pritamaero21

@t_pritamaero21

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Chainlink just broke out of a 2-year ascending trendline with +70% gains in the last 28 days. Momentum is backed by strong volume and a clean bullish structure. Next target? The $30 macro supply zone. 📈🔗

A symmetrical triangle is forming with declining volume — signaling a likely breakout. 🔼 Break above ~$119.5K → Target: $123K 🔽 Break below ~$116K → Target: $113.5K ⚠️ Await confirmation before entering. Risk management is key. Bitcoin (BTC/USDT) Technical Outlook – 2H Chart

Order blocks are zones where big players (like institutions) place large orders, often leading to strong moves in price. They act as key areas of interest—bullish order blocks signal potential upward moves, while bearish

Bitcoin is showing signs of a short-term pullback after tapping into a Fair Value Gap (FVG) zone, triggering a potential short setup. Price is likely to retrace toward the bullish order block and retracement zone around 105,000–110,000. If that area holds, we could see a strong bounce back toward the 123,000 level.

Gold is targeting an external liquidity zone around 3,450 after breaking structure and forming a bullish setup. Price is expected to dip into the discount zone near 3,300 to collect liquidity from trendline stops before a strong move upward. Smart money is likely hunting below prior lows before initiating the next bullish leg.

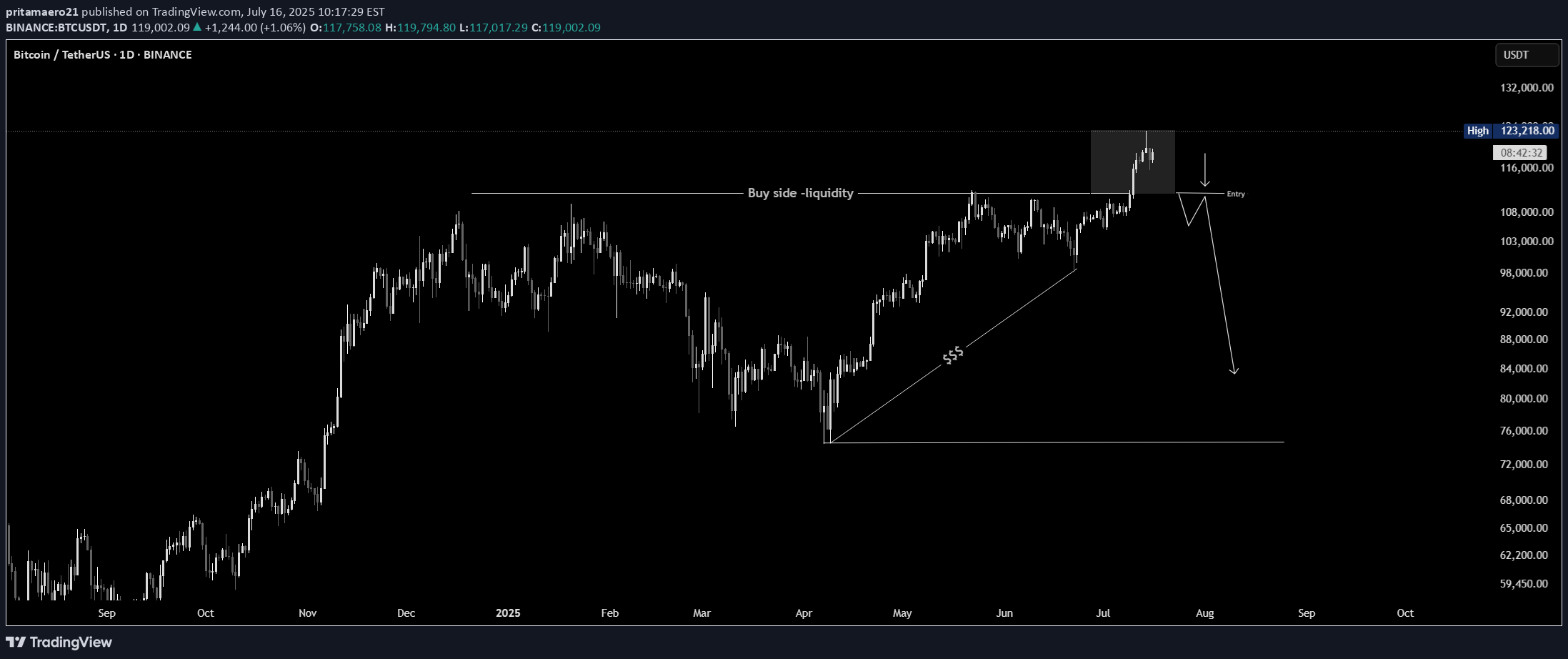

Bitcoin just swept the recent high, triggering breakout euphoria. But this could be a classic liquidity grab, not a true breakout. If price fails to hold above the level and shifts structure, we may see a sharp bearish reversal BTCUSDT ETHUSDT 👀

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.