njmanura

@t_njmanura

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

njmanura

Bitcoin is in a downtrend and Ascending wedge

Bitcoin is in a clear downtrend and below key moving averages like 20 WEMA, 34WEMA and below EMA ribbon and below previous low which is 98k. Now it is forming and ascending wedge pattern on 4H time frame which is very bearish. Fundamentally DATs are cooked, No ETF inflows (Mainly outflows), Whales still selling, Gold took the crown of hedge for money printing and with tokenized gold it becomes clear bitcoins narrative has being proven wrong. Until people accept bitcoin as a proper hedge downtrend will continue. Probably can buy bitcoin once Strategy start selling.

njmanura

تایید رسمی بازار خرسی: چرا حالا باید نگران بیت کوین باشیم؟

My previous posts had some ambivalence. But now the bear market is confirmed by daily closing below this rising wedge pattern. Treasury companies started to sell their bitcoin to cover losses. Market makers are rekt following Oct 10 the crash. US retail is more focused on AI stocks hence continuous ETF outflows. Bitcoin is also closed below weekly 21 and 34 EMA. Checks all bearish indicators.

njmanura

بیت کوین در حال ساخت کفهای بالاتر؛ آیا زمان صعود نهایی فرا رسیده است؟

Bitcoin despite continuous bad news such as whale selling, cycle end theories and bad sentiment, holding higher lows. In addition, it is above 34 weekly EMA. It will go above ATH one more time. At that time think of shorting. Now bullish. Nov, Dec Santa clause and Halloween effects are good for risk assets.

njmanura

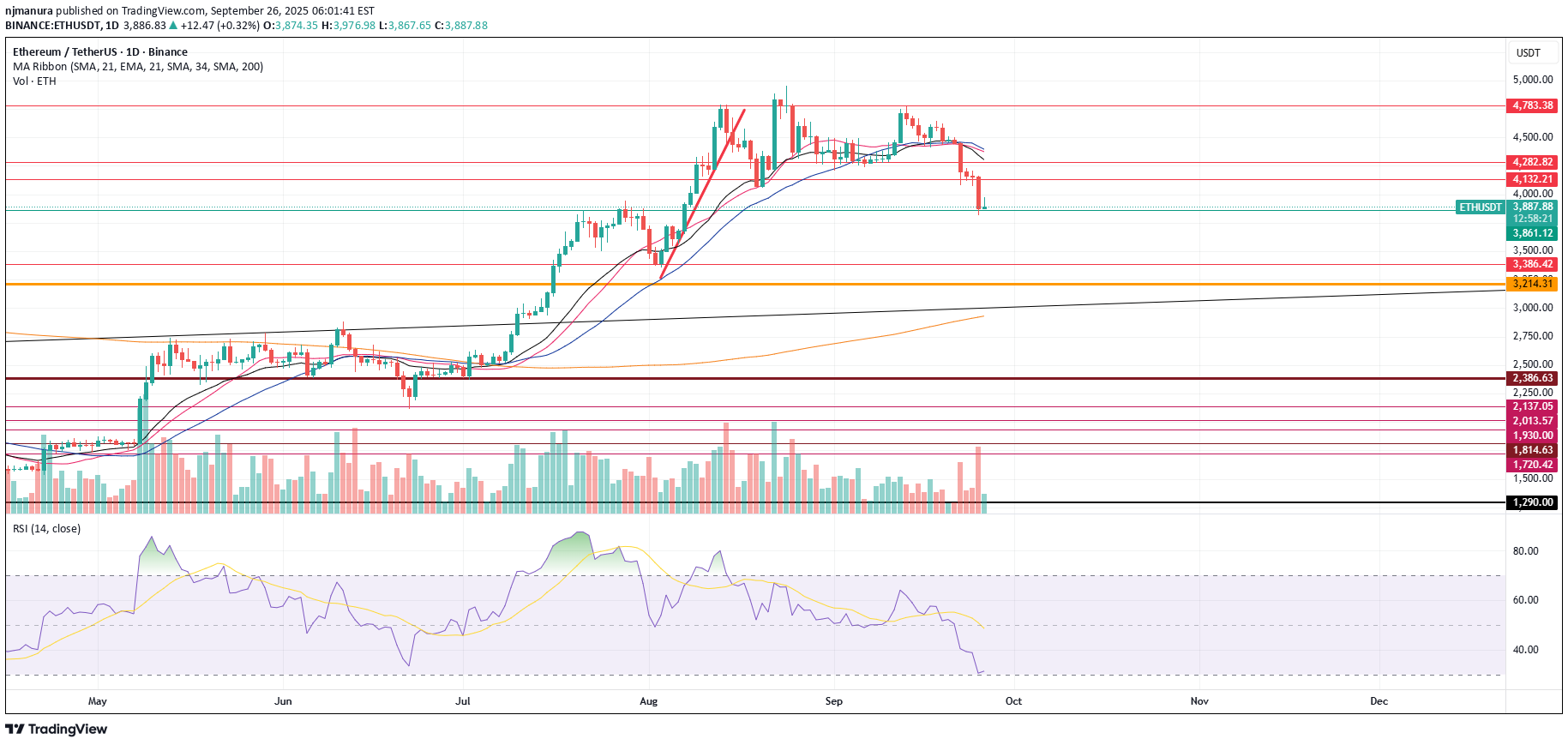

A bounce to 4200 is on the cards

RSI is oversold, ETH is at the support. Everyone in Twitter is Bearish. A short term bounce to 4200 is on the cards. Then we will continue the dump.

njmanura

njmanura

We are going down

Bitcoin clearly broken below this bear flag and retested lower line. Invalidation is close above 120k.

njmanura

This head and shoulder structure may push price to 95k

This head and shoulder pattern may push price to 95k. At 95k we have weekly moving average bands and they will act as support. But as recent history suggest it will be a very choppy downward move.

njmanura

Bitcoin has broken out from its downward channel

Bitcoin has broken out from its downward channel. I changed my bearish view to cautiously bullish. Broader market also digested the trump tariffs and US federal reserve has starting to ease despite high inflation to counter short term effects of tariffs. FED also started slowing its balance sheet reduction from April and more rate cuts are planned in 2025. US favorable environment for crypto helps generally for bitcoin and other crypto to rally. Only issue is TradFi markets may see more downside due to reduced earnings due to tariffs which would drag bitcoin with it.

njmanura

Bitcoin is respecting this downward channel

We will take one of two paths. Anyway bearish and bottom may be at 69k - 72k.

njmanura

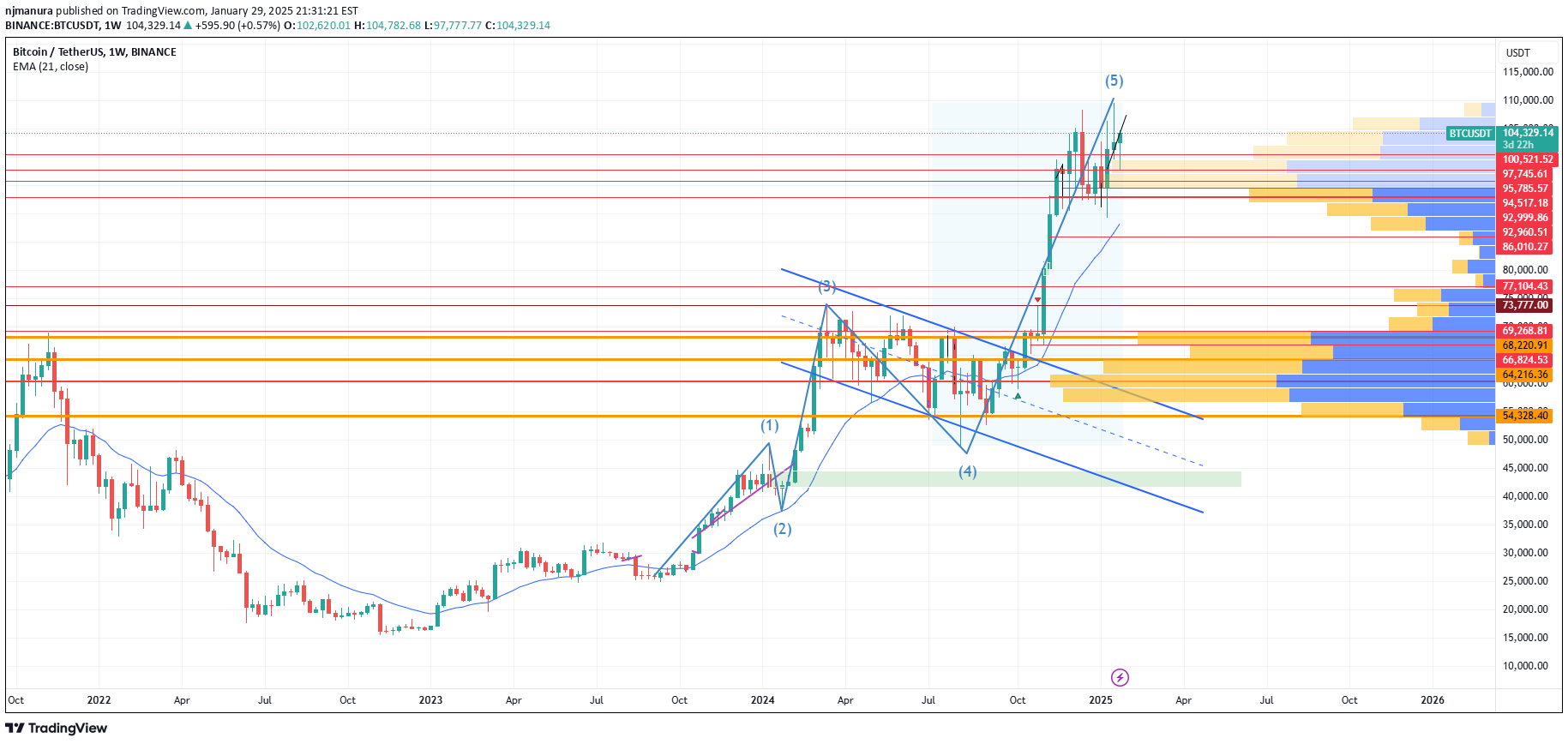

We are at the local top

Elliot wave counts from one year back makes it clear we are at the end of 5 wave. This cycle is mainly driven by US economy, all moves comes during US trading hours. There is very little retail participation in bitcoin trades, they are all in meme coins and altcoins. There is bearish sentiment in retail participants, but extremely bullish sentiment in US cooperate buyers, esp Micheal Saylor and others. Fundamentally also Trump trade is over. What trump did was to ease regulation which takes time to reflect in the market. His bitcoin reserve regulation does not buy bitcoins from market. In addition, by way of launching several meme coins he made his intentions clear (To extract as much money as possible from retail investors). Lower time frame chart wise it made an SFP or Swing failure pattern, made new lower highs and lows. Supposedly good news did not make into rallies. In Macro, central banks are re tightening monetary policy across the board. It seems only Saylor is buying bitcoin to avoid it crashing and closing below support. How long can he do that. He is also doing it by issuing more and more debt. More bitcoins he buys in these prices his average buy price increases. Closing and trading below his avg price for longer can make MicroStrategy bankrupt which would be disastrous to bitcoin.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.