rasooldavarpanah

@t_rasooldavarpanah

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

rasooldavarpanah

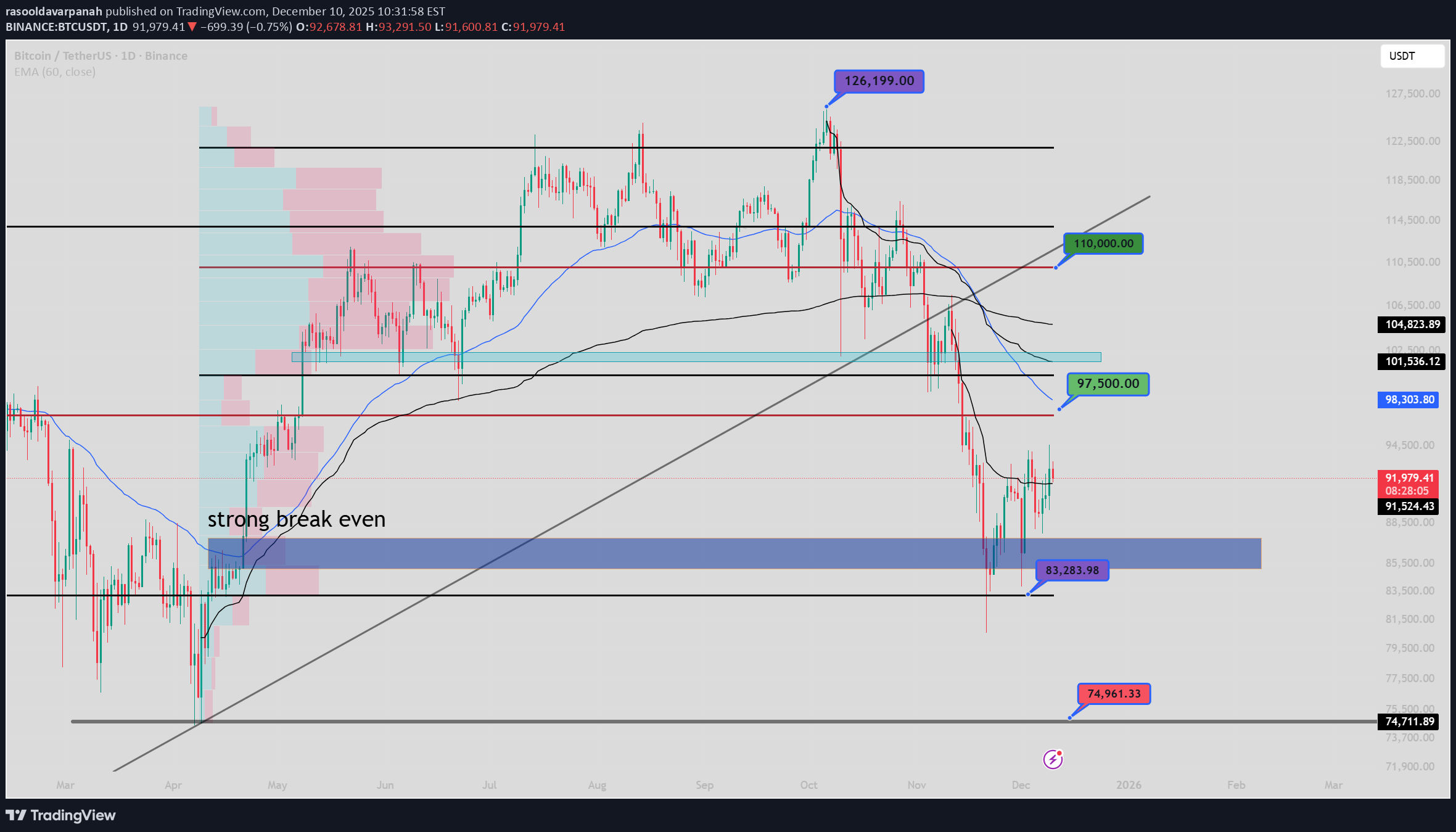

هشدار فوری بیت کوین: آیا ریزش عمیقتر BTCUSDT در راه است؟

Bitcoin Analysis In the previous analysis, I mentioned that every time Bitcoin corrects more than 30% from its price top, it enters a downward phase. Although the price dropped close to $80k (36%), it didn’t establish a solid consolidation there, so our scenario is still valid. With a confirmed consolidation below the $86k–$87k range, we would officially enter a bearish phase, with the first potential target around the $74k zone. For now, the price is being held up well, and we need to see what tonight’s interest-rate decision and Jerome Powell’s remarks will signal for the market. It’s also worth mentioning that we are in the final month of the calendar year, and historically, this month has consistently shown stronger selling pressure in previous years. Even though the rate cut has already been priced in, the announcement itself could still generate demand in the market — unless Powell, in his speech afterward, tries to emphasize strengthening the U.S. dollar, which could create selling pressure across markets. Overall, tonight will give us a much clearer direction for Bitcoin’s price action, and as always, we will move in sync with the market.

rasooldavarpanah

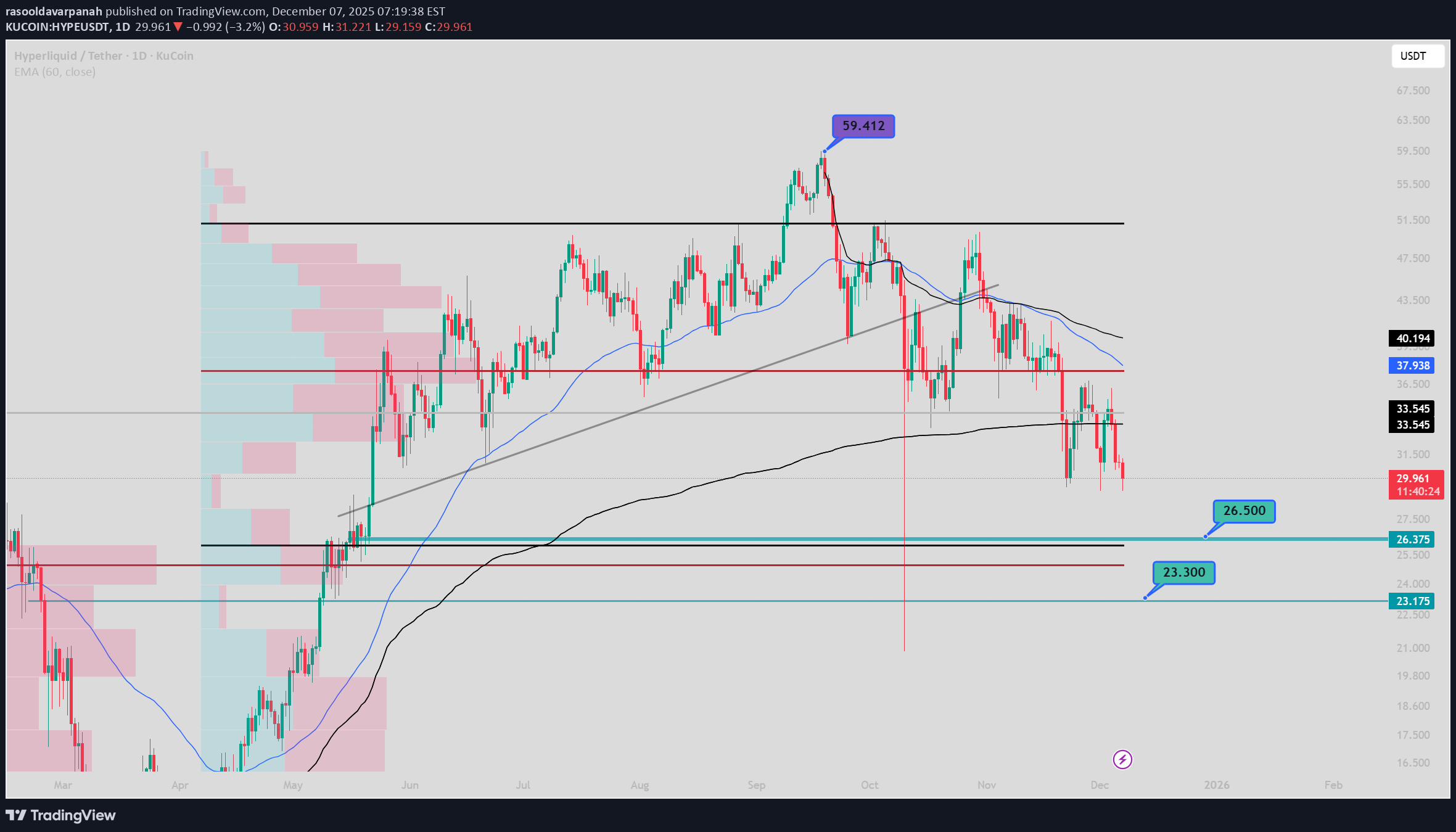

HYPEUSDT: سقوط قریبالوقوع یا فرصت طلایی خرید؟ تحلیل تکنیکال هفته

So far, the price has retraced about 50%, and on the weekly chart, a bearish pin bar has slightly increased fear. If the weekly candle closes as a strong bearish pin bar at the end of the week, many who haven’t sold yet may start selling, and the price could drop toward the lower levels shown in the chart. However, if the price completes its triple bottom pattern on the daily timeframe, as you can see, and demand appears from here, the pessimistic scenario may not happen. Personally, I remain a long-term buyer, and I will continue accumulating this coin with every dip.

rasooldavarpanah

HNT/USDT: منطقه طلایی خرید کجاست؟ سیگنال صعودی با شکست ۲.۴ دلار!

In my view, it’s completing its accumulation base, and I’m waiting for a higher low and a higher high. The $1.5–$1.8 zone is a valuable area for accumulation. Bullish leg confirmation comes with a sustained hold above $2.4.

rasooldavarpanah

هشدار فوری: زمان خروج از سرمایهگذاری Zcash/USDT فرا رسیده است!

As you know, over the past three months the market has delivered strong gains for investors. But given the current conditions, I hope you’ve already secured your profits and if you haven’t, now is the time to do it. Both the technical outlook and the overall market environment are clearly signaling the same thing: Take your profits and stay on the sidelines for now. With the current momentum of the correction and the break of the 60-day moving average on the daily timeframe, I expect the pullback to continue toward the highlighted zone the area where the moving average converges with the VWAP low.

rasooldavarpanah

تحلیل طلای جهانی (XAUUSD): منتظر صعود به اوج تاریخی یا سقوط تا ۳۸۰۰!

If it consolidates above this existing ceiling or above 4200 for greater certainty, we will go for the previous ATH. Otherwise, 3800 will be my main target.

rasooldavarpanah

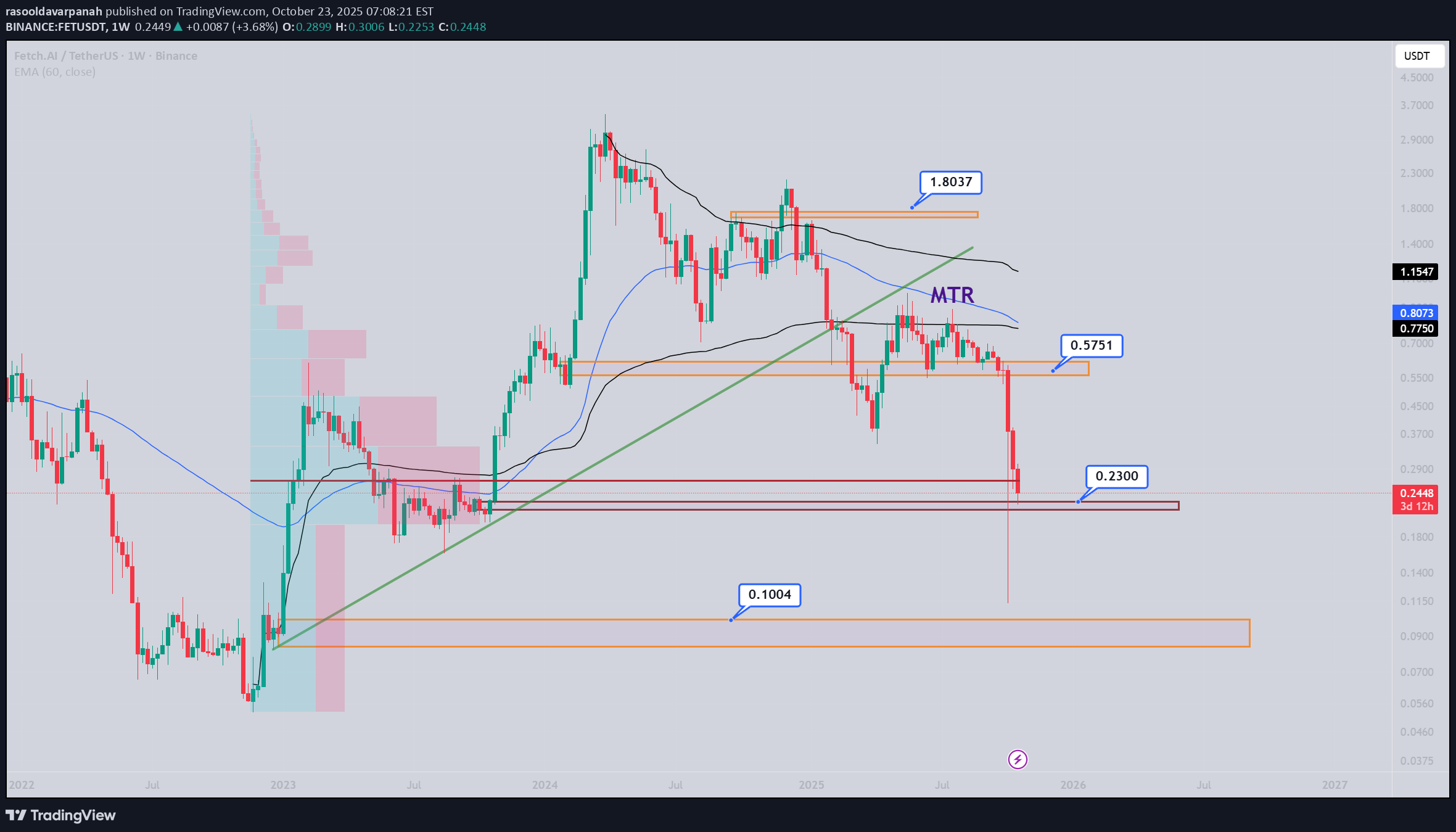

تحلیل تکنیکال FET/USDT: آیا قیمت به ۰.۵۰ دلار میرسد یا سقوط میکند؟

You’re looking at the FET weekly chart for a broader perspective. As shown, the price has completed its three-wave corrective structure and has already collected liquidity below 0.23 technically finishing its corrective leg. If overall market sentiment turns positive and liquidity flows back in, the price could potentially rally toward the $0.50 zone, which represents a 100% move from current levels. However, if we get a weekly close below 0.23, it would likely signal further time and price correction, as reflected on the chart.

rasooldavarpanah

تحلیل تکنیکال ETH/USDT: صبر برای شکست یا سقوط به زیر ۳۴۰۰؟

As you can see on the chart, the price has formed a beautiful triple-bottom pattern and is currently accumulating liquidity. As we all know, liquidity accumulation usually comes with a period of time correction (consolidation). If the price loses the triple-bottom support zone, it’s likely to drop toward 3300–3400. However, if buying pressure appears here and we see a confirmed price stabilization above the 4000 zone, we can expect the first potential bullish target around 4640. Respectfully

rasooldavarpanah

تحلیل SYRUPUSDT: فرصت خرید در کف قیمت و استراتژی میانمدت معاملهگران بزرگ!

Analysis of Syrop: Considering the overall market conditions, Syrop has performed very well and shown a strong recovery. This indicates that lower prices have been attractive for many investors — including whales — and liquidity has been flowing in. We’ve placed our entry trigger in a proper zone to have higher confidence in taking risk. Personally, I’ll keep buying on dips and adding gradually for a mid-term outlook. ⚠️ Always take risk and capital management seriously, and make sure to keep enough liquidity for future opportunities. Respect ✌️

rasooldavarpanah

آینده ریپل (XRP): آیا قیمت به مرز ۳ دلار میرسد یا سقوط میکند؟ (تحلیل کلیدی)

Ripple has settled around the 2.5 zone after a correction. If demand continues, it could easily reach the 2.8 and 3.0 levels. With a confirmed breakout above 3.0, we might expect further growth toward 3.6 or even higher. However, if stronger selling pressure appears before 2.7, Ripple’s price could drop to around 2.0 or even lower. For now, we’ll wait until the data and market direction become clearer. If you have any questions, feel free to ask. Respectfully.

rasooldavarpanah

تحلیل SYRUP: استراتژی خرید پلهای در چه قیمتهایی؟

Analysis of SYRUP: After this unusual correction, I’ll be looking to buy gradually (in multiple entries) at attractive price levels. If we get a daily close below 0.32, the price could drop to around 0.24, which would be a good zone for one of the buying entries. As time passes, the overall market conditions will become clearer, and we’ll have more confirmations. Make sure to divide your capital into at least four parts for each asset and wait for opportunities to buy at valuable price levels. Keep in mind, we’ll likely have a time correction, so there’s no rush to buy. Respectfully.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.