kaboozyako

@t_kaboozyako

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

kaboozyako

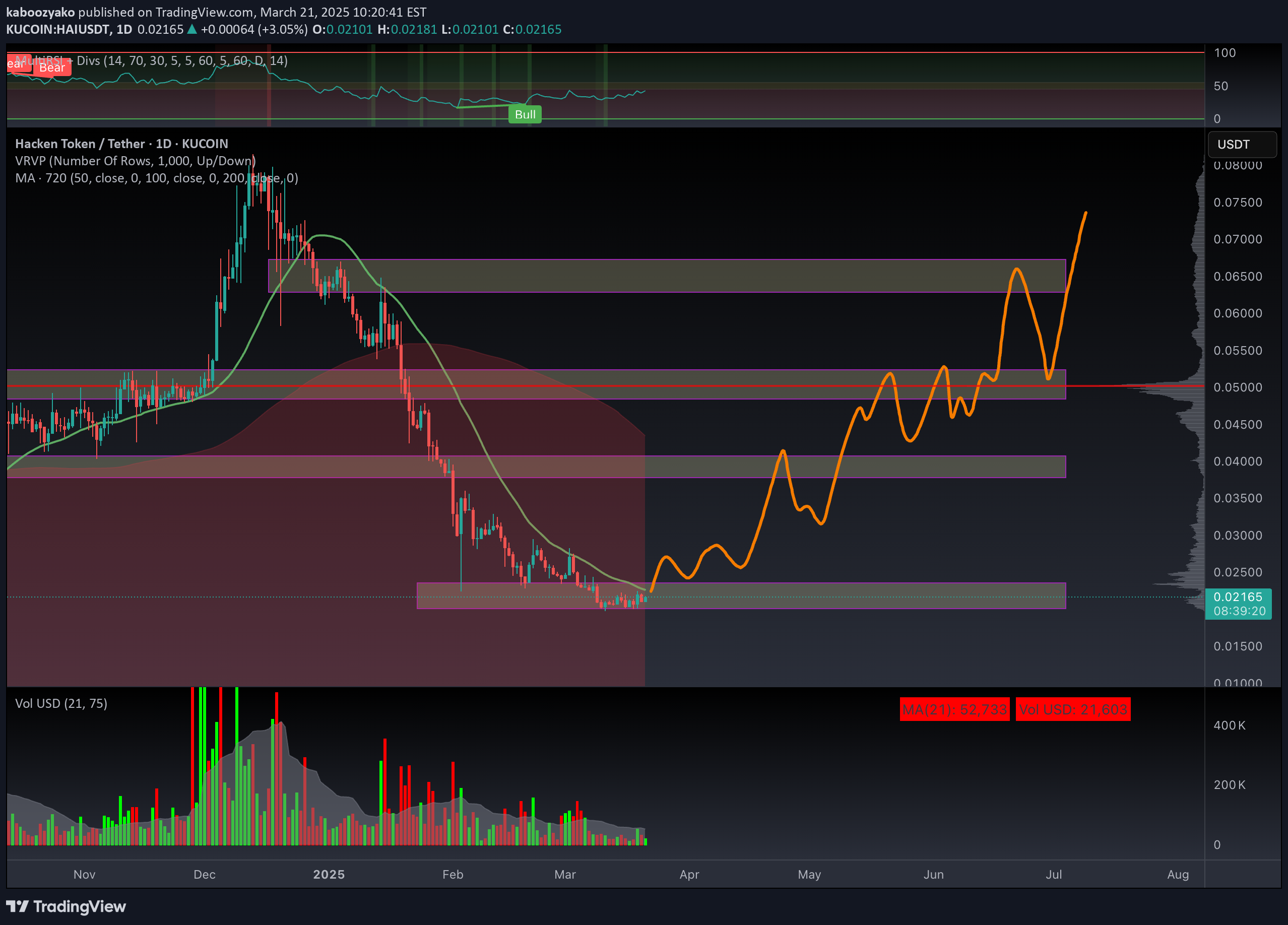

Hacken Token (HAI) has experienced a prolonged bearish trend characterized by consistent lower highs and lower lows. Recently, HAI showed signs of a possible reversal, forming a strong bounce off the critical support level around 0.0200 USDT, indicating increased buying interest and demand. The broader cryptocurrency market sentiment is also improving due to the Federal Reserve's recent decision to maintain interest rates and significantly slow down QT, providing favorable liquidity conditions for risk assets like cryptocurrencies. Fundamental Growth Factors: Successful Flash Pools: Continued success and popularity of Hacken’s flash pools increase token demand and user engagement. Upcoming Hacken Rounds Launchpad: The imminent launch of Hacken Rounds, accessible exclusively via HAI, is a major catalyst expected to drive token utility and demand significantly higher. Project Expansion: Moving beyond cybersecurity projects, Hacken Rounds will host a variety of new projects, diversifying and strengthening the long-term utility and sustainability of HAI. General Market Conditions: Improved overall cryptocurrency market sentiment due to easing monetary policy by the Federal Reserve, increasing market liquidity and reducing bond yields. Anticipated depreciation of the US dollar could lead to further investment inflows into cryptocurrencies as alternative investments and inflation hedges. Bullish on-chain metrics across major cryptocurrencies suggest strong accumulation trends and confidence among long-term holders, positively influencing sentiment towards smaller-cap tokens like HAI. Strong Support Zone (~0.0200 USDT): A recent significant bounce from this level suggests it is an important accumulation area and robust demand zone. Conservative entry: Confirmed breakout and stabilization above 0.0300 USDT. Aggressive entry: Near the current support level (~0.0210-0.0220 USDT), anticipating further bullish confirmation. Stop Loss Placement: Slightly below the significant support area at 0.0190-0.0200 USDT to limit potential downside. First Target: 0.0380-0.0400 USDT (partial profit-taking and reassessment). Second Target: 0.0450-0.0500 USDT (major resistance zone, substantial profit-taking recommended). Third Target: 0.0600-0.0650 USDT (longer-term bullish target and potential momentum trigger).

kaboozyako

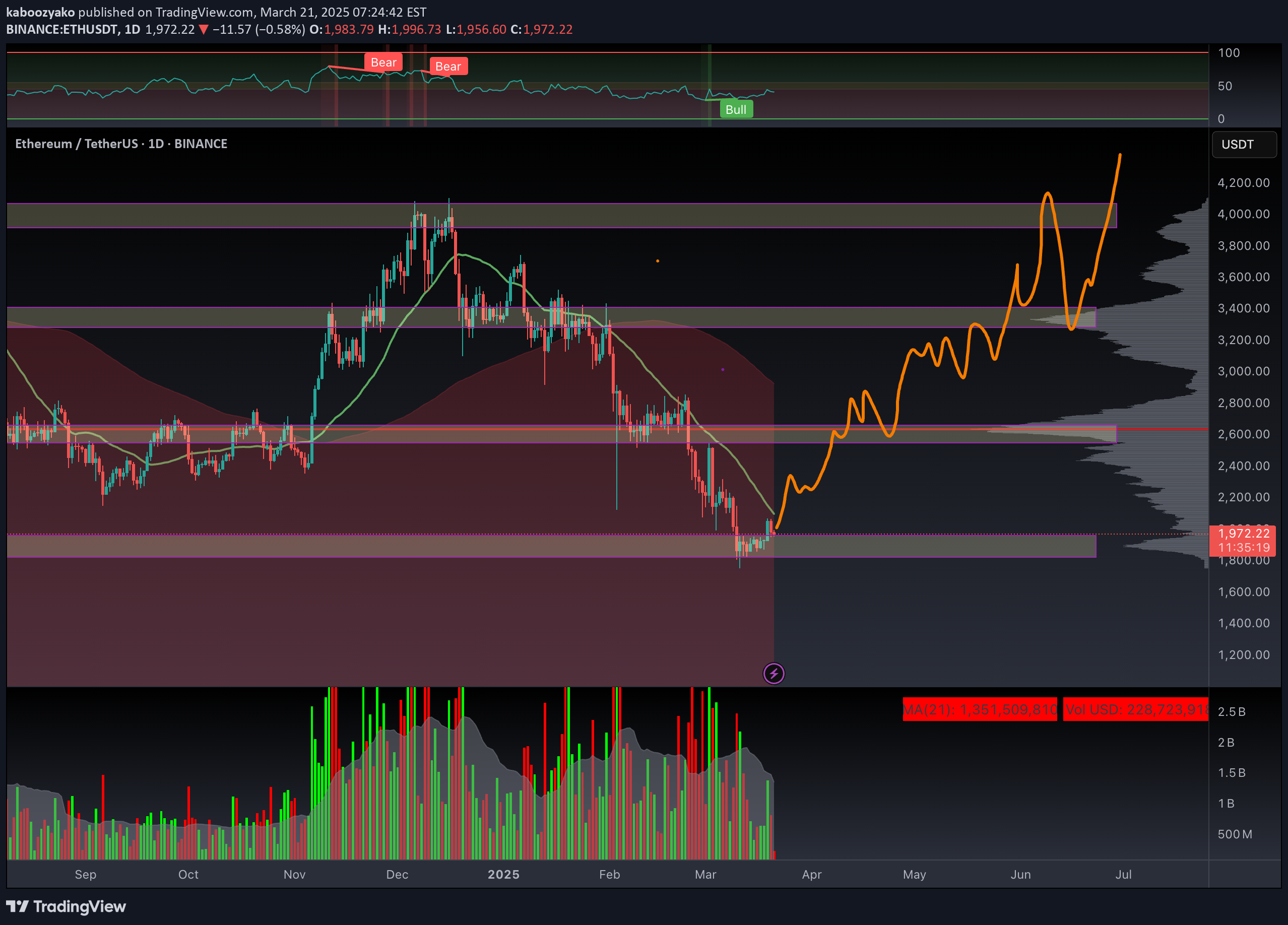

Ethereum is currently trading near key psychological and technical levels, following recent developments in macroeconomic policy and cryptocurrency-specific catalysts. The Federal Reserve's decision to maintain interest rates and significantly slow down QT has created a favorable liquidity environment, positively influencing Ethereum as a high-beta risk asset. Fed monetary policy easing and increased liquidity traditionally benefit cryptocurrencies, particularly Ethereum, given its high correlation with risk appetite. Ethereum's imminent network upgrade is expected to significantly enhance its scalability, usability, and overall ecosystem efficiency, attracting further institutional and retail adoption. Plans about Include Ethereum in a strategic crypto reserve significantly boosts the asset’s credibility and long-term bullish sentiment. Anticipated approval and launch of spot Ethereum ETFs, increasing institutional investment accessibility, further supporting strong bullish sentiment. Ethereum on-chain data exhibits strong accumulation signals, reduced supply on exchanges, and increased staking activities, indicating confidence among long-term holders. Entry Strategy: Enter long positions upon a confirmed breakout and stabilization above the critical resistance at $2,500. Stop Loss Placement: Positioned just below recent local support around $2,000 to manage risk effectively. Profit-Taking Targets: First Target: $3,000 (partial profit-taking and reassessment) Second Target: $3,500 (substantial profit-taking point) Ultimate Target: $4,000 (key resistance and potential breakout point) Current Price Zone (~$2,000 - $2,500): A significant accumulation zone, reflecting investor interest and readiness for upward movement. Immediate Resistance ($2,500): A strong psychological and historical resistance level. Confirmed breakout above this level is crucial for validating the bullish reversal. Subsequent Targets ($3,000 - $3,500): Breaking above $2,500 will open a path to these intermediate resistance levels, with likely minor retracements. Ultimate Target ($4,000): Represents previous local highs and key psychological resistance. A confirmed breakout above this level could signal further bullish expansion. Anticipated bullish momentum is expected to accelerate substantially over the next 2-3 months (April-June 2025), aligning with macroeconomic improvements and cryptocurrency-specific developments.

kaboozyako

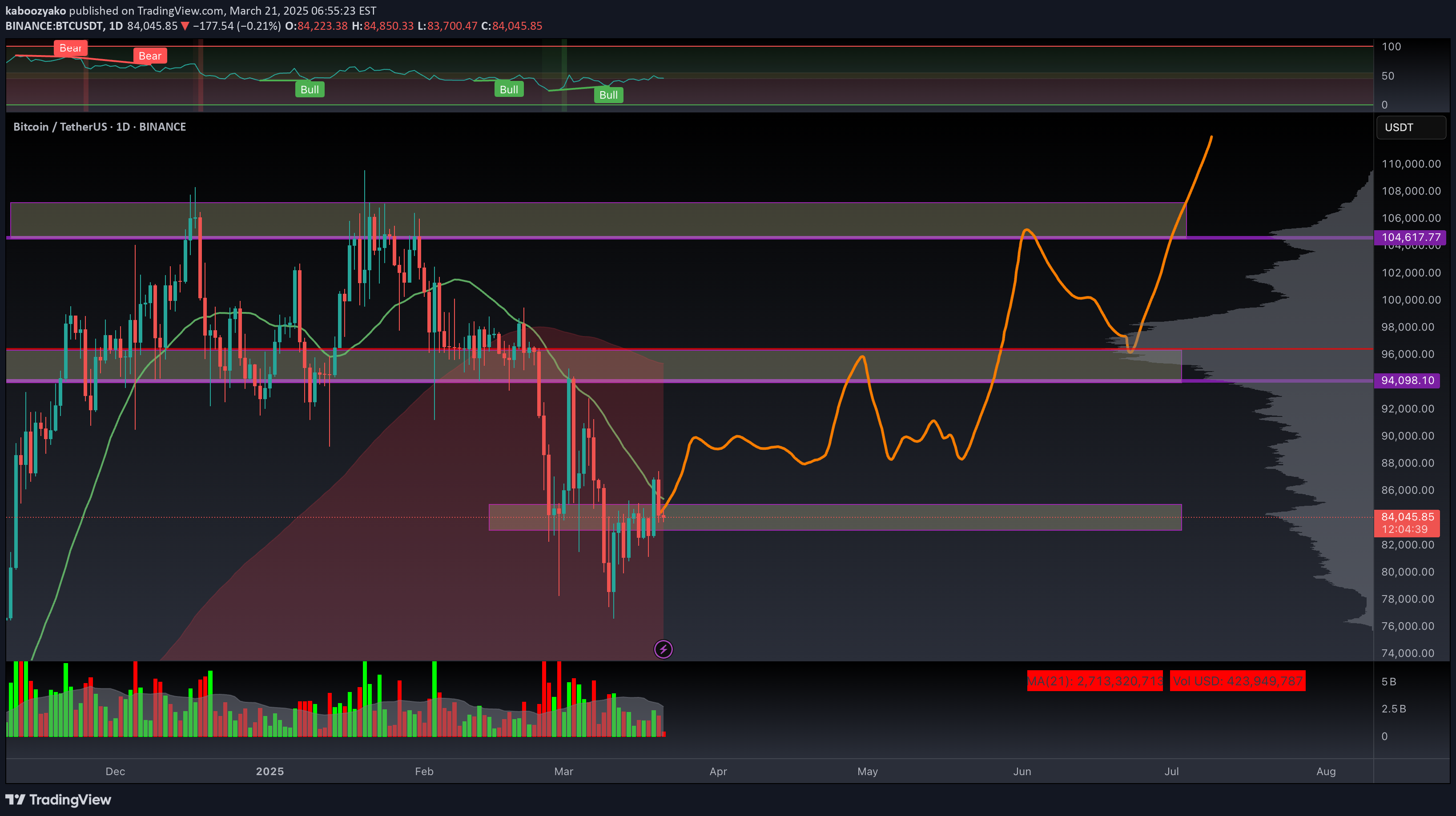

The Federal Reserve recently kept interest rates unchanged and announced a significant slowdown in Quantitative Tightening (QT), effectively signaling a transition towards a looser monetary policy. This scenario typically leads to increased liquidity in financial markets, benefiting risk assets, including cryptocurrencies like Bitcoin. The pause in interest rate hikes combined with the reduction of QT from $25 billion to $5 billion per month indicates Fed readiness to support economic stability and market liquidity. Increased market liquidity and lower bond yields generally stimulate risk appetite, potentially leading to capital inflows into Bitcoin. Anticipated depreciation of the US dollar amid an easier monetary policy scenario also supports Bitcoin as an alternative asset and hedge against currency devaluation. Bitcoin’s current on-chain metrics are extremely bullish, showing strong accumulation patterns, declining exchange balances, and increased long-term holder activity. President Donald Trump's recent announcement about including Bitcoin, Ethereum, Solana, Ripple, and Cardano into a strategic crypto reserve significantly bolsters long-term bullish sentiment and provides institutional credibility. Entry Strategy: Enter long positions upon confirmed breakout and price stabilization above $85,000. Stop Loss Placement: Below the local support and accumulation zone at approximately $81,000, ensuring risk control while allowing room for short-term volatility. First Target: $92,500 (partial profit-taking and reassessment) Second Target: $109,000 (historical high retest and potential breakout) Moonbag Target: $120,000 (lets pray about it)

kaboozyako

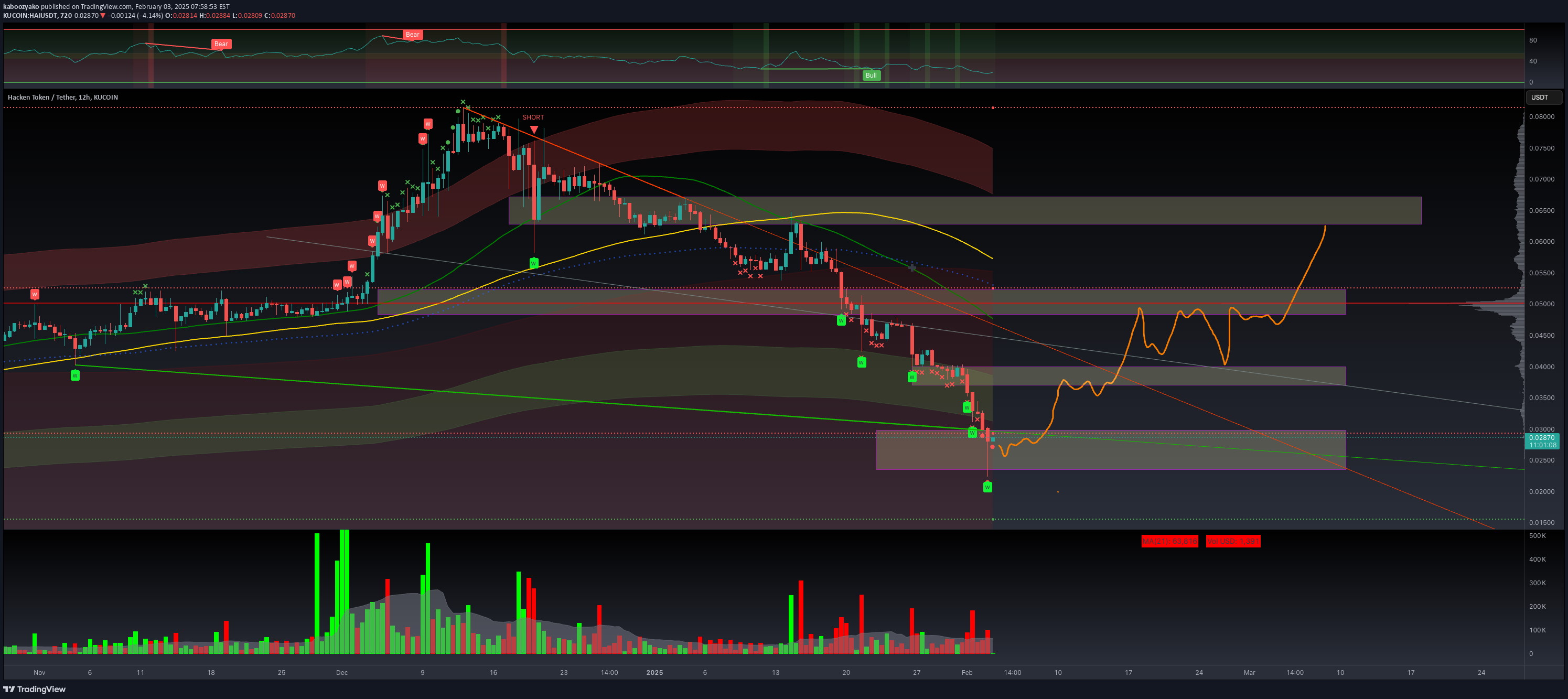

📉 Technical Analysis 1. Current Market Situation •Deep Downtrend: HAI has been in a strong downtrend, making lower highs and lower lows. •Sharp Drop: The price has recently experienced a significant decline, but the latest rebound signals a potential trend reversal. •Support Zone: A strong bounce occurred around 0.0200 USDT, with multiple buy signals confirming demand at this level. •Volume: Increasing buying volume on recent candles indicates renewed interest and potential accumulation. 2. Bullish Reversal Pattern Formation •Bullish Hammer: On the 12H timeframe, a bullish hammer candlestick pattern is forming, which is one of the strongest reversal signals. This suggests a possible trend change to the upside. •Potential Upside Targets: •First Target: 0.0380-0.0400 USDT (local resistance zone). •Second Target: 0.0450-0.0500 USDT (previous support now acting as resistance). •Third Target (Key Growth Level): 0.0600-0.0650 USDT (high liquidity zone and potential FOMO trigger). 📊 Fundamental Growth Factors •🔥 Successful Flash Pools: HAI continues to attract new users through flash pools, which create additional demand for the token. •🚀 Upcoming Launchpad ( Hacken Rounds ): Hacken Rounds are set to launch soon, allowing participation exclusively with HAI. •📈 Expansion of Projects: Previously, the main focus was on cybersecurity, but the new Hacken Rounds will introduce diverse projects, expanding the use case for HAI and strengthening long-term demand. 📌 Conclusion •Technically: •A bullish hammer pattern is forming → possible reversal. •Key resistance levels: 0.0380 USDT, 0.0450 USDT, 0.0600 USDT. •Major support zone: 0.0200 USDT. •Fundamentally: •Successful flash pools → increased token demand. •Launchpad announcement → major growth catalyst. •Expansion of HAI’s use case → sustainable long-term demand. 🎯 If the price holds above 0.0300 USDT, the likelihood of an upward move to 0.0450-0.0500 USDT significantly increases!

kaboozyako

HAI is coming to BASE. It's hard to overestimate this event. BASE is the most promising ecosystem, developing incredibly dynamically and fundamentally. HAI will become part of this process, offering its new products and interacting with other projects on Base—opening up new opportunities for its community and adding new members. One of the first products will be Flash Pools: hacken.io/hacken-news/dualdefense/ And all this is set against very favorable market conditions Two main resistance zones will be around 0.038 and 0.05. 0.05 is also a strong weekly level and the 12-hour MA200 is the zone as well. When the price overcomes this zone, it will become a very strong support for the next target at 0.08 (Target 1). Target 2 - 0.12, where the 0.236 Fibonacci level is and the high of the movement that occurred in the spring. Target 3 - 0.18, the 0.382 Fibonacci level and a strong weekly level.

kaboozyako

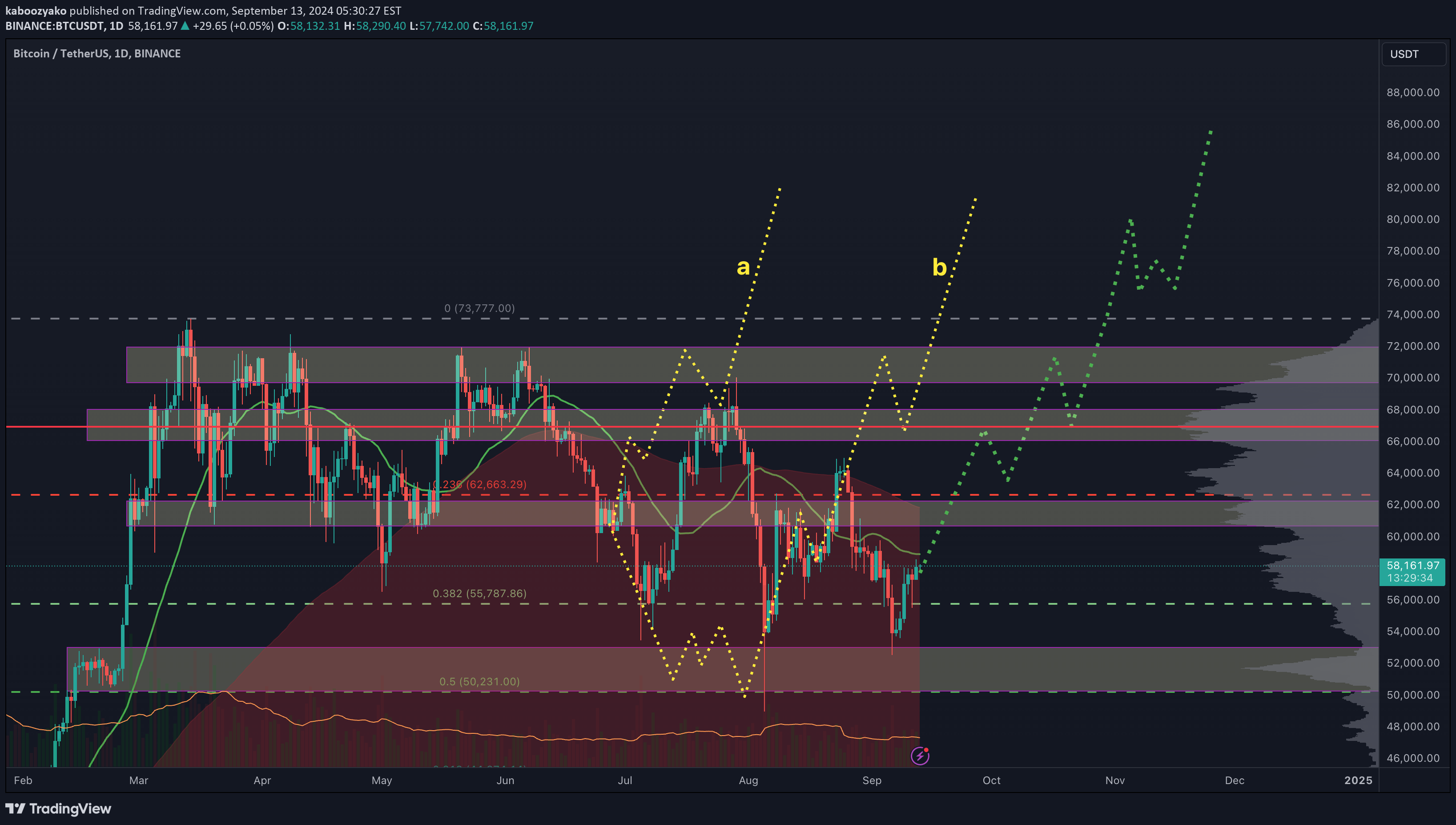

time to update my previously idea The price of Bitcoin has followed path B and has been moving sideways for some time. Partly, this was due to very weak data from the U.S. labor market. A few months ago, bulls were anticipating this weakness, but now they are afraid because it has started to smell like a recession. Mr. Powell already announced on August 23 that "the time has come," and now monetary policy will be eased. There is a consensus in the market that the rate will be lowered in September, although many are expecting an immediate reduction of 50 bp. I agree with the opinion that there will be a 25 bp reduction, as a 50 bp cut would be an acknowledgment by the Federal Reserve that they erred by delaying the start of the reduction and could cause additional panic among investors. I don't think it could happen 1.5 months before the elections. Also, additional reasons for growth are stock market buybacks in September/October and payments from FTX of about $16 billion in October. So yes, I'm sure that the bottom has already been passed and it's only up from here

kaboozyako

Past forecasts worked out perfectly and are in the process of working out tradingview.com/chart/HAIUSDT/wpaHsc07-BULLISH-on-HAI-1W/. HAI performed well in 2024 and now HAI price is now in a strong support zone at 0.038-0.041. There is also the 0.786 Fibo level, which signals that the asset has corrected deeply. Now 1-2 weeks of accumulation in this zone and probably HAI will start storming local tops in my opinion. This idea fits well with my view on bitcoin and the market in general for the coming months. It is rumored that ETN ETFs will be listed in early June, which will give the market additional liquidity and may be the start of the alt season. Hacken is actively building and plans to conquer Base with its products, which will naturally be an additional growth driver ALL TIME HAI targets are marked on the chart, the final target of this idea is the zone 0.16-0.18, where historically strong level, which will be a springboard for future assaults of HAI tops.

kaboozyako

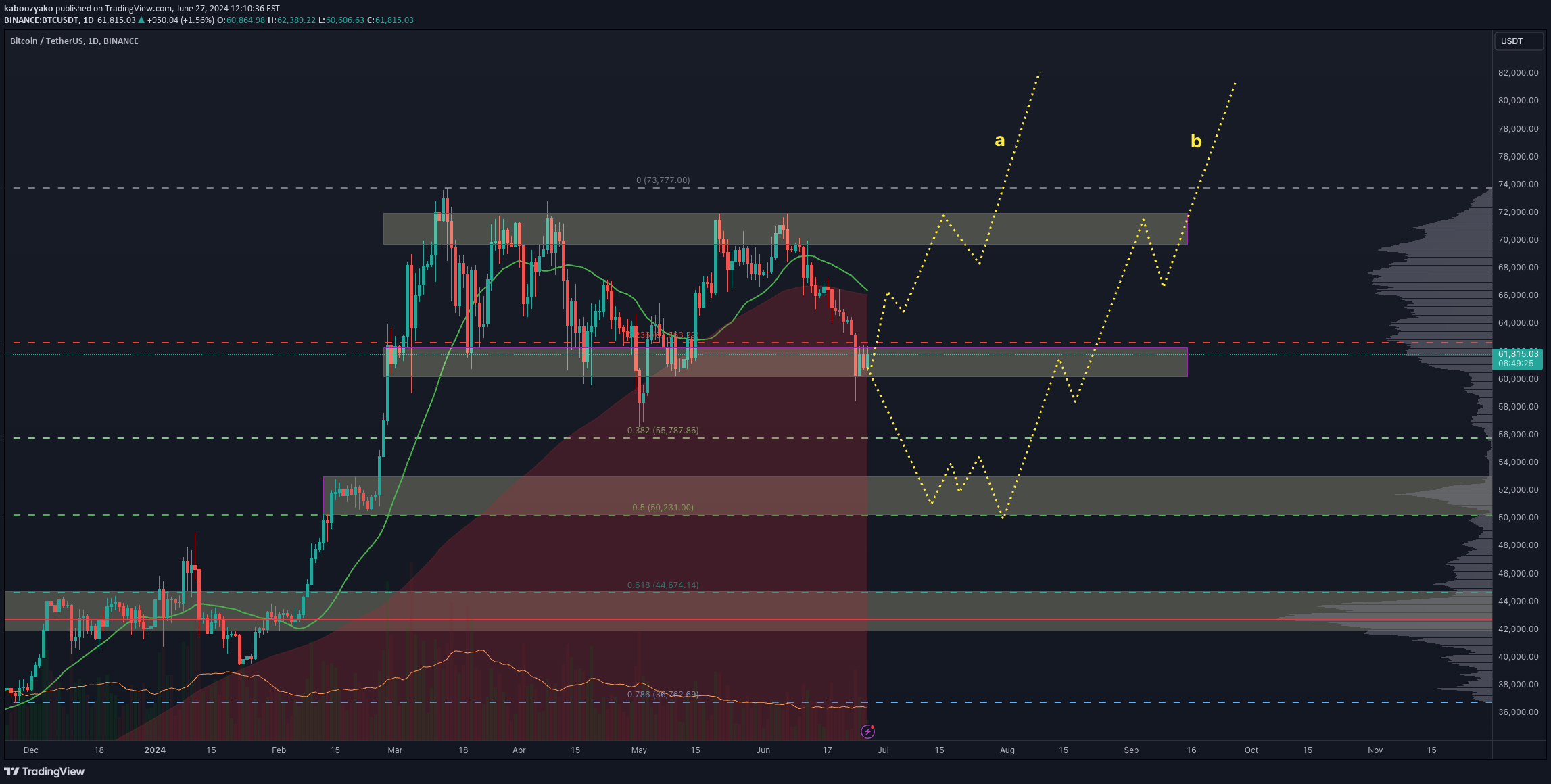

The price is still in a wide range between 60k and 70k, now at the lower boundary. if we look only at the chart and according to the canons of technical analysis we should soon see BTC in the 51k-52k zone (path B). but I'm looking at the big picture and path A is closer to me. 1/ the listing of the spot ETH-ETF will take place in early July, which will definitely be a strong trigger for growth. 2/ there are a lot of shorts and negativity in the market right now, which means the fuel for that very trigger growth is present. 3/ if the bullish investor consensus strengthens on positive macro data, then capital flows into spot BTC & ETH ETF's will be off the charts, which will create a demand imbalance (plus FOMO) in the market and lead to stronger growth. Macro data is expected to come out good in July and may start the discussion of a rate cut in September. The actual rate cut in September will *sell the news*. 4/ In a US election year, historically good activity in the summer and in September/October markets reassure and freeze in anticipation of election results 4/ onchain metrics continue to signal that we are in a bull market and whales continue to build exposure to top coins. I expect the next two months to be bullish and portfolios to turn a nice green over the summer.

kaboozyako

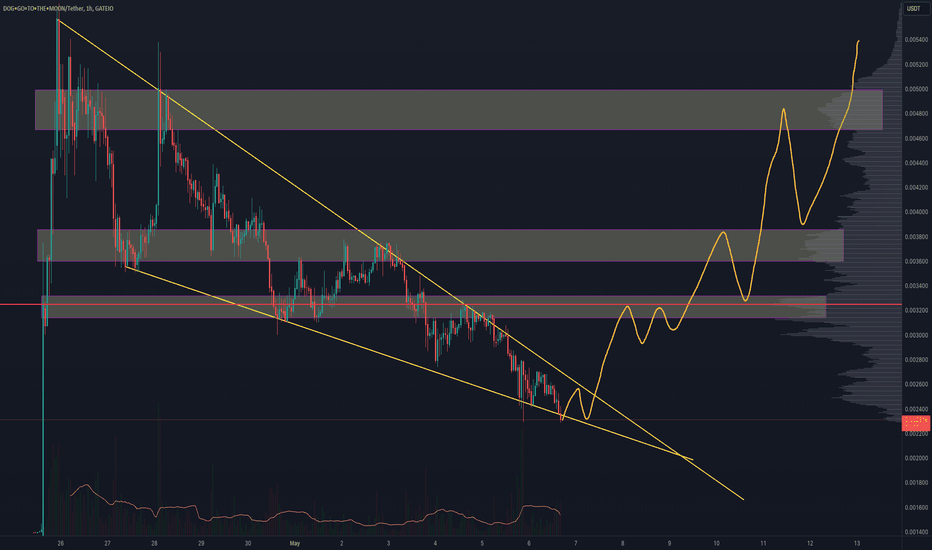

DOG by ( coinmarketcap.com/currencies/dog-go-to-the-moon-rune/ , coingecko.com/en/coins/dog-go-to-the-moon-rune) is a memecoin on the #Runes protocol #BTC , created just a week ago and distributed to all Runestone owners 889 806 DOG per RUNESTONE. With a total supply of 100 billion tokens, DOG boasts the largest capitalization (now about 350+ million, peaking at 600+ million), the highest number of holders, and the most active community, comprising both regular enthusiasts, and founders of various projects, celebrities, artists etc For example, beeple dedicated artwork to Runestone x.com/beeple/status/1776801823988256820 , and another to the halving event featuring Runestone x.com/beeple/status/1781532166477828444 . @FTI_DA , one of the world’s largest investment managers with a total AUM of $1.6 trillion, mentioned Runestone x.com/FTI_DA/status/1775552645689749905 and recently expressed bullish sentiment towards the Runes protocol x.com/FTI_DA/status/1779979775651561691. article on @Bybit_Official learn.bybit.com/web3/what-is-dog-go-to-the-moon/ Personally, I'm not a fan of memecoins because it often seems like a senseless waste of money. However, DOG is more than just a memecoin; it's a story! Here are a few notable features: /No team allocation /No presale /No unlocks in future, all supply in circulation /No manipulation to collect points for an airdrop /No favoritism towards whales in the airdrop algorithm /No gifts to influencers /No VC backing /No hired market makers /No listing fees paid to centralized exchanges /No celebrity endorsements /No paid promotion or marketing Community just organized amongst ourselves and if something needed to happen then people stepped up If donations were needed to cover the 10 BTC of network fees to do the 100K+ address airdrop people donated If devs were needed to execute the airdrop devs volunteered And together community created the #1 memecoin on #Bitcoin called DOG It is time to take a radically different approach It is time for a memecoin supercycle like you have never seen and DOG will lead the way by attempting to create the #1 memecoin in the world DOG is the largest memecoin on the largest chain #Bitcoin DOG GO TO THE MOON

kaboozyako

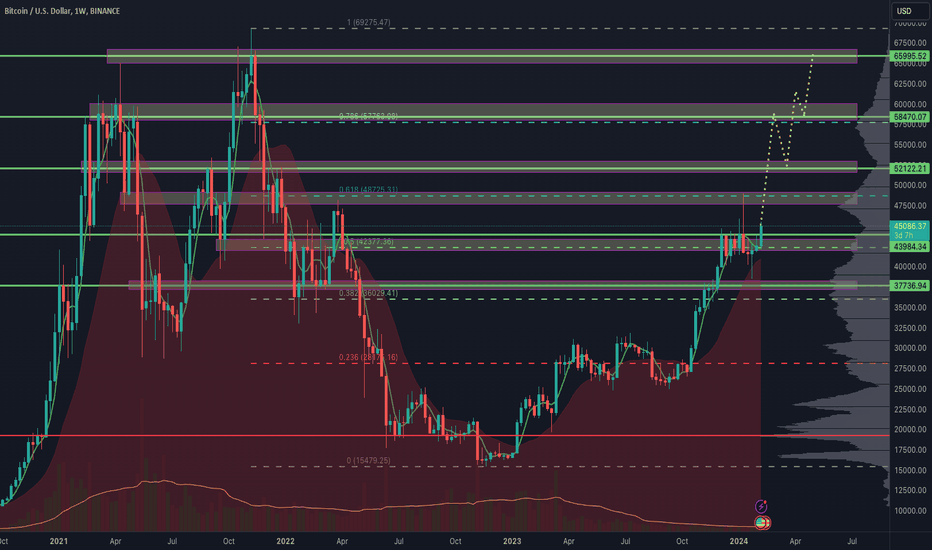

The previous idea has been executed, and the correction of the 2-year fall has occurred at the 0.618 level. Now, the question is, what comes next? On one hand, An ETF for spot Bitcoin has been approved, and big money is gradually coming in. The Federal Reserve's rate hike cycle is likely finished, with three reductions probable in 2024. The halving is coming up. On the other hand, The US economy is on the brink of a recession, which could spiral out of the Fed's control. The Chinese economy shows significant weakness, and the bankruptcy of Evergrande could still have a very strong impact. Geopolitical risks and the threat of new global conflicts exist. I am inclined towards growth in the coming months, not excluding strong volatility and periods of accumulation at important levels. The nearest levels are 48k, 52k, and 58k. These are the levels that, in my opinion, the price will challenge.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.