illuminati_K027

@t_illuminati_K027

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

illuminati_K027

Dogecoin’s Lifecycle Outlook: A Deeper Bottom Before a Historic

Dogecoin is likely to form a bottom lower than that of the previous cycle before entering the next major market cycle. Following this phase, it may reach an all-time high that marks the peak of its entire lifecycle, surpassing all previous highs. However, after completing this historic top, Dogecoin is expected to experience a severe crash alongside Bitcoin, reflecting a broader market-wide collapse. This pattern suggests that the next cycle could represent both the final euphoric expansion and the most extreme drawdown in Dogecoin’s full market lifecycle.

illuminati_K027

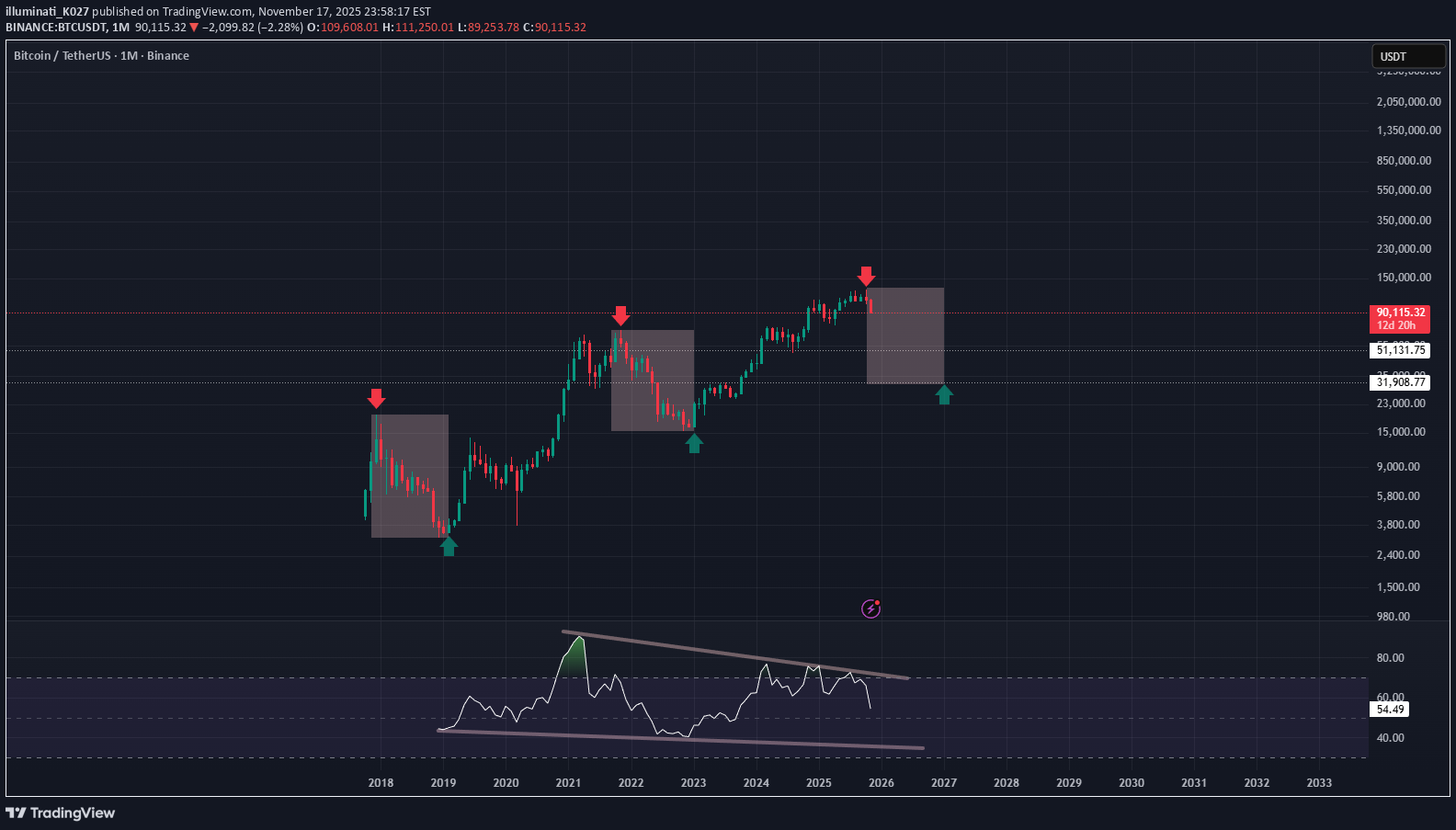

The Future Outlook of Bitcoin

When we think about the future direction of Bitcoin, it can be outlined as follows.It is likely that Bitcoin could experience a downward trend for about a year, potentially falling into the $30,000–$50,000 range before forming a bottom. Once that bottom is established, a final major bull cycle may begin around 2027, eventually pushing Bitcoin to challenge a new all-time high somewhere above $200,000. However, if such a scenario unfolds, the large institutions that many retail investors have long trusted may execute a well-orchestrated distribution, transferring their holdings to the public and realizing substantial profits. At that point, the first round of this game would come to an end, and a prolonged bearish phase of three to four years could follow before the second round begins.It is important to emphasize that this outlook represents a baseline scenario derived from Bitcoin’s historically observed market cycles and halving-driven supply dynamics. However, the introduction of quantum computing as an active attack vector fundamentally alters the risk profile. Should quantum-capable systems begin real-world cryptographic attacks on public blockchains, Bitcoin could enter a worst-case scenario in which traditional market cycles cease to function as reliable reference models. In such a case, price behavior would no longer be governed primarily by supply scarcity or investor psychology, but by an abrupt loss of confidence in protocol-level security. This would represent a structural break rather than an extension or distortion of existing cycles. Critically, the severity and timing of this disruption would depend not merely on the commercial availability of quantum computers, but on the moment they are actively deployed to test or exploit cryptographic vulnerabilities. The closer this attack phase occurs to a market peak or late-stage distribution phase, the more violently the conventional cycle could collapse. Therefore, while this analysis focuses on the traditional cyclical framework, it must be understood that quantum-driven security breaches constitute a regime-change risk—one capable of pushing Bitcoin’s trajectory far outside historical expectations and rendering standard cycle-based projections obsolete.

illuminati_K027

کامپیوترهای کوانتومی: چرا بیتکوین و ارزهای دیجیتال اولین قربانیان خواهند بود؟

Personally, I believe that once quantum computers reach practical power, the first assets to collapse won’t be banks or credit card networks— it’ll be Bitcoin and most cryptocurrencies. Banks can upgrade their encryption overnight inside closed, centralized servers. Users won’t even notice. But Bitcoin can’t. Every address that has ever made a transaction already has its public key permanently exposed on the blockchain. Quantum computers can reverse that and steal the private key directly. And Bitcoin can’t fix this fast. A security upgrade requires global consensus, node updates, exchange updates, wallet updates, and millions of users moving funds. Banks need hours. Bitcoin needs years. Quantum needs a day. That’s why, in a true quantum era, the first systems to fall aren’t traditional finance—they’re Bitcoin and 99% of all cryptocurrencies. When the cryptography breaks, the asset doesn’t drop in value— it disappears.The real solution is simple: move crypto to quantum-resistant encryption before quantum hits.If crypto can’t become quantum-resistant, even Bitcoin and Ethereum won’t survive. The quantum era will erase today’s rankings and create a completely new crypto world.To be clear, everything above is simply my personal warning about the challenges crypto may face. But I don’t think crypto is doomed — far from it. If this industry adapts, evolves, and becomes truly quantum-resistant, it can survive, scale, and even thrive. And if crypto ever wants real adoption — real utility, real monetary use, and real global value — then reaching half of gold’s market cap, or even surpassing it, isn’t impossible. It may take decades, but I believe it can happen.

illuminati_K027

کف واقعی بیت کوین کجاست؟ پیشبینی سطوح حمایتی و زمان ورود استراتژیک

1/ Bitcoin has entered a clear downtrend cycle. Historically, BTC experiences a time-based correction lasting 12–18 months after each major multi-year bull run. 2/ In this cycle, two major bottom zones matter the most: • $50K range — if fundamentals remain strong • $30K range — if a typical cycle-style washout occurs 3/ Even strong cycles have produced deep corrections. So both price levels must be considered realistic accumulation zones. 4/ The ideal entry strategy? Wait for the market to complete a full time correction into 2027+, form a clear bottom structure, and then show a confirmed green monthly candle close. 5/ When that monthly trend reversal appears after a long consolidation, that’s when high-conviction positioning makes sense.In the next halving cycle, the so-called “big players” or large market participants have likely already anticipated and analyzed the current downturn. Using AI models and various market indicators, they would have detected early signs of a bearish shift and adjusted their positions accordingly—either by selling a portion of their spot holdings or by opening short positions for hedging. Rather than selling their entire holdings during this decline, these players tend to lower their average entry price, secure liquidity, and prepare for the next major upward cycle. Near the market bottom, they may even accumulate additional positions to strengthen their long-term strategy. In the next bullish phase, narratives promoting targets such as $200,000 could emerge, amplifying market optimism and driving sentiment. Their strategy is not driven by short-term gains but by a long-term perspective, continuously positioning themselves across multiple cycles. The current downturn is likely just another phase they’ve accounted for within their broader long-term plan.In conclusion, they no longer see this market as a simple investment—it has become a “game” to them. And in this game, they are far from satisfied. After countless cycles, they haven’t escaped the thrill; if anything, they’ve become addicted to it. So when a downturn comes, they prepare. When the next round approaches, they position themselves again. They don’t think the game is over, and they have no intention of stepping away from it. To them, it’s just another stage of the cycle—another chance to play.

illuminati_K027

illuminati_K027

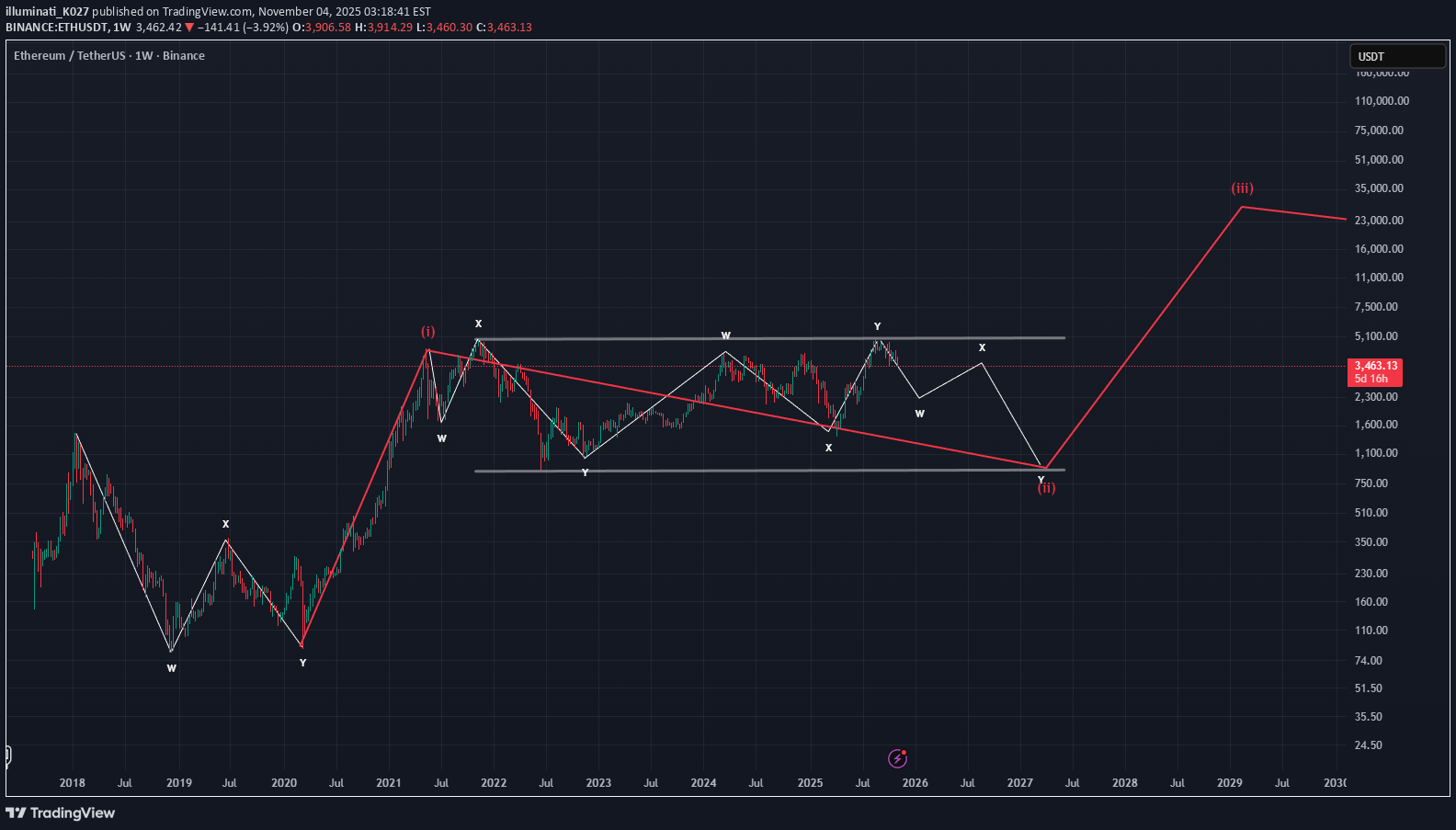

اتریوم از بیت کوین جا ماند؛ آیا موج دوم سقوط ETH آغاز شده است؟

illuminati_K027

illuminati_K027

illuminati_K027

بیت کوین وارد فاز نزولی میشود؟ پیشبینی سقوط ۶۰ درصدی و زمان شروع چرخه صعودی جدید

I believe Bitcoin is entering a downward cycle. But unlike the past — where we saw 90%, 80%, even 70% drawdowns — this one could be around 60%. I’m convinced the top is already in.If Ethereum drops around 80% from its peak, then Bitcoin’s correction around 60% feels fair. Different assets, different volatility — same cycle logic.I believe the winds of a new bull cycle may start blowing in 2027. Until then, we’re still in consolidation — building the base for the next wave.

illuminati_K027

زمان انفجار بزرگ اتریوم: آیا تا سال ۲۰۲۷ منتظر رشد انفجاری ETH هستیم؟

Ethereum feels sluggish — price action lacks momentum while the ecosystem keeps building. Why is ETH moving this way, and when will the impulse-level bull cycle finally start? Here’s my view on the upcoming cycleA move toward $1,000? Maybe. In my view, Ethereum’s long stagnation isn’t a collapse — it’s part of a broader integration and consolidation phase. We’re still in a major corrective cycle within the grand structure. Real change may not come until after 2027.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.