henryartem

@t_henryartem

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

henryartem

IS BNB READY FOR THE BULL RUN?

BINANCE COIN PRICE PREDICTION 2024-2033: IS BNB READY FOR THE BULL RUN? Binance Coin Price Prediction 2024-2033 BNB Price Prediction 2024 – up to $511.62 BNB Price Prediction 2027 – up to $1,593.00 BNB Price Prediction 2030 – up to $4,915.00 BNB Price Prediction 2033 – up to $15,903.00 After notable changes in its executive team, Binance has shown notable resilience and prospects for recovery. The departure of Changpeng Zhao, Binance’s CEO, who was also embroiled in legal challenges, initially caused a decline in the value of Binance Coin (BNB). Despite this initial setback, the cryptocurrency has shown a positive trend. Presently, BNB is trading at $317.6, reflecting a modest rise of 7.01% in the past month. What next for BNB in 2024? Let’s get into the details. How much is BNB worth? The current Binance coin price is $332.42 with a 24-hour trading volume of $883,690,728. BNB is up 2.94% in the last 24 hours. The current CoinMarketCap ranking is #4, with a live market cap of $49,711,054,737. It has a circulating supply of 149,544,917 BNB coins and the max. supply is not available. Binance Coin Price Analysis: Upsweep continues forward as BNB crosses $333 barrier TL;DR Breakdown Binance Coin price analysis confirms an uptrend. Coin value has increased up to $333.8. Strong support is provided at $289.6. The latest one-day and four-hour Binance Coin price analysis for 14th February 2024 confirms signs of an increasing trend. A rapid bullish swing has been observed over the span of the past few weeks. In the past 24-hours, a further escalation in the ongoing uptrend has been recorded. BNB/USD value has increased up to $334 because of the bullish swing. BNB price analysis on a daily timeframe: Bullish momentum intensifies growth beyond $333.8 The recent one-day Binance Coin price analysis gives out a favorable prediction for the cryptocurrency buyers. Green candlesticks seem to be dominating the one-day price chart as the buying activity is aggravating. Today, a considerable upturn in price was recorded as BNB/USD value rallied past $333.8. Its Moving Average (MA) value has improved up to $310.3 because of the rapid upturn.

henryartem

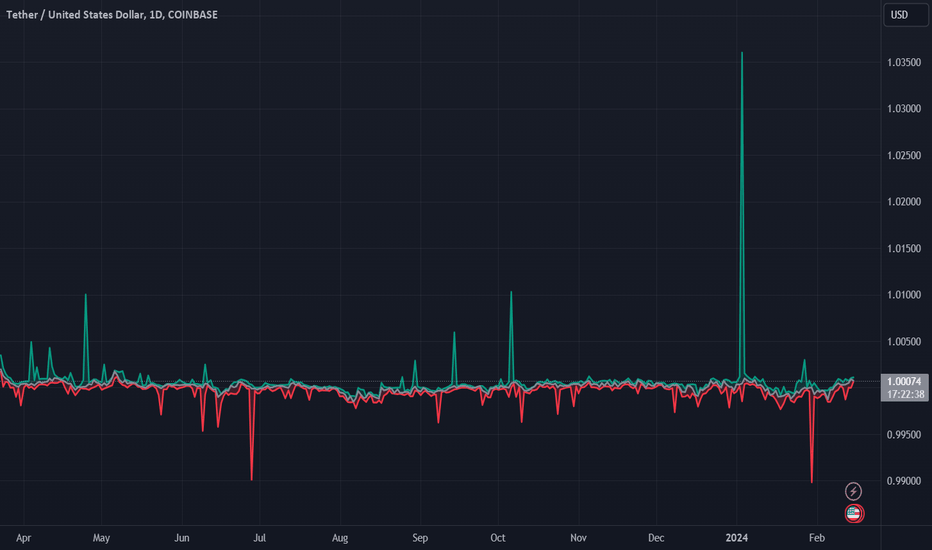

WHY IS THE FEDERAL RESERVE PUSHING FOR STABLECOIN REGULATION?

WHY IS THE FEDERAL RESERVE PUSHING FOR STABLECOIN REGULATION? Federal Reserve Chair Jerome Powell emphasizes the need for a legislative framework for stablecoins to ensure financial stability. The Fed’s push for regulation highlights the growing integration of stablecoins with the traditional financial system and their potential risks. Recent financial turmoil involving stablecoins, like the USD Coin incident, showcases their vulnerability and interconnectedness with traditional banks. Looks like the Federal Reserve is steering America toward a future where stablecoins are not just acknowledged but also regulated. In his recent meetings with House Democrats, Jerome Powell made it plain that a legal framework for stablecoins is an absolute must if the United States is to effectively traverse these unexplored seas. This position shows a major change in attitude toward digital currencies, which is indicative of the increasing awareness of the possible effects they may have on the conventional financial system. The Case for Regulatory Frameworks Financial experts have come to a common understanding, as Powell has pointed out, that without a regulated framework, digital currencies might face problems as they gain popularity. One way to protect one’s wealth from the ever-changing cryptocurrency market is to invest in stablecoins, which are tethered to conventional currencies such as the US dollar. In addition to allowing merchants to make rapid transactions, they also provide a way to store or transfer funds independently of banks and are becoming more integrated into the traditional financial system. But this connection isn’t risk-free. Recent events at Silicon Valley Bank and Circle Internet Financial Ltd. show how stablecoins are susceptible to swings in the conventional banking industry. Circle Internet Financial Ltd. had a large amount of USD Coin reserves stuck in the failing bank. Even while stablecoins are intended to be stable, they may still be affected by actual financial crises, which can impact both their value and the market as a whole. As an example of how closely linked digital currencies are to the conventional banking system, consider the USD Coin event, in which its value fell below $1 during a banking crisis before recovering due to government intervention. The Ripple Effect on Monetary Policy Stablecoin regulation is important to the Federal Reserve for a number of reasons, including but not limited to avoiding market volatility and mitigating their influence on monetary policy. Conventional methods of monetary regulation face a serious threat from the advent of narrow banks, stablecoins, and central bank digital currencies (CBDCs). One example of how financial regulation is changing is the way the Federal Reserve has changed its monetary policy practices since 2007. These include paying interest on reserves and using reverse repos and central bank reserves to influence interest rates. Looking at digital currency makes this transition even more apparent. Interest rate setting and the total amount of the Federal Reserve’s balance sheet are only two areas where CBDCs and stablecoins have the ability to cause significant systemic disruption. In their published study, the Federal Reserve examines these effects and notes that monetary policy adjustments may be required to forestall a decline in lending and preserve economic stability in the case of digital currency integration. Based on the similarities between stablecoins and CBDCs, the study concludes that digital currencies with higher interest rates would attract more investors and deter depositors from going to conventional banks, which might have an effect on lending volumes. As a result, the equilibrium interest rate would fall and the central bank would have less room to manoeuvre in times of crisis if this scenario plays out. Another nuance comes from the idea of “narrow banks,” which compete with traditional commercial banks for customers’ deposits but do not provide loans themselves. Commercial banks may see a decline in lending capacity and repercussions to the loan market as a whole if depositors flee to these institutions due to their lower interest rates and easier structure.

henryartem

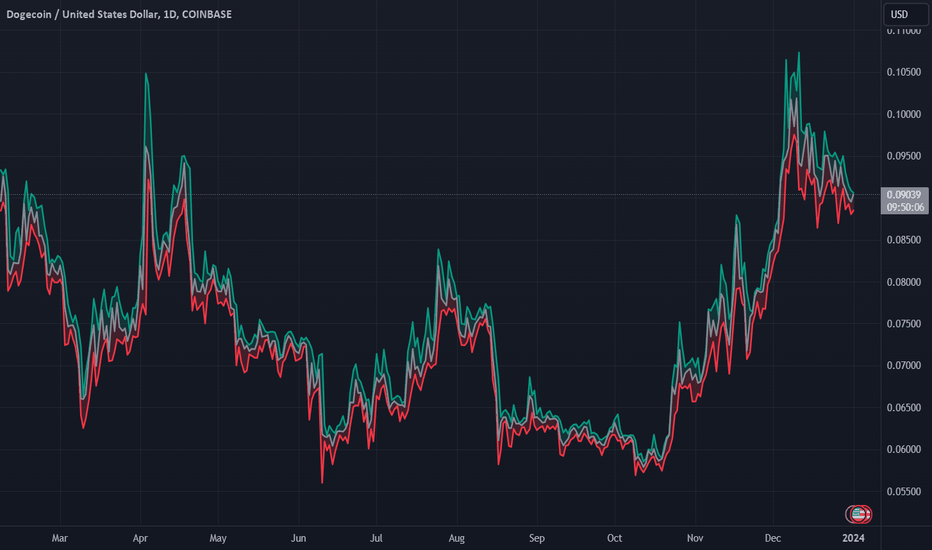

DOGECOIN FOUNDER SHARES 2024 AI RESOLUTIONS

DOGECOIN FOUNDER SHARES 2024 AI RESOLUTIONS Dogecoin co-founder Billy Markus shares 2024 New Year resolutions centered around AI integration. Elon Musk’s Grok AI challenges ChatGPT with humor and tackling sensitive topics. AI tools like ChatGPT and Grok AI are reshaping learning, creativity, and content creation in 2024. In an unexpected turn of events, Billy Markus, the co-founder of Dogecoin, took to Twitter to share his New Year resolutions for 2024. While his tweet might have surprised many, it sheds light on a growing trend – the integration of artificial intelligence (AI) into various aspects of our lives. Markus’s AI-centric resolutions: Billy Markus, one of the minds behind the creation of the iconic cryptocurrency Dogecoin, recently shared his 2024 New Year resolutions on Twitter. With a following of 2.1 million users on the platform, his tweet caught the attention of many. What’s remarkable about his resolutions is that each one is centered around harnessing the power of artificial intelligence (AI). Among his aspirations, Markus aims to “learn to draw (via ai), learn to code (via ai), write a novel (via ai), write a musical (via ai),” and more. These resolutions underscore a significant shift towards AI integration in various professional and creative endeavors. It appears that Markus is not just sharing his personal goals but is also predicting a trend that is likely to dominate 2024 across various fields.

henryartem

BILLIONAIRE TIM DRAPER PREDICTS BITCOIN PRICE TO REACH $250,000

BILLIONAIRE TIM DRAPER PREDICTS BITCOIN PRICE TO REACH $250,000 IN 2024 Billionaire Tim Draper predicts Bitcoin will hit $250,000 in 2024, thanks to potential US ETF approval. Draper sees an even higher potential for Bitcoin with smart contracts and a friendlier US attitude. The US awaits a Bitcoin ETF, making crypto more accessible to traditional investors. Renowned billionaire venture capitalist Tim Draper has made a bold prediction regarding the price of Bitcoin (BTC) in 2024. Draper anticipates that the leading cryptocurrency will surge to an impressive $250,000 within the next few years, citing factors that could drive its value to new heights. Draper’s optimistic forecast for Bitcoin In a recent conversation, Tim Draper expressed his bullish outlook on Bitcoin’s future. He forecasted a price of $250,000 for BTC by 2024 and hinted that this milestone could be achieved sooner than expected. Draper’s optimism is grounded in several key factors, including the potential approval of a Spot Bitcoin ETF by the US Securities and Exchange Commission (SEC). Draper’s prediction is not the first of its kind, as many industry experts and analysts have also been speculating about Bitcoin’s remarkable potential in the coming year. The anticipation surrounding the SEC’s possible approval of a Spot Bitcoin ETF has fueled these expectations, with many eyeing early 2024 as a potential timeframe for its introduction. Discussing his earlier Bitcoin forecast, Draper recalled how he had predicted a price of $250,000 for the cryptocurrency when it was trading at just $4,000.

henryartem

WHY RIPPLE’S XRP COULD SMASH ALL-TIME HIGH IN 2024

WHY RIPPLE’S XRP COULD SMASH ALL-TIME HIGH IN 2024 As the cryptocurrency world continues to evolve at a breakneck pace, Ripple’s XRP stands out as a token with significant potential. The year 2023 has been a rollercoaster for cryptocurrencies, but XRP has shown remarkable resilience and growth, surging by almost 80% since the beginning of the year. This growth trajectory has fueled speculations and predictions about XRP smashing its all-time high in the upcoming year 2024, riding on a wave of positive developments and market dynamics. The journey of XRP in recent times has been anything but ordinary. Hindered by the legal battles with the Securities and Exchange Commission (SEC), XRP was one of the few major projects that didn’t hit its peak during the 2021 bull run. However, the tables are turning. With a favorable ruling from a US district court and anticipation of positive outcomes from the ongoing legal saga, XRP is poised to reach new heights.

henryartem

CHARLES HOSKINSON REITERATES STANCE AGAINST XRP HARASSMENT

CHARLES HOSKINSON REITERATES STANCE AGAINST XRP HARASSMENT Charles Hoskinson, the founder of Cardano, has reiterated his critical stance toward the XRP community, labeling it as toxic and petty. Hoskinson has consistently faced harassment from the XRP community for over two years, reinforcing his firm stance against them. There is a clear lack of technical alignment and different market focuses between Cardano and Ripple, the company behind XRP. A surge in high-value account transfers Since October 23, when Robinhood began offering a 1% match on transferred brokerage accounts, the platform has seen about $1.1 billion in account transfers. This surge in transfers, especially from larger brokerages like Charles Schwab, Fidelity Investments, and Morgan Stanley’s E*Trade, indicates Robinhood’s growing appeal to a more affluent clientele. Over 150 account transfers have exceeded $1 million, showcasing the platform’s successful enticement of wealthier investors. This trend is notable, given Robinhood’s previous focus on younger, novice investors and its comparatively smaller size in the brokerage industry. Despite Robinhood’s assets under custody totaling $94 billion at the end of November, it pales in comparison to giants like Schwab, with $8.2 trillion, and Fidelity and Morgan Stanley, with trillions in assets under administration and total client assets, respectively. However, the influx of high-value accounts highlights the platform’s potential to disrupt the traditional brokerage landscape and appeal to a broader market segment.

henryartem

BITCOIN PRICE PREDICTION 2023-2032: WILL BITCOIN BULLS RALLY?

BITCOIN PRICE PREDICTION 2023-2032: WILL BITCOIN BULLS RALLY? BTC Price Predictions 2023-2032 Bitcoin Price Prediction 2023 – up to $47384.02 Bitcoin Price Prediction 2026 – up to $160960.69 Bitcoin Price Prediction 2029 – up to $490898.3 Bitcoin Price Prediction 2032 – up to $1603338.68 How much is Bitcoin (BTC) worth? Today, the price of Bitcoin stands at $42,159, with a trading volume over the past 24 hours reaching $25.7 billion. Its market capitalization is $825 billion, and it currently commands 54% of the market share. Over the last 24 hours, the BTC price has experienced a 1.31% decrease. As for its circulating supply, 19.46 million BTC are in circulation out of a maximum possible supply of 21 million BTC. Bitcoin price analysis: BTC price continues to decline but holds momentum above $41,500 TL; DR Breakdown BTC price analysis shows that Bitcoin faced rejection at $43K; however, buyers hold above $41.5K Resistance for BTC is present at $43,385 Support for BTC/USD is present at $41,405 The BTC price analysis for 16 December confirms that bears sparked a solid selling pressure as the BTC price lost buyers’ confidence near $43,000. However, the BTC price is attempting to hold buying pressure as buyers defend a decline below $41,500.

henryartem

SOLANA FOUNDER ANATOLY YAKOVENKO ADVOCATE FOR BLOCKCHAIN HARMONY

SOLANA FOUNDER ANATOLY YAKOVENKO ADVOCATES FOR BLOCKCHAIN HARMONY, REJECTS “ETH KILLER” LABEL Solana founder Anatoly Yakovenko has publicly criticized the “ETH Killer” narrative, advocating against the idea of Solana and other emerging blockchain technologies being direct competitors to Ethereum. Yakovenko emphasizes the importance of collaboration and coexistence in the blockchain space, arguing that different platforms like Solana and Ethereum can thrive simultaneously without undermining each other. In a recent development that has caught the attention of the cryptocurrency community, Solana founder Anatoly Yakovenko has taken a firm stand against the divisive narrative that pits emerging blockchain protocols against Ethereum, often labeled as “ETH killers.” The term has been frequently used in the crypto space to describe newer blockchain technologies like Solana (SOL), which are seen as potential rivals to Ethereum (ETH). Yakovenko’s statements came through a post on the X app, where he addressed the public and the crypto community at large. He emphasized the detrimental effects of sparking a so-called cold war between Ethereum and other protocols. According to Yakovenko, such narratives do more harm than good, undermining the collective progress of the blockchain ecosystem.

henryartem

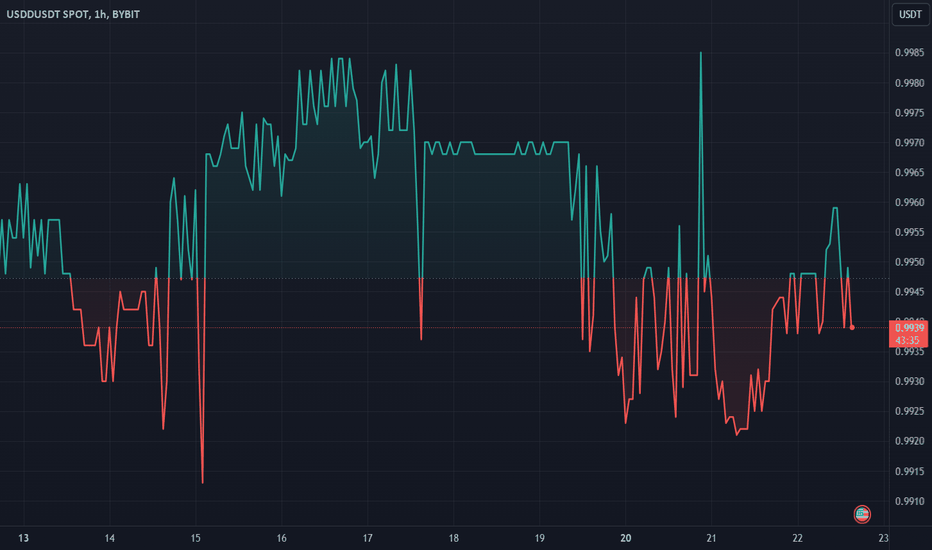

WHY TETHER’S PARTNER BRITANNIA BANK IS FACING MASSIVE LAWSUIT

WHY TETHER’S PARTNER BRITANNIA BANK IS FACING MASSIVE LAWSUIT Britannia Financial Group, partnered with Tether, faces a legal battle over a $1 billion deposit made by Tether into one of its subsidiaries. The lawsuit involves a dispute over a brokerage acquisition and payment disagreements, amidst allegations against Britannia’s founder for bribery. This legal issue highlights the complex and opaque banking relationships in the cryptocurrency industry, with potential implications for Tether and the broader crypto market. Britannia Financial Group, a name that’s been resonating in the financial corridors for its association with Tether, the largest stablecoin issuer, is now in the eye of a legal storm. The group, which received over $1 billion from Tether, is embroiled in a complex legal battle, revealing the intricacies and risks involved in the banking relationships of all cryptocurrency entities.

henryartem

BINANCE, COINBASE, AND KRAKEN ADAPT NEW VENTURE CAPITAL TACTICS

BINANCE, COINBASE, AND KRAKEN ADAPT NEW VENTURE CAPITAL TACTICS AMID CRYPTO MARKET CHANGES Binance Labs now focuses on supporting startups with actual products and revenue, moving away from projects based solely on hype. Coinbase Ventures is shifting its investment focus towards startups outside the United States, particularly in India, Singapore, Australia, and the UK. Kraken Ventures observes that early-stage companies have valuations of about $10 million to $30 million, indicating sustained interest in new ventures despite broader market changes. Key players like Binance Labs, Coinbase Ventures, and Kraken Ventures are recalibrating their investment strategies in response to evolving market conditions, according to a Bloomberg report. This shift is characterized by a focus on sustainable investments and geographical diversification.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.