josip

@t_josip

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

josip

Strategic Bitcoin Reserve

Strategic Bitcoin reserve is being prepared. whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-strategic-bitcoin-reserve-and-u-s-digital-asset-stockpile/

josip

It's going up forever Laura!

Yeah, It's going up forever. Everyone will copy MSTR and include BTC in their reserves. Valuing companies will be much much simpler on Bitcoin standard. This will contribute to the efficiency of society immensly.Good luck!Bitcoin on exchanges is drying up, and a big contributor of permanently locked Bitcoin is Michael Saylor. That's the Bitcoin that's never getting into circulation again XD coinglass.com/BalanceNooooobody expects the Saylor acquisition! youtube.com/watch?v=QqreRufrkxMTornado and smart contract sanctions are deemed illegal by the court. This is a big change. Ivan on tech: youtube.com/watch?v=jAvt_W_hc3QYou cannot play fiat games in the Bitcoin world with Microstrategy. If Bitcoin is at 50vol and MSTR is at 100 or 150 vol, you need to hedge your MSTR shorts with 2x or 3x fiat entering the Bitcoin. Bitcoin sensitivity is 10/1, meaning that for every 33B you put into Bitcoin, the market cap goes up 30B. You are shorting MSTR and hedging with senior asset. On paper, you are shorting 1/100th of MSTR and longing 30/2000 BTC, which is roughly a 1/15 MSTR/BTC ratio. That's still fine if you ignore the fact that the premium is usually over 70%. You can't do that in the Bitcoin world because price is determined on the margin, and the margin at the moment includes only 2.5M Bitcoin available on exchanges, which is consistently dropping. This means that MSTR can soon easily have over 50% of circulating supply of Bitcoin, the rest are long term holders. On top of that, MSTR is essentially "burning" BTC because there are no mechanisms that will force MSTR to sell (at least not before 2029). The bond holders will constantly hedge in order to get stable returns, but they are leaving the rest of the profits to the Bitcoiners because MSTR will just recycle the premium into Bitcoin, which it also personally holds. If these ratios are correct (the balance between new liquidity coming in, and price sensitivity), you cannot hedge MSTR efficiently, meaning that MSTR is turning both long and short capital into a long capital ram pump. On top of that, for every 10% that MSTR moves BTC price up, only 5% can go down in case of a bear market. According to me, and Chat GPT, MSTR accounts for 30-40% of the Bitcoin market on the margin this bull run, and a total of 100B by MSTR and IBIT pushed the market cap of Bitcoin by 1T. The thing is, even though so little actual capital is tied up to this immense market cap, about 30% of it or more (basically MSTR purchases) is only tied up in upwards direction but not downwards through MSTR debt. Now, that's not perfect because it's still debt, but we are frontrunning. On top of that, all the "hedging" that these big institutions are doing are providing even more flooring for MSTR and for BTC. I am expecting that this bull run, all of the corrections will be only 60% as large than compared to the last bull run. Meaning that a 50% correction will now be more like a 30% correction, and 30% correction will be a 20% correction.I just want to add that I mentioned exchanges, but I forgot to mention OTC. I can only track what's happening on exchanges, unfortunately, I have no idea about the OTC market.Price is 100% manipulated. There is no Bitcoin in circulation, which means that Wall Street is determining the price while the NYSE is closed. How do I know? I've been watching MSTR-BTC relation. BTC always comes back to the neutral price from the previous daily close of MSTR in order to make a discrepancy as small as possible. Since there is a severe lack of retail investors, basically, Wall Street is using algos to force 15min and 1hr candles up and down in order to scoop some reflexivity one way or the other. Since they are gambling with other peoples money, they have to put Bitcoin price back in place where it was once the market opens, so that MSTR or MSTR holders wouldn't have any extra opportunities to kill their positions. It's a big club, and you ain't in it. But it's just temporary and their power is limited to 5% up/down + they can extend the sideways movement for some sustained periods of time like weeks, or in case of 68k, a couple of months. This is just to earn money on option decay and option premiums, nothing more. They are basically scamming their own investors by showing the wrong Bitcoin price, because now they account for most of the market and they have good models of relation between actual capital inflows and price sensitivity (I have discussed this relation in previous posts). So, we have to remain patient until they implode. But there is no Bitcoin.Now we have a beautiful candle as a proof of manipulation lol. MSTR shorts are off the chart btw XD The squeeze will be legendary (unless wall street just makes their friends exit during closed hours like with GME stock). They basically just put their names in front of your orders...

josip

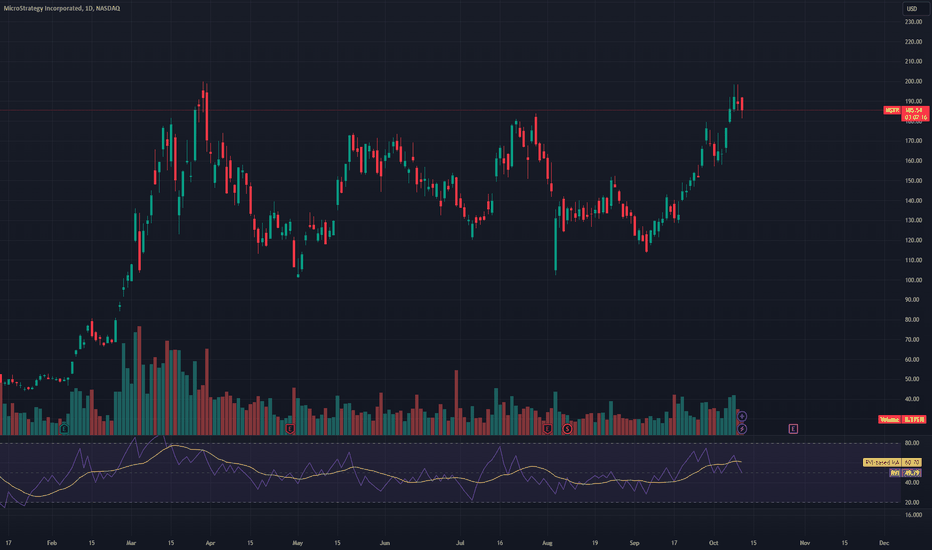

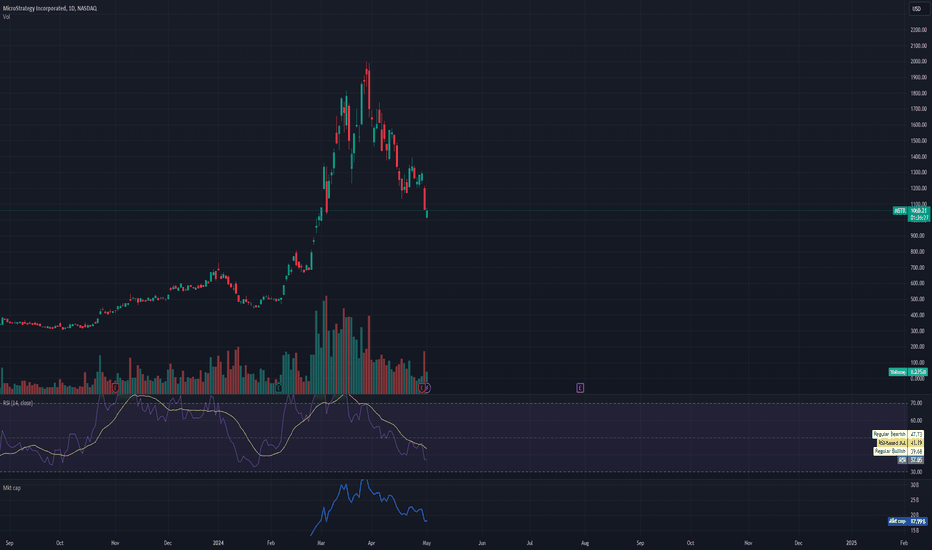

I bought calls on this dip lol MSTR

Massive dip due to market skepticism. People really don't understand...I actually use MSTX for calls, it's cheaper XD- by mistake I used trade active for the first comment, I want to add a comment so I'll add it below. I mean, the trade is active since it was posted (since the red line) but I'm adding some info after the fact.Citron research is wrong. They caused the sudden price drop because they figured the stock is overvalued. They are totally wrong in assesing the stock. MSTR holders are only interested in extra bitcoin yield. To us, Bitcoin price doesn't matter. I see a lot of articles emphasize the risk of Michael Saylor's strategy, however, the structure of his debt is very good for this purpose. He is leveraged a lot, but the bet on Bitcoin that MSTR is providing is simply amplified Bitcoin. That's the only risk, whether you can handle volatility. And yes, because of the way MSTR is financing the future Bitcoin purchases, they are definitely creating a bubble. Not only that, but the more the Bitcoin price grows, the more MSTR grows, and on top of that, the MORE Michael Saylor wants to buy Bitcoin because he can issu more stocks and bonds. But as he buys more Bitcoin, he also increases the price of bitcoin which closes the loop. This is identical to real estate Cantillonares. On top of that is diluting stocks in the fiat world while simountainously providing a higher concentration of Bitcoin per stock for the holders. In Bitcoin terms, the stock is actually anti-dilutionary, it's getting more and more concentrated. If you are a Bitcoin maximalist, this is the greatest speculative attack on a currency EVER. And it's attacking the dollar $$$ hahaha My biggest fear is that this could escalate pretty quickly and someone may stop it by force. I also hope that Michael Saylor stays true to his strategy so that people who invest with him can be fully aware of what the future will look like. This is actually quite brutal, I have a feeling that something doesn't add up, but the truth is, it probably doesn't. And now we can see that on such a crisp clear example. Good luck guys!Friends asked me, what about the premium? Well, the premium is 3-5x which, in conventional finances is actually pretty low. Citron research is shorting a 3-5x premium company in the world where P/E ratios are normally going over 10-20, for tech stocks over 50. They are going to get rekt quickly. Premium of 3-5x on a company that brings you 15-20% bitcoin per year is insane. At an average of 12% yield, for every 1 Bitcoin, Microstrategy will acquire 8-10 more bitcoin over the course of 10 years. And we are not even calculating what the Bitcoin value could be. Everyone is assesing MSTR risk in $$$, which is completely wrong. That way, you will calculate that the company is EXTREMELY risky and trades at a huge premium. When you are in the Bitcoin world, MSTR is dirt cheap.Here Michael Saylor says that MSTR is a MONSTER for Bitcoiners. It truly is. I don't think that people understand it. youtube.com/watch?v=Fztho2KqqdUI have to post this too: youtube.com/watch?v=P5LKZ1-6BWM Basically the same thing that the financial system is doing, only with Bitcoin. Think of that what you will lol. If I were Michael Saylor, I would use this bet to rob wall street, acquire all the Bitcoin I can, essentially burining it (who knows if we'll ever see any of MSTR Bitcoin being released), and make sure that Bitcoin becomes even scarcer.Market leverage assesment: chatgpt.com/share/67433066-250c-8003-8ca2-dc7f65c80e92 I am limited with the data, but under some assumption, BTC price action from 20k to 64k in 2021. was driven by about 12x leverage. Today, we are at over 18x leverage. Use this information as you wish. This is important for risk assesment and the risk may be very very high.Because this is such a complex topic, I am adding some opinions: Every bear case for MSTR: youtube.com/watch?v=3IlR0GbUMXE What people get wrong about MSTR (by Dylan LeClair): youtube.com/watch?v=bTrdWIVc9aMMy bet could very well be a mistake, so I don't encourage anyone to replicate it. I am just going to leave some long term pro MSTR arguments here, but in the near term it's not worth buying if you are a Bitcoin maximalist (better to just buy Bitcoin). I am going to let this play out and see, but I will probably try to reduce my position next week as I can still collect a hefty premium from my old positions. This will be difficult to decide and it will rely heavily on the news and short squeezes, and the effect of "premium squeezers" on the Bitcoin price. 1. MSTR holds virtually no risk if BTC falls. They can cover their debt with cashflows. 2. Convertible bond debt is removed if the stock gains 40%, they swap the bond for the stock at the original price and amount and burn the debt. But than that company can dump MSTR on the market to realize gains. 3. Stock qualifies for Nasdaq100 4. Stock maybe qualifies for S&P500 too 5. I'm not 100% sure about this, but apparantly there is still a lot of money around the world that can't be parked directly into Bitcoin, Bitcoin ETF or options, so I'm guessing that those might still be the buyers of MSTR regardless of the premium. We witnessed in many countries with currency collapse, that people are willing to pay over 2x premium just to get some Bitcoin or $$$. 6. Fair value accounting will reveal huge profits, which will draw in more capital from conservative companies. I don't know. It just might work out. And I have 0 idea what will be the full impact of short squeezes and hedging, because those who want to squeeze the premium out of MSTR, also have to purchase BTC, which is the underlying. To me, it looks like they are just doing the arbitrage between Bitcoin and Microstrategy stock, which should be healthy for the market.trading-volatility.com/Trading-Volatility.pdf This will be the guide for our journey. A battle of titans.Oh yeah, did I mention that Bitcoin liquidity is drying up? That means that less and less fiat will be needed to push the price up, and MSTR is willing to buy at any price :) The volatility won't allow ANYONE to efficiently exploit the stock, that's the beauty. Everyone who tries to exploit it will be sucked dry if Bitcoin keeps going up. What Saylor is offering is stable and guaranteed but lower returns, to the big companies, and embedding the full Bitcoin returns in the company and Bitcoin itself. Basically, if you hold MSTR, It seems like you don't have to care about the premium that much because sooner or later, MSTR volatility will give you an escape and you will essentialy be given an opportunity to cash in your premium. He gave us, the Bitcoin holders, this infinitely volatile thing to handle, traders are helping to reduce the volatility and increase efficiency, meanwhile, he is outputting a product that is stable but has lower projected returns than Bitcoin itself. As a reward for holding and "managing" MSTR stability and financing, instead of buying Bitcoin, MSTR will ensure that all of their investors are made whole over the long term, even if they are not controlling the full bitcoin they could've bought for the same price because of the premium. This strategy highly relies on fair value accounting, smart convertible bond issuance during the times of low premium, and a massive battle between the traders (hopefully wallstreetbets activates) and hedge funds. Only I don't think that anyone has to fight for MSTR, this "reactor" as Saylor calls it will simply go through all of it if the Bitcoin thesis is correct. Bear markets won't kill him, but Bitcoin does need to start taking over the world. Here is the man: youtube.com/watch?v=Fztho2KqqdUThis was my initial thesis when MSTR was at 114: And this is from when MSTR traded at a discount to NAV. Given the new regulations, I believe that MSTR premium can easily go to 30-40-50x. They wil dilute the common stock to pump Bitcoin even harder, which will lower the premium, the stock will become cheap again, it will regain it's premium and the cycle repeats. In a world with such a finite amount of Bitcoin, MSTR will take over and hold, essentially "burn" a vaaast amount of Bitcoin, and essentially create a monopoly (like when real estate moguls take over the whole neighbourhood). In the meantime, MSTR will pay the Bitcoiners a hefty reward to release their Bitcoin. At that point, Bitcoin price is whatever you wish it to be. This will actually probably work. And the reason why the premium will be 30-50x at least is because that's the equivallent to a P/E ratio of a tech stock, and this multiple will be derived by multiplying the company revenue in terms of Bitcoin holdings (after fair value accounting takes place) which will reveal massive net profit and growth of MSTR. It's genius. Michael Saylor is the guy with the gun. He created the gun and channeled the power of gunpowder. Gunpowder, same as Bitcoin, is a store of energy. Not only that, he is making sure that nobody else can get the gun. Everyone will have to jump on the bandwagon it's ridiculous. My plan, of course, is to convert a lot of my premium into Bitcoin and store it in cold wallet, but MSTR bet could be a bet of a lifetime. Leave 30-50 stocks on your account, forget about them, and you never have to worry about your pension. MSTR will be able to provide limitless Bitcoin based products once they become the biggest holder, their future business is probably in finances based on Bitcoin. This whole confusion (which is also obvious from my theory development) comes from the fact that we just can't wrap our heads around how upside down this is, but it is a mirror image of our current system, only without the leak. Money doesn't leak here through inflation. When you hold a large chunk of the reserve currency, that's it. That's your cut, and percentagevize, your cut never changes. The money is not just extracted from the premium, that's wrong. Because we are not looking at the whole massive circle of market dynamics. You can't just extract the premium from MSTR by shorting MSTR and longing BTC. You simply can't. The two are so interconnected that you will wreck yourself. Check yourself before you wreck yourself.I get it now. I think Saylor is trying to make a new "S&P500". I wish him luck.I recommend this video: What could go wrong with microstrategy? youtube.com/watch?v=TozHW2SPpjQHere is the detailed explanation of my thesis and why MSTR will be insane: youtu.be/CjhhNMaHb3II added MSTX Jun20'25 49 CallsI added them when MSTX was at $116.5.Bitcoin price will matter, but if it holds, we are about to see some short liquidations :) MSTR holders won't prodvide them with a $ of profit. None. 0.We are in control now. Finally.I'm not sure if the people are aware of this, but when the "dump" is over and people take their miniscule profits because they don't know how to do it without selling Bitcoin on the market, there won't be any Bitcoin on the market. The supply is dry. MSTR won't budge. This isn't a feedback loop downwards spiral setup, this is a feedback loop UPWARDS spiral setup :)mstr-tracker.com/Bitcoin on exchanges is steadily decreasing: coinglass.com/BalanceSomeone is still trying to short the premium out of Microstrategy hahahahaI think I was wrong. Since options are available on the market, we can make our own MSTR leverage without paying the unnecessary 2.5x premium. Although MSTR does have some future potential, no matter how I value it, it is difficult to justify the premium. The problem grows bigger because big money can extract the premium pretty easily through Gamma squeeze, which they have proven yesterday. Short interest was significantly reduced, without any significant move in MSTR price. The premium will be extracted in the end. You should sell while the premium is still there, buy it when it comes close to NAV or below. Maybe in the future (in a year or two) they become a bank, but until then this is unjustified when we look at other options. Yes, convertible bonds will remain extremely profitable, but just convertible bonds won't be enough to rack up the premium enough to justify the premium that previous holders have paid. It is an elaborate pyramid scheme (still, like most of finances) that will give MSTR a lot of ownership over Bitcoin at the expense of its investors. Only some investors will be able to escape, others will have to hold it out until the company figures out how to make this a profitable business. I still hold my opinion that it is impossible to short MSTR or hedge anything on MSTR. I will be collecting my premium and leaving as soon as I can.I want to clarify, every long term MSTR stock investor will be fine. And it may be smart to do some supplemental gamma squeeze trades. But mid-term and short term it will be very difficult and unnecessary to use options, or buy the company at such a high premium to NAV. That said, in the Bitcoin bull market, that premium is what outperforms. However, it will require ever increasing convertible debt, and I'm not sure what's the capacity for that, and how the rising price of Bitcoin will affect the equation. All I know is that there will be some diminishing returns pretty soon.Michael Saylor - Why You Can't Buy Bitcoin Fast Enough youtube.com/watch?v=jIrPbsxWywEAaaand those who were patient will now witness a massive short squeeze. Short interest is comming from market manipulators.I believe that MSTR may soon start selling bonds with negative interest rates.

josip

josip

Technical Nonsense Territory

We are slowly approaching a technical nonsense territory... "Breaking from the downwards channel" "Swing trading the upwards channel" and similar degenerate strategies may soon become a thing. After breaking an ATH, we are entering the uncharted territory. Legends will be guided by the ghosts of technical analysis. The truth is, the best strategy will be to buy and hold.Do I even need to post anymore? Does anyone care?

josip

Spike in the Bitcoin price in the near future

I have noticed that there is a big discrepancy between the price of Bitcoin and MSTR. I haven't checked how the trading volumes compare, but my guess is that this arbitrage should have a noticable impact on increasing the Bitcoin price, until the prices of MSTR and Bitcoin find each other in the middle. The "Middle" is dependent on the price discrepancy and total volume discrepancy.There is the spikeOh boy how immensely accurate I am :)At 65 800, I'm closing my MSTR (@ $215) and MSTX (@ $44) options. I will be rolling this into MSTR stocks and pure Bitcoin over time. I also bought 1 more MTCH option (for a total of 3). I see no more good opportinities in the near future.

josip

Why is MSTR at an ATH while Bitcoin is dumping at 60k?

Something doesn't make sense here. Either people closer to the stocks know something about Bitcoin that we don't, or the market became extremely inefficient and there is a great opportunity for arbitrage. I am not sure how to execute this yet, maybe I leave something in the comments.The thing is, in order for arbitrage to happen, someone needs to buy Bitcoin and sell MSTR. Therefore, this arbitrage should also cause a Bitcoin spike in price.Click at the comment aboveThere are some news related to my observations: youtube.com/watch?v=c3E0RKtYT0k I haven't evaluated this yet.Let me just clarify, the arbitradge fully happened over mondey and tuesday. At a certain point there was a significan Bitcoin price growth while at the same time MSTR had a dump. Only, both values were higher than initial values from friday but I did point out that this change will be relative and not absolute.

josip

MSTR Call Options

I think this is a perfect opportunity for MSTR Calls. Bitcoin is quiet, at a local minimum, everyone is desperate. The bottom may not be in but it's definitely close. Options are problematic because of timing. I rarely use them but in this case I believe that the benefits far outweigh the risks. I bought some options on friday but I'm getting some more options with 1-2 months until expiration.I exited this trade with a 272% gain. Temporarily staying in MSTR.I forgot to update the idea, but I reentered with MSTX calls a little over 6 hours ago. There is a comment in the comment section.If this turns south, I will probably have to hedge my positions during the weekend by shorting BTC on Binance. It's ready but I'll activate it only in case this thing doesn't hold.I'm hedging on Binance over the weekend, so options losses will appear as Binance profits.I almost completely removed my hedge overnight.

josip

Seems like another DOGE bottom

I am not a big DOGE guy, but aside from Bitcoin, it is one of rare crypto meme coins with some credibility. Of course, the whole market is driven by Bitcoin, however, Doge provides more leverage without risk of liquidation due to excessive leverage. I expect that Doge will reach over $0.2 when Bitcoin passes 70k again.Good time to get out.Good time to re-enter

josip

MSTR is a good buy now with $18B market cap

Even though MSTR holds $12B Bitcoin, they have demonstrated that when bitcoin is doing well, the market cap is almost 2x Bitcoin holdings. This could be a great way to leverage yourself safely and pick up the dip at about 3x gains (if Bitcoin moves up of course). For every 5%, MSTR will move 10-15%. Good Luck!I sold, waiting for the better entry.Keep en eye on it1035 may be a good entry if Bitcoin holds 56 000 Sell if Bitcoin breaks $56 000.I am reposting one of my comments here (4 hours after) just to keep the timeline easy to follow. "I sold MSTR at 1300 and swapped it for more TSLA at 184. I'm on my phone so I cannot publish this undr my analysis. This will be temporary until Bitcoin finishes the dip."

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.