mejazkhanm

@t_mejazkhanm

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

mejazkhanm

طلا در آستانه ریزش سنگین؟ بهترین نقطه ورود برای فروش (XAUUSD)

Gold closed strong Bearish in Weekly now retesting the Bearish Ob, Until unless it doesn't take liquidation below, chances are higher it will dump again. Use proper risk management, if it forms the daily fvg, then take first entry from the 50% of daily fvg, 2nd from the entry mentioned, and hold till tp or SL.

mejazkhanm

truusdt buy + spot investment setup

truusdt is defi project, when money flow into the defi system it will blast soon, doesn't matter what btc or eth doing, build positions from mention zone n use tigh sl. don't expect too much targets from any dead cat. First wait for the sweep of previous daily swing low n then enter. for any continuously update must join my tg or discord group it's free.

mejazkhanm

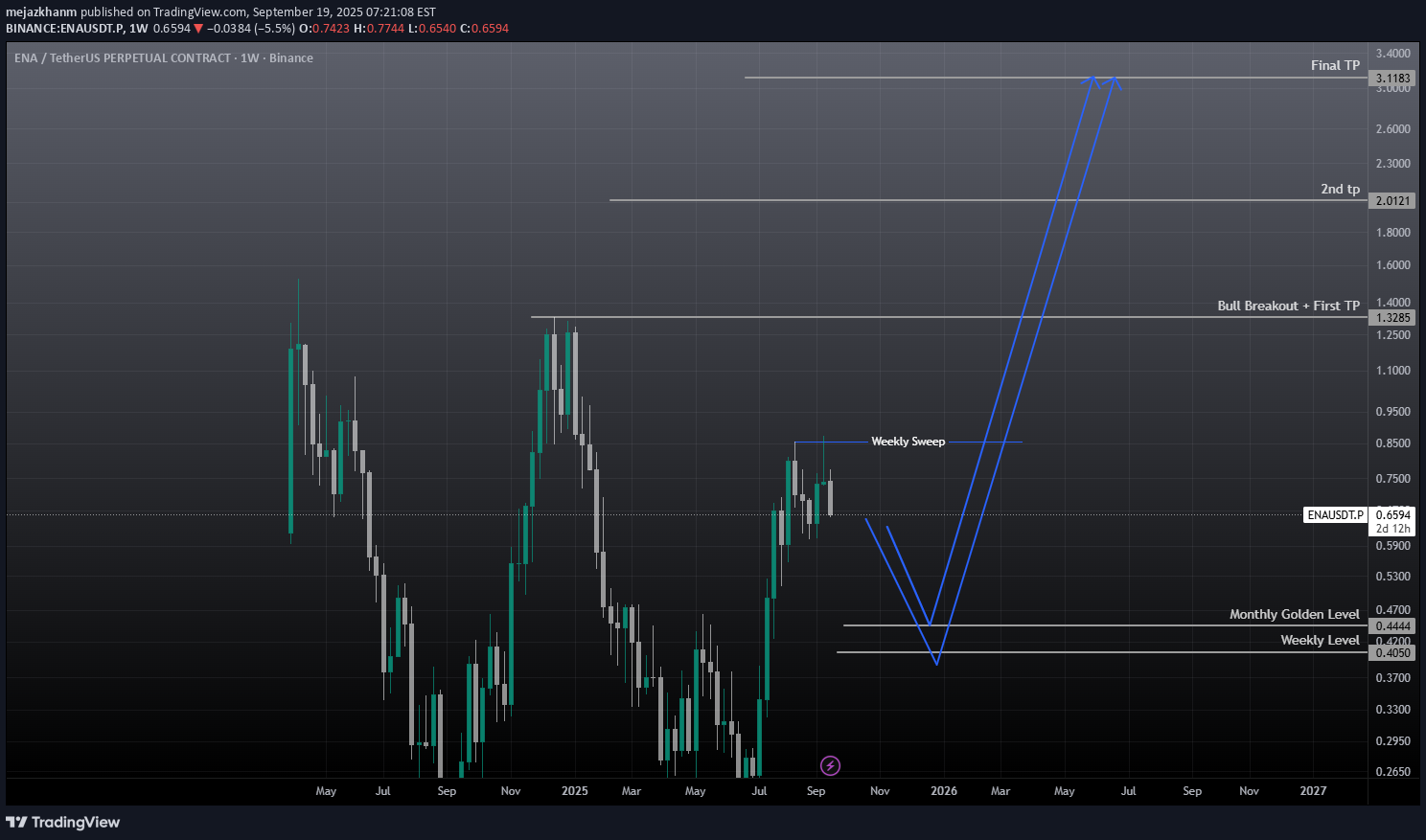

ENA Swing Setup + Investment Idea

Ena showed some Great Strength, we took it from 0.30 and sold at 0.66 n 0.80. Now wait for the Monthly + Weekly level to reach n show some reaction, and then Buy. for spot traders keep buying from 0.55 , 0.45 , 0.40 and wait for the Uptober Bull Run specially for alts. Will update the trade, if ena doesn't reach to those levels.

mejazkhanm

BTC Swing short Setup

If setup failed, then possible btc may form 3 drive pattern n dump again, in this case will share new setup, while not bearish but looking for a good correction, take short with low margin from first setup, n 4% on second setup must use SL on both short setups. Best Of Luck. Don't short any alt coin, wait for btc to retrace these levels and open long for swing setups, will share some good gems, after confirmationSL on entry

mejazkhanm

mejazkhanm

SUI SCALP Long / Buy Setup

It's a scalp setup, don't hold any trade for so long, must use sl and never use more than 2% of your wallet size on SL. Market is risky can take a sharp movement any side, So be careful. Reason for this trade is, it has taken downside SL and didn't close the candle, So we can take the long trade n target early shorters sl. If tp hits first then ignore the trade.i entered from 3.4521 with same sl

mejazkhanm

inj swing buy / long setup

Wait for the entry n monitor closely the price action. Must close if candle closed below the mentioned zone, cause there is no zone that will be held below side. If candle closed below the gap, then close the trade on retracement. I continuously update about my trades whether you should hold or close to minimize the loss. So, join my tg channel it's free.

mejazkhanm

ENA Swing Buy / Long Setup

ENA looking too strong, I'm already in from 0.67$, will book some on 0.75-0.85, and will add some more margin if it comes to again on my entry which is breaker & fvg area. I took eth, doge, griffain, link and inj long. All are running on good profits. If you wanna join me for free contact me on tg, I have no paid group etc. tg @sstradingtg

mejazkhanm

BTC Buy / Long Setup

Wait for the entry till London Session, and Hold the trade, Must use SL with proper risk management.missed entry

mejazkhanm

eth swing buy / long setup

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.