 after breaking the psychological $3,000 level. However, momentum is fading, and a potential bearish Head and Shoulders pattern is forming. 🔎 Levels to Watch: Neckline Support: $3,025 – A decisive break below this level could signal further declines. Bearish Targets: ✅ $3,005 ✅ $2,993 ✅ $2,980 📈 Outlook: A confirmed pattern breakdown could accelerate selling pressure.( $2960-$2940 Range) Failure to break the neckline may see gold remain range-bound or attempt a rebound.($3060-$3080 Range ) 💰 Traders should stay cautious and monitor technical signals for potential price shifts! 🚀📉

sagaahhelite

FED RATE DECISION DAY 19-03-2025

⏺️ Will the Federal Reserve Hold Rates at the March FOMC Meeting Amid Economic Uncertainty? 📌 The Federal Reserve is widely expected to keep interest rates unchanged at 4.25%-4.50% in its March meeting, as policymakers assess mixed economic signals. Markets will focus on any hints regarding future rate cuts. 🔹 What to Expect from the March Fed Meeting 📅 FOMC Meeting Date: March 18-19, 2025 ✅ Consensus Expectation: Fed to hold rates steady at 4.25%-4.50% ✅ Fed's Cautious Approach: Inflation has eased, but uncertainty remains over labour market trends & economic growth. ✅ Jerome Powell’s View: The U.S. economy remains resilient, with no immediate need for rate adjustments. 🔹 Economic Indicators Impacting the Fed's Decision 🟢 Consumer Sentiment Decline – 29-month low due to tariffs & government restructuring. 🟢 Inflation Cooling – CPI moving toward 2% target, but progress varies by sector. 🟢 Labour Market Stability – Unemployment remains low, though job creation & wage growth show signs of cooling. 🟢 Mixed Data in Retail, Manufacturing, & Housing – Complex economic picture for Fed to evaluate. 📊 Market Implications of the Fed’s Decision 📈 Stock Markets: Likely to react to Fed’s tone & future guidance rather than the rate hold itself. 📉 Bond Markets: Sensitive to any hints of rate cuts. Yield curve movements will be closely watched. 💵 Currency Markets: A dovish stance weakens the USD, while a hawkish tone strengthens it. 🛢 Gold & Commodities: Gold typically moves inversely to the dollar; a dovish Fed could drive gold prices higher. 🔹 Fed's Economic Projections & Dot Plot Impact 📌 Updated Projections for: ✅ Interest Rate Outlook (Dot Plot) – Key for assessing the Fed’s policy trajectory. ✅ GDP Growth, Inflation, & Unemployment – Will shape market expectations. 📊Main Focus: December’s dot plot suggested fewer rate cuts than markets anticipated. Any revisions could signal the Fed’s confidence or concern over the economic outlook. Substantial changes could trigger major moves across stocks, bonds, currencies, and commodities. 💰 Traders should stay alert for post-FOMC market volatility! 🚀📈

sagaahhelite

XAUUSD ANALYSIS UPDATE #SEMS #2834 Strong Demand Area

XAUUSD Analysis Update : XAUUSD Bounces Back to $2,877 on Weaker Dollar 📌 Gold rebounded sharply on Monday, reaching $2,877 after touching a weekly low of $2,833 on Friday, as a weaker U.S. dollar, ongoing Ukraine peace deal uncertainty, and tariff concerns boosted safe-haven demand. 🔹 Key Market Drivers: Weaker USD: Traders continue to price in two Fed rate cuts by year-end despite in-line inflation data on Friday. Ukraine Peace Deal Uncertainty: Delays in reaching an agreement have fueled further market caution. Projected Support Held Strong: As alerted in advance, the $2,834 demand zone proved to be a key buy area, triggering a successful rebound. 📊 Trade Execution & Results: ✅ All Buy Trades Closed in Profit at $2,876.14 ✅ Critical Support Levels Held on: 04-02-25 | 14-02-25 | 21-02-25 🔗 Verify Analysis & Trade Records: 📍 Analysis 1: 14-2-25 📍 Analysis 2:21-2-25 Contatc for Details 💰 Precision trading pays off—another profitable move! 🚀📈 💰 Check Profits and Analysis Advance Alerts

sagaahhelite

XAUUSD ANALYSIS UPDATE 27-02-25 #SEMS #ACCURATEGOLDANALYSIS

XAUUSD Analysis Update – XAUUSD Pulls Back After All-Time High 📌 Gold (XAU/USD) hit a record high of $2,955 on 20-02-25 before retreating to a weekly low of $2867.64, as market turbulence, Trump’s tariff threats, ceasefire talks, and new trade deals contributed to a cooling effect. 🔹 Upcoming Events That Could Drive Market Volatility: NFP & CPI Reports-pending Fresh Trade Data & International Trade Imbalance Federal Reserve Interest Rate Decision-pending 📊 Technical Outlook & Trading Strategy: $2,834 remains a critical support and demand range. Until then, we will trade with moderate lot sizes, advising traders to exercise caution and follow the preset trade levels and exit strategies. Selling at highs once again proved highly effective, reinforcing the accuracy of our strategy. 🔹 Key Buy Levels & Trading Plan: ✅ Buy Zones: $2,855 – $2,840 – $2,825 – $2,800 ✅ Trading Approach: Buy within this range, adjust position sizing based on volume, and exit partially at key resistance levels. 📢 Precision & strategy remain our edge—trade smart! 🚀📈

sagaahhelite

XAUUSD ALL TIME HIGH 2955 PREDICTED EARLIER #SEMS #GOLD #XAUUSD

🚨Gold Market Update – XAUUSD CMP $2,920.85 📌 Gold once again reached an all-time high before reversing, confirming the accuracy of key demand and supply zones highlighted since February 7, 2025. This marks the third time this month that gold has hit a record level before pulling back, reinforcing the strength of these strategic levels($2834-$2855-$2890-$2942) which were mentioned again and again in analysis. 📊 What’s Next to Keep and Eye for ? 1.Gold remains on track for $3,000, a milestone projected by economists and our panel since November 2024. 2.Reversals and corrections were anticipated, allowing for profitable trades in both buying and selling directions. 3.Strong market demand continues to drive new highs, with strategic trading opportunities ahead. 🔗 Check our analysis & Contact for profit verification: 💰 Precision trading with best results—stay tuned for the next move of Gold ! 🚀📈 🚨XAUUSD TRADE LEVELS: SELL AT: $2960-$2990-$3020-$3050 BUY AT: $2915-$2885-$2855-$2825 ⚠WARNING: Do not risk more than 5% of your capital, Trading in gold and other financial instruments involves significant risk and may result in substantial losses.

sagaahhelite

XAUUSD ALL TIME HIGH $2870 #SEMS #GOLD ANALYSIS

Important Trading Levels XAUUSD (as of NFP Release Week):🔻🔺📌🚨 Immediate Sell Zone: $2,880–$2,900–$2,930🔺 Immediate Buy Zone: $2,840–$2,810–$2,790🔻 H4 Buying Levels: $2,720–$2,690–$2,650–$2,610🔺 H4 Selling Levels: $2,885–$2,910–$2,939–$2,964🔻 ⚠Warning : Do Not risk more than 5% Of Your Capital. Trading in Gold an other Financial instruments and markets involves significant risk and may result in substantial losses. 🇨🇳China’s Retaliation: Antitrust Investigations into U.S. Tech Giants •Google: Investigated over Android dominance, affecting Oppo & Xiaomi. •Nvidia: Probe revived after initial investigation in December. •Intel: Possible investigation pending based on U.S.-China relations. 📌 These regulatory actions appear to be part of China’s retaliation against Trump’s new tariffs on Chinese imports. President Xi is expected to engage with Trump soon, potentially shaping further developments. 🌎Market Outlook & Takeaways: •Gold remains supported by trade tensions and safe-haven demand. •The Japanese yen strengthens amid rising wages, inflation, and an expanding services sector. •China’s regulatory actions could escalate U.S.-China trade tensions, impacting tech stocks and market volatility. 🇺🇸🇮🇱Markets React to Trump’s Gaza Proposal & Economic Data Trump’s Gaza Proposal: Market Indifference •President Donald Trump’s suggestion to turn Gaza into the "Riviera of the Middle East" has not influenced markets significantly. •The idea, echoing a previous proposal by Jared Kushner, remains unclear in intent and has been largely dismissed by traders. •Oil prices remain stable, and global markets have shown no strong reaction. USD/JPY & Japanese Economic Outlook 📌 USD/JPY Weakens (-0.9%) •The dollar continues to decline for the third consecutive day as Treasury yields drop. •The yen strengthens following a larger-than-expected rise in Japanese wages, increasing the likelihood of Bank of Japan rate hikes. 📉 Technical Breakdown: •Break below key support levels at 153.76 & 153.36, signaling a continuation of the short-term downtrend from its 2025 peak (158.87, Jan 10). •Next downside targets: 1. 151.50 (Fibo 38.2% retracement of 139.57–158.87 rally) 2. 151.00 (psychological support) 📊 Key Resistance & Selling Opportunities: •200DMA (152.77) breached, validating further downside potential. •Limited price upticks may provide better entry points for short positions. U.S. Economic Data to Watch Today 📌 ADP Private Sector Payrolls (Jan) •Previous: 122K | Forecast: 148K •Potential impact on USD strength if data beats expectations. 📌 December Trade Balance & January Services PMI •Expected to influence market sentiment and dollar movement. Japan’s Wage Growth Strengthens BoJ Rate Hike Case 📌 Labour Cash Earnings (Dec): •+4.8% YoY (above expectations) •Base earnings steady at +2.5% YoY for the second month. •Real cash earnings: +0.6% (Nov: +0.5%), despite rising inflation. 📌 Implications for BoJ Policy: •If Shunto wage negotiations deliver strong results, the BoJ may hike rates by 25bps as early as May. •Base earnings growth (+5.2%) aligns with BoJ’s target for sustainable wage growth (3%), reinforcing expectations for policy tightening. Stay tuned for further updates as geopolitical and economic events unfold. 📊📈

sagaahhelite

FOMC DAY ANALYSIS 29-01-2025 SEMS # GOLDTRADING

FOMC DAY BUY/ SELL LEVELS : Sell at: $2790-$2814-$2838-$2862 Buy at: $2725-$2701-$2677-$2653 Gold Gains as Economic Uncertainty Offsets Calm Markets Despite calmer global market conditions, gold prices found support from lingering economic concerns ahead of the Federal Reserve’s key policy announcement. 📈 10-Year Treasury Yield: Edged up 1 basis point to 4.538% 📉 U.S. Dollar Recovery: Capped by weakening bond yields Investors remain wary of potential economic disruptions stemming from President Trump’s proposal to impose tariffs on imported computer chips, pharmaceuticals, aluminum, steel, and copper. The initiative aims to encourage domestic production but risks triggering renewed global trade tensions—an outcome that could further boost safe-haven demand for gold. Meanwhile, the Federal Reserve’s rate decision remains the primary market driver, influencing U.S. dollar dynamics and providing fresh momentum for XAU/USD. CTA (Commodity Trading Advisor) activity is also expected to support gold prices in the short term.

sagaahhelite

XAUUSD POST CPI UPDATE

As alerted in advance for the $2700-$2715 Range Sell Target Achieved with a low of $2703 Surprise Fed Statements: Potential March Rate Cut Federal Reserve Governor Christopher Waller suggested in a CNBC interview that if December’s positive inflation trend continues, a rate cut could occur in the first half of the year, possibly even in March. Waller hinted at the possibility of up to three or four cuts this year if inflation declines further. He noted that inflation has returned to its prevailing trend and expressed optimism that it will reach the Fed’s target. Regarding the labor market, Waller described it as strong but not booming, considering the latest jobs data as a mix of previous weaker readings. Waller downplayed concerns about potential tariffs under a future Trump presidency, suggesting they may not significantly impact inflation. UBS: Fed Unlikely to Cut Rates Before June UBS analysts predict that the Federal Reserve will hold off on rate cuts until June, following a weaker-than-expected core inflation reading. Headline CPI rose 0.4% in December, slightly up from 0.3% in November. The annual CPI increase was 2.9%, compared to 2.7% in November, suggesting inflation is still higher than the Fed’s comfort zone. XAUUSD CMP $2723 Major Sell Zone: $2,745–$2,765–$2,787🔻 XAUUSD CMP $2704 Let us Exit in All Sell Trades IN Net Average Profit Net Profit - $25 $2500 Profit in 1 lot $12500 Profit in 5 lots $25000 Profit in 10 lots Kindly Exit from all Sell Trades open and Book Profit Wait for new High or Lows Stay tuned

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.