outkla

@t_outkla

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

outkla

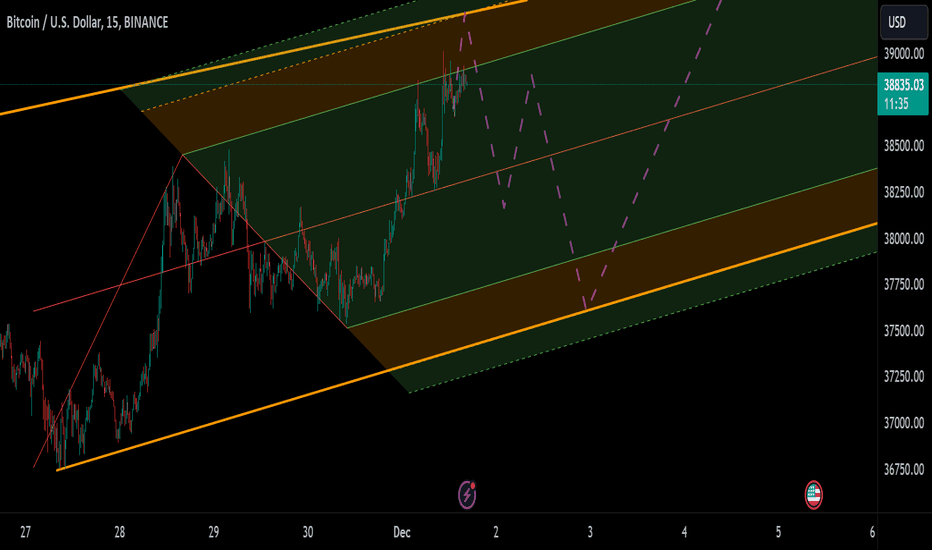

Bitcoin is expected to continue bullish as the trendline breaks bullishness is expectd at the retest

outkla

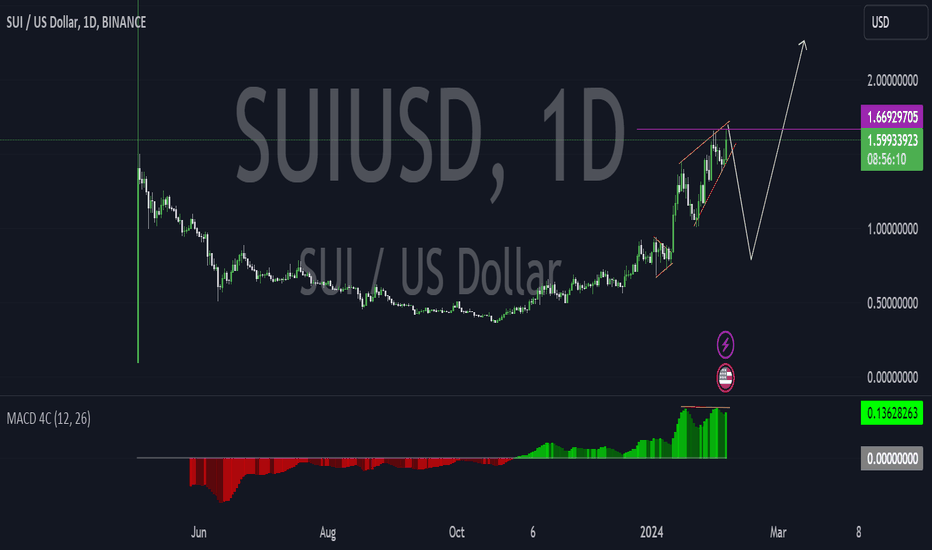

Title: SUI/USDT: Bearish Signals Emerge - Ending Diagonal Pattern and MACD Divergence Overview: SUI/USDT is currently displaying clear bearish signals, suggesting a potential reversal in the near term. Two key factors contribute to this bearish outlook - the formation of an ending diagonal pattern and the emergence of a bearish divergence on the MACD indicator. Technical Analysis: Ending Diagonal Pattern: SUI/USDT is exhibiting the characteristics of an ending diagonal pattern, a reversal pattern typically signaling the end of an uptrend. The converging trendlines of the diagonal suggest diminishing buying interest, with a higher likelihood of a bearish reversal. MACD Bearish Divergence: The MACD indicator is showing a bearish divergence, where the price is making higher highs, but the MACD is making lower highs. This divergence implies a weakening bullish momentum, often preceding a potential trend reversal. Trade Setup: Cautious Approach: Given the bearish signals, a cautious stance is recommended for traders. Short Entry: Consider shorting SUI/USDT on a confirmed breakdown from the ending diagonal pattern or a breach of a key support level. Stop-Loss: Place a stop-loss above the recent swing high or a level that aligns with your risk tolerance. Take Profit: Identify potential support zones or Fibonacci retracement levels as profit-taking targets. Risk Management: Always employ proper risk management strategies, ensuring that potential losses are controlled and do not exceed predetermined levels. Stay informed about upcoming events or announcements that may impact SUI/USDT. Cautionary Notes: Keep a close eye on the price action and be prepared to adapt your strategy based on real-time market developments. Be aware of potential false signals and monitor confirmatory factors alongside the technical analysis. Conclusion: The combination of the ending diagonal pattern and the MACD bearish divergence on SUI/USDT suggests a potential shift in market sentiment. Exercise caution and wait for confirmation before considering any trading positions. Always conduct thorough analysis and maintain a disciplined approach to risk management.

outkla

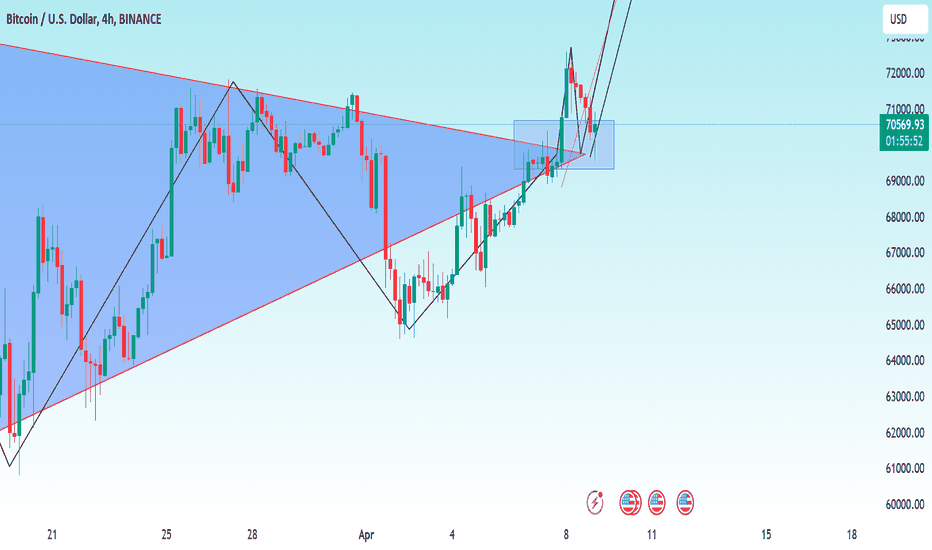

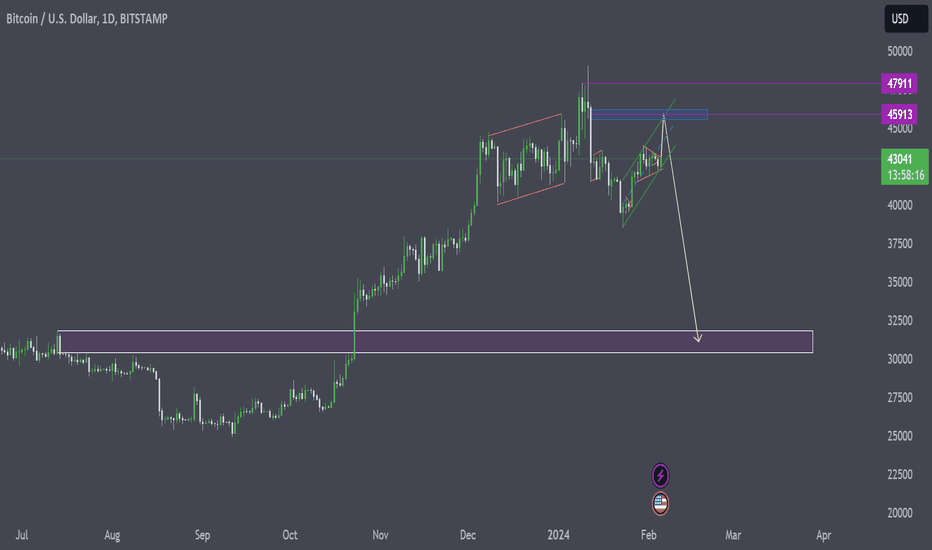

Technical Analysis: Bitcoin is currently exhibiting a short-term bullish sentiment as it approaches the 45661 order block. The recent price action suggests a potential move upward, aligning with the prevailing market sentiment. Key Levels: Resistance at 45661: The upcoming order block at 45661 is a critical level to watch. A breakout above this level could signal further upside potential. Support at 30876: On the downside, the 30876 order block serves as a crucial support level. A retracement to this level may provide buying opportunities for traders.

outkla

outkla

outkla

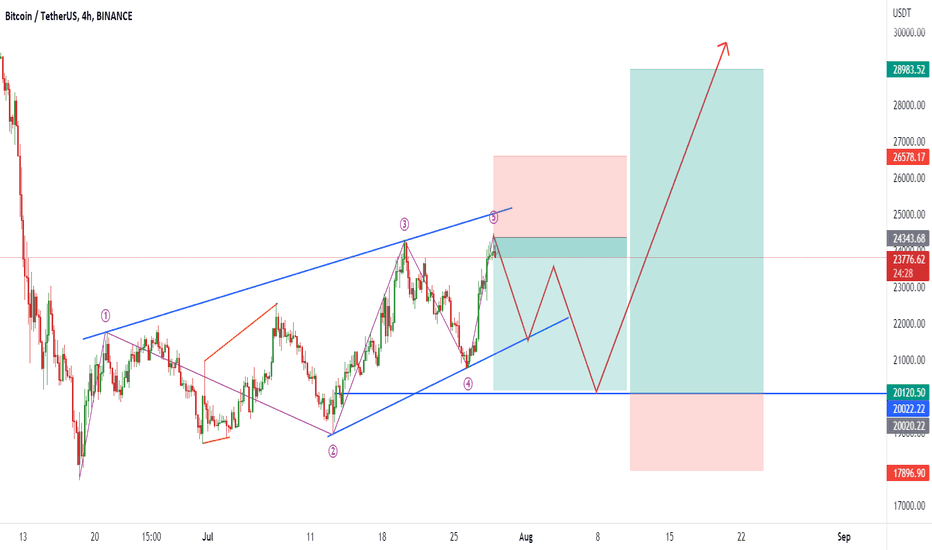

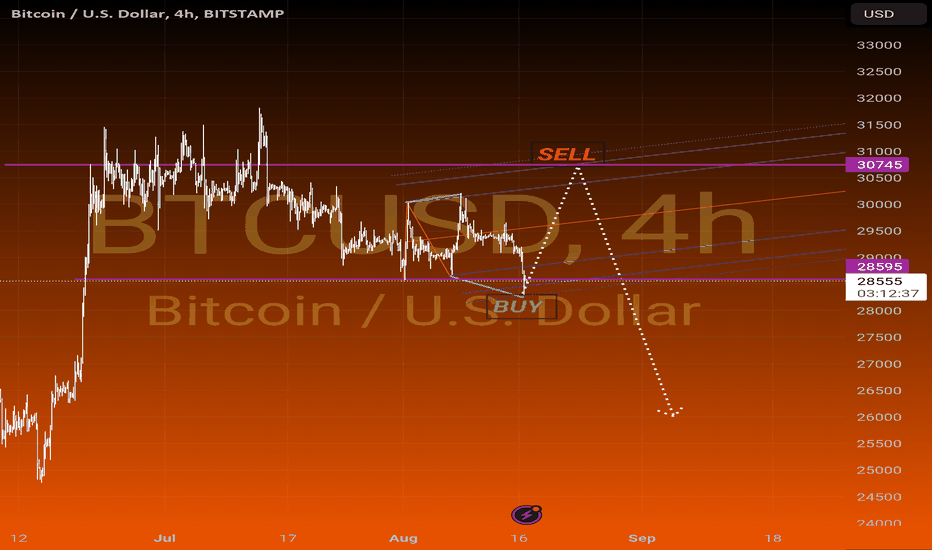

"📈🚀 Bitcoin's rollercoaster ride ahead! 🎢 From its CURRENT price, get ready for a thrilling pump aiming towards 30,745! 📈💥 But hold on tight, as it might take a dip into the 22k territory 📉😱. Elliott Wave experts, get excited - Bitcoin's forming an expanding flat wave C 🌊, aiming to balance the scales between 30,505 and 30,997 🏁⚖️. Brace yourselves, because after this correction, a super-hard dump is on the horizon! Get ready for the wild ride of crypto! 🎢📉🚀 #BitcoinBullRun #ElliottWaveMagic #CryptoCoaster"

outkla

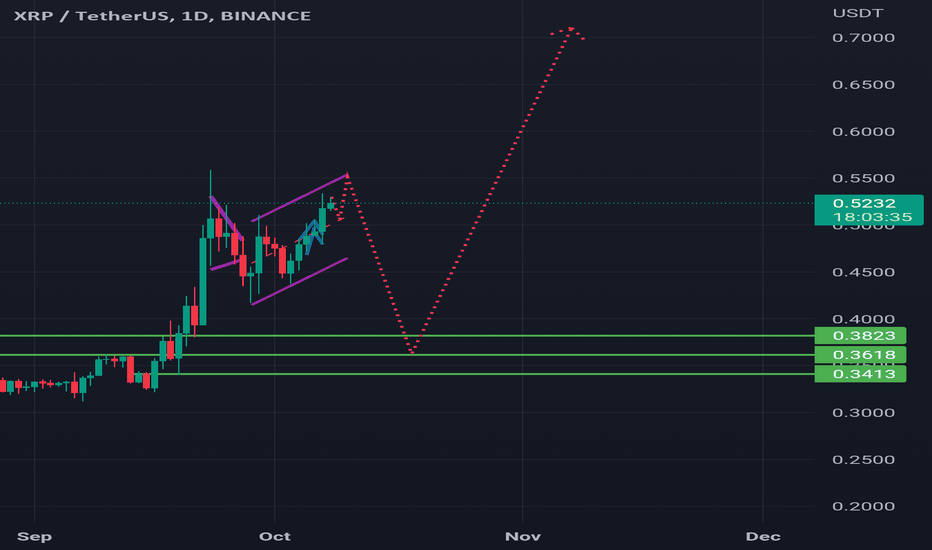

I see XRP dumping into the 0.36 area before the real move to the upside This will signify the real test of the structure and from there bullish impulsiveness will procceed

outkla

outkla

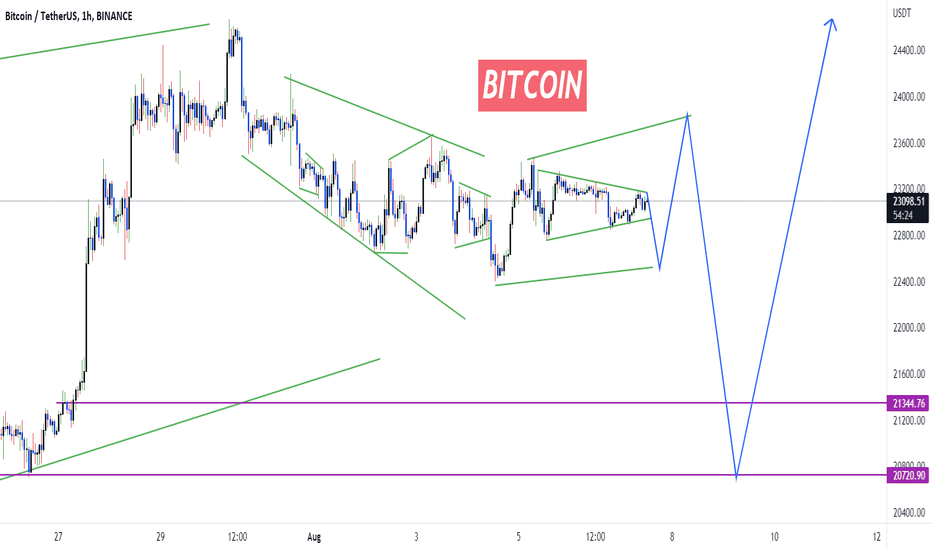

I see bicoin around the 20117,6 before the major move to the upside

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.