oaksacorn

@t_oaksacorn

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

oaksacorn

A Different Fractal

Not Trading Advice A different fractal may be appearing. The seed fractal may actually start from December 2015. If so, the initial monthly move up in 2024 is greater than the one in December 2015 with both being followed by consolidation. This larger initial move may be due to the fruition of the plumbing that has been laid in the past 4 years. It also foreshadows a possible move to 247-327. Possible February lift off if this fractal plays out time wise.

oaksacorn

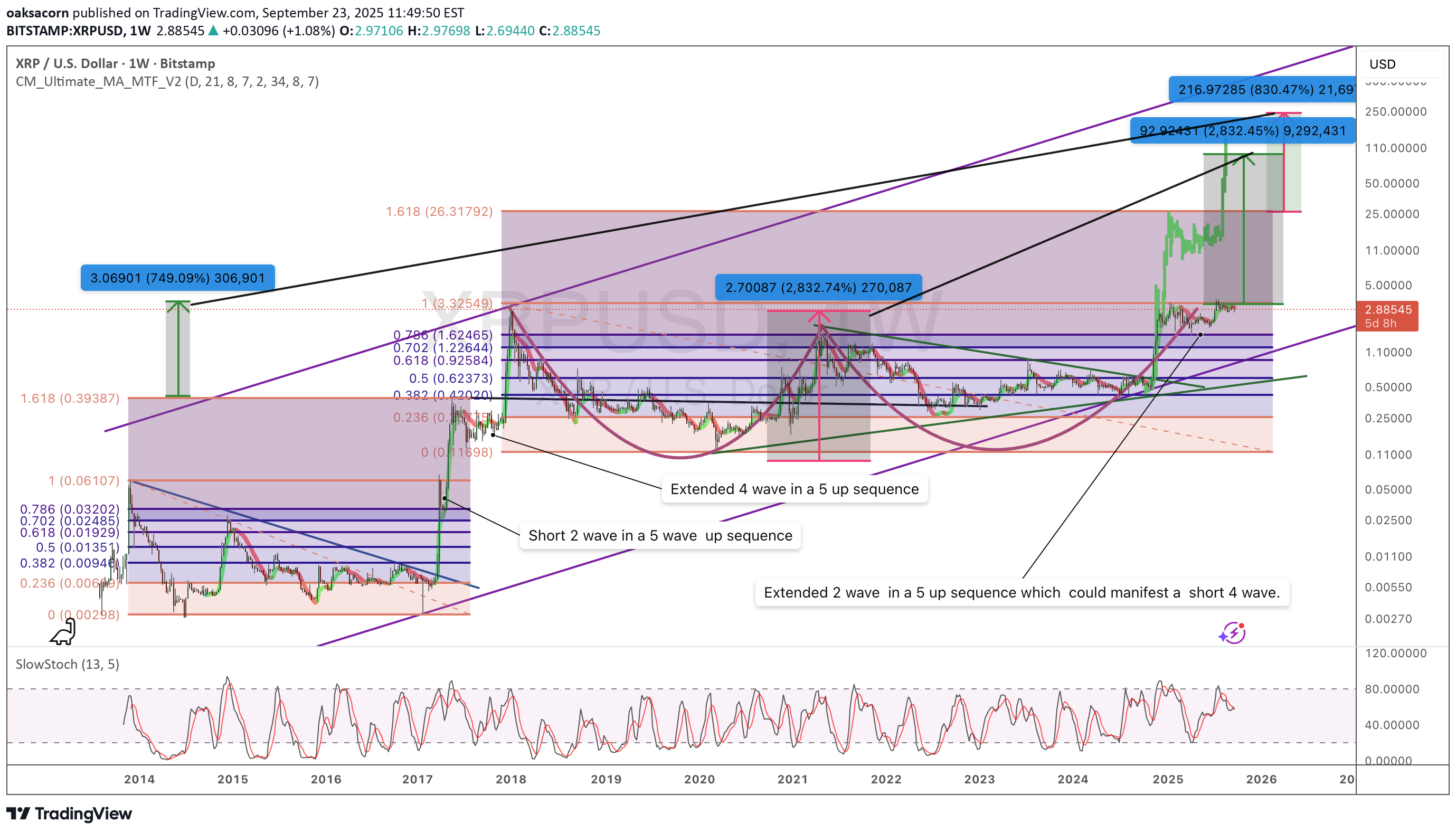

XRP - Diamond Level

Not Trading Advice - formulate your own path. Note here that a 2017 type fractal - starting in Nov 2025 - would point to a XRP 218 price. The Nov 2025 fractal is producing an extended 2 wave vs the very short one in 2017. This may manifest a short 4th wave in the possible 5 up sequence. Note also the the classic W pattern exists currently starting in ATH of 2017 and churning that line now in 2025 to establish a classic W given a break out here soon. The projection here is 95. At either of these levels many will argue that the market capitalization would be non sensical - 11.6 Trillion & 5.2 Trillion. The problem with this argument is that it is not understanding the pricing dynamics of a Non-Security, Globally Interoperable, Decentralized Virtual Currency. Note the AI (blah blah blah Kohonen) overview: A ripple fed master account is an application by Ripple through its subsidiary Standard Custody & Trust Co to get direct access to the U.S. Federal Reserve's payment infrastructure, enabling it to hold its RLUSD stablecoin reserves and conduct settlements directly with the central bank. This application, filed in conjunction with a national bank charter application, is a highly significant move in crypto's convergence with traditional finance, granting access to the payment system through Fedwire and ACH. It's considered "diamond level" in terms of access rights, surpassing a banking license or trust charter. Diamond Level indeed. How many ACH transfers are done under the Fed Master Account? Having fun yet? Also note: To establish RLUSD, XRP is not used as the backing asset, but rather as the native token for covering transaction fees on the XRP Ledger (XRPL). The amount of XRP required for transactions is minimal, meaning no specific amount of XRP is needed to back RLUSD. And more importantly..... The XRP cryptocurrency's primary function in this process is to pay for transaction fees on the XRPL network. A wallet on the XRPL must hold a small reserve of XRP (typically 1-2 XRP) to remain active and to cover minor transaction costs. In contrast to RLUSD's backing, the amount of XRP burned per transaction is extremely small. In 2024, the Automated Clearing House (ACH) network processed transactions with a total value of $86.2 trillion. In 2024, the Automated Clearing House (ACH) network processed transactions with a total value of $86.2 trillion.

oaksacorn

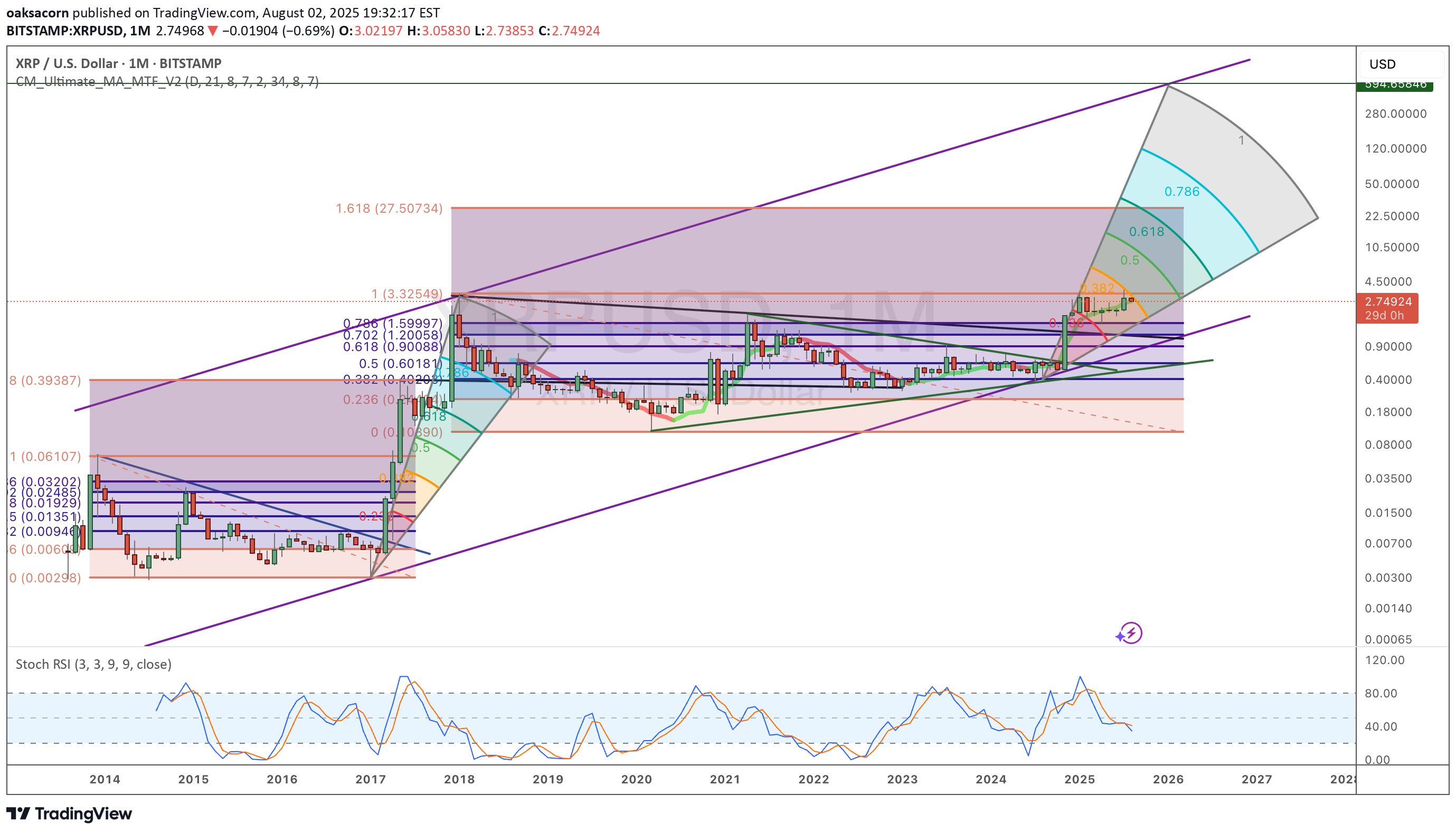

Satoshi & XRP

Not Trading Advice Most in the XRP community know the Bearableguy123 XRP price prediction of $589. I would argue that this price may be the high of THIS cycle but will not be an all time high. So who is Bearableguy? Satoshi signed off (last email) on April 23, 2011 and said he was moving on to do "other things". 589 days later, Brad Garlinghouse was named CEO of Ripple. Note Brad's number of followers on X continues to be 589. On a deeper fundamental note and from Crypto data platform Dune, XRP Ledger recorded 70 million new transactions last month, bringing the total to 3.83 billion. Last week alone, 13.5 million transactions were added, with an average daily transaction of 1.8 million, which remains among the highest of any chain. XRPL is evolving as a global stablecoin settlement layer. In July, Braza Bank issued $4.2 million BBRL, while daily RLUSD transactions increased from roughly 5,000 to more than 12,000 in a single month. For fun, I added two Fib wedges to picture a possible repeat of 2017. As a friendly reminder the concept of market cap does not play well for a Globally Interoperable, Decentralized Virtual Currency. It just does not apply. So yes, 589 for this cycle is a bit extreme (a repeat fractal of 2017 does put a potential price of 234 in play) but not out of the question.

oaksacorn

Hidden Road

Not Trading Advice The market will price in tokenization why before it happens. Ripple's purchase of Hidden Road will spark & sustain the progression. Never underestimate the value of a good Prime Broker in Finance.

oaksacorn

Stickin With The Chicken

Not Trading Advice Forget The Duck I am stickin with the chicken Cause that's one fine bird The Elliot Wave 5 wave pattern is present throughout trading history. Successfully predicting 5 wave patterns is a blessing. The current fractal has proven so far to be different than 2017 where we had a quick/fast 2 wave and a drawn out 4 wave. This, I would argue, is good. Currently this 2 wave is more drawn out. We can then expect 4 to be quick. We see in trading history that this 2 & 4 wave switch often occurs in repeating fractal like 5 wave moves. Fundamentally, crypto wise, BTC dominance will wain - it remains to be seen if the XRPBTX chart undergoes a complete and total phase change - there is a small probability here. My heart will always be with BTC from a benchmark old Daddy standpoint but one must be cognizant of the a possibility of a complete dominance switch. (The Sigma Wolf is whispering to the She-Wolves and prompting a change in the Alpha of the pack). I do not hold to the Market Cap argument when it comes to a global crypto currency that is truly DECENTRALIZED (due to its consensus protocol & Escrow parameters), interoperable, cost effective and fast. XRP is not a stock. The numerous XRP ETFs applications are waiting in the wings could be a game changer in very short order. Remember, Fidelity was mining BTC in 2018 - I sold them some of my BTC miners to do so and they mined in the facility in our startup. Some of the current - really good - chartists are pulling back their XRP projections. Understood. I am not in that camp. I respect the $13 - $27 projections. 5 wave history does point to projections that are much higher once you shed the shackles of the market cap argument.

oaksacorn

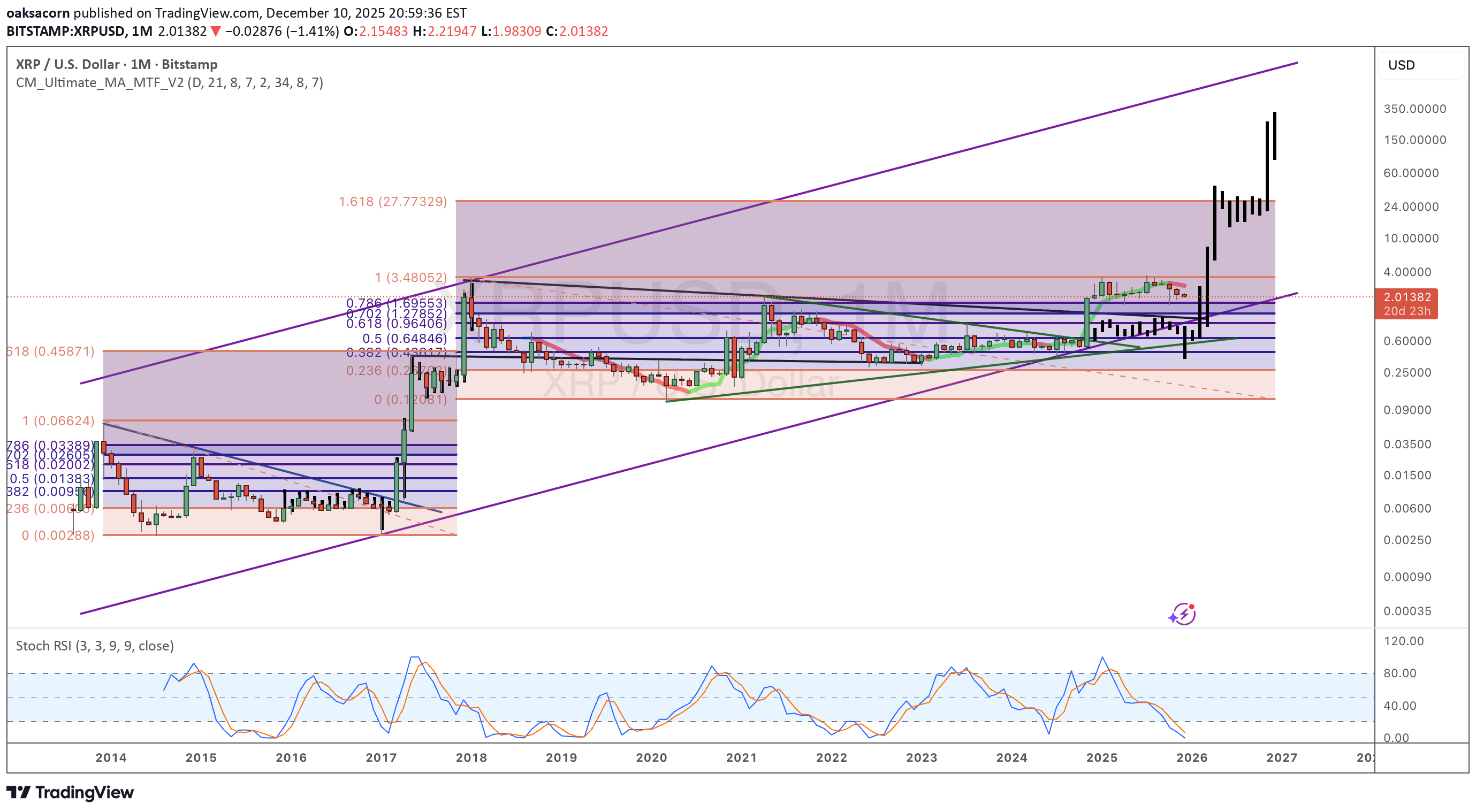

First Target Met

Not Trading Advice First Target met -> 1 -> 3.40 A retracement down to 1.50 is possible but it won't last. Second Target awaits -> 1.618 -> $24 Third Target -> possible -> 147 to 208. The Second and Third target are on the table. Do not let market cap nonsense fool you. This is not a classic "market cap" asset. It is a Non-Security, Globally Interoperable, Decentralized Virtual Currency. It will not play by normal market cap rules.

oaksacorn

Strategic Reserve

I think it is very important to point out that the escrow in no way shape or form represents a “controlling” interest in XRP. The fact that trillions may be made should not be anyone’s concern. There has been opportunity to buy that escrow cheap. XRP is a fantastic candidate for the strategic reserve. I am confident Stuart and Brad made this clear during their dinner with Trump.

oaksacorn

X429

NOT TRADING ADVICE @WhaleNoName on X calls for an Alt season valuation of 7T 260 days from now. The account is a self proclaimed whale. As a former small whale, it is only fair to say that one must be careful with this. That said, NoName is spot on IMO. This is the goal. This is the mission. This is the positive manifestation above and beyond ones own needs. This is putting the proper pieces together. September 1, 2025 is 260 days forward. If one were driven to do so, it will be one of the best forward value swaps in trading history - the kind that would make Miguel Lienzo (The Coffee Trader by David Liss) smile. All tightly woven in a profound and historical parallel channel. XRP will continue to bring life to this parallel channel. With an intense amount of utility in a world that desperately needs it, a X429 ROI in this time frame is on the table for XRP. It is a Miguel Lienzo moment. This is the goal. This is the way.

oaksacorn

XRP Monthly Bandwidth

Not Trading Advice. I have used bandwidth for many years. It has been integral input for my long term trading approach. Note the monthly bandwidth for XRP is at historical lows. This mean that the monthly chart has coiled and compressed to a point that is historically tight. If momentum continues here, the possibilities for a historic move (much like 2017) are good. This is what the current bandwidth and the Polarized Fractal Dimension (not pictured on purpose) are saying. Note also the monthly RSI is touching a brake out moment from low levels. XRP has been the redheaded stepchild (such an annoying term) of crypto. Pre-mined and never appreciated for its potential in a world where liquidity and settlements will be key to the financial survival of the financial world. Red hair and fair skin are OG genetic traits passed on to us from Neanderthals (a Neanderthal mutation). This genetic trait predates modern man and is a result of interbreeding with non-African modern humans. (Many of us carry these Neanderthal genes). Today redheads constitute 2% of global population and their uniqueness and beauty are captivating. BTC is the Neanderthal of crypto and will go extinct only from the standpoint of efficient value transfer but will remain a benchmark of crypto. Many involved with BTC forged ahead with XRP. The beauty of XRP will soon be understood as this bull cycle corresponds with institutional momentum (think of Bollinger Band bandwith about to explode) and the potential onset of tokenization. The derivative market is a 1 quadrillion dollar market. XRP is genetically primed to take a role in this. Please don't be fooled the market cap arguments. Folks making this claim are not putting the puzzle pieces together. XRP monthly bandwidth is set to explode - the bands will splay. Be ready to be captivated.

oaksacorn

XRP Unleashed

Quotes about XRP : DAI -Jay Clayton drops this law suit on his last day in office Jimmy Vallee -We became convinced that this whole case was merely a show Congress - The SEC has become a rogue agency Trump - Day one, I will fire Gary Gensler and appoint a new SEC Chairman Gensler - We don't need a digital currency, we have a digital currency - its called the dollar Brad Garlinghouse - The SEC came out and said Ether also is not a security John Deaton - He was also being paid as a profit sharing partner from his law firm - Simpson Thatcher Fred Rispoli -These two individual are working at firms that made very big bets in Ehtereum Jimmy Vallee - Follow the money - it paints a very clear picture Jimmy Vallee -China's financial elite working with U.S. financial elite with regulators to front run the new system China will do what China does - dystopian CBDC (while mining for CCP elites only) The U.S. is still an open book. XRP AMM volume up 40X in the past week We win!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.