Technical analysis by sagaahhelite about Symbol PAXG on 5/13/2025

sagaahhelite

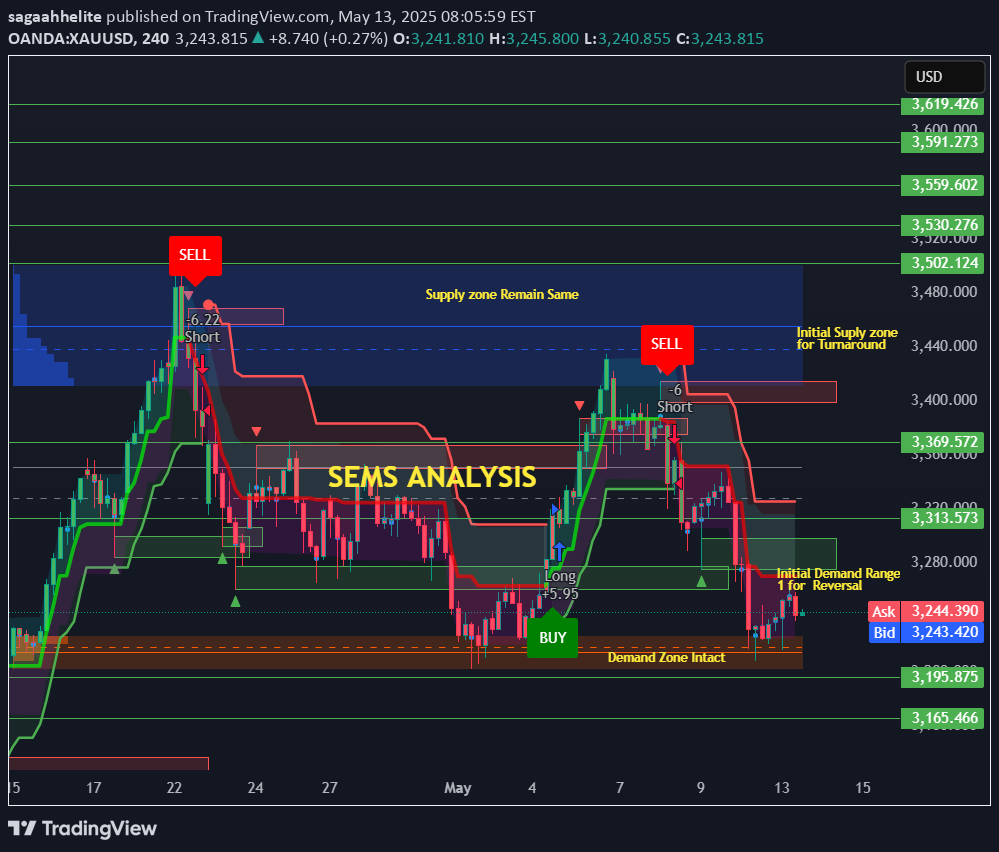

CPI DAY XAUUSD CHART FORMATION # TRADE RANGE #SEMS #13-05-2025

📌 Trading Framework – Positioning on Pullbacks | Reacting at Resistance 🟢 Rebound Strategy – Buy Zones: • Entry: $3,215 → $3,190 → $3,165 → $3,135 • Targets: TP1 $3,250 → TP2 $3,265 → TP3 $3,295 → TP4 $3,320 🔴 Downtrend Strategy – Sell Zones: • Entry: $3,340 → $3,378 → $3,408 → $3,428 • Targets: TP1 $3,310 → TP2 $3,290 → TP3 $3,260 → TP4 $3,230 📊 Technical Snapshot Indicator Status D1 SMA 100 ✅ Buy @ $3,050.15 D1 SMA 200 ✅ Buy @ $2,980.78 H4 SMA 100/200 ❌ Sell / ✅ Buy ($3,330 / $3,190) H1 SMA 100/200 ❌ Sell ($3,310 / $3,325) RSI (14) ❌ Sell MACD / ADX / STOCH ❌ Sell / ❌ Sell / ⚖️ Neutral ATR (14) 🔕 Low Volatility Overall Sentiment ✅ Buy 📌 Key Guidance • CPI data may trigger sharp moves—adjust stop-loss & lot sizes • Watch: Headline CPI (YoY) and Core CPI (MoM) (April release) • Prior zones have yielded results—levels remain highly actionable 🟡 Conclusion: Stay adaptable. CPI will guide short-term trend. We're ready for breakouts or pullbacks. ⚠️ Risk management is your best strategy—profits follow discipline.