reddeck

@t_reddeck

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

reddeck

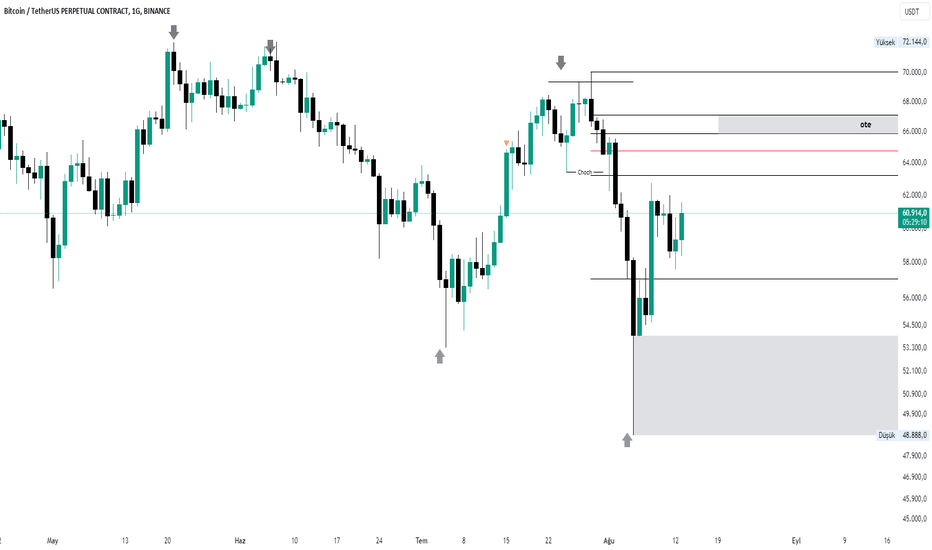

BİTCOİN DÖNDÜ MÜ? BOĞA BAŞLADI MI?

Hello friends. My current video with you. I wish you all a good time.

reddeck

BUDA MI GOL DEĞİL BİTCOİN

Merhaba arkadaşlar. Geçen hafta bildiğiniz üzere bitcoinde 70k seviyelerini gördük ama aynı gün için 5k dolar aşağı düşüş yaşadık. Bu sefer aklımız "buda mı gol değil" sorusu geliyor. İşte bu ve buna benzer soruların cevaplarını videoda bulacaksınız. Hepinize şimdiden iyi seyirler diliyorum.

reddeck

Bizim Boğa Vardı Ya, Artık Yok..

Merhaba arkadaşlar. Biliyorum çok zaman oldu analiz videosu atmayalı. Bunun bazı sebepleri vardı ama artık o sebepler ortadan kalktı. Bundan sonra periyodik olarak analiz videolarına devam edeceğiz. BU videoda piyasada dönen boğa söylentilerine ters olarak neden short beklediğimden bahsettim. Hepinize iyi seyirler.

reddeck

reddeck

Grafik Okuma Sanatı ile Bitcoin Analizi

Friends in this video with candle analysis bitcoin technical analysis and direction I tried to make direction. We watched an exuberant bitcoin which came enthusiastically with the latest Fake ETF news. Since the 30000 band he threw herself was the last area that remains open in the swing structure, it has now completed its fiction in swing and after that. If we only interpret it as a short term, it will first fall to 27690 band with 27878. After the weak response to the price of the price of the 28450 - 28500 band waiting to test. After these tests, the price will start to release the price if the price loses 26550 - 25980 levels according to the graph. After that, friends will meet us 24000 - 22200 bands. I wish you all good evening.

reddeck

1 SAATLİKTE BİTCOİN SON MUMLARIN ANALİZ

Hello friends. In this video, we examine the horizontal course he draws after the fall of Bitcoin. I tried to explain what the last candles tell us. There were moments when I got stuck. I hope I have been understandable. :) All of you have a good time.

reddeck

UZUN ZAMAN OLDU BTC ANALİZİ YAPMAYALI

Hello friends. It has been a long time btc We weren't doing analysis. When we look at the graph, we see that the last hill made in the rising wave coming from the bottom of 15000 was taken with a high seller candle. With the latest stop operation above, the liquidity dry in the range structure is completed and will now want to take the open spaces below. For this, the first 28500 Flip level attracts attention. With the future reaction, the re -test of the 30000 levels and the open FLIP demand zone at the level of 27000 - 26500, which are open below, are important. Looking at the big picture from the monthly graphics, things are a bit annoying. After the retreats mentioned above, a strong sales wave of Order Fow (through the command channel) will start between 37000 - 48000 bands. When we look at the monthly graph, many of us see the 15000 levels, which they see as bottoms, are actually inducement fields. In this case, it shows us the 12000 levels that have never been thrown a needle before. As a result, it is logical to follow the market instantly. Plenty of gains to all of you, friends.

reddeck

TALEP ÜZERİNE ETHUSDT ANALİZİ

Hello friends. I am here with live broadcasts and education with the new video. We will do today's analysis in the Ethusdt parity. With the last decline, the box strategy mentioned in the posts in the post -1623 reaction was completed and all liquidity was taken in the range structure that was formed before the hourly falling and the price is now floating downwards. My expectation is like this, friends. First of all, after receiving the stops of the 1714 area, which I expect a lot of reaction, a weak output will come up. Afterwards, the journey to 1681, which is not tested at the bottom, will begin. However, the last rise we see right now does not bring a new high, the 1623 level is a potential target. However, landing on a daily basis will land on the lower lower 1400 - 1300 band. Then we will follow the graphics gradually and continue to analyze. I would like you to stay on track and like it. I wish everyone auspicious days, plenty of gains.

reddeck

#xrp #sol PRICE ACTION ANALİZİ

Hello friends. In this video, we examined Ripple and Solana coins. First, I want to start from XRP. When I look at the graph, I see that it draws a different graph than other coins and is relatively horizontal after the decline. For the time being, I'm waiting for a stop operation in the area here, or rather up to 0.4375. Then there is a 0.50 - 0.53 band that has not been visited above. I expect that the main sales can come from this level. For the Long process, the 0.39 - 0.37 band, which he has never reached, seems to be appropriate. SOL On the side of November 07, 2022, the area began to collapse yet. For this reason, as the first target, I expect the 28-32 band. Why am I waiting for sales here? Because the market takes the price horizontally and has shown the upper band of this horizontal channel as resistance to the market. Approximately 26.50 levels can travel to the upper 28-32 band to clean the stop pool accumulated here. There are two areas that have never come below but reacts strongly. The first of these is 13,50 - 13 band and the other is 11.50 - 10 bands. I think these levels have appropriate purchase levels.

reddeck

#FLOW BU UZUN YOLDA SENİ NELER BEKLİYOR*

In this screw, I talked about what critical levels are in the Flowusdt parity without going very deep and about the possible goals in the long run. If we talk about these levels, briefly as follows; First of all, he constantly finds a new bottom in the weekly falling trend. If it closes below 0.64 level, it will search for another bottom with its retreat. However, I think it will return up by stopping at a level of 0.64 on behalf of myself. In this case, the level we need to follow is 1.46 level. However, after 1.46 to enter the purchase, you must follow the withdrawal. Since the market structure will be broken, 12,65 - 17.83 levels seem to be possible as my long term targets.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.