gumoca

@t_gumoca

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

gumoca

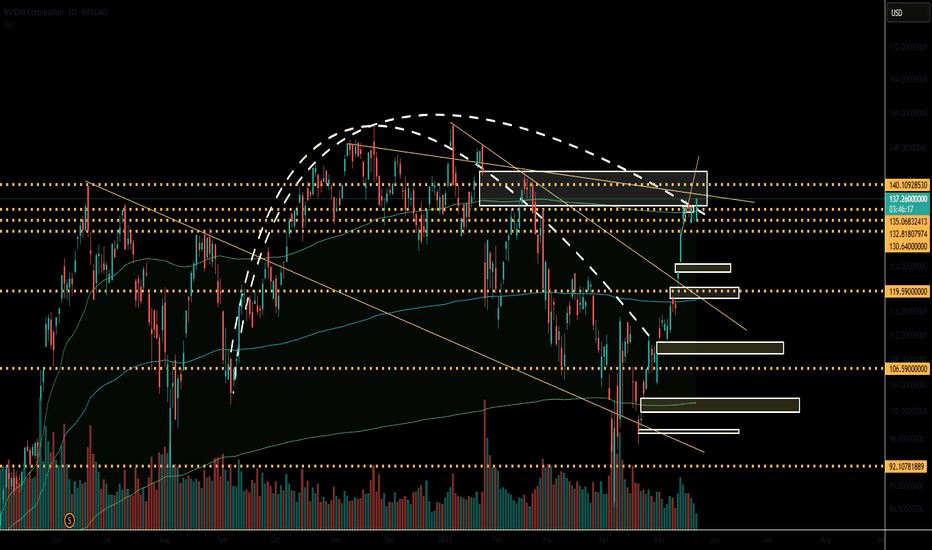

NVDA When the Dome is Pierced but the Crowd Doesn’t Cheer.

NVDA pierced the dome. But the market didn’t roar—just whispered. You’d expect prices to leap on headlines like “hyperscalers buying hundreds of thousands of H100s and B200s.” But instead, we’ve seen price hesitations… rejection wicks… and a quiet fade into the resistance box. That’s the tell. The “bull case” is loud—CoreWeave, Meta, and Microsoft are all investing capex in datacenter growth. Headlines scream demand. Analysts raise price targets. AI buildout is the macro story. And yet… NVDA can’t sustain above 137. Technically, this is what I'm seeing: A clear inverted dome pattern—price pierced through, but volume didn’t confirm. Rejection within the gray box: 134–137 remains a trap zone. Rising wedge structure beneath, with weakening RSI momentum. Key levels to watch: 137.50: Failure here confirms the fakeout. 134.28: break below, and the dome reasserts control. 130.64: losing this brings 119.59 into play—fast. Fundamentally, the risk is timing: Much of the demand for NVDA’s next-gen chips is already pre-booked. Margins on the newer nodes may face pressure. The buyer base is concentrated: a few hyperscalers dictate 80% of the flow. If AI expectations plateau—even temporarily—valuation multiple compression is severe. And then there’s the macro: 10Y and 30Y yields are pushing higher after a soft CPI print. Moody’s downgrade lingers in the background. Japan’s bond market is wobbling. The bond lords are watching—and if they whisper “not at these yields”, risk assets will reprice. This isn’t about fear. It’s about understanding silence. When the loudest news doesn’t move price, something else is pulling strings. Positioning note: I hold puts. 5 contracts. Small size, but high conviction setup. This isn’t just about charts—it’s about recognizing when perception has outpaced inflow, and when liquidity begins to vote. The dome was pierced. But without volume, it’s just vapor. And when vapor meets gravity, price falls—silently.

gumoca

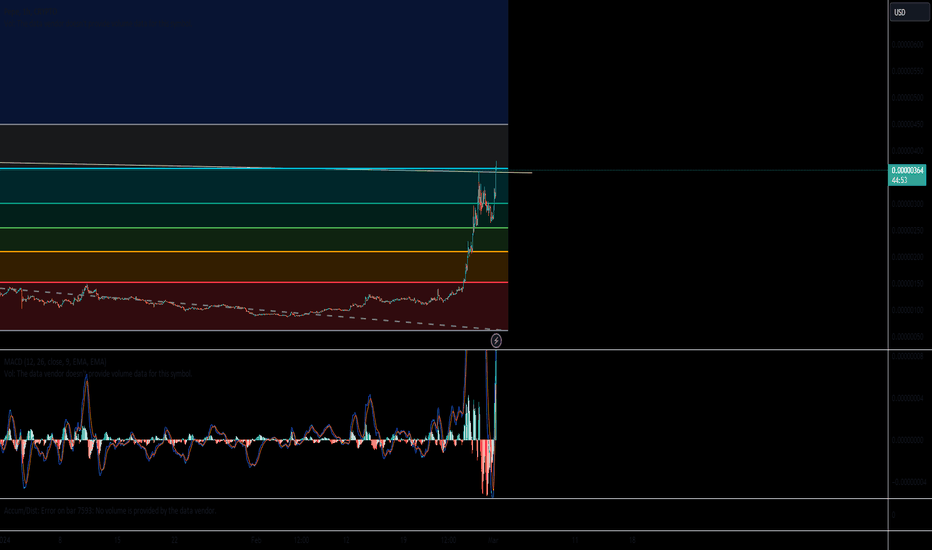

$PEPE could be topping here, time will tell

This looks like another H/S formation, yet given the tons of volume coming into PEPE it has been hard for PEPE to correct a bit, hence a sharp correction may be coming into PEPE. I see it highly correlated to BTC. Perhaps already some traders trading this based on BTC moves. BTC just sneezed and PEPE had a cold, so be careful around these levels if confirmed. Tread carefully.

gumoca

$PEPE forming Head and Shoulders, confirmation takes it 257-95

I've been following meme coins, particularly PEPE SHIB, DOGE and recently GUAC. I think there should be a breather over this level for many of these coins, although BTC seems strong still, given the amount of flows into ETFs. Meme coins have a lot of room to the upside. Think about how many people are thinking "Oh! BTC too expensive at 60k, I may try and buy another thing with my $200... Oh! this GUAG / PEPE etc. looks cheap, imagine if it goes to a dollar! (mute)" as many individual retail investors are thinking the same thing, price pushes up, just to provide liquidity to a few individuals that want out at these levels. Hence, a sharp corrective wave to the downside may start soon for BTC and other coins. When? I don't know but BTC seems like can climb up to 87K in the short term, although looks frothy here at $63,405. It rejected 65K and perhaps as it is sitting just in the edge of the bollinger band it looks toppy. My immediate level for BTC to the downside is about 57k, then 46K-44k and may end up trading at $38-41K with super strong support at 30k in case something extreme takes it down. A sharp move of BTC to the downside will take all the crypto down, but so far it looks like nothing can beat BTC. Looks at GLD at ath. Something that GLD wants to tell us here?

gumoca

Simple FIB analysis puts $PEPE closer to 0.00001

This is what is happening: You have $300 and open a Coinbase account. You log in and realize BTC is too expensive at 60k. You realize you can't afford to become a whole Bitcoiner for now. Then you scroll down and see a bunch of meme coins, and you think... what if? what if this thing goes up to $1. That will most likely never happen, but these meme coins give you hope. You press buy, and hope to hold for long. Then a whale comes and sells on this liquidity and leaves you there. That's the story of meme coins. PEPE has a strong meme, and can hold for now, but be realistic about your expectations, and size accordingly. Never put more money than what you can afford to lose. Godspeed.

gumoca

ETH could finally hit $5K this week!

I've been posting ETH potential moves for a few weeks now, moving through that wedge, and finally is going to come out of it today/tomorrow and the measured move from that inverse head and shoulders is around $5,000. I think decision should be clearly to the upside given past volume/price action and solid positive momentum. We may end up having a backtest to $4.6 and if that holds should be load area before ETH makes its path to 5.6K. Keep an eye of the purple line I've drawn here. Once ETH is able to move past that line and breaks decisively 6k could be on tap, perhaps by end of november, early december. I hope you guys are enjoying these posts.

gumoca

Seems like ETH on its path to $6K by EOY

ETH is traversing thought that wedge. It will take time for it to be completely out of that supply zone. It is still consolidating and gaining power for a move to 5K, and then potentially close to 6K. By Nov 10, the pattern should be cleared from the wedge and will be decision time. Remember not every pattern works 100% of the time, it could fail and drop perhaps to test $4.2 again, potentially even the black line around 3.8K for a quick bounce. If so, that could be a great opportunity to add before the EOY bull run. Breaking through that purple trend line (I purposely left it purple and bold) is going to be pretty telling, keep an eye on that potential break perhaps by mid Nov. Trade safe. No financial advice.

gumoca

DOGE on its path to ATH

DOGE/USDT looks ready to break. For some reason, they contained it here. Maybe in tonight's session as it for now seems like a false breakout. Above 0.32 should be ready to make a sizeable move to at least 0.50 then retrace perhaps and prepare for a slingshot move into 0.75 and a final move to $1.0. Let's see. I'm positioning here for the move.

gumoca

ETH back into the wedge fighting the supply zone towards $4.4K

Let's see ETH in the next couple of weeks if it manages to move past that supply zone. Seems like a zone with some turbulence. Maybe investors who bought on the hype of May 2021 just want out. Once the weak hands go, then ETH will be ready to move past 5K imo. It's a matter of time. So I'm proposing that ETH will move along the wedge from now until the first week of November. Once it passes and clears 4.4K-ish then it will be free to move a bit faster towards 5K. 5K is such a psychological level imo that can get retested multiple times before we move higher. Perhaps $5.6 could be resistance. Above $6.25 I think ETH could make a strong move towards 8K perhaps by year-end. Let's see...

gumoca

ETH next resistance around $4,395 nice volume coming

ETH took off in the right direction with strong volume, confirming the inverse head and shoulders pattern with a measured move towards 5K. Now resistance at $4,390 is relevant, will need to push with strong volume there to break that supply zone, although recent action indicates it may be able to do it. I'm extending a bit that purple line to keep it in mind for potential rejection zones that may appear in the coming days as ETH makes its climb to 5k after breaking all-time highs. All the best to you all. Thanks for reading these posts. And I hope I'm being of good service to you by sharing these ideas, which may be horribly wrong so do your own DD!!!

gumoca

ETH decision time here to beat resistance at $3,850s

ETH has to break resistance here around $3,853. I think now it should move at par with BTC as 0.06 seems like a nice support area of ETH/BTC, so I think ETH is preparing for a jump to $4,140 then to a measured move to 5K as volume comes. I'd favor a more bullish move until 10/21/21 but anything can happen here as the consolidation is good enough now.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.